Trading the Charts for Wednesday, May 24th

In addition to my “Trading the Charts” newsletter, below are a few more newsletters that I publish plus my Investing with the Whales podcast, my Stocktwits room, my Seeking Alpha investment service and my new Twitter Spaces coming soon.

I also run a Stocktwits room where I’m very active throughout the day and post about both of my portfolios with 100% transparency. FWIW, I’m up ~60% YTD thanks to huge gains with CELH, LNTH, UBER, MELI, SDGR, ONON, TSLA, GLBE, SWAV, XPOF, NU, FLNC, and several others. You can join by clicking the button below:

Good morning and Happy Wednesday,

We get a couple big earnings earnings reports after the close today, NVDA and SNOW are the two that I’m watching closest. Both are up nicely since Q4 earnings, especially NVDA.

ELF is up 45% since Q4 earnings so expectations are pretty high and the valuation has gotten a little ridiculous so it’s pulled back to the 50d ema, looks more interesting now but I don’t think I’m playing it into earnings… too risky.

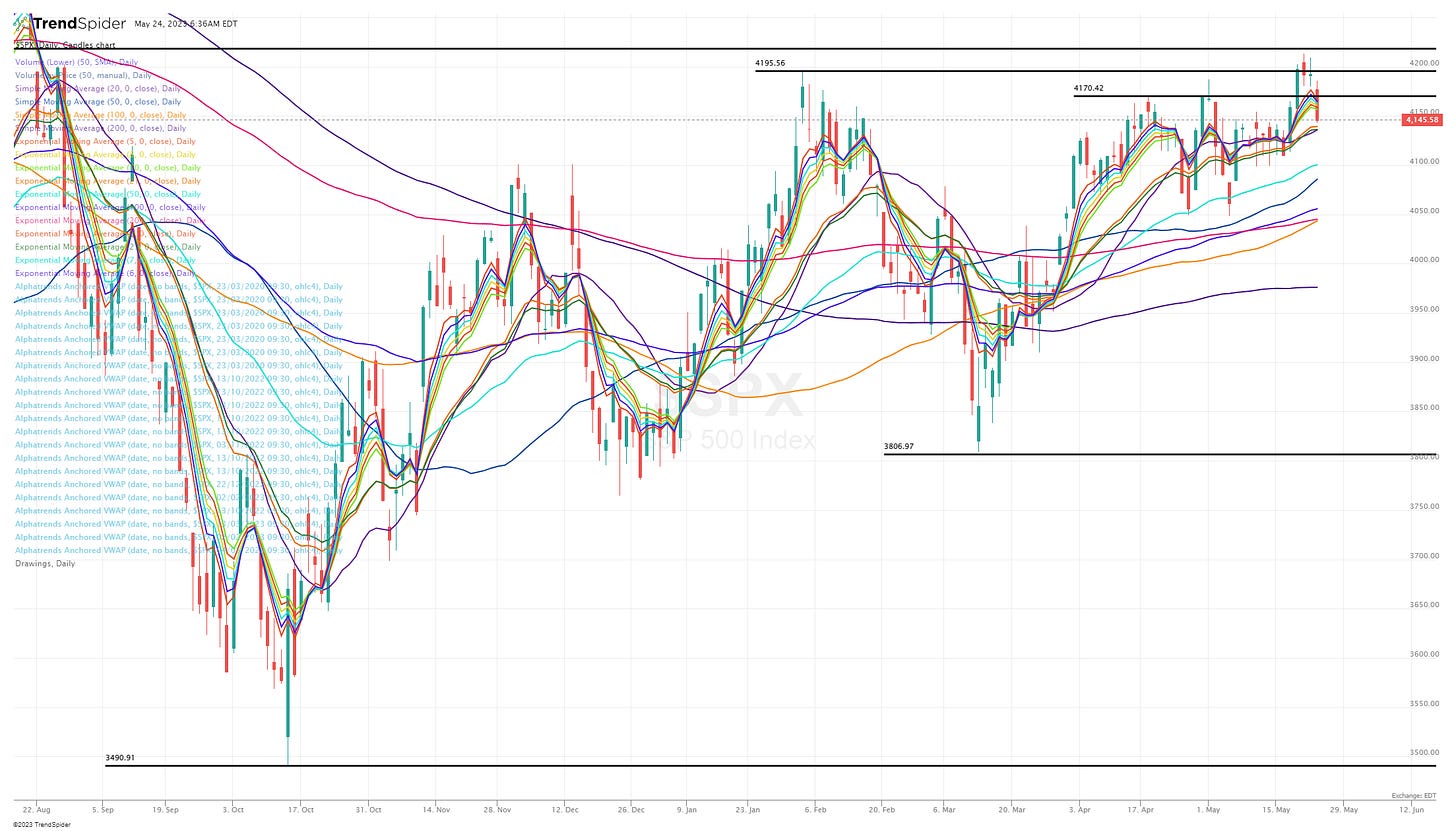

You’re going to see the word “reversal” quite often in the next 10 minutes but that’s the best word to describe yesterday’s price action. After SPX was unable to close above 4200 on Monday, it had a nasty reversal yesterday, perhaps on fears the useless politicians won’t be able to finalize an agreement on the debt ceiling before June 1st. If the market is finally going to focus on this topic we could increased volatility this week and that’s not something I want to trade into.

It’s hard to trade the VIX, one way that I do it from time to time is UVIX, if we see a big spike in the VIX this week and/or next than UVIX should rip higher but this ETF should only be used short term because the long-term decay is nasty and will wreck you. UVIX is up 3% pre-market which means it’s up 10% from the lows yesterday, it basically started bouncing as the markets started reversing.

Another ugly candle/reversal for RSP, rejected at the 200d sma yesterday. If you’re looking to get hedged in my portfolio than shorting RSP on the rejected yesterday would have been a smart play and I’d stay short RSP as long as we stay below the 200d sma but I’d start to cover if we bounced off 140.16 but increase my short if we broke below it.

QQQ came into yesterday looking the best, reversed yesterday into the 7d ema which is also at the previous pivot and closing high from last summer. QQQ is down 0.45% pre-market so looks like we won’t hold it. I’d look for a bounce at the 10d ema/sma.

QQQE is already pulling back to the 10d ema so I’d look for a bounce at the VWAP from the most recent highs or perhaps the 21/23d ema just below.

IWM might have had the worst reversal yesterday, it closed 1.75% off the highs of the morning. In my investment portfolio I tripled my IWM short from 10% to 30% when IWM got rejected at the 200d sma. I’d probably cover half the short at the 10/21d ema unless we just blow through. Small/mid caps have underperformed YTD and yesterday morning they were finally showing relative strength but that didn’t last long.

IWO with another ugly reversal candle, took out the previous day highs then crash and closed below the 200d ema. If you run a growth portfolio and have big gains in 2023, it’s probably a good idea to start hedging with IWO as long as it’s below the 200d ema and then I’d increase those hedges if IWO broke down below the 200d sma.

ARKK with a big reversal yesterday, the day before it pushed through some important resistance levels but then gave back a couple of them. ARKK is still above the VWAP from the Feb highs so I’d look for a bounce there, if not then it’s definitely time to get more hedged

I doubled my ARKK short yesterday from 15% to 30% when ARKK was unable to hold $41, I might increase the short if ARKK fails to hold the VWAP and then the 200d sma.

I noticed IPO (ETF with lots of growth stocks, recent IPOs from past few years) got rejected at the 200d ema yesterday which means it’s slightly ahead of ARKK which was still 3-4% below the 200d ema. I don’t have any IPO position but if we retest the 200d ema and get rejected again I might short it as a hedge however if it pushes through the 200d ema it probably means I should be reducing some of my hedges and adding equity exposure.

Yields flat this morning, off their recent highs. I was adding to TMF yesterday because I think we’re near another top in yields.

The probability of no rate hike at the June FOMC meeting is under 70% for the first time. If the clowns in Washington can’t come to an agreement and we get a default I don’t see how the FOMC could raise rates. Remember, we get another jobs report and CPI report before the next FOMC meeting so these numbers will change over the next 3 weeks.

Below the paywall is my current trading portfolio (with positions, sizes, entry price, stop loss, etc), current watchlist and links to my daily Zoom webcasts.