Trading the Charts for Wednesday, April 26th

In addition to my “Trading the Charts” newsletter, here are some other newsletters that I publish plus my Investing with the Whales podcast and my Stocktwits room.

I also run a Stocktwits room where I’m very active throughout the day, you can join by clicking on the buttons below:

Good morning and Happy Wednesday,

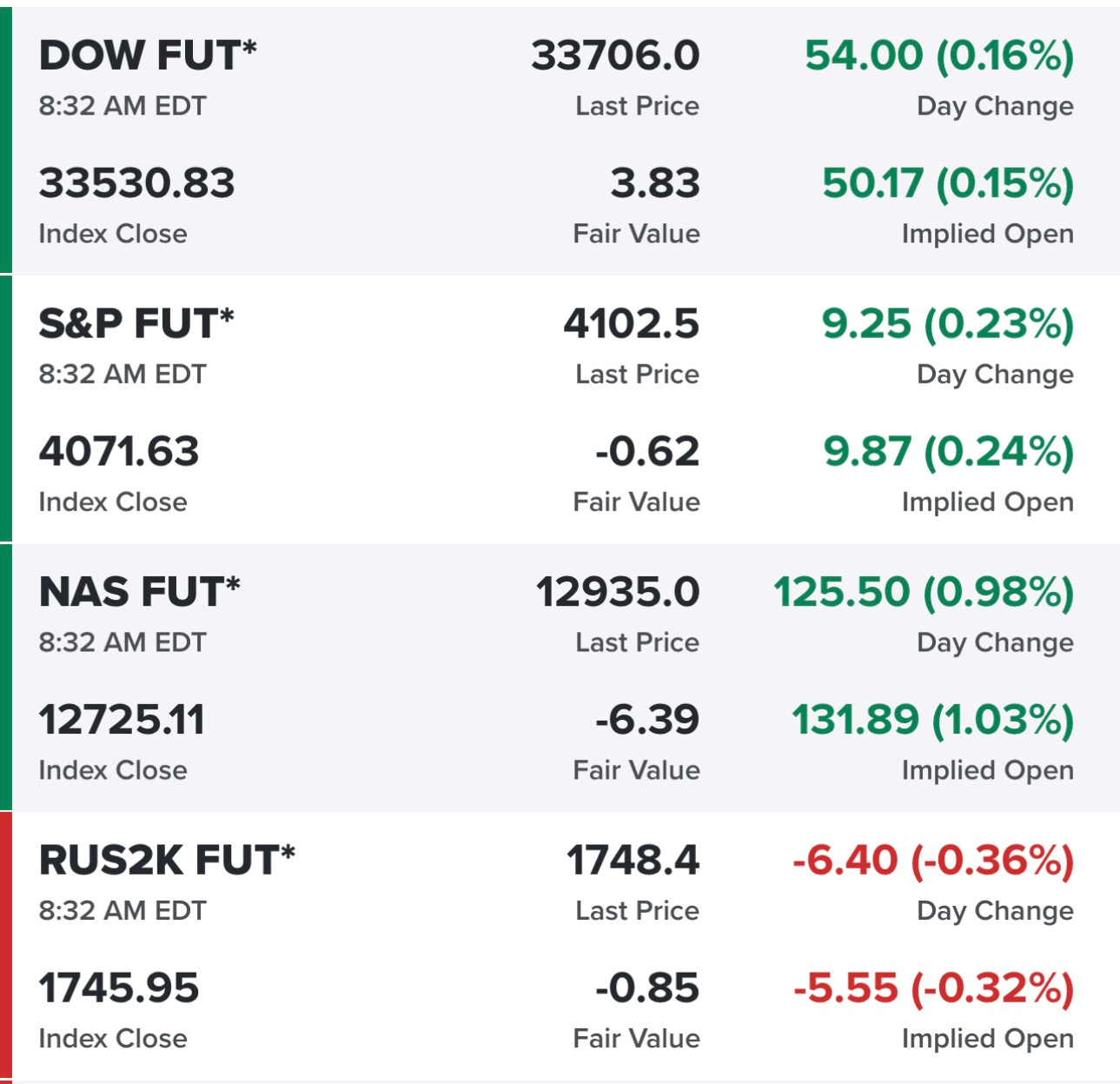

Futures looking decent, mostly because earnings continue to be better than expected.

Last night we got good/decent reports from MSFT, GOOG, CMG, V and several others. The earnings recession has not started for some of these companies but others are forced to clamp down on costs/spending/inventory in order to hit their numbers and there’s only so much “cost cutting” that can happen before the business becomes impaired. We’re also seeing some decent stock buybacks and dividend increases because the best companies are still flushed with cash and willing to return it to shareholders. I still don’t see any major catalysts that will take these markets substantially higher, I think we’ll continue to stay range bound but you can still make money trading this range not to mention there are plenty of individual stories/stocks that look attractive on fundamentals, valuation, technicals, etc.

I continue to hear $240-250 for SPX earnings in 2024, I think that gets us back to 4800 by end of next year but there’s going to be plenty of choppiness between now and then. I have no idea if we end up retesting the October lows at 3491 on SPX, I think it’s unlikely unless something really bad happens in the economy or credit markets. Not sure a light recession later this year would do it because we’re near the end of FOMC rate hike cycle which means the pivot will be coming at some point in the next 3-6 months and the markets know that.

Yields have been dropping but nobody is talking about it, 2Y back under 4% and 10Y back under 3.5% — We also need to be watching FRC, it was down 50% yesterday and down another 15% pre-market on reports they are reaching out to the bigger banks and asking for more help.

Below the paywall is my current trading portfolio and primary watchlist. I got stopped out of several positions yesterday so I’m back to 80% cash in my trading portfolio and will wait for the right setups to put that money to work. I was getting too aggressive with new positions the past few days and that ugly price action yesterday told me to be more patient because supports aren’t holding, too many stocks slicing through where they should be bouncing.