Trading the Charts for Wednesday, August 16th

In order to read this entire newsletter you’ll need to become a paid subscriber by clicking the button below. Paid subscribers get full access to my trading portfolio (up ~63.5% YTD), daily watchlists, daily activity (buys, sells, entry prices, stop losses, performance), daily webcasts/recordings and my options portfolio.

I also run a Stocktwits rooms where I post about my investment portfolio (up ~98% YTD and ~1,000% over the past 3-years) with full access to all holdings, performance, daily activity, market commentary, quarterly earnings analysis, daily webcasts and more.

Here are my deep dive newsletters…

Good morning and Happy Wednesday,

We’re almost done with earnings season, it’s been a wild one with an endless number of 10-20% more pops and drops. It’s been hard to avoid all the landmines over the past few weeks, anyone that has a portfolio of 20+ stocks probably had at least one of them drop 10% or more on earnings… the question is whether you add to that position, trim it or sell it? Personally if a stock misses on earnings and lowers guidance there’s a 90% chance I’m selling it because my investment thesis is probably falling apart — just take the loss and move on.

Unless the miss can be explained by management and they suggest it’s just a short term hiccup, there’s no reason for me to keep holding because the stock will probably trade lower (or at least it’s stuck in the doghouse until the next earnings report) and more often than not, the stocks that gap down on earnings tend to do it again the next quarter ie SE, SNAP, PYPL, plus many others that have been disappointing investors over and over for the past 2 years.

TGT had disappointing numbers this morning but the stock is trading higher, maybe because it’s already been beaten down pretty bad or perhaps the markets are getting a little oversold in the short term and we could get a sentiment uplift in the second half of August. Unfortunately the markets seem focused right now on yields, the dollar and China — all of which are trending in the wrong direction for equities.

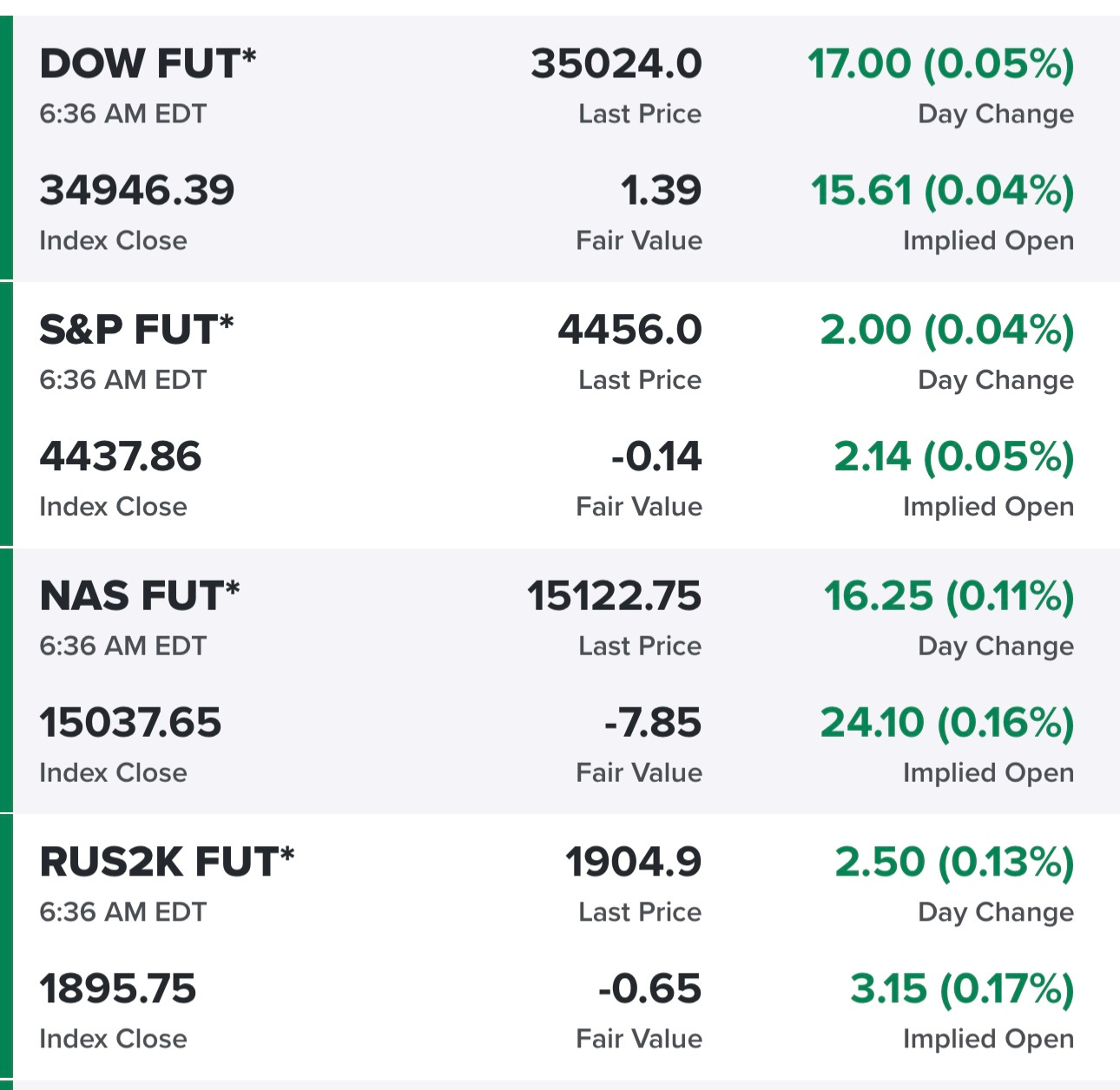

Futures are slightly up this morning (as of 6:30am EST)…

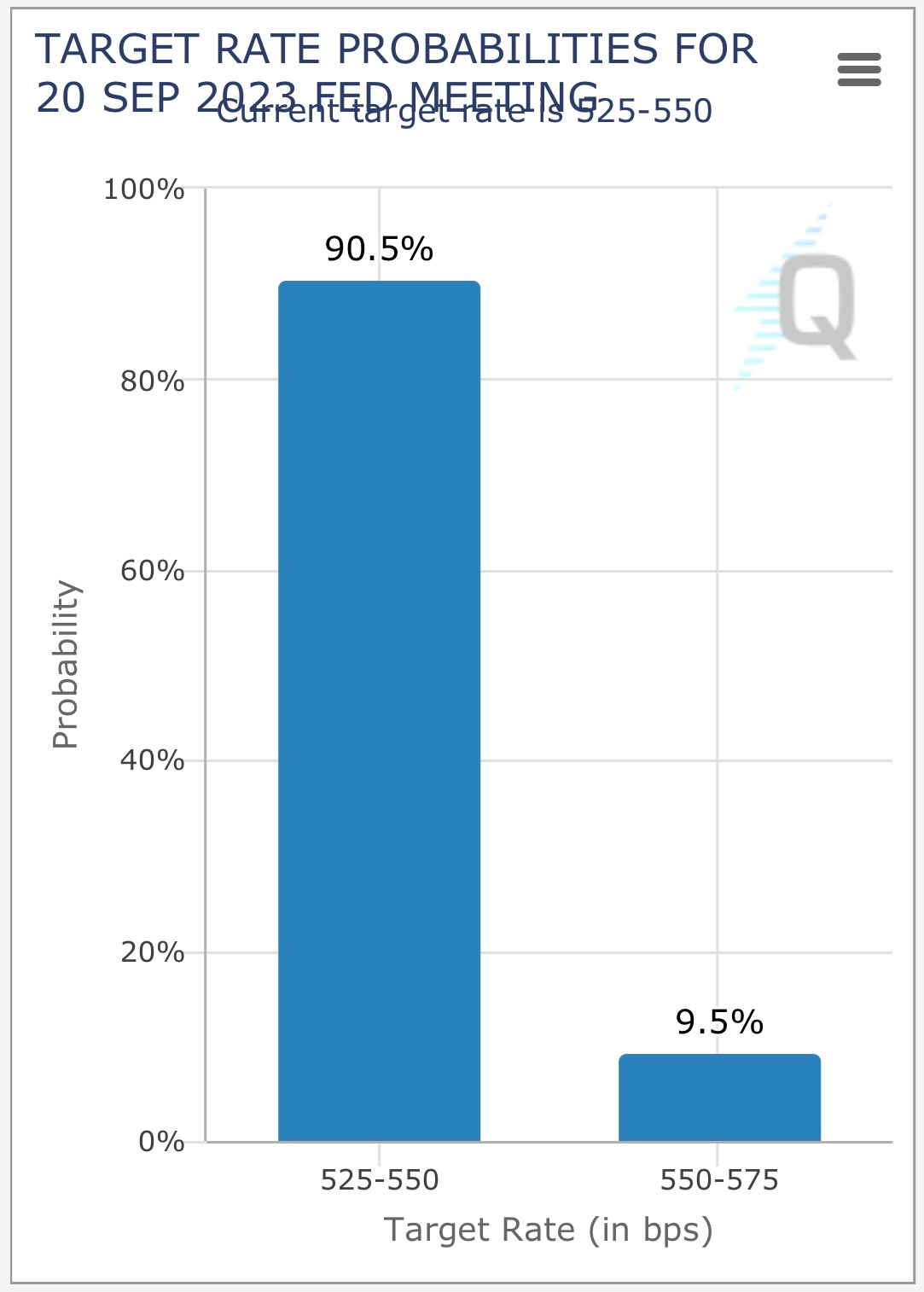

Even though rates have been moving higher the past few weeks there’s still a less than 10% chance we get a rate hike at the next FOMC meeting in September…

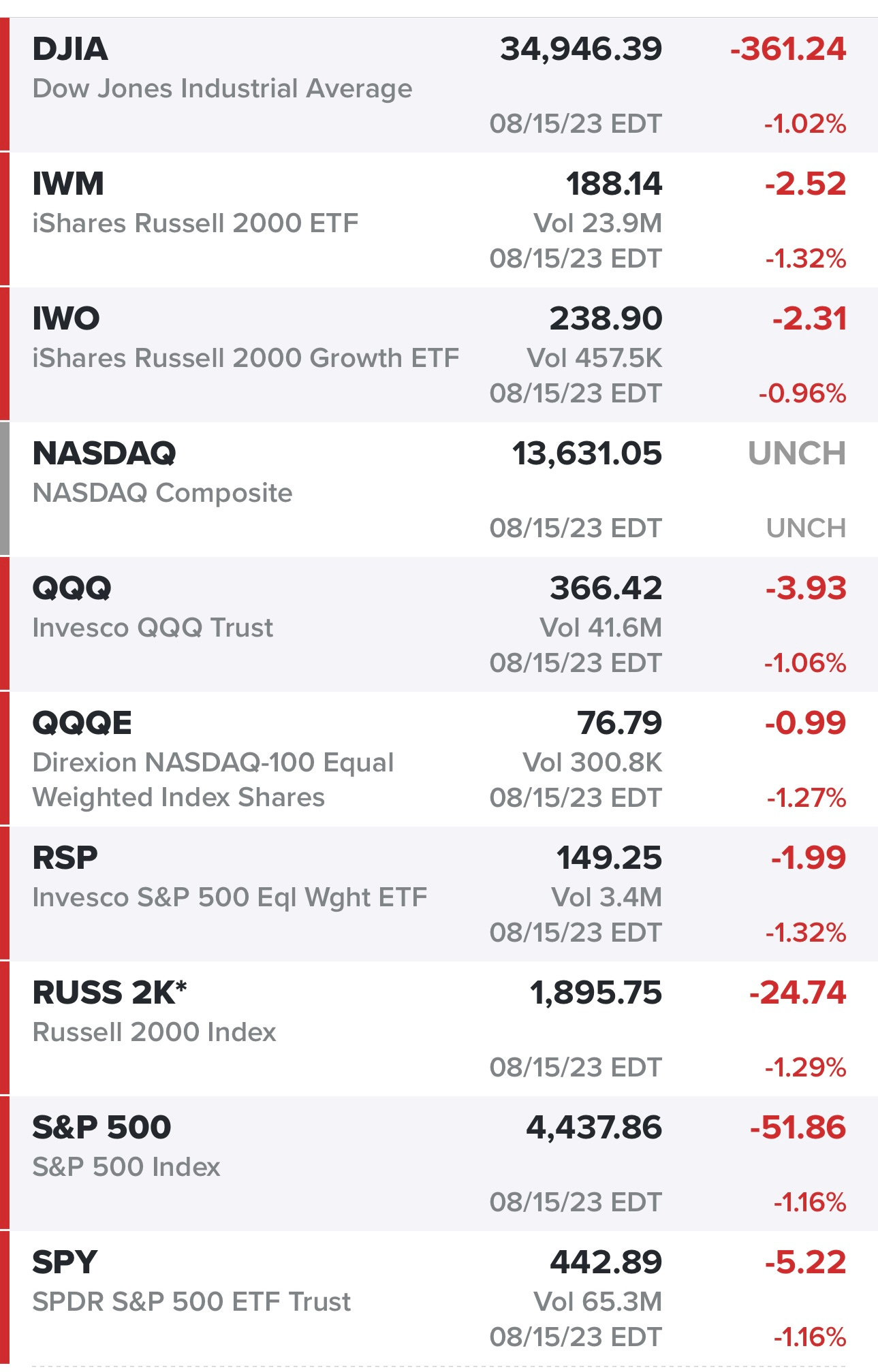

All of the indexes finishing in the red yesterday with small/mid caps taking it the hardest, they’re likely to underperform relative to large caps if yields keep moving higher…

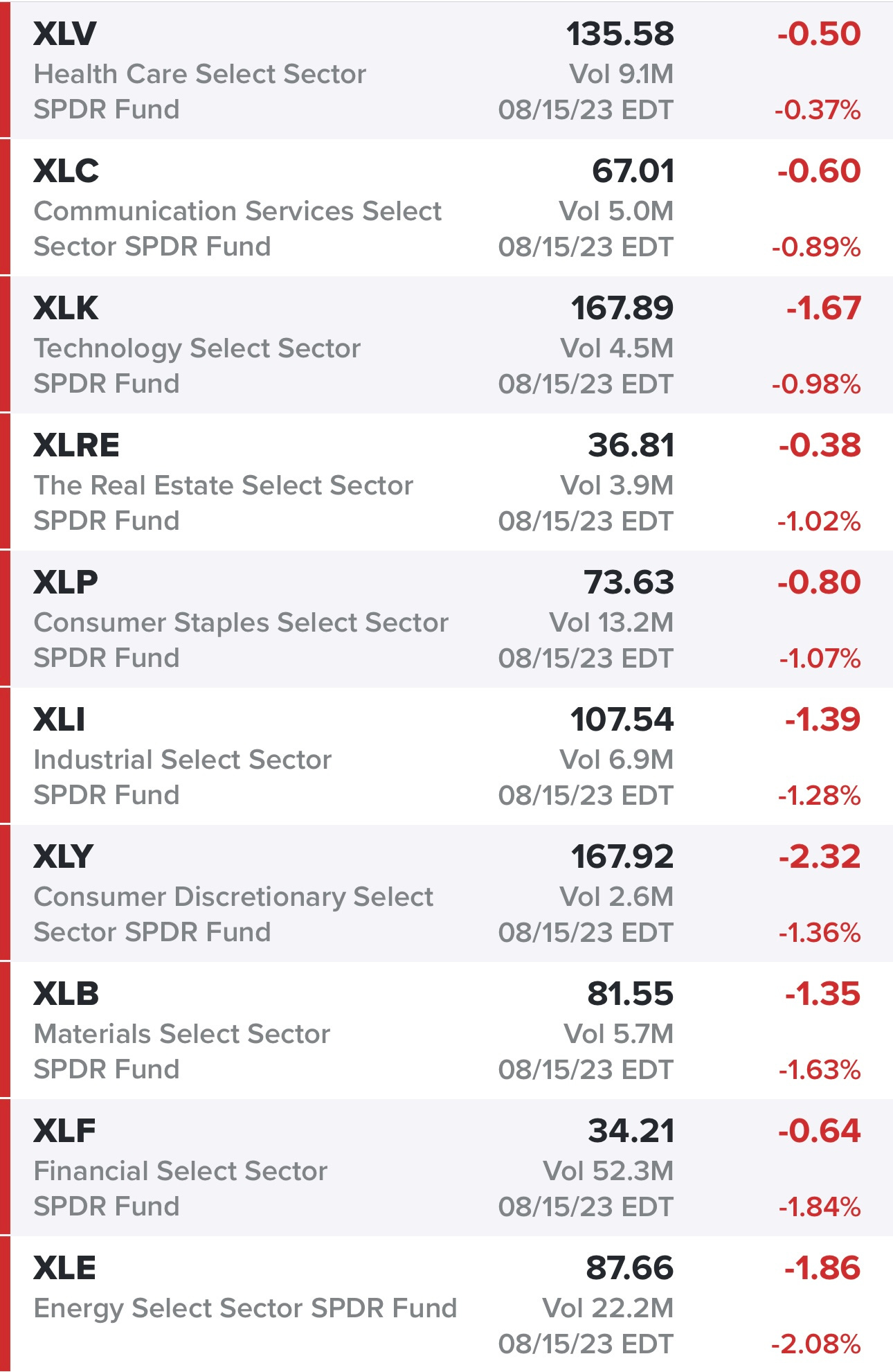

All of the sectors finished in the red yesterday however healthcare did the best with energy doing the worst…

Yields finally starting to retreat after a week of moving higher, 10Y under 4.2% right now…

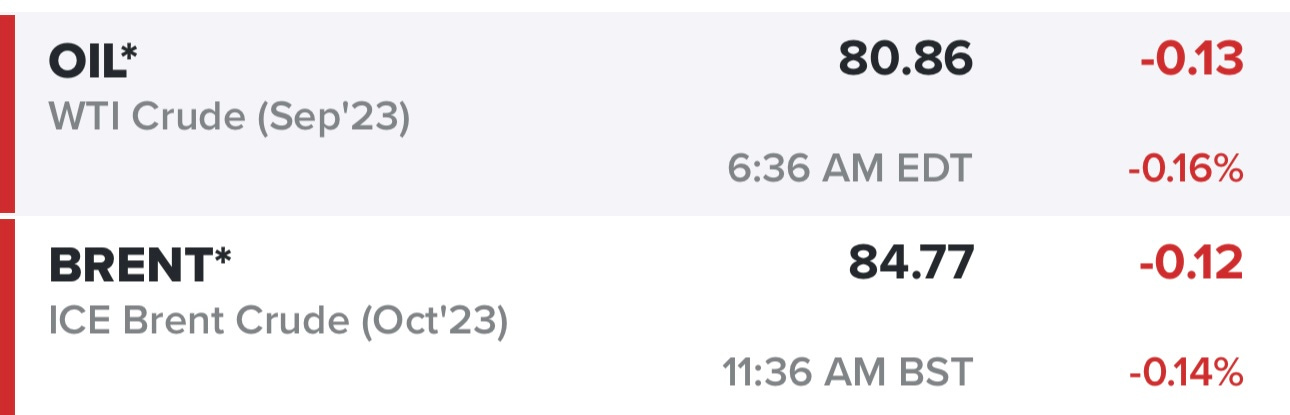

Oil has retreated back to $80-81, if it dips below $80 we’ll probably see more selling in the energy stocks…

SPY bouncing off the 50d ema although closing below 50d sma for the first time in since March

RSP slicing through 50d ema/sma, now sitting on VWAP From May lows

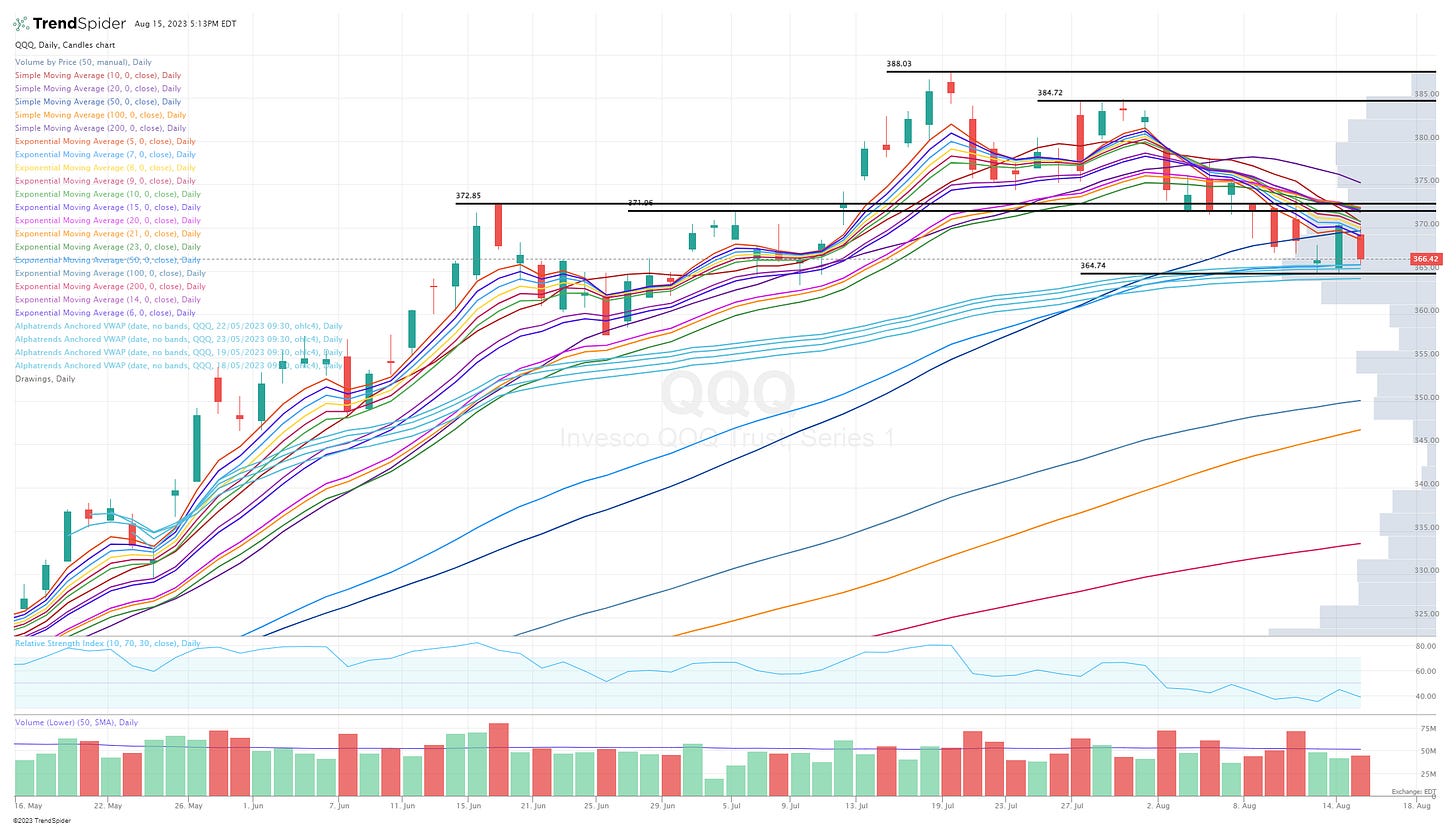

QQQ still below 50d sma but still finding support at 50d ema, needs to hold here

QQQE trying to bounce off the VWAPs from March lows

IWM closing below 50d ema/sma and the June pivot, now trying to find support at VWAPs from May lows

IWO looking bad, below 50d ema/sma and June pivot, now trying to find support at VWAPs from April lows

ARKK looking horrible, down -18% since July 19th (less than 4 weeks), sliced through 200d ema last week, now trying to stay above the 100d sma, RSI on ARKK is finally below 30 so we could see a bounce here.

Below the paywall is my current trading portfolio including all positions (open & closed), watchlists, entry prices, stop losses and YTD performance and my daily webcasts.