Trading the Charts for Wednesday, May 31st

In addition to my “Trading the Charts” newsletter, below are a few more newsletters that I publish plus my Investing with the Whales podcast, my Stocktwits room, my Seeking Alpha investment service and my new Twitter Spaces coming soon.

I also run a Stocktwits room where I’m very active throughout the day and post about both of my portfolios with 100% transparency. FWIW, I’m up ~58.5% YTD thanks to huge gains with CELH, LNTH, UBER, MELI, SDGR, ONON, TSLA, GLBE, SWAV, XPOF, NU, FLNC, and several others. You can join by clicking the button below:

Good morning and Happy Wednesday,

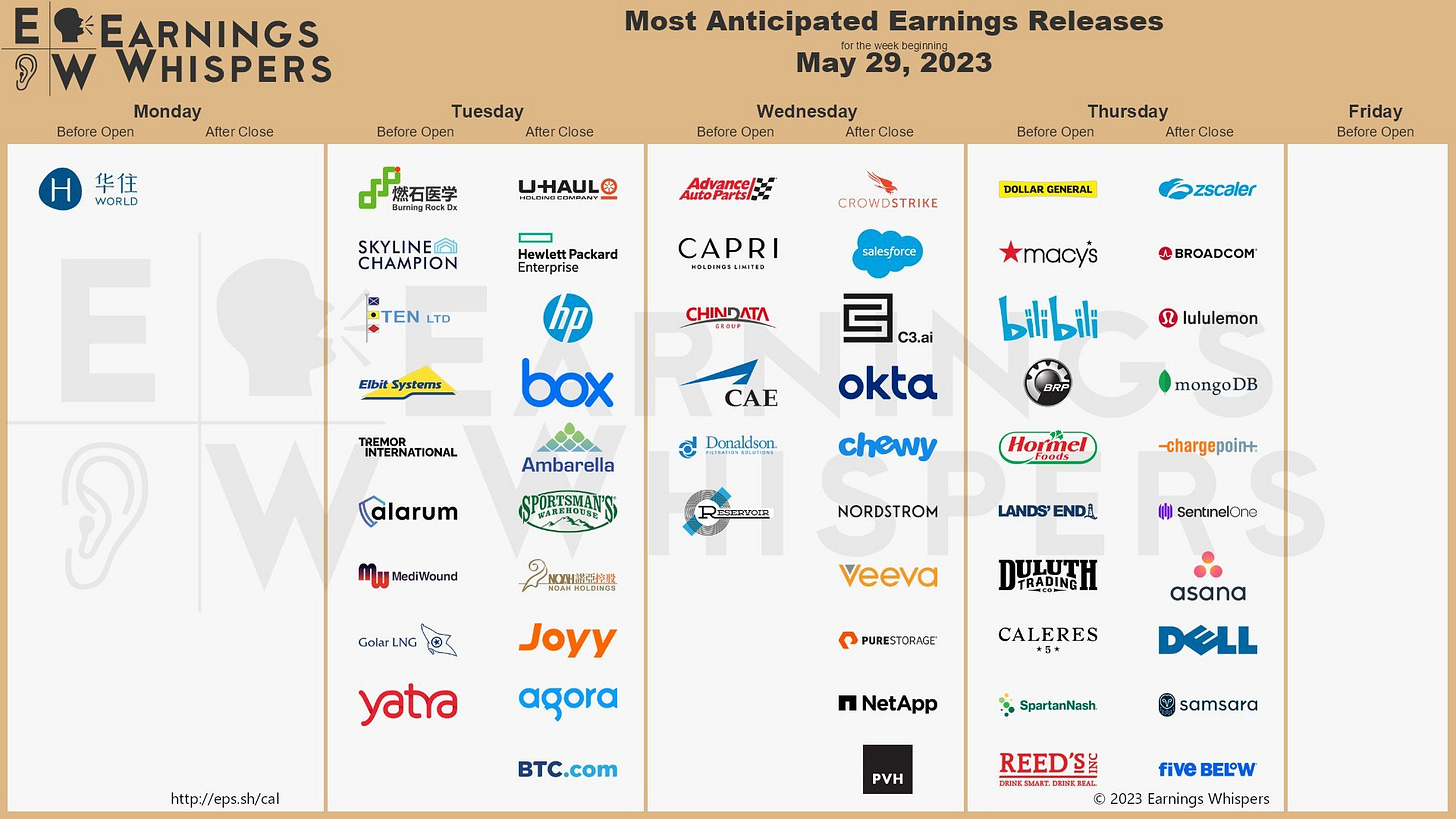

Some interesting earnings reports today and tomorrow, I’ll be watching CRWD, CRM, AI, S, ZS, LULU, CHPT, MDB, AVGO, and IOT

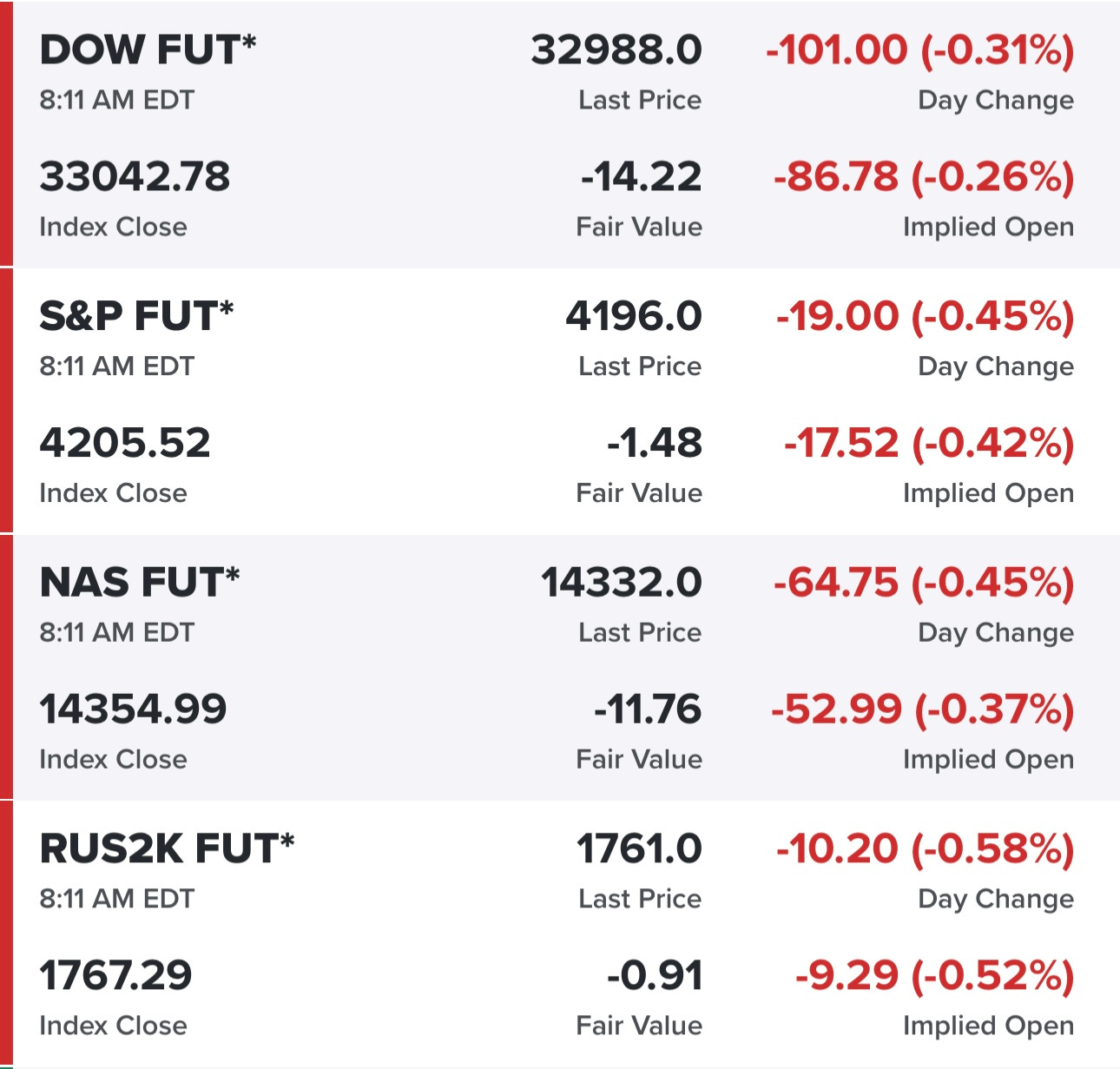

Futures down this morning…

Yields down again this morning…

Kind of shocking what’s happening with the Fed Funds futures, the market is now pricing in a 65% chance of another rate hike at the June 14th FOMC meeting…

SPX closed that unfilled gap yesterday from last summer then pulled back and bounced off the February highs while still closing above 4200, if we can’t hold 4195 then I’d definitely get a little bearish.

RSP — the equal weighted indexes still look like crap, nothing to like about this chart right now, still below the 200d sma

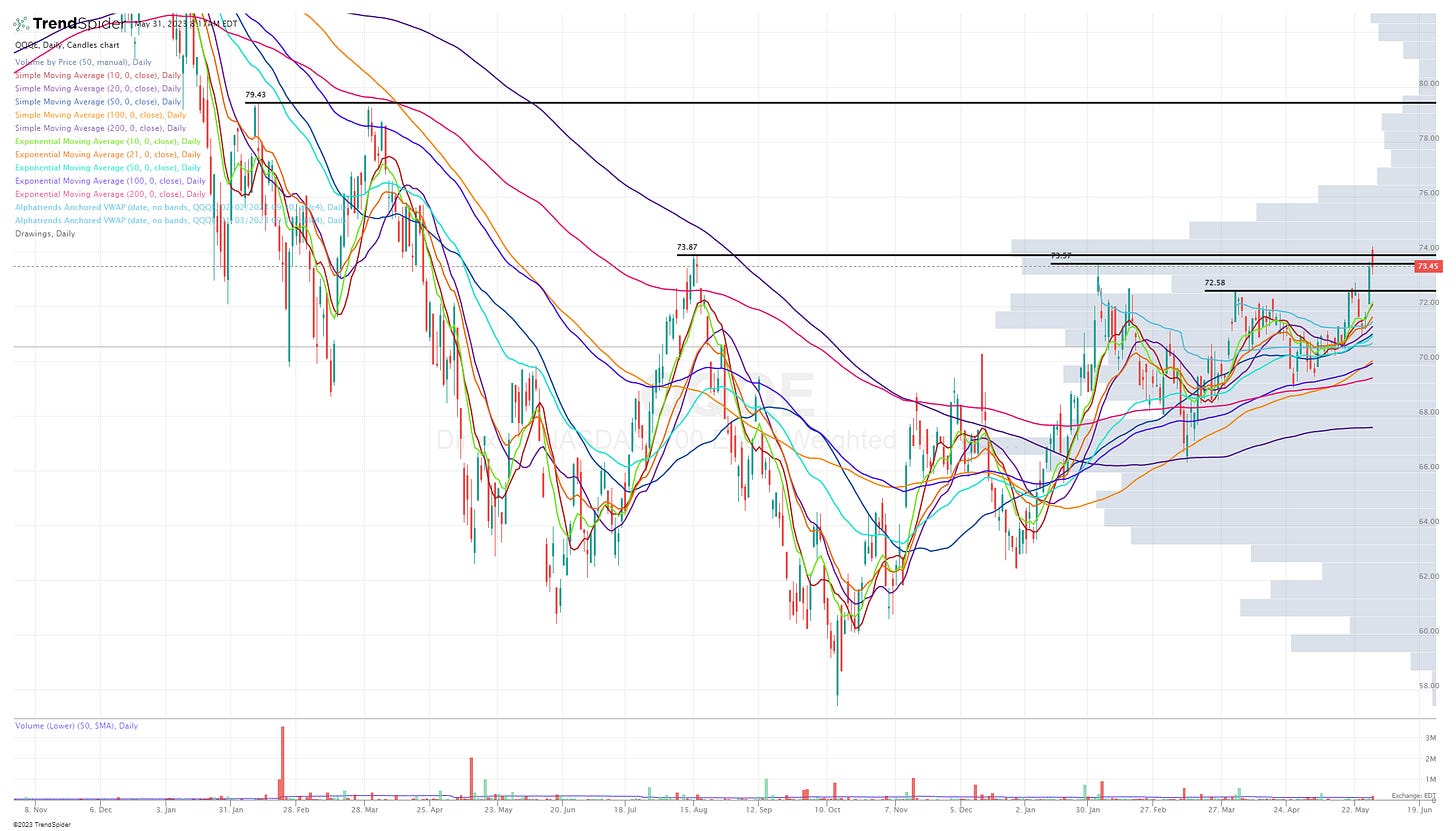

Similar to SPX/SPY, yesterday QQQ filled a gap from last summer then pulled back and bounced off the bottom of that gap, this is still a decent looking chart although yesterday’s big fade would definitely give me some pause about adding positions today.

QQQE tried to take out the highs from last summer but failed and closed below the February highs. If you wanted to hedge with QQQE, I think you can be short as long as QQQE can’t close above 73.87 but if it does you should cover the short can get long.

IWM was showing some promised yesterday morning but then faded hard and closed back below the 50d ema, I’ll keep at least part of my IWM short (hedge) as long as IWM keeps closing below the 50d ema.

IWO tried to rally yesterday morning but was unable to reclaim the 200d ema, I’m still short IWO (hedge) and regret not increasing my short after it failed at the 200d ema. It did find support at the 50d ema so I’d increase my short if it loses that support and I’d cover my short back above the 200d ema

ARKK with a big fade yesterday, I don’t have a short position anymore because it’s in no man’s land, I think you can be long ARKK above 41.00 but short ARKK below the VWAP from February highs and then add to that short below the 200d sma.

IPO actually looks a little better than ARKK, nice bounce yesterday off the 5/6d ema, I don’t have any long or short position. I’d probably get short (as a hedge) below the 200d sma or if rejected at 200d ema. Right now I think IWM and IWO are in better spots on the charts to manage risk/hedges for my portfolio.

Below the paywall is my current trading portfolio (with positions, sizes, entry price, stop loss, etc), current watchlist and links to my daily Zoom webcasts.