Over the next 3+ months I’m doing a webinar every 2 weeks, hosted by TrendSpider. The first one will be later today, Monday, July 22nd at 4:30pm EST, you can signup at https://us06web.zoom.us/webinar/register/WN_yDFoS-ieTDO5otwaYv2u0w#/registration

It will be recorded but you still need to register ahead of time.

Save 50% on TrendSpider annual plans by using my link… http://trendspider.cc/luptoncapital

Some of the topics I’m hoping to cover:

What is my hedging strategy? What indicators do I use to guide me for my intraday trading of hedges?

What specific trading setups I’m looking for during earnings season?

What tools and/or custom scans do I use to identify the best setups?

How do I manage positions before/during/after earnings season?

What key names am I watching this earnings season?

In order to read this entire newsletter you’ll need to become a paid subscriber by clicking the button below. Paid subscribers get full access to my trading portfolio (up +35% in 2024, up +97% in 2023), daily watchlists with charts, daily activity with entry prices & stop losses, all trading stats with performance, and my daily webcasts.

My other Substack newsletter is called Growth Stock Deep Dives where paid subscribers receive 2-3 deep dives per month (8,000+ words each), 2-3 mini deep dives per month (2,000+ words each) and quarterly earnings analysis (on most of my portfolio companies) plus access to my investment portfolio (up +161% YTD in 2024, up +134% in 2023 and up +2,650% since January 2020) with real-time activity and notes/commentary throughout the day on my portfolio spreadsheet.

Earnings reports for the week…

Macro reports for the week…

CPI spreadsheet…

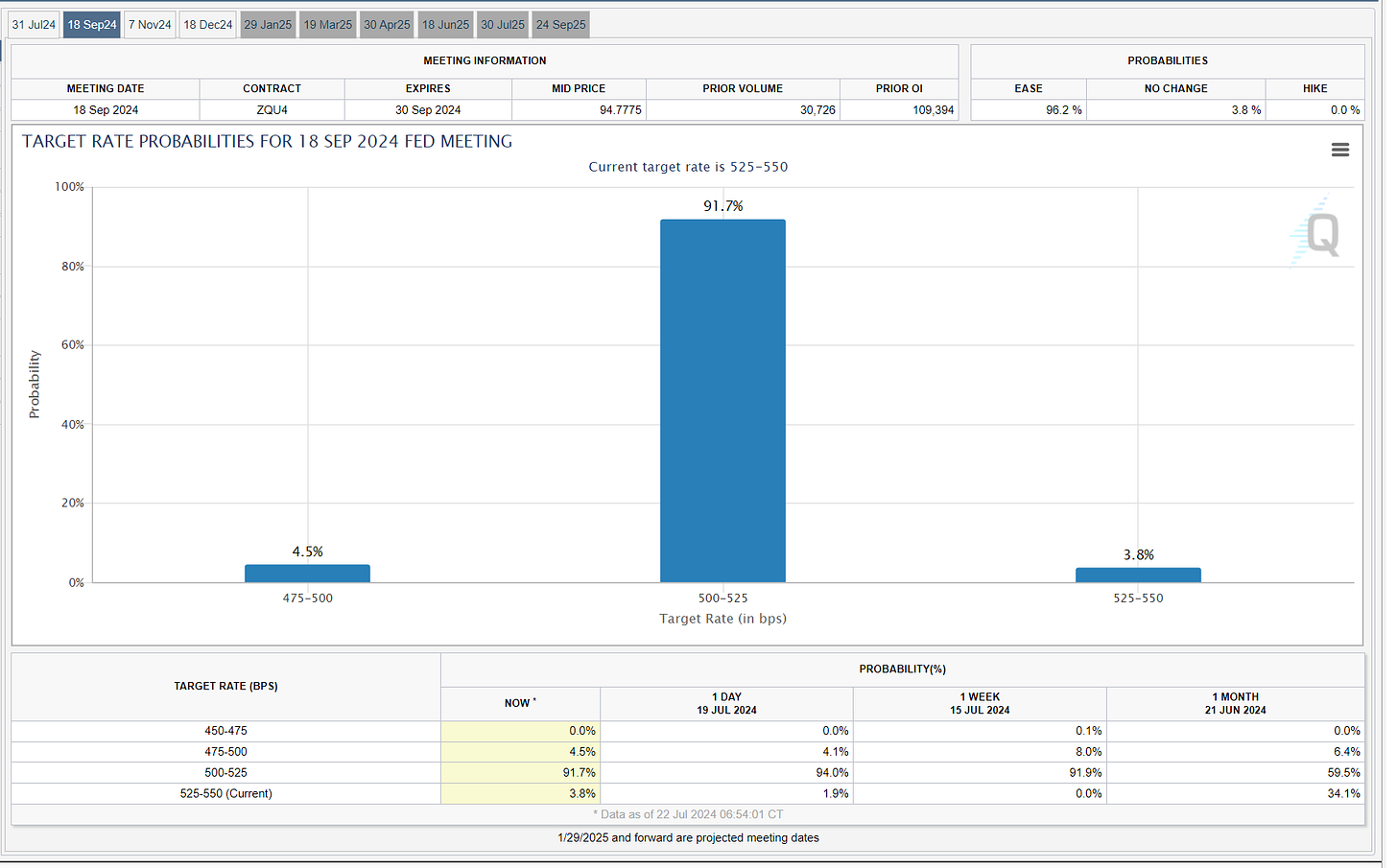

FOMC updates…

New highs vs new lows…

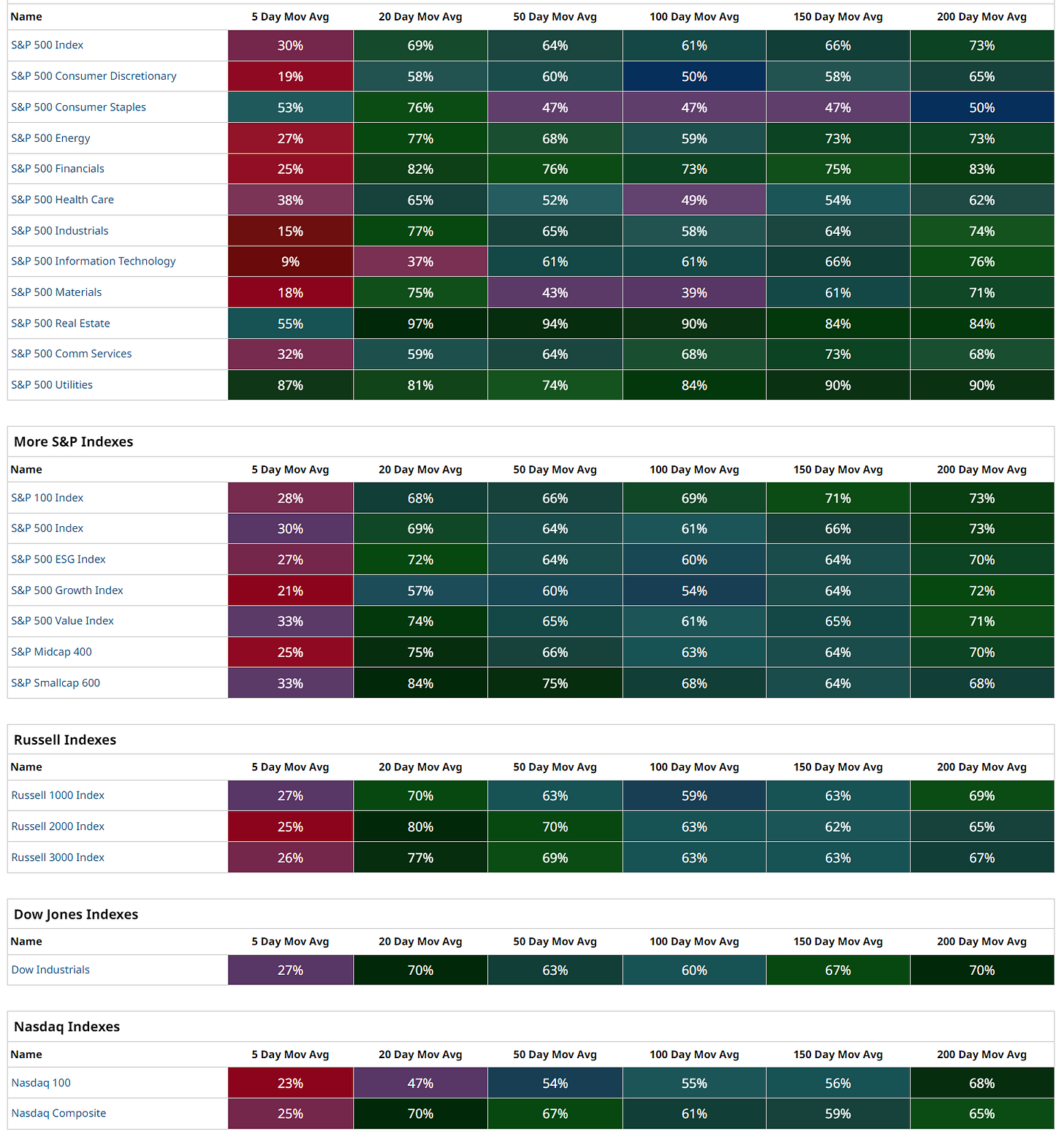

Market momentum…

$TNX (10Y Treasury)

$VIX

$CL1! (Oil)

SPY (S&P 500, market cap weighted)

RSP (S&P 500, equal cap weighted)

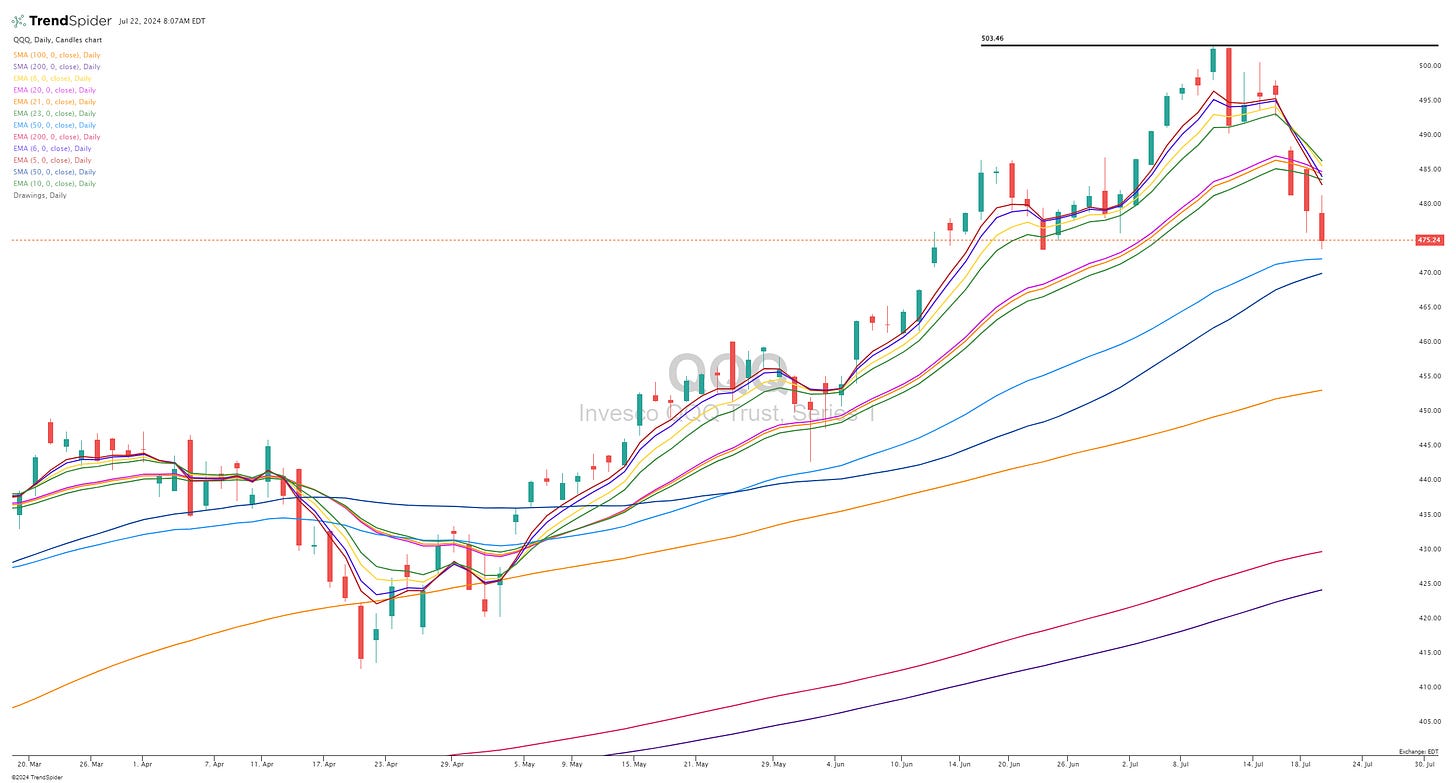

QQQ (Nasdaq 100, market cap weighted)

QQQE (Nasdaq 100, equal cap weighted)

IWM (Russell 2000, small/mid caps)

Some of the stocks on my watchlist today…

S — pushes through 200d sma and VWAP from February highs

CLBT — pushes through 12.66

MARA — pushes through 24.63

AMD — pushes through 200d sma & 200d ema

SOFI — pushes through 200d sma and VWAP from December highs

RBRK — pushes through VWAP from IPO

BBVA — pushes through VWAPs from March/April highs

KN — pushes through 18.47

L — pushes through 78.25

MNKD — pushes through 5.73

PCVX — pushes through 82.05

PGY — pushes through 200d ema and VWAP from last summer highs

SFNC — pushes through 20.81

Below the paywall is the links to my current trading portfolio spreadsheet with all holdings, position sizes, entry prices, stop losses, etc plus my spreadsheet includes all daily activity (real time), daily notes/commentary (real time) and my daily watchlist with charts.