Trading the Charts for Tuesday, May 9th

In addition to my “Trading the Charts” newsletter, below are a few more newsletters that I publish plus my Investing with the Whales podcast, my Stocktwits room and my Seeking Alpha investment service.

I also run a Stocktwits room where I’m very active throughout the day and post about both of my portfolios with 100% transparency. FWIW, I’m up 39% YTD thanks to huge gains with LNTH UBER ONON TSLA SDGR MELI GLBE SWAV XPOF NU and several others. You can join by clicking the button below:

Good morning and Happy Tuesday,

No newsletter on Wednesday, May 10th because I have jury duty all day :)

Earnings season continues with lots of “beat & raise” reports leading to strong price action. Last night PLTR reported better than expected numbers so the stock is up 19% pre-market although it was up as much as 28% last night. I have no idea if it holds onto those gains today but it’s clear the growth companies showing improving profit margins are the ones being rewarded.

I don’t mind buying ahead of the FOMC meetings because those are mid-day events and we can set our stop losses pretty tight so if the decision, prepared statement or press conference tanks the market our stops will get us out with minimal damage done. Buying ahead of the CPI report is different because that happens pre-market (8:30am EST) when stop losses don’t work so of course you can put in orders manually but that doesn’t really work for most people so I’m probably not doing much today (if anything).

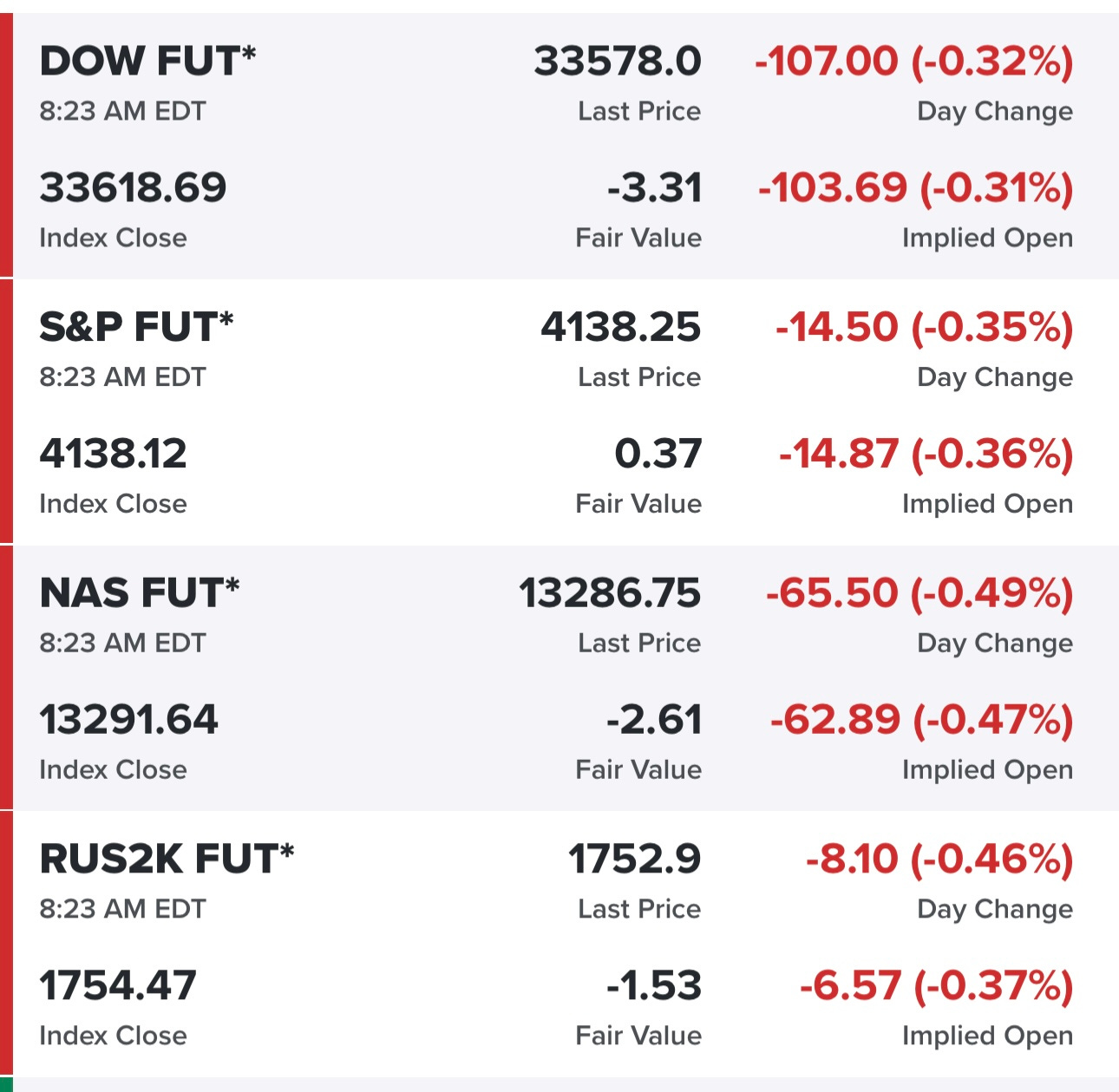

Futures down slightly, could be a boring day ahead of CPI tomorrow (not including the stocks that are moving off earnings)…

Yields down slightly today after being up yesterday, curious to see what they look like after CPI…

Just a few days ago the chances of no rate hike at the June FOMC meeting was 92% and now it’s down to 83% meaning there’s a 16.6% chance we get another 25 bps which would only happen if CPI comes in hot tomorrow and the macro data over the next 4 weeks continues to come in above expectations. Otherwise it will be hard for the FOMC to continue raising with so many economic issues looming in the background.

Below the paywall is my current trading portfolio, current watchlist and links to daily Zoom webcasts