Trading the Charts for Wednesday, May 17th

In addition to my “Trading the Charts” newsletter, below are a few more newsletters that I publish plus my Investing with the Whales podcast, my Stocktwits room, my Seeking Alpha investment service and my new Twitter Spaces coming soon.

I also run a Stocktwits room where I’m very active throughout the day and post about both of my portfolios with 100% transparency. FWIW, I’m up 48.5% YTD thanks to huge gains with CELH, LNTH, UBER, ONON, TSLA, SDGR, MELI, GLBE, SWAV, XPOF, FLNC, NU and several others. You can join by clicking the button below:

Good morning and Happy Wednesday,

I definitely started more positions the past couple days than I was expecting but I saw some great opportunities on pullbacks and breakouts. I’m not planning to do much today unless I get really excited about a specific setup, there’s a few that I’ll be stalking at the open.

I’m definitely no uber bull right now but I still think the market backdrop is decent with earnings season better than expected, inflation coming down, labor market holding up and FOMC about to pause however consumer sentiment is not great, second half of year looks less certain and the debt ceiling is still a risk if the morons in Washington can’t figure something out — there’s a chance they just kick it down the road to September which means we get to have these same stupid conversations in 4 months after they’ve spent the summer doing nothing productive.

When it comes to trading I like that scene from the movie “The Patriot” with Mel Gibson where he’s giving shooting advice to his sons, he says “aim small, miss small” which can be applied to your trading strategy. If you’re going to be a volume trader like me (10-20 positions) you need very strict/tight risk management, knowing you’re going to get stopped out of 60% of positions is fine as long as those losses are small (less than 2% on average) because the other 40% (your winners) should average 10-20% on the upside (in a choppy market) which more than make up for the losers and sometimes in the case of CELH you get a 50% winner. In a bull market (which this is not), those 40% of winners should average 20-30% on the upside with a bunch of 40-60% winners in a good year.

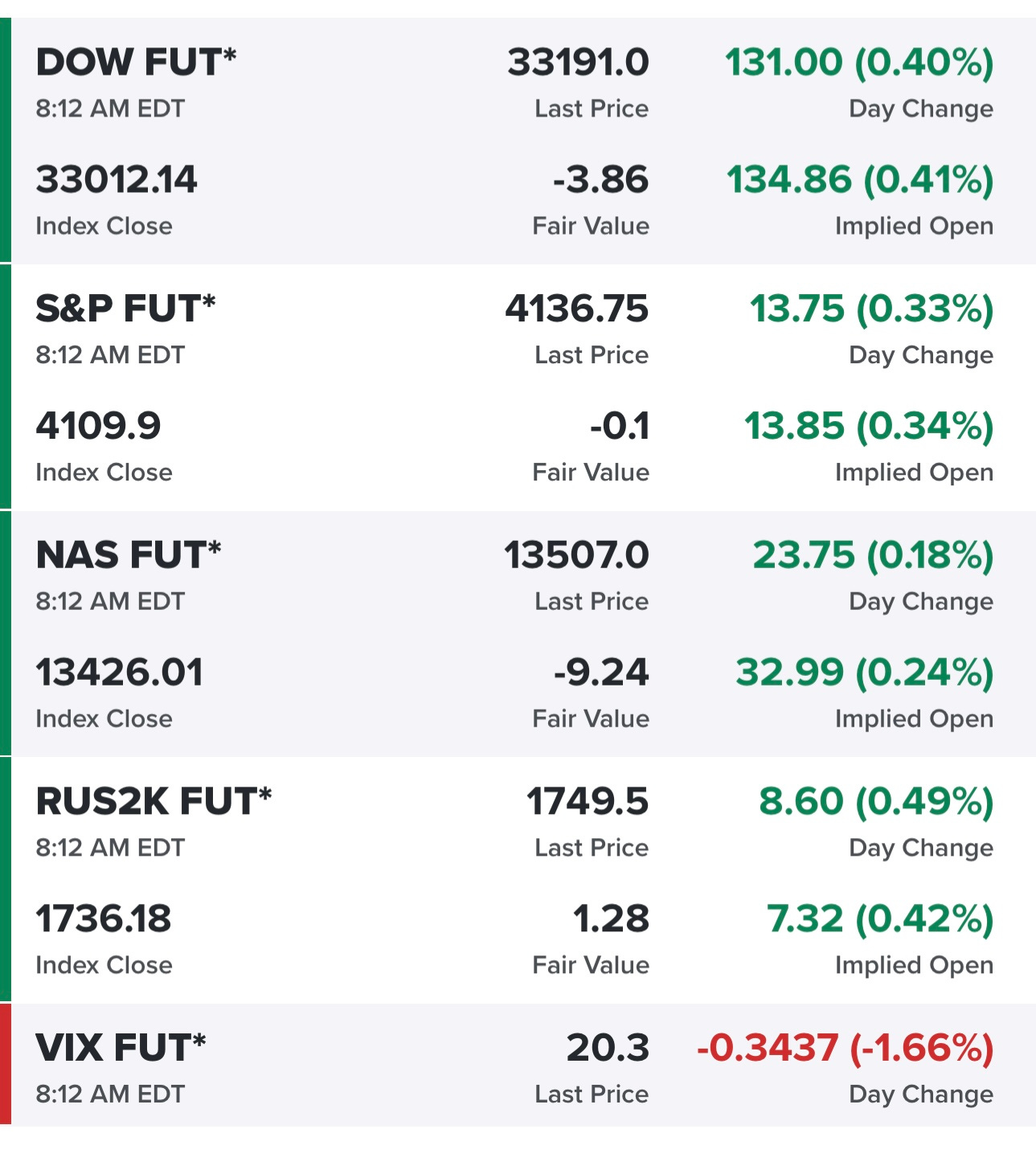

Equity futures looking good…

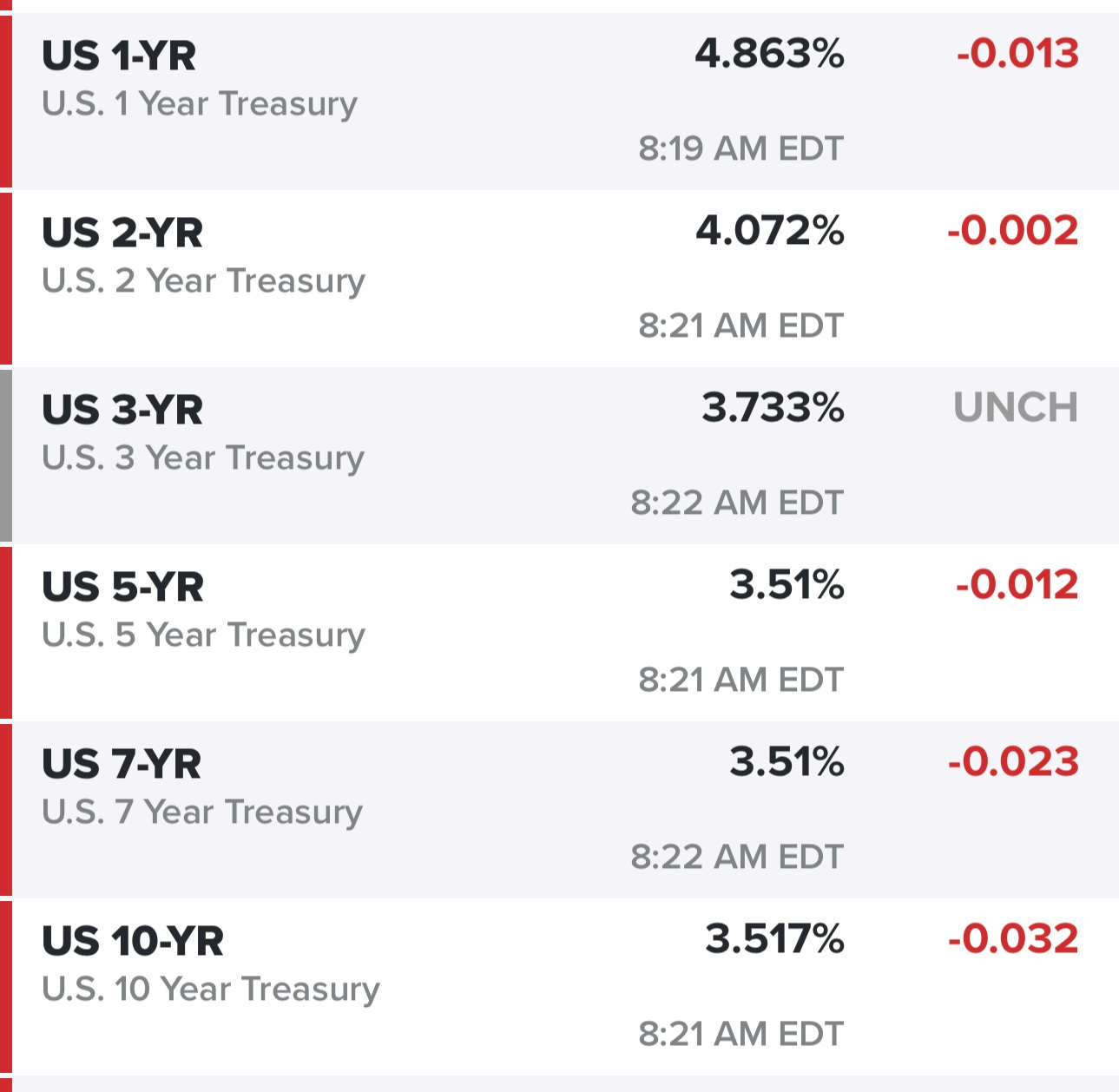

Yields down slightly… FWIW, I started a position in TMF yesterday in my investment portfolio which will do well if yields start moving lower again…

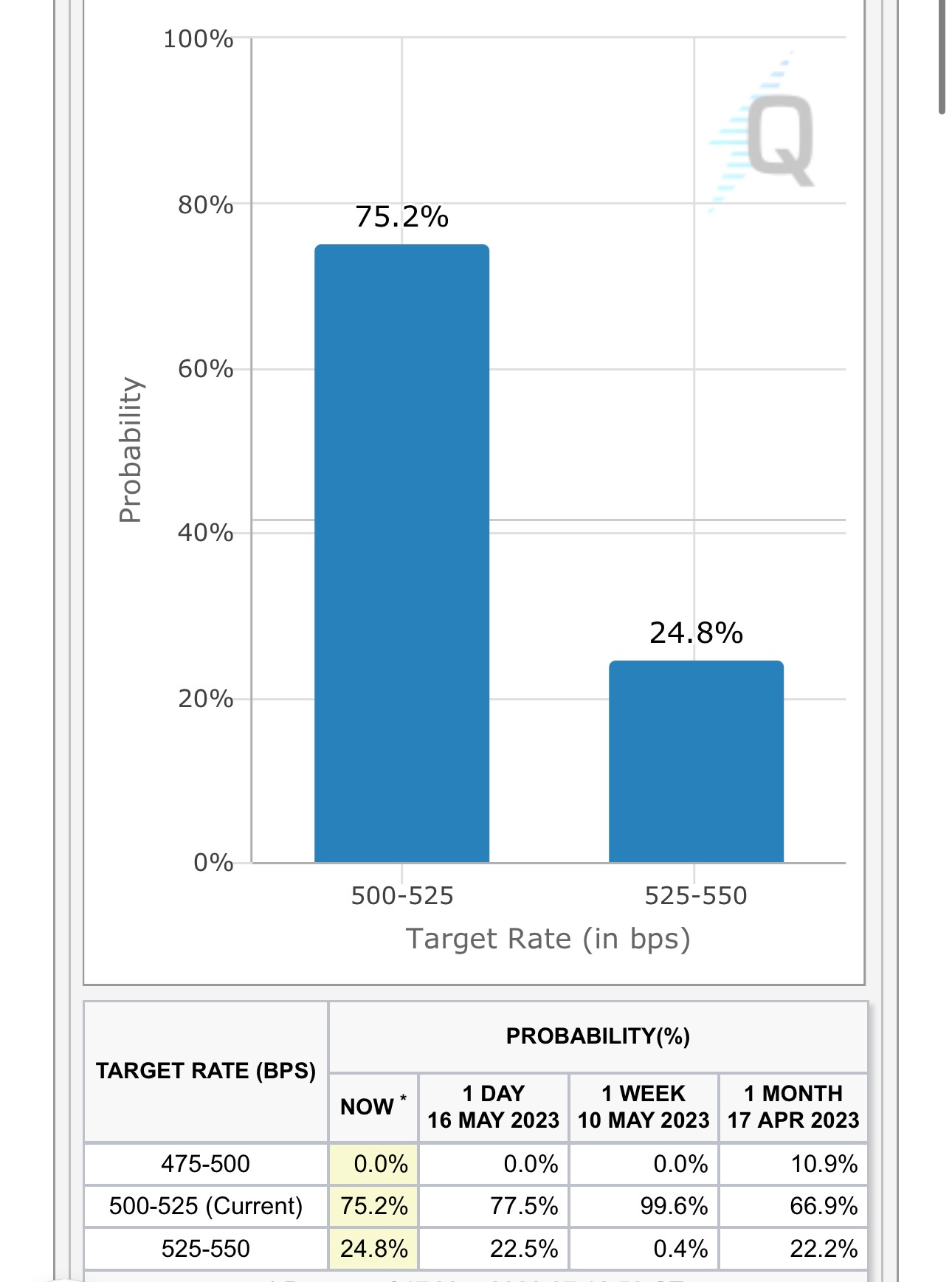

Just one week ago there was a 96-99% chance of no rate hike at the June FOMC meeting but as of this morning that number is down to 75.2% What’s unique about the June FOMC meeting is they’ll have 2 CPI reports and 2 jobs reports to take into consideration when they give their decision on June 14th because the May FOMC meeting was so early in the month we hadn’t gotten any of the April data yet…

Below the paywall is my current trading portfolio (with positions, sizes, entry price, stop loss, etc), current watchlist and links to my daily Zoom webcasts.