Trading the Charts for Wednesday, May 3rd

In addition to my “Trading the Charts” newsletter, below are a few more newsletters that I publish plus my Investing with the Whales podcast, my Stocktwits room and my Seeking Alpha investment service.

I also run a Stocktwits room where I’m very active throughout the day and post about both of my portfolios with 100% transparency. You can join by clicking the button below:

Good morning and Happy Wednesday,

Sorry this email is going out after the open, I’ve literally been waiting 60+ minutes for Zoom to process the webcast I did this morning to share some thoughts and charts… https://us06web.zoom.us/rec/share/MXs-QoA4q267NDLQxnUCvrorqdVBan-SABk3BdUe4EZQWjsfu7ViGe8iq5iI5FXb.AG9lsIeNbMVjbckz

We have the FOMC decision today at 2pm with the Powell press conference at 2:30pm. I won’t be starting any positions ahead of the FOMC decision. We also have the jobs report on Friday morning and CPI next week.

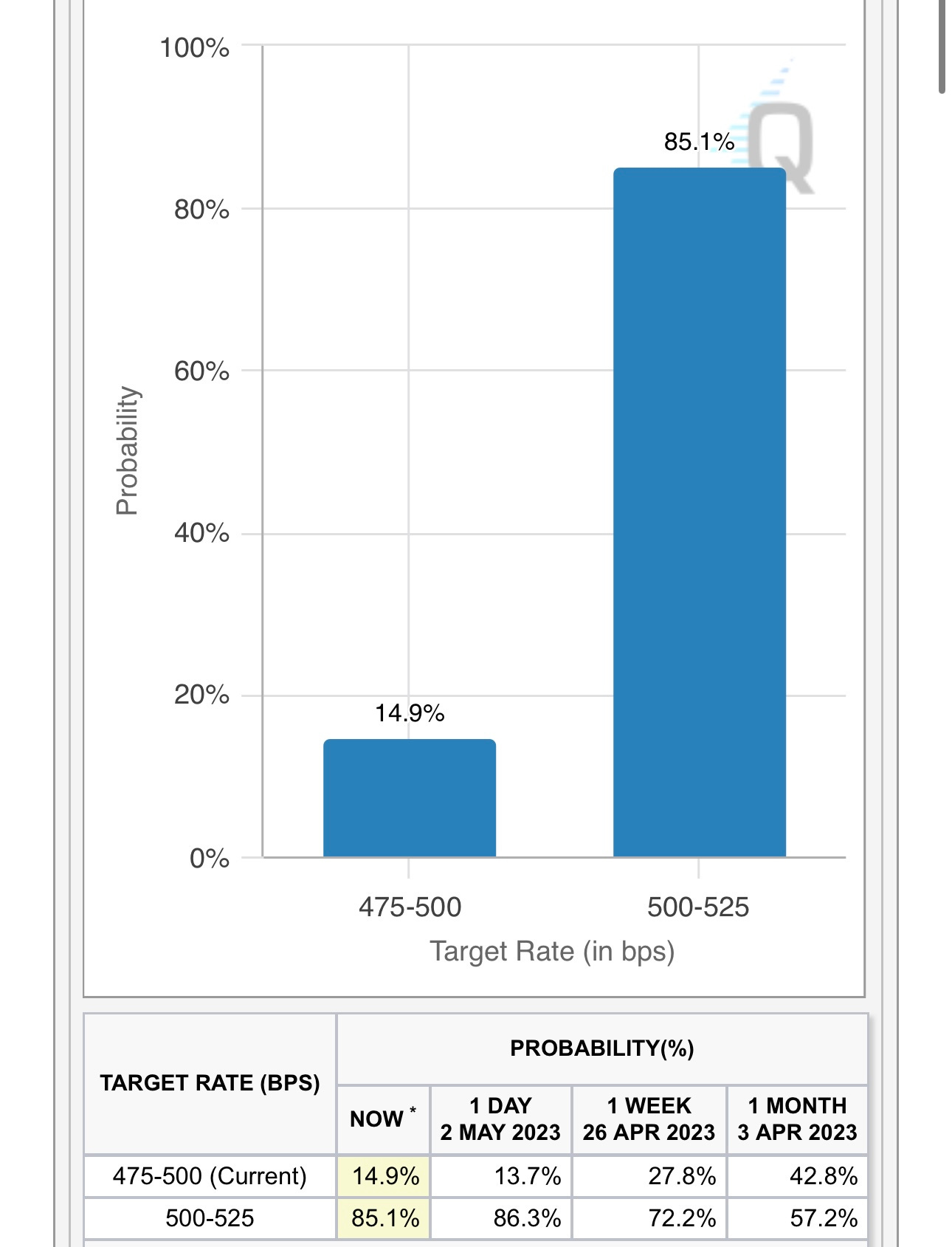

According to the CME fed watch tool there’s still an 85-90% chance that we get 25 bps today so the bigger question is what the FOMC and Powell say about future rate hikes. Do they sound hawkish or dovish? Do they talk about a pause? Do they talk about QT? Do they talk about the banking failures and tightening credit markets?

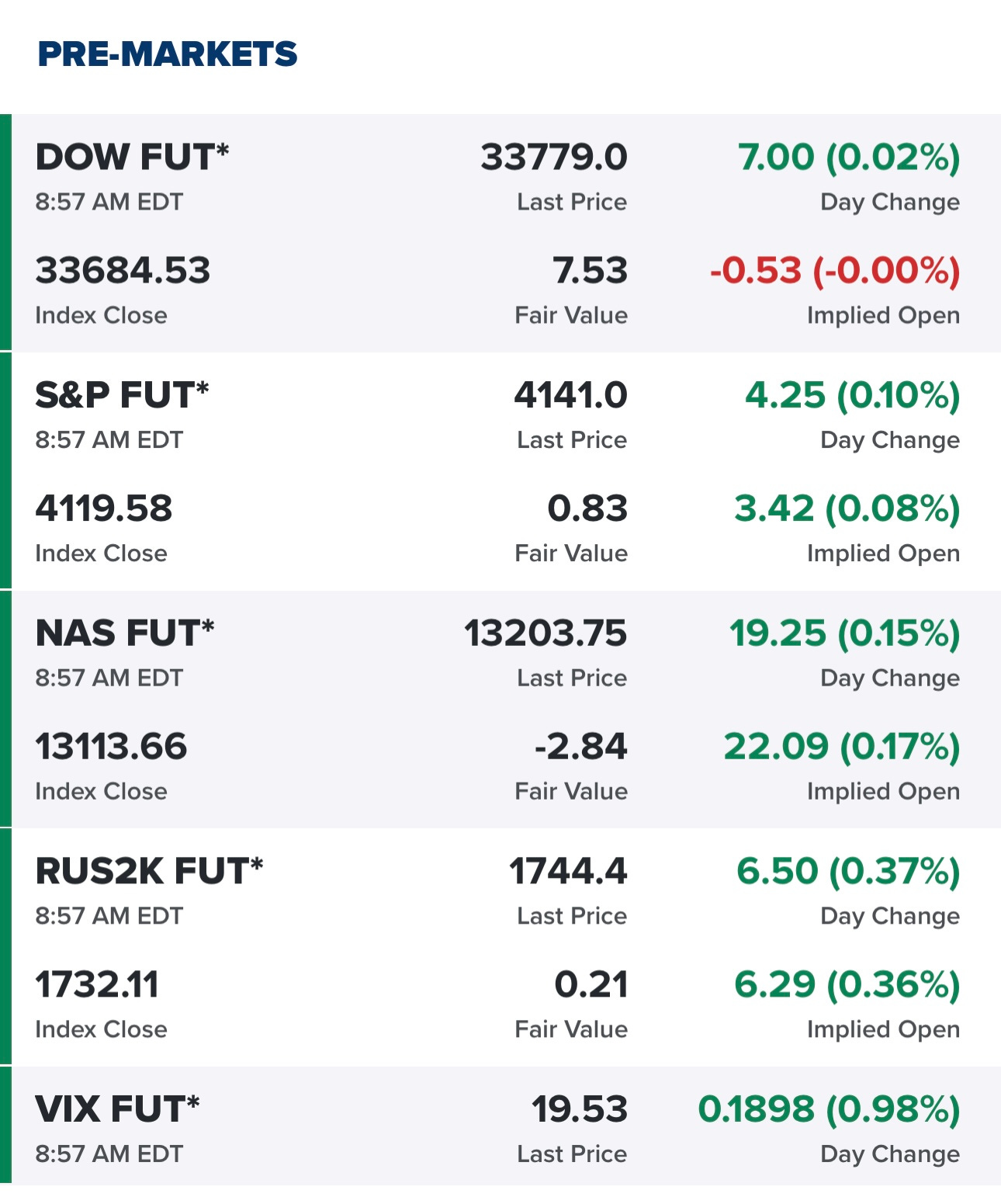

Futures relatively flat going into FOMC day…

Yields have been pulling back the past week…

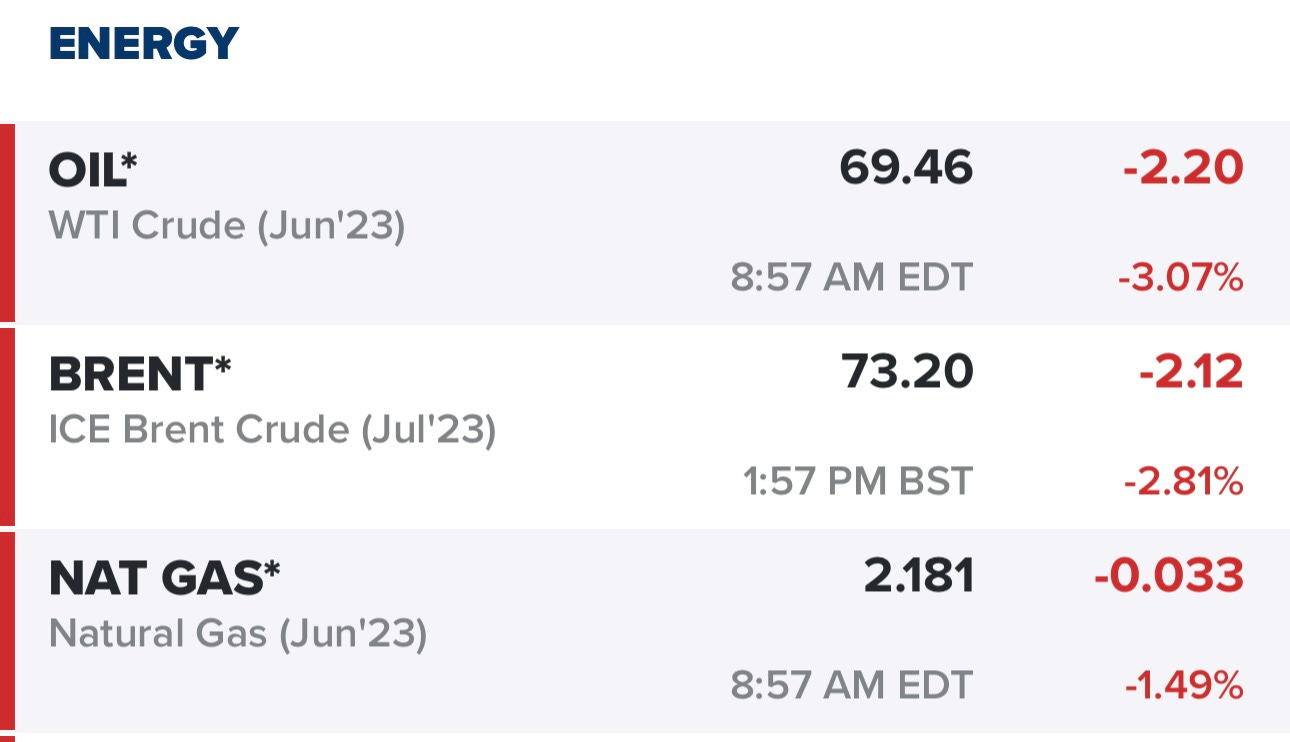

Oil prices have been pulling back for two weeks and now back under $70…

Don’t forget we still get more earnings this week…