Trading the Charts for Wednesday, June 7th

Here are my other newsletters…

I also run a Stocktwits room where I’m very active throughout the day and post about both of my portfolios with 100% transparency.

FWIW, I’m up ~71.4% YTD thanks to huge gains with CELH, LNTH, UBER, MELI, SDGR, ONON, TSLA, GLBE, SWAV, XPOF, NU, FLNC, CFLT, DOCN and several others. You can join by clicking the button below:

Good morning and Happy Wednesday,

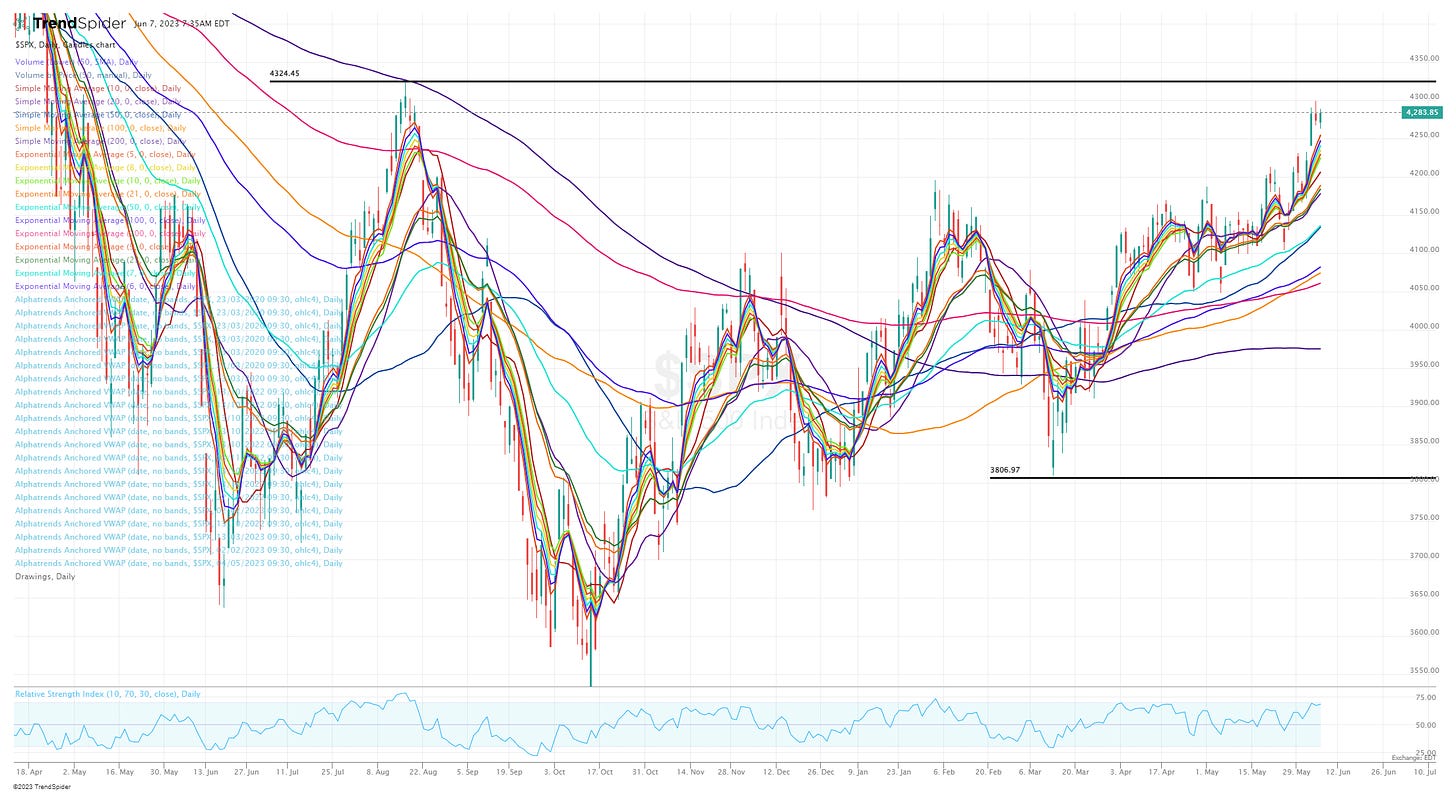

Equity futures are slightly up/green, yields are flat, 77% probability of no rate hike at the FOMC meeting next week.

These markets continue to amaze me, we are clearly climbing the wall of worry. I still think we’re overdue for a pullback but I have no idea when it happens or what sparks it. In many ways this is a goldilocks scenario for stocks with earnings holding up (some valuations look great and some look stretched), inflation coming down, FOMC almost done, labor market strong, commodity prices down, housing still strong (at least new builds) but we still have high rates, 5% inflation, inverted yield curve and flat YoY earnings growth for S&P 500 — so pick your side hahaha.

I’m 100% net (140% long, 40% short) in my investment portfolio (up 71.4% YTD), I’ll continue to increase my shorts/hedges to protect my YTD gains rather than trim/sell positions and trigger lots of tax consequences. I’d rather get super hedged into a pullback, make money on my hedges then sell the hedges after the correction and use those profits to add to my longs which most likely pulled back in the correction however it’s always possible my longs show relative strength and hold up well (because of strong fundamentals) while my hedges make me money, this is best possible scenario.

I’m 131% long in my trading portfolio with no hedges but I continue to raise my stops to protect my gains, this portfolio is up 42.5% YTD.

SPX printing another green day, unable to take our Monday’s highs but still above 5d ema and that gap from last summer that it recently filled. I have no clue if/when we take out 4324 but that would certainly piss off the bears.

RSP finally coming to life, yesterday it took out and closed above the 200d ema. I’ll get short RSP if it fails to hold the 200d ema

QQQ still the leader, personally I love the current consolidation which is why we’re seeing some broadening out which is what is needed to keep this rally going higher. We can’t have the top 10 stocks accounting for 95% of the gains. We need other sectors to participate so the sideways action for megacap tech would be ideal while other indexes start to catch up.

QQQE outperforming QQQ yesterday which just proves my point above that megacap tech is taking a breather while other stocks see some inflows.

Monster move yesterday for IWM, I’m glad I wasn’t short haha — small/mid caps have shown massive outperformance 2 of the past 3 days as you can see from these candles, hopefully it continues because IWM is only up 5.7% YTD vs SPY at 11.9% YTD and QQQ at 33.2% YTD.

IWO also printing a crazy bullish candle (I am short, as a hedge), lots of possible resistance above but there’s clearly some momentum here, climbing the volume shelf like a champ.

ARKK finally closing above the 200d ema for the first time since November 2021 which was basically the peak of tech/growth, this is certainly meaningful and very bullish for growth stocks. I cut my ARKK short position in half yesterday when it took out the 200d ema, I didn’t cover my entire short because I’m 140% long and don’t want to be more than 100% net so I need 40% of shorts/hedges (although it’s only 30% after the price action yesterday). I’ll keep my 15% ARKK short position and will increase if ARKK loses the 200d ema or gets rejected at 43.74

Below the paywall is my current trading portfolio and watchlist with charts, entry points, stop losses, etc. (PS: my investment portfolio is different and only available to my Stocktwits subscribers and my Substack deep dive subscribers)

Please note that I have changed the links/URLs for my webcasts as well as my portfolio spreadsheet — I have to do this at the beginning of every month so former subscribers no longer have access to the content that is exclusive for paid subscribers.