Trading the Charts for Wednesday, July 5th

I also run a Stocktwits room where I’m active throughout the day and also post about my investment portfolio which is up ~86% YTD thanks to big gains in CELH, LNTH, UBER, MELI, SDGR, ONON, TSLA, GLBE, SWAV, NU, FLNC, CFLT, DOCN and others.

Here are my other newsletters…

As you probably know I use Trendspider for all my charting and they’re currently running a massive July 4th sale which you can claim by clicking on the button below…

Trading portfolio stats through July 3rd (including open positions):

642 trades

34% win rate

+8.5% average winner

-2.0% average loser

+58.7% YTD performance

Good morning and Happy Wednesday,

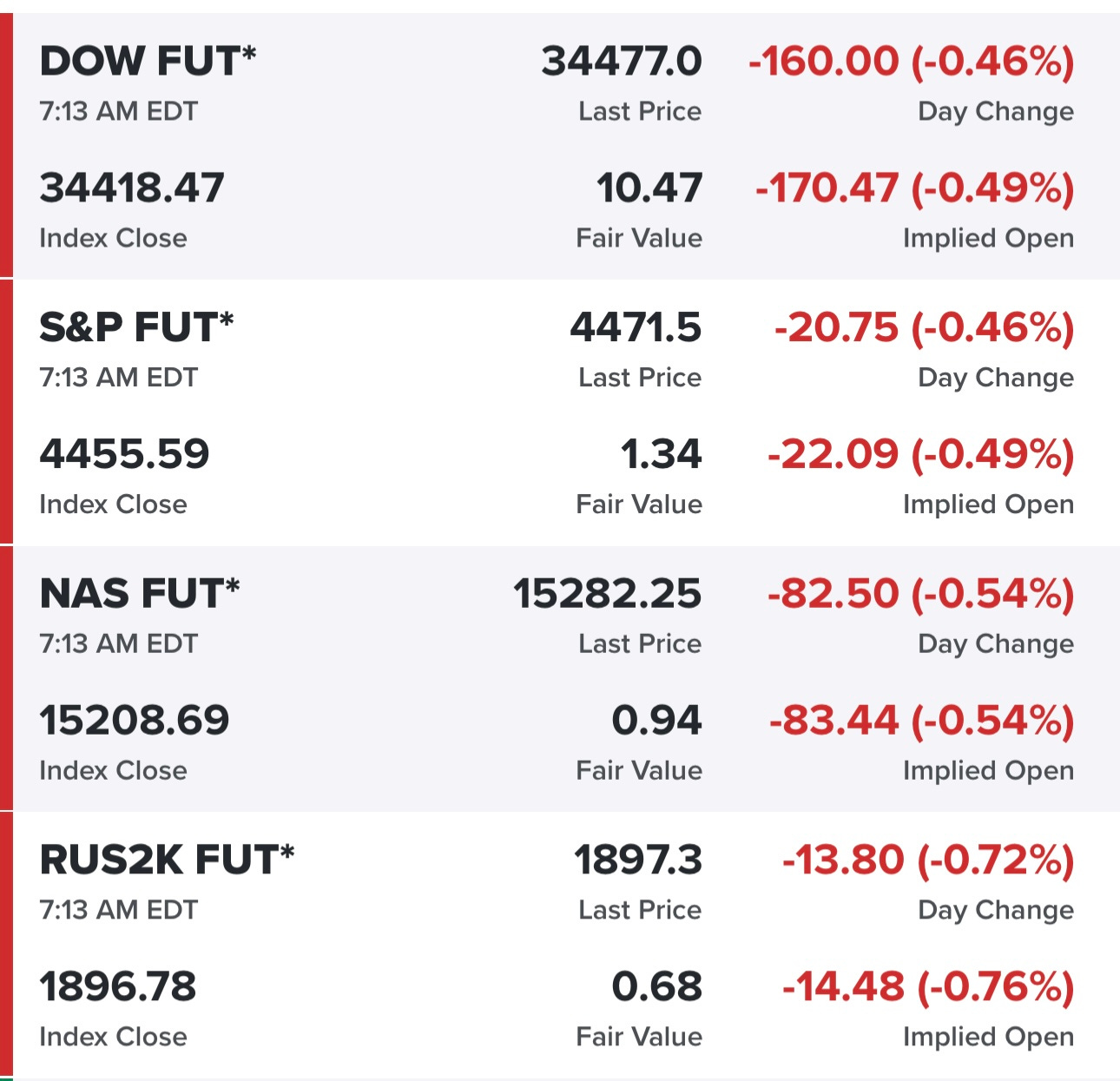

Hope everyone enjoyed the July 4th holiday, equity futures are in the red today….

Yields are their highest levels since the banking crisis in early March…

SPY still trying to push through the YTD highs from a couple weeks ago.

RSP took out the highs from a couple weeks ago but still needs ~3.7% higher to take out the February highs.

QQQ closed on Monday at a new high for 2023, slightly above the previous high from June 15th. I would not be surprised if all the indexes spend this week and maybe next week digesting the recent gains which means some slight pullbacks into the ST moving averages

QQQE finished Q2 on a high note, not sure where go from here.

IWM obviously lagged SPY and QQQ in Q1 and Q2, will be curious to see if that continues in Q3 or do small/mid caps start to outperform.

IWO outperformed IWM and RSP in Q1/Q2, but lots of ground to make up to catch QQQ so hopefully we see the gains continue for growth stocks. That would be good for my portfolios.

ARKK has been rallying the past week and was very strong on Monday thanks to TSLA. Monday was a new YTD closing high for ARKK (as you can see in the 2nd chart) and the highest close since last September.

Below the paywall is my current trading portfolio and watchlist with charts, entry points, stop losses, etc. (PS: my investment portfolio is different and only available to my Stocktwits subscribers and my Substack deep dive subscribers)