Trading the Charts for Wednesday, July 12th (part 1)

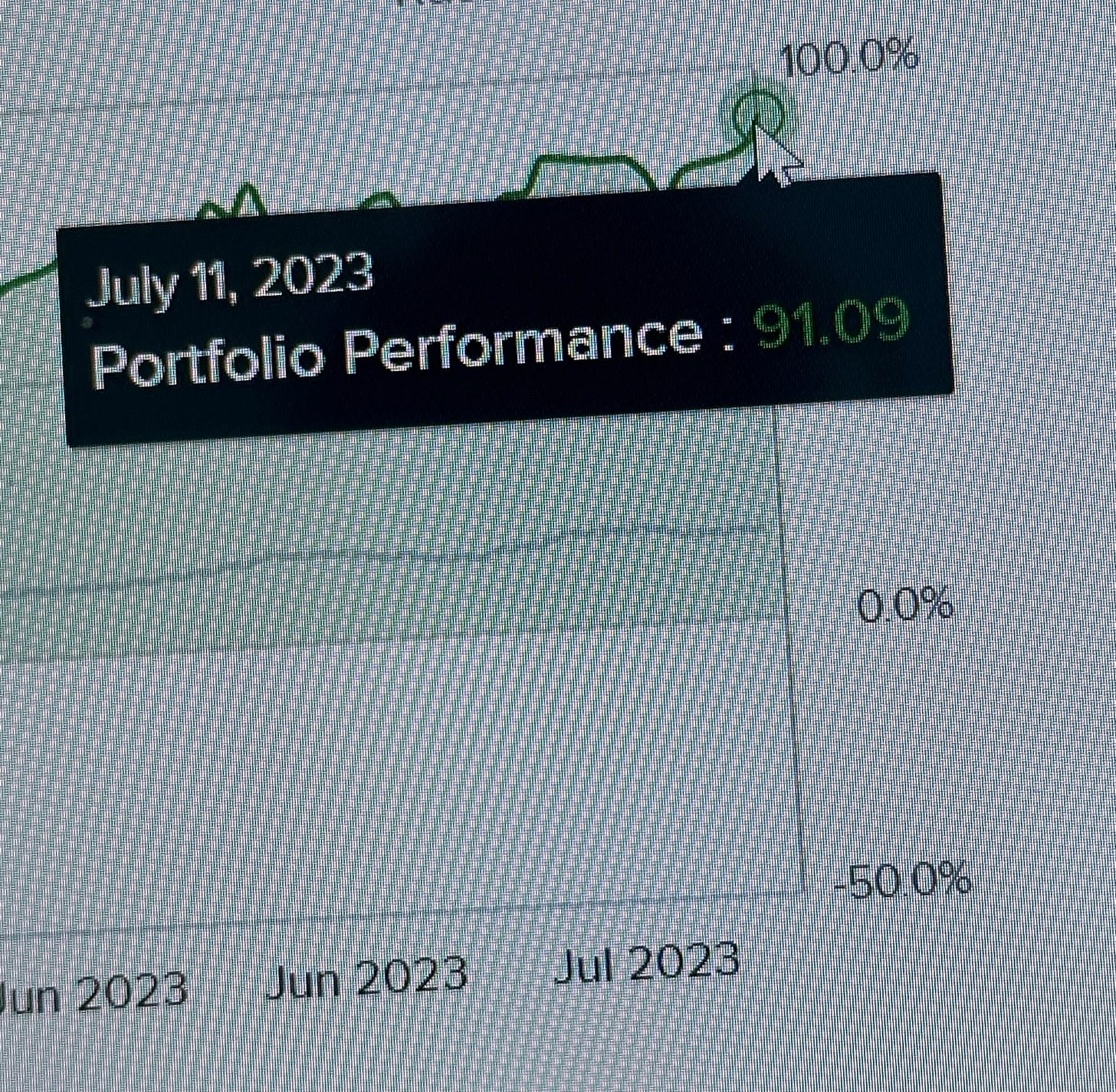

I also run a Stocktwits room where I’m active throughout the day but post mostly about my investment portfolio which is up ~91% YTD, I’m currently offering a free trial if you’d like to check it out.

Here are my other newsletters…

Good morning and Happy Wednesday,

Today is CPI day, which comes out at 8:30am EST. Headline CPI gets more attention however it’s core CPI that is the more important number because that’s what the FOMC is focused on. Core CPI takes out food and energy which is ridiculous because those are significant monthly expense for the average consumer/family. Not sure about you but after housing/shelter, my biggest monthly expense is food. Last year CPI was being pushed higher by food & energy but now those same people don’t want to include food & energy because it shows that YoY inflation is down to 3%. IMO, that’s freaking stupid and proves most of this crap is just a big game and if you’re a long term investor you should just drown out all of this noise and focus on buying quality companies with quality fundamentals at reasonable valuations — don’t be stressing over the monthly inflation numbers.

It’s kind of pathetic the markets will move higher or lower today (by trillions) depending on whether MoM CPI comes in at +0.1%, +0.2% or +0.3% just like last week when a hot ADP payroll number crushed growth stocks which is silly because that just means we have a stronger economy and a stronger labor market, both of which are good for earnings and profits.

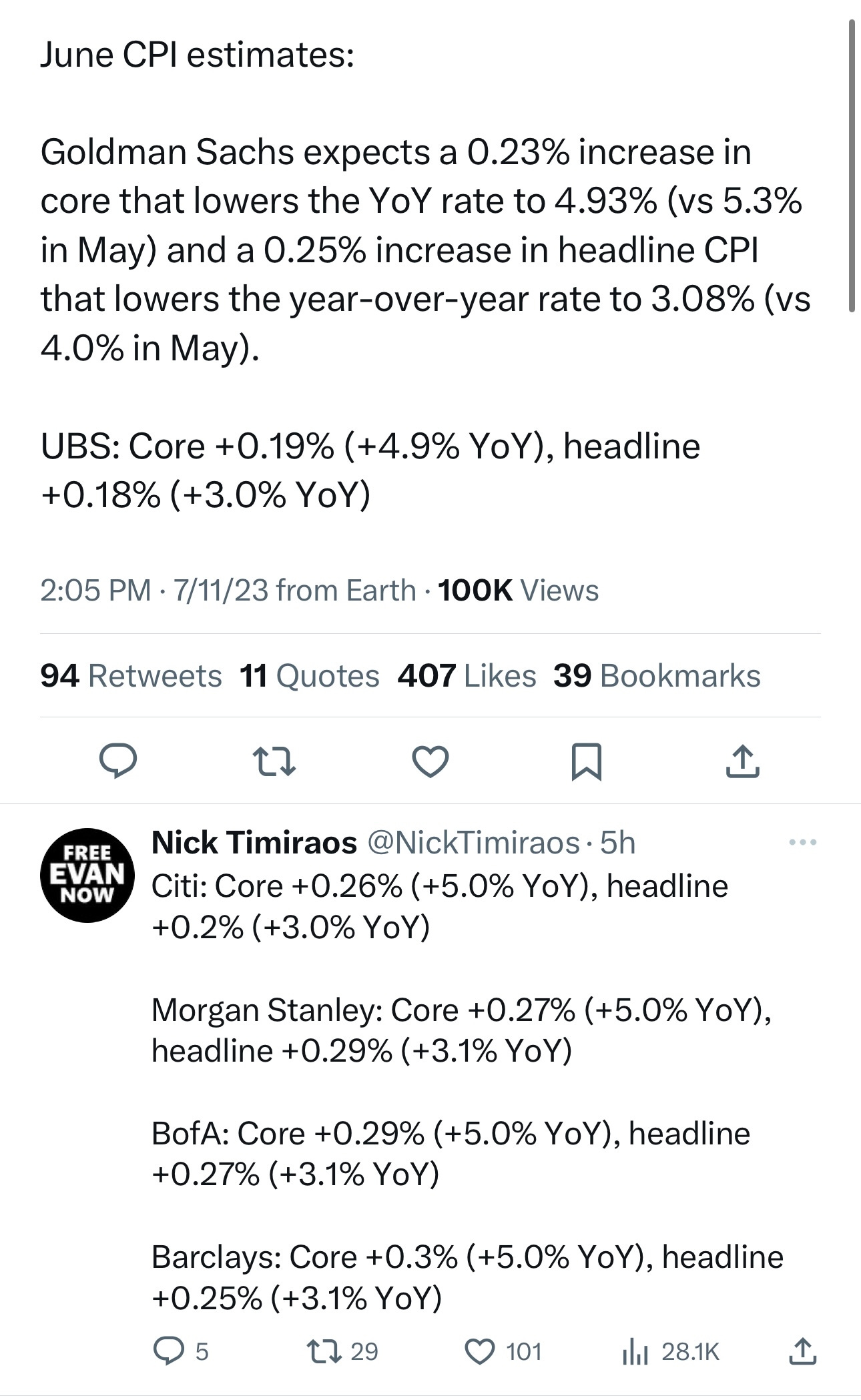

Here’s what the big Wall Street firms are predicting for CPI today…

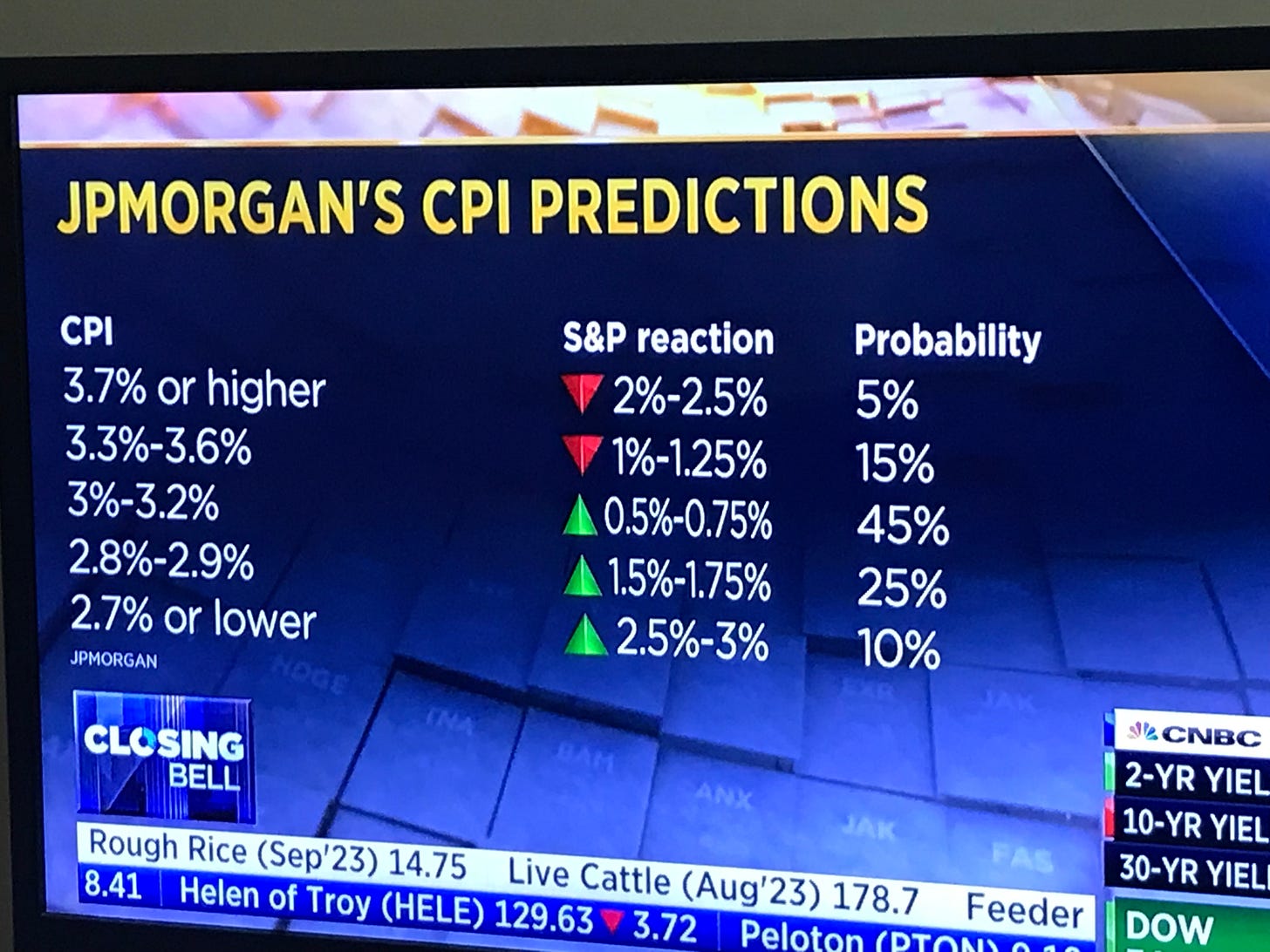

Here’s what JPM is predicting from the markets (SPY, QQQ) depending on where CPI comes in (this is based on headline when we know core is more important for the FOMC)…

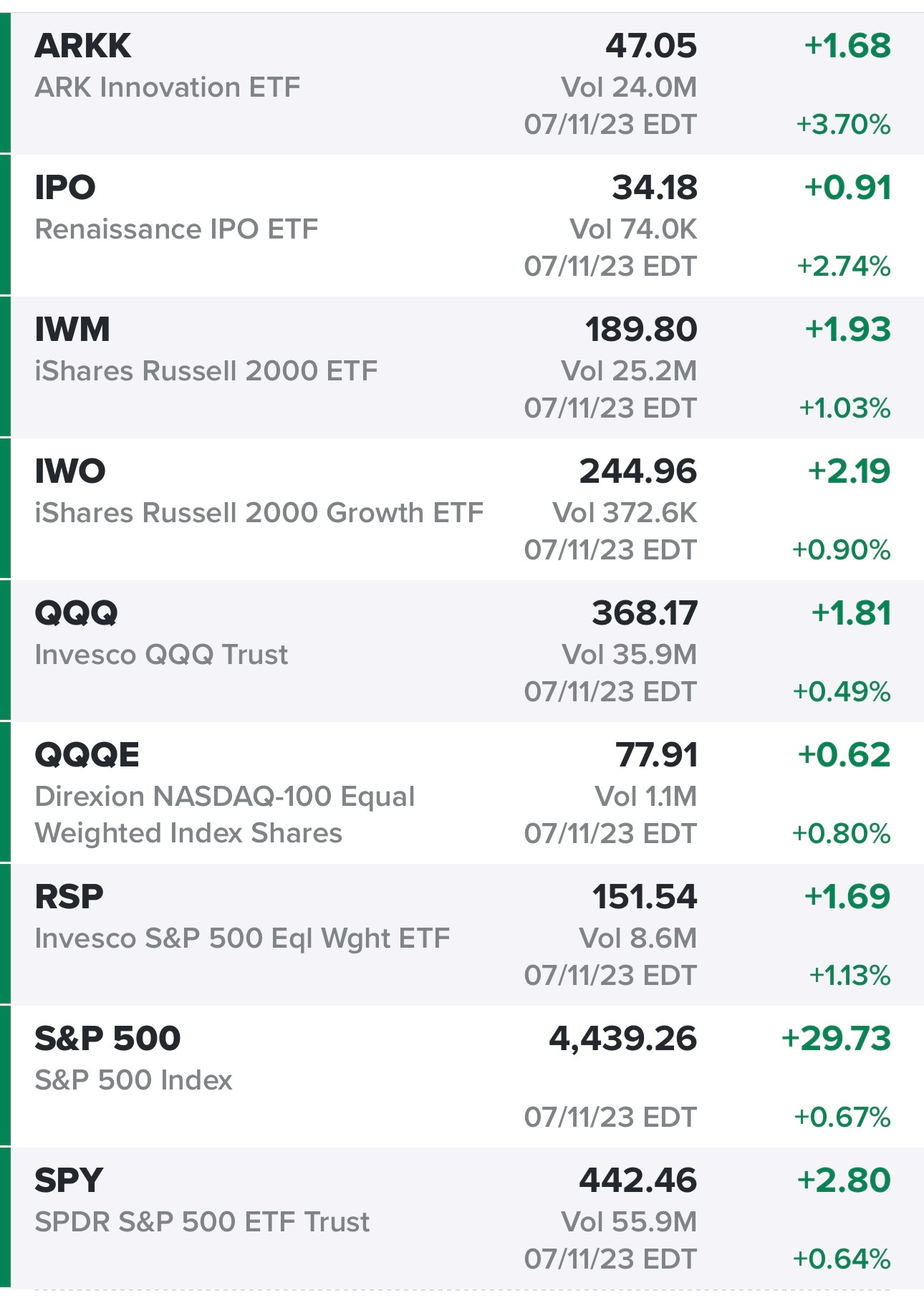

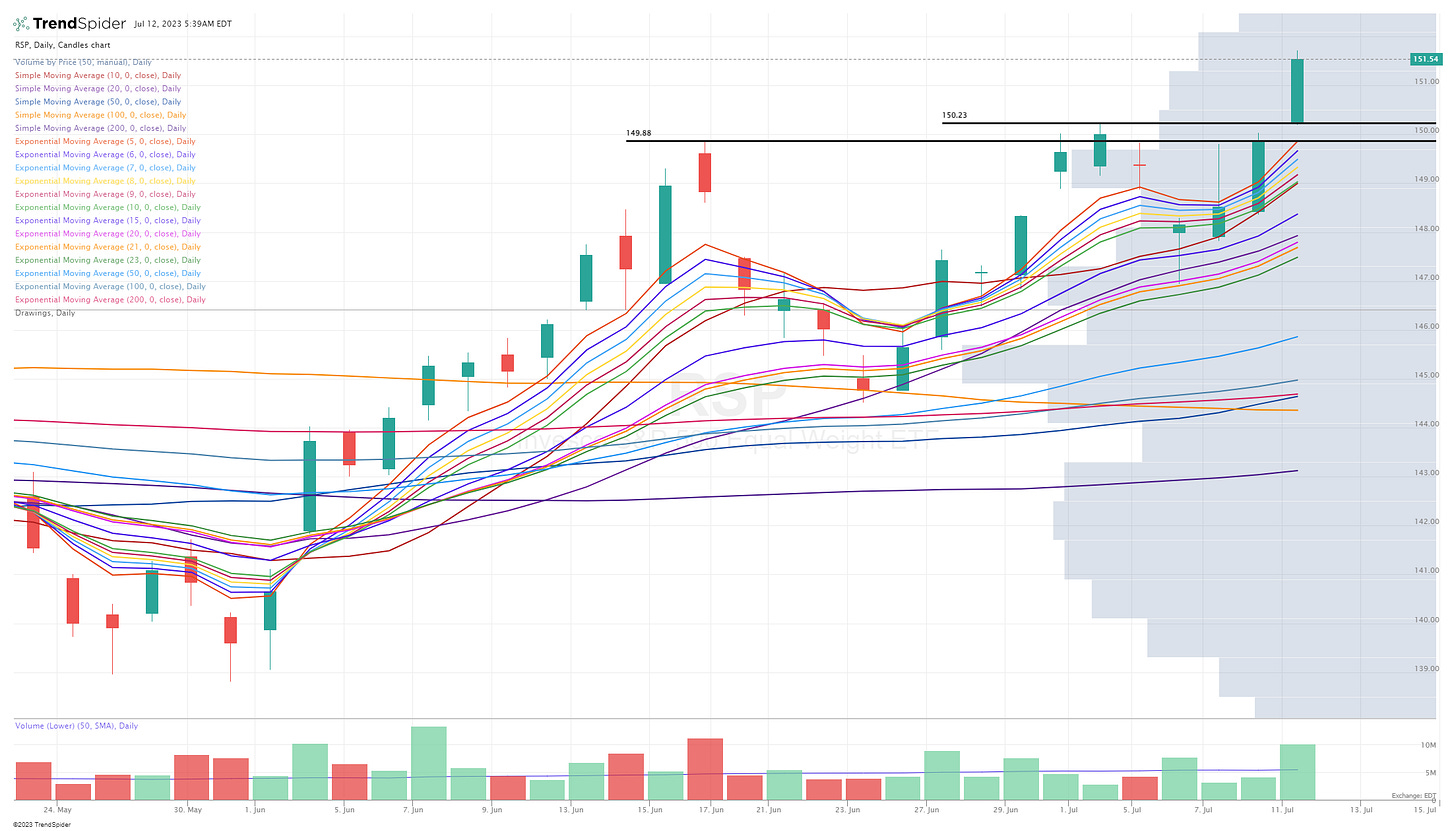

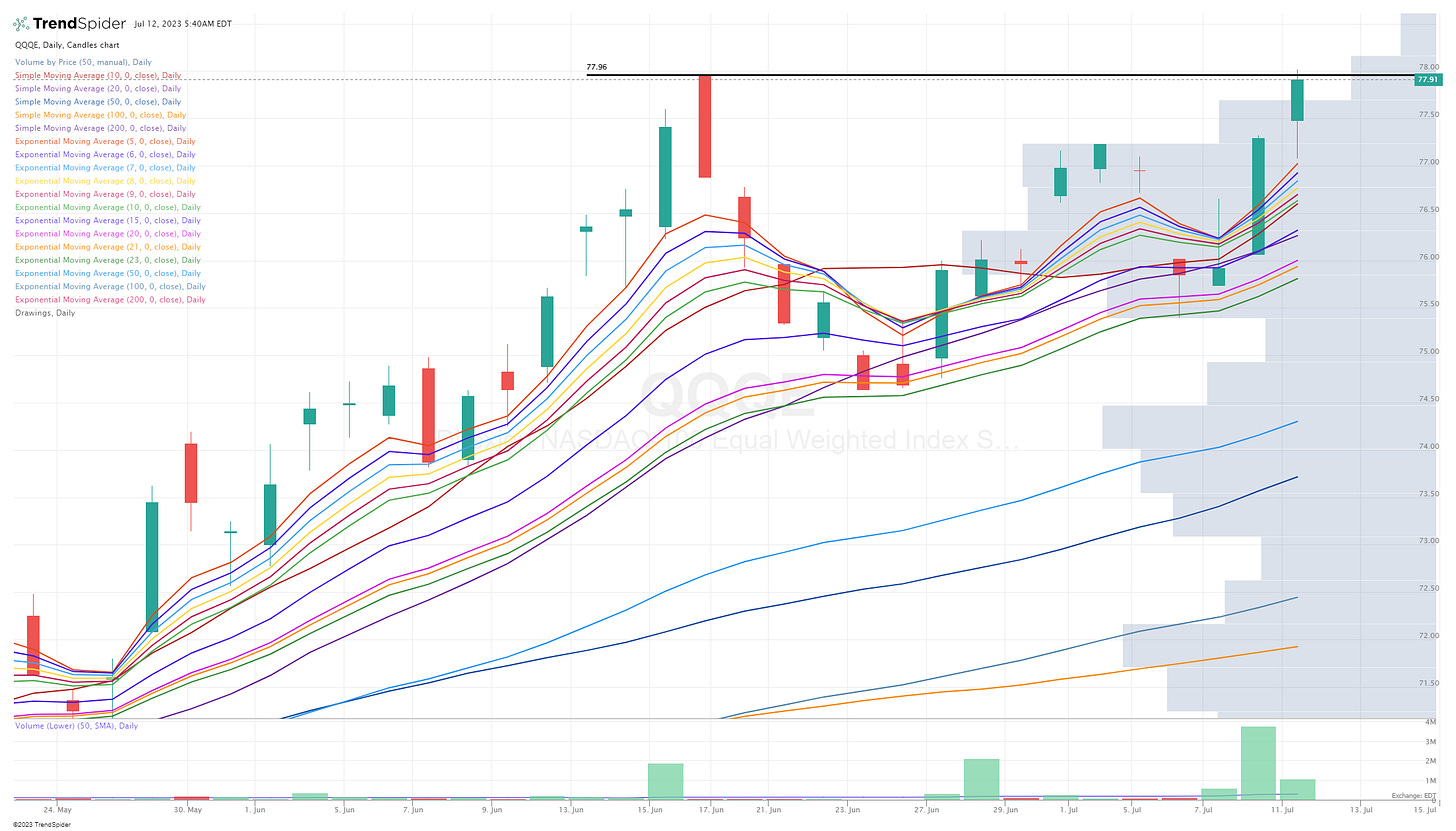

Markets coming off a strong day, especially for growth stocks (ie ARKK, IPO) with small/mid caps over large caps and with equal weighted indexes (RSP, QQQE) once again outperforming the market cap weighted indexes (SPY, QQQ)…

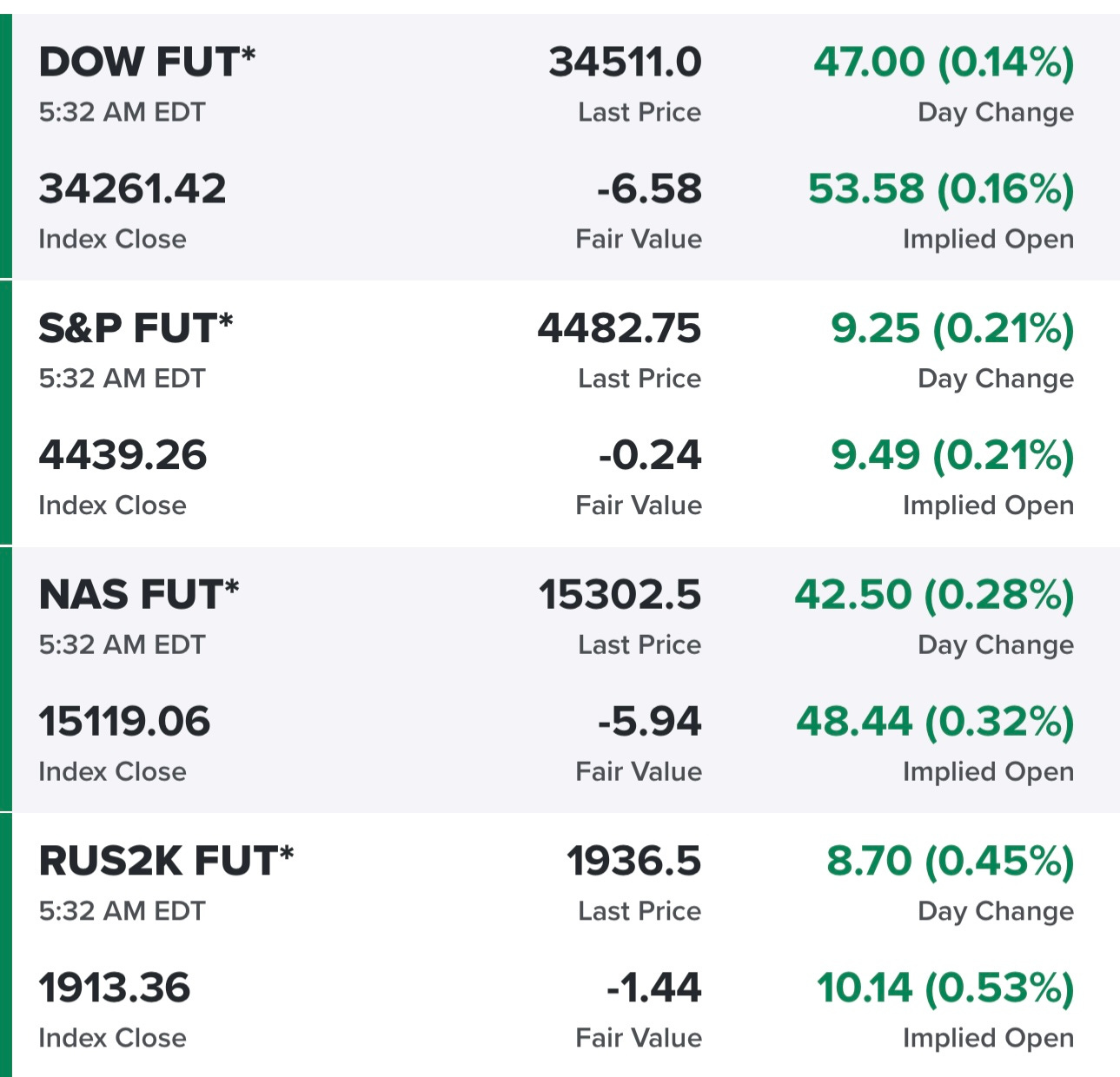

Equity futures looking decent this morning, pre-CPI, but this will change at 8:30am so buckle up…

Yields down again this morning, 10Y now below 3.95% going into CPI…

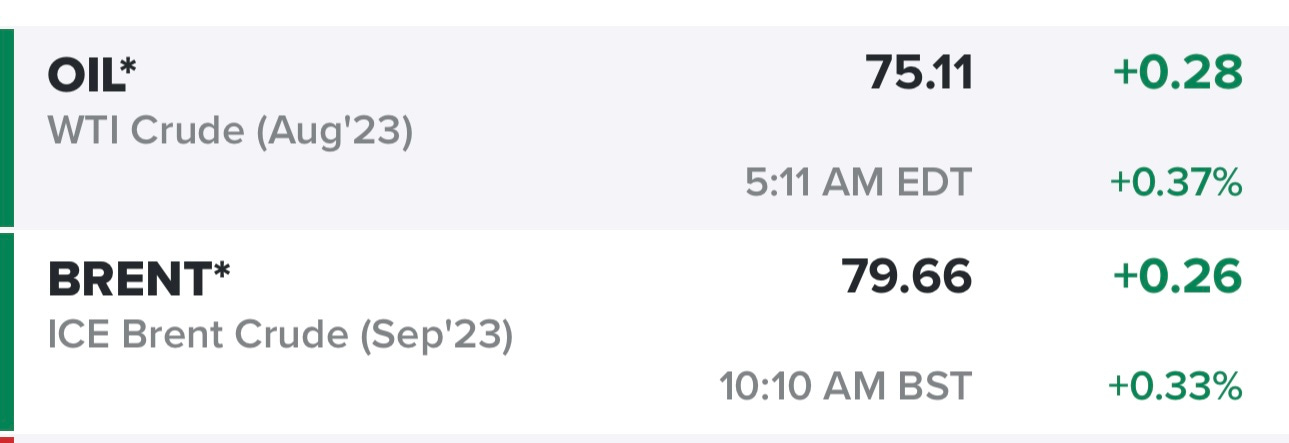

Oil back into the mid-$70s, this is one reason why energy stocks have finally caught a bid…

Energy was the best performing sector yesterday, with all sectors were in the green…

SPY with a nice bounce yesterday off the 10d ema, closing near the highs of day.

RSP gapping up yesterday above the recent high and just grinding higher throughout the day, closing near highs of day.

QQQ bouncing off the 15d ema, closing near highs of day.

QQQE with a small pullback at the open but then bounced just above the 5d ema, eventually getting rejected at the recent high from a month ago, closing near highs of day.

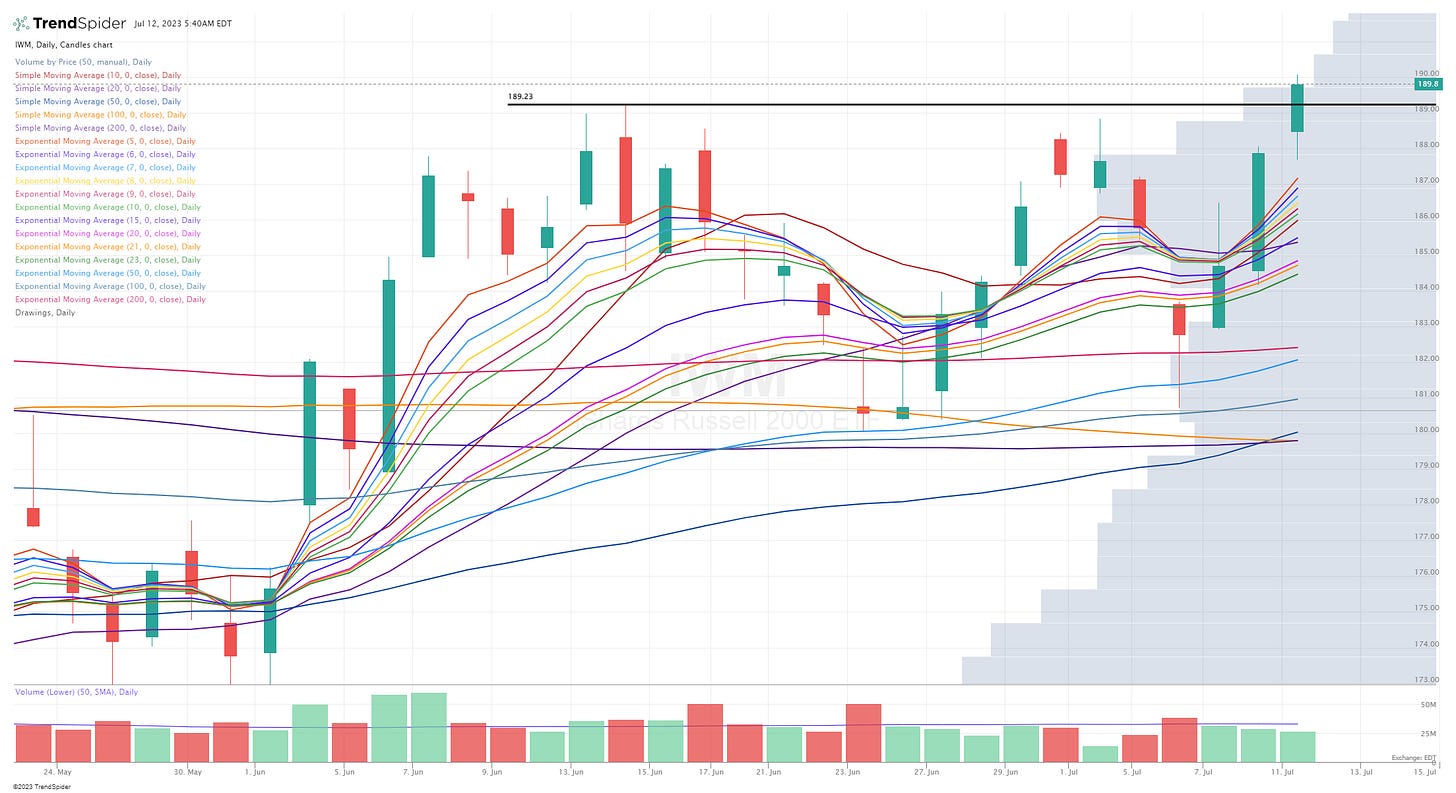

IWM gapped up at open, then small pullback then ripped higher and pushed through the recent highs, closed near highs of day.

IWO chart looking similar to IWM, gapped up at open, small pullback then ripped higher and pushed through recent highs, closed near highs of day.

ARKK with another very strong day, now up 10% from those July 6th lows when ARKK tested the 23d ema. ARKK gapped up at the open, ripped higher in the morning than leveled out the rest of the day but ultimately closed at a new high for the year. Over the past couple months it was mostly TSLA pushing ARKK higher but now stocks like COIN and ROKU have been helping out.

Below the paywall is my current trading portfolio and watchlist with charts, entry points, stop losses, etc.

PS: my investment portfolio is different and only available to my Stocktwits subscribers and my Substack deep dive subscribers