Trading the Charts for Tuesday, May 28th

In order to read this entire newsletter you’ll need to become a paid subscriber by clicking the button below. Paid subscribers get full access to my trading portfolio (up +30% in 2024, up +97% in 2023), daily watchlists with charts, daily activity with entry prices & stop losses, all trading stats with performance, and my daily webcasts.

My other Substack newsletter is called Growth Stock Deep Dives where paid subscribers receive 2-3 deep dives per month (8,000+ words each), 2-3 mini deep dives per month (2,000+ words each) and quarterly earnings analysis (on most of my portfolio companies) plus access to my investment portfolio (up +147% YTD in 2024, up +134% in 2023 and up +2,500% since January 2020) with real-time activity and notes/commentary throughout the day on my portfolio spreadsheet.

Earnings reports for the week…

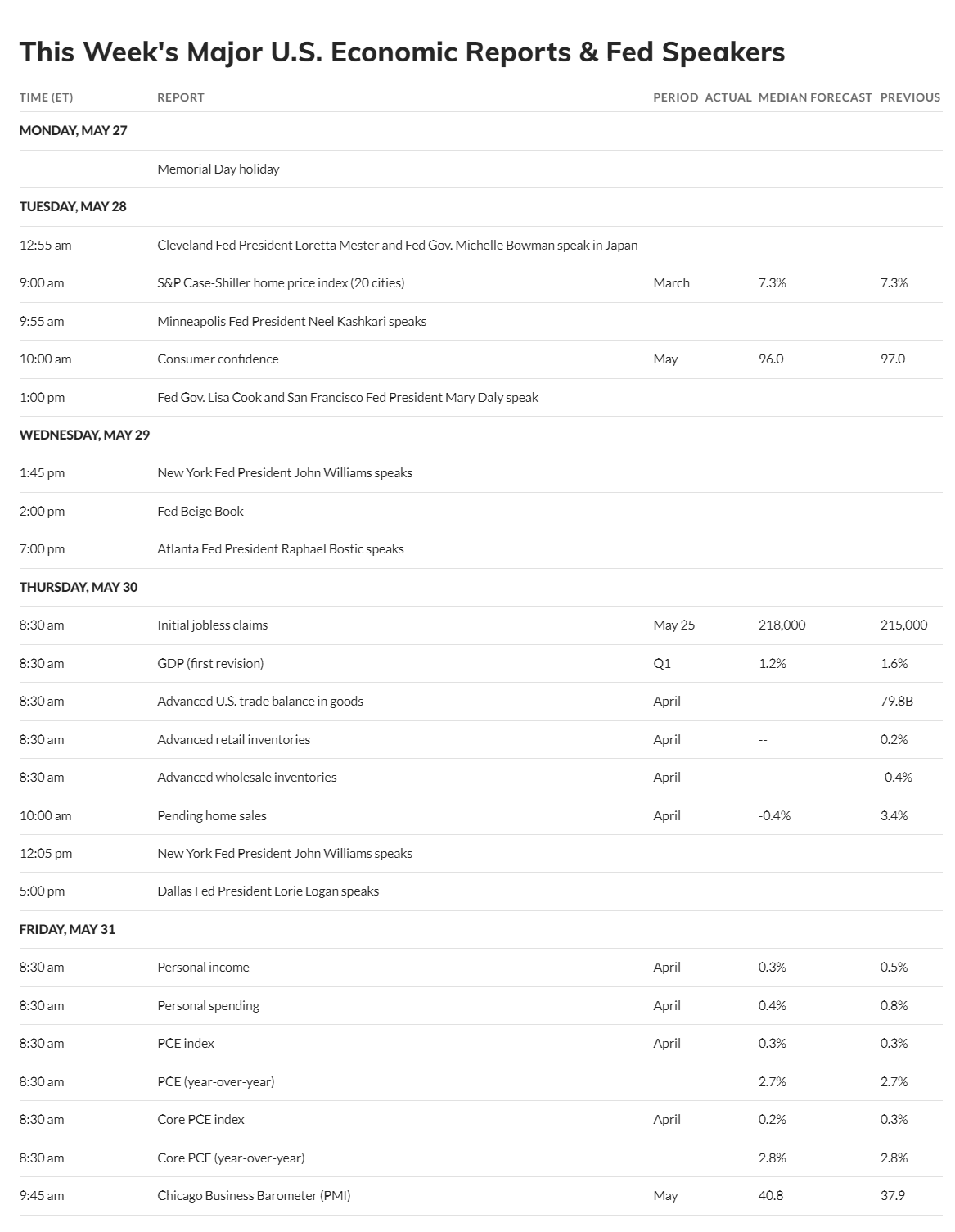

Macro reports for the week…

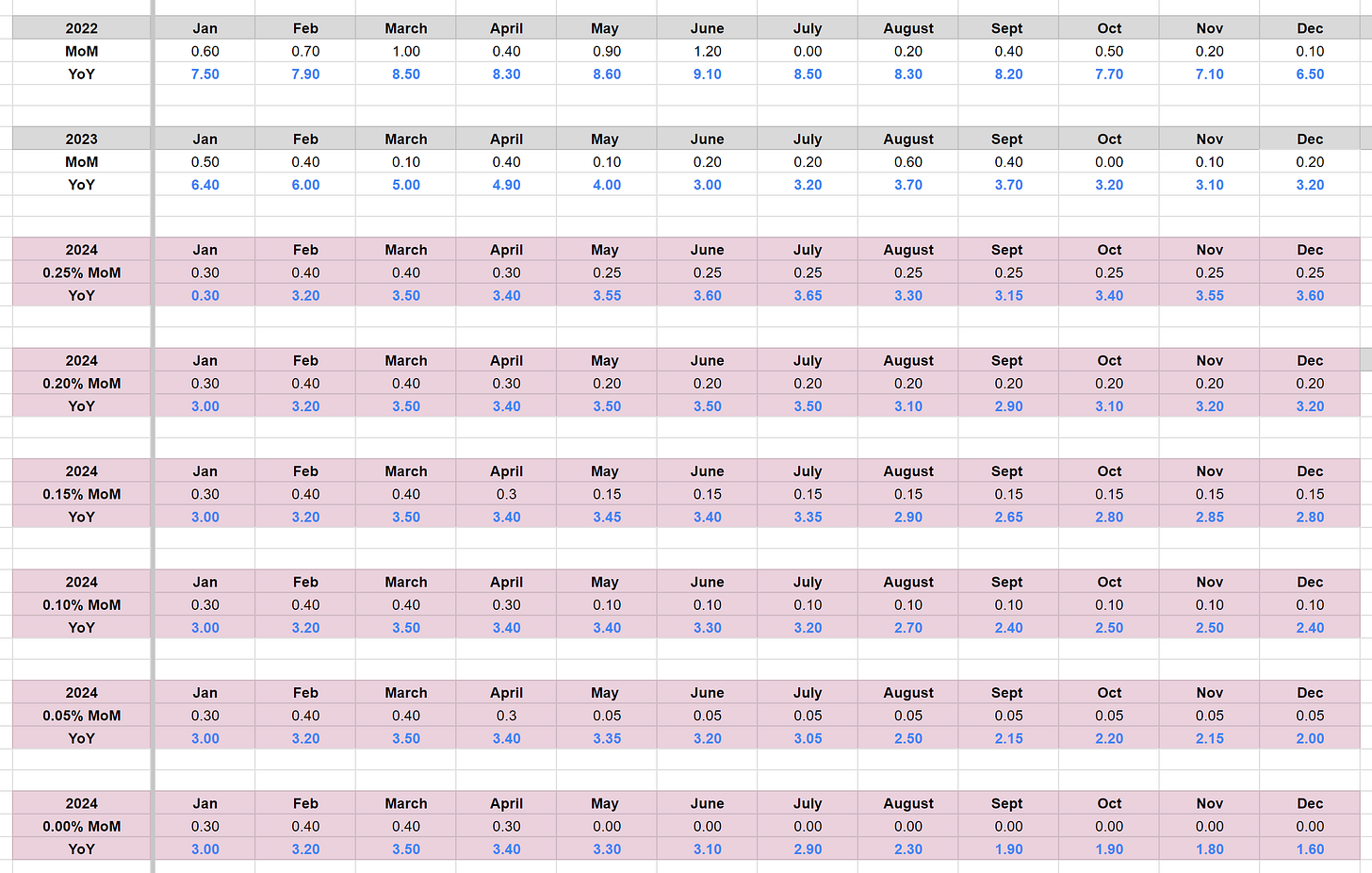

CPI spreadsheet…

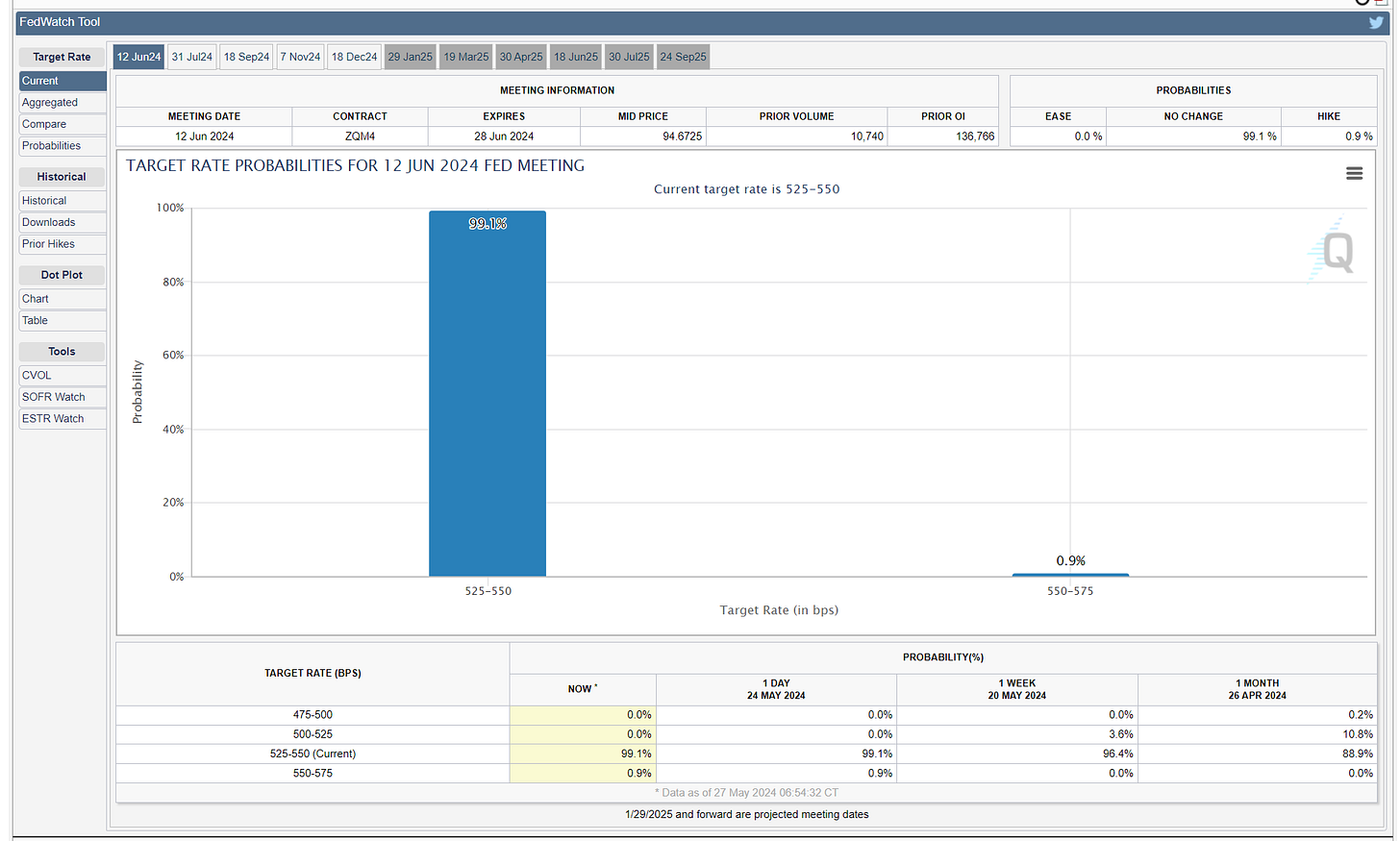

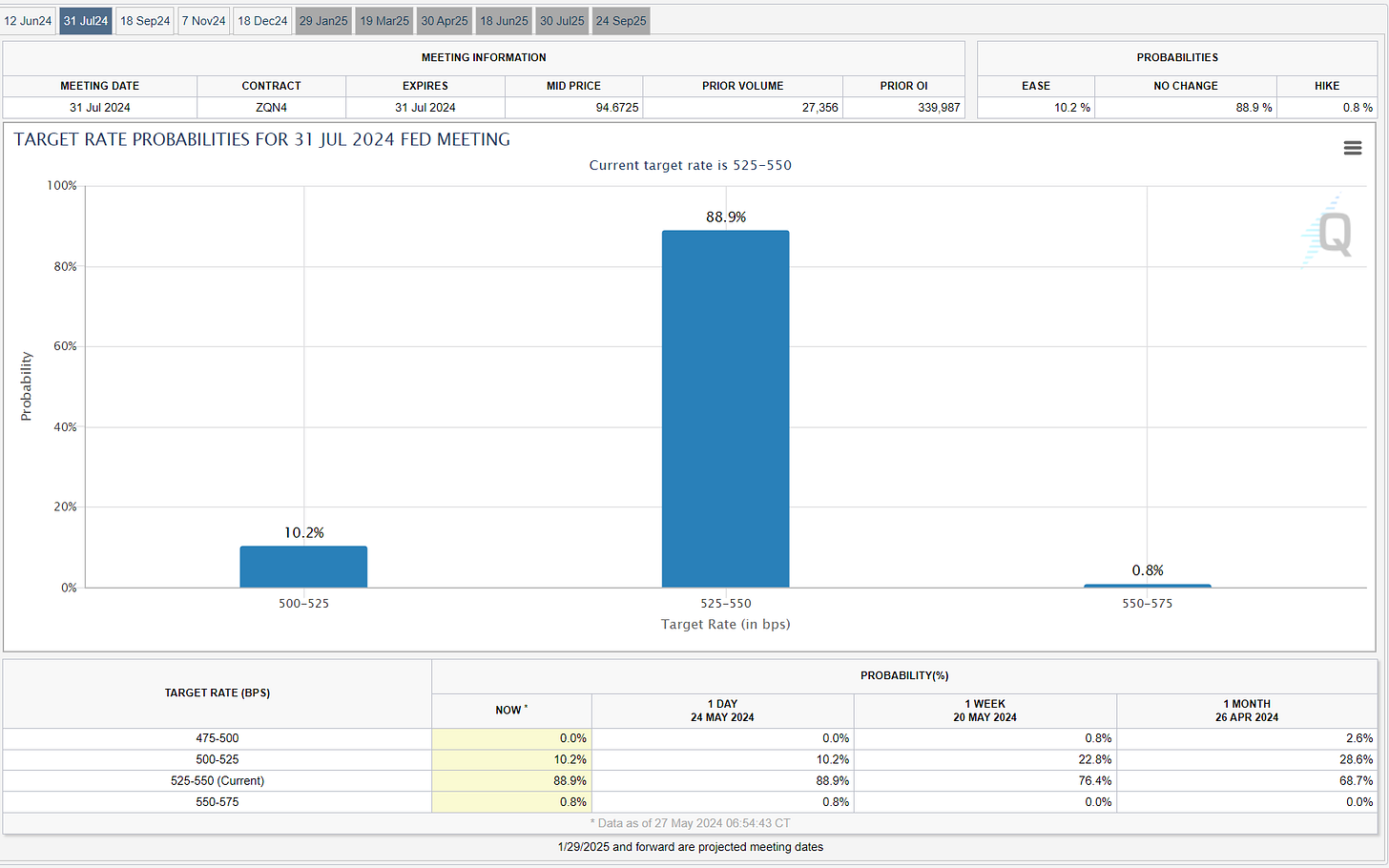

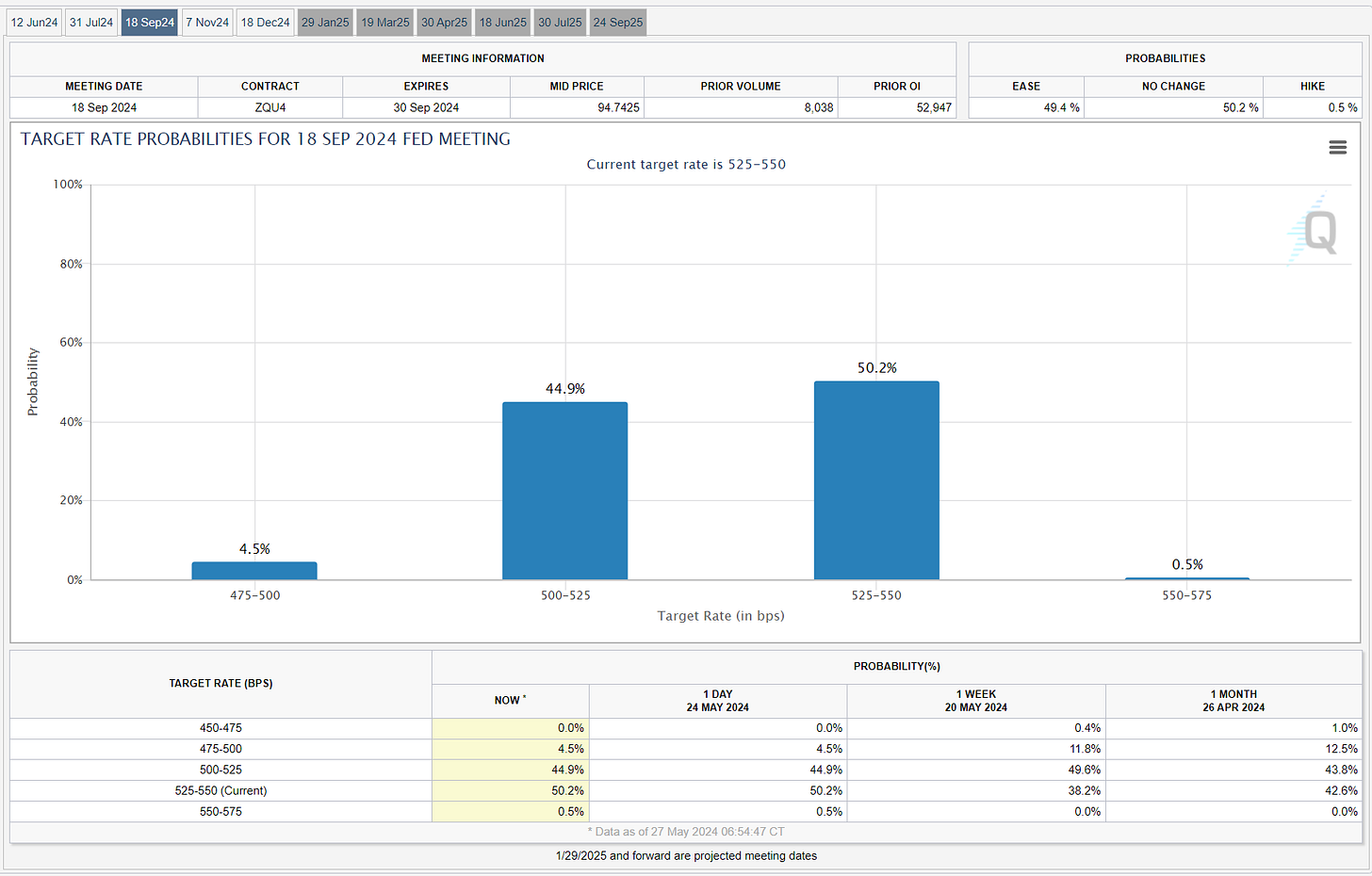

FOMC updates…

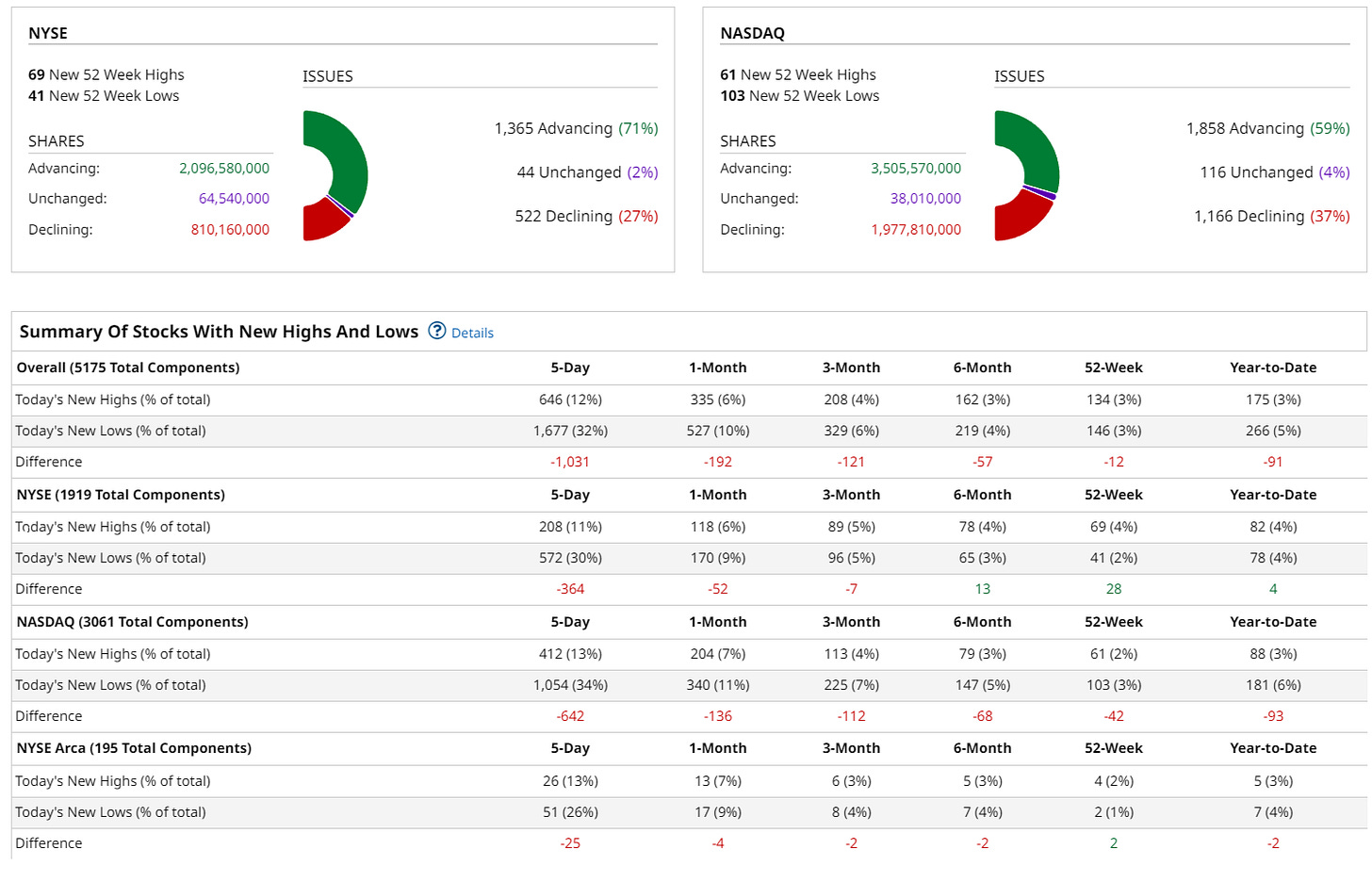

New highs vs new lows…

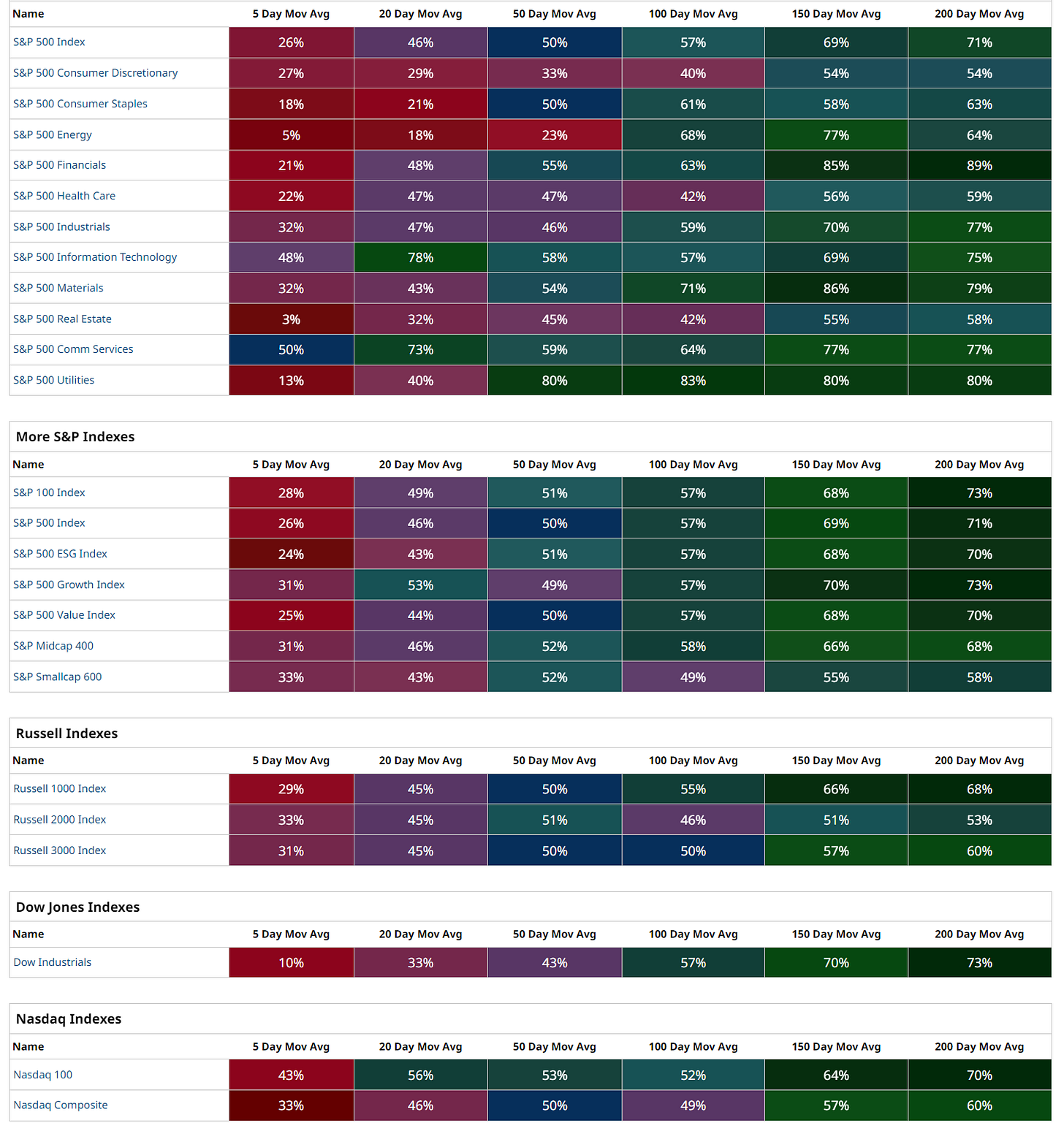

Market momentum…

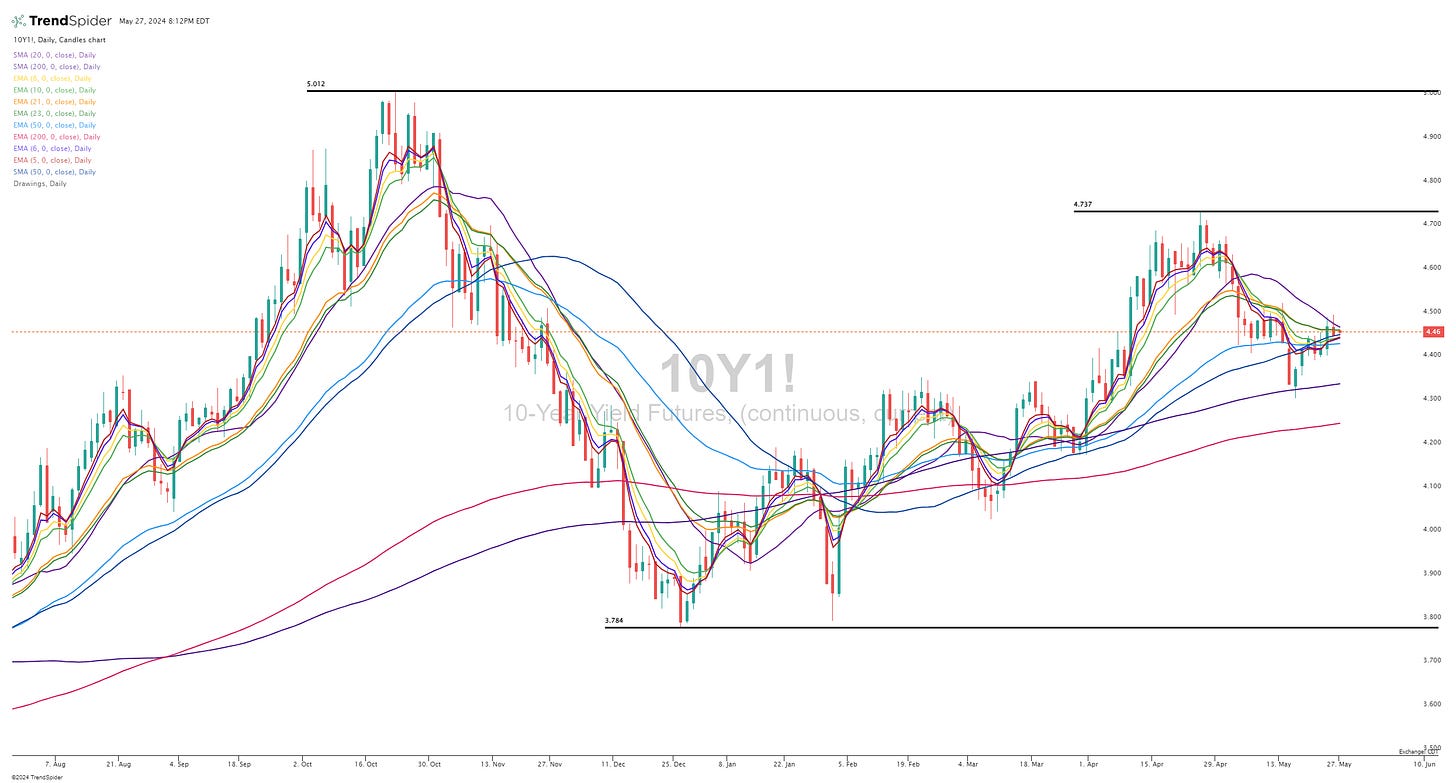

$TNX (10Y Treasury)

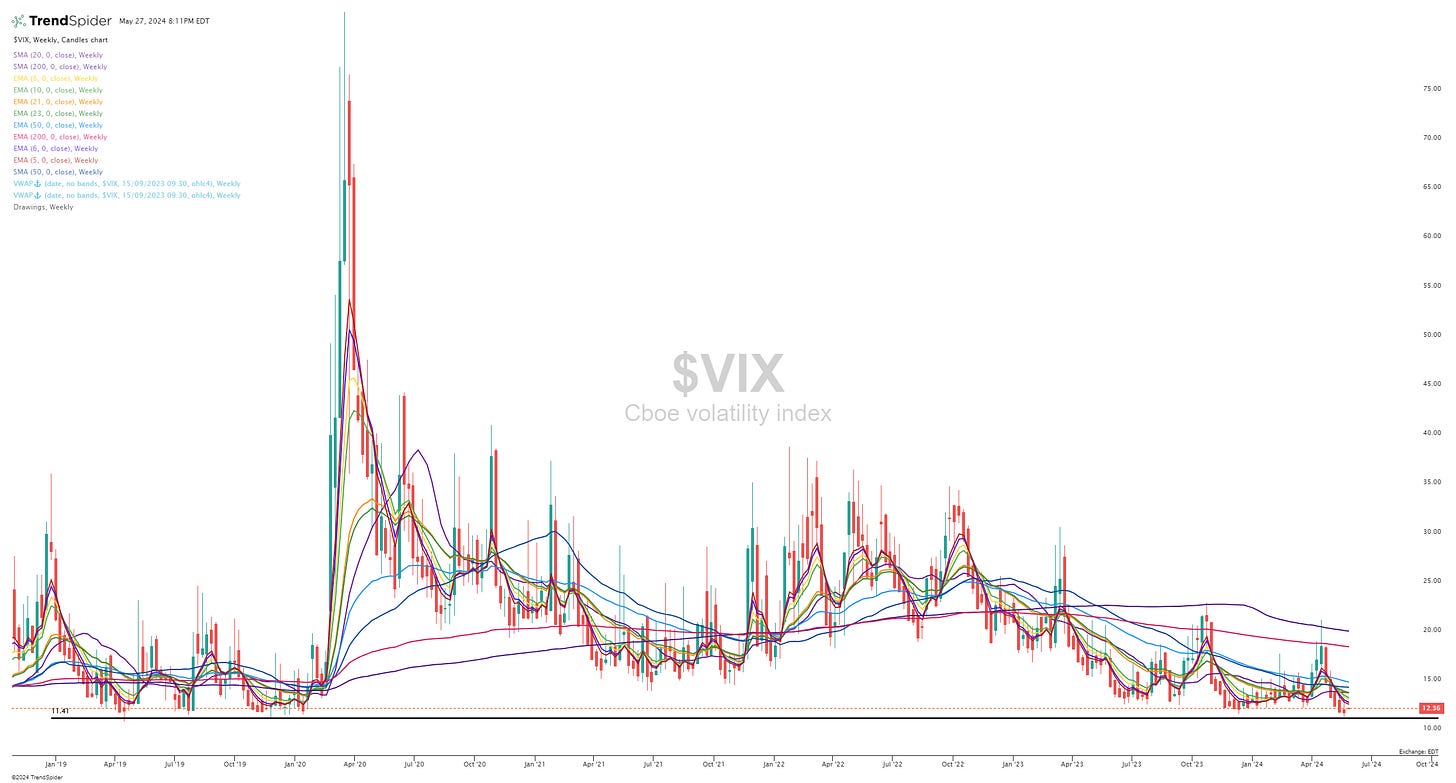

$VIX

$CL1! (Oil)

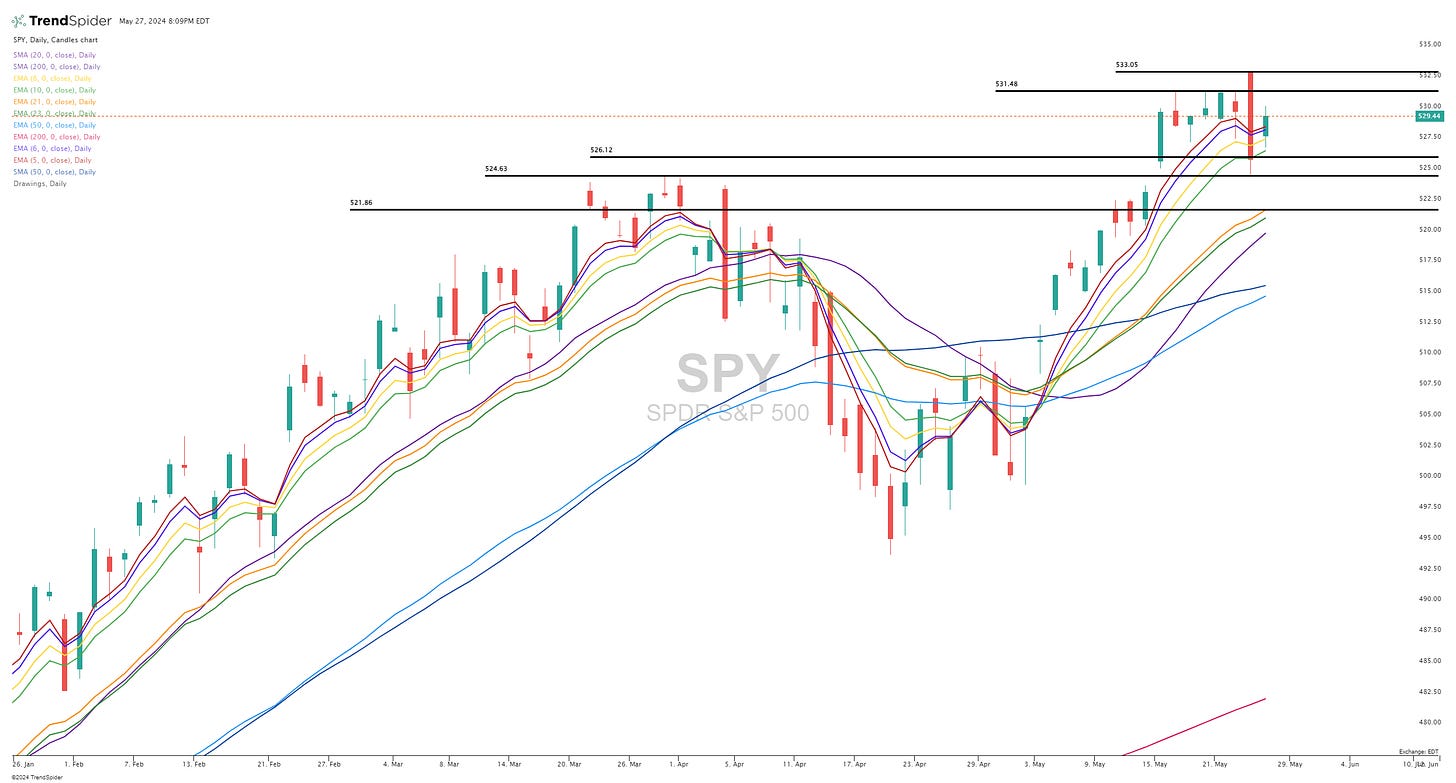

SPY (S&P 500, market cap weighted)

QQQ (Nasdaq 100, market cap weighted)

IWM (Russell 2000, small/mid caps)

Finviz screen #1: ACGL ACVA ADC ADMA AEM AESI AGNC AJG ALHC AMGN ANET ANF APO APP ASPN AVGO AVPT AZN BAC BBDC BCRX BIP BIPC BK BLBD BMO BORR BRBR BROS BTSG BVN BZ C CARR CAVA CB CELH CFLT CGAU CHRD CLS CLSK CNO COIN CORT CPRX CRBG CRWD CTRE CWAN DB DCPH DDOG DO DRS EDR ELF EMR ENVX EQH ERJ ESNT FHN FOUR FRPT FSLR FSM FWONK GH GLNG GMED GOOG GOOGL GOOS GS HALO HASI HBM HESM HIMS HLN HOOD HSBC IBKR IBN ICE IDCC INTR IOT IREN ITRI JEF JPM JXN KGC KKR KN KNTK KTOS LAZ LHX LLY LNC LNTH LOAR LPX LTH MARA MC MCO MDXG MMYT MNDY MSFT MU NEE NTNX NTRA NU NVAX NVDA NVO NVT NXT OBDC OLLI ONON OSCR OSW OWL PAAS PANW PAYO PDD PINS PODD PRCT PRM PRU PUBM RBA RCL RDDT RKT RNA RY RYAN SAN SATS SBLK SE SEMR SFL SG SHOO SMFG SMTC SN SPOT SQSP SWAV TGTX TKO TMDX TPG TRN TRUP TTD TW TWST UBS UTHR VAL VERX VITL WDC WELL WES WPM WRBY WT XYL YMM ZETA

Criteria: stock price above $5, market cap above $1 billion, above 50d sma, above 200d sma, average daily volume above 500k, sales growth above 15%

Finviz screen #2: ACGL ACVA ADC ADMA AEM AESI AJG ALHC AMGN ANET ANF APO APP ASPN AVGO AVPT AZN BAC BCRX BIP BIPC BK BLBD BORR BRBR BROS BTSG BVN BZ C CARR CAVA CELH CFLT CLS CLSK CORT CPRX CRBG CRWD CTRE CWAN DB DCPH DDOG DO DRS EDR ELF EMR EQH ERJ ESNT FOUR FRPT FSLR FSM FWONK GH GMED GOOG GOOGL GOOS GS HALO HASI HBM HESM HIMS HLN HOOD IBKR IBN ICE INTR IOT IREN ITRI JEF JXN KGC KKR KN KTOS LAZ LHX LLY LNC LNTH LOAR LTH MC MCO MMYT MNDY MSFT MU NEE NTNX NTRA NU NVDA NVO NVT OLLI ONON OSCR OSW OWL PAAS PANW PDD PINS PODD PRCT PRM PRU PUBM RBA RCL RKT RYAN SAN SBLK SE SEMR SG SHOO SMFG SMTC SN SPOT SQSP SWAV TKO TMDX TPG TRN TRUP TTD TW TWST UBS UTHR VERX VITL WDC WELL WPM WRBY WT XYL YMM ZETA

Criteria: stock price above $5, market cap above $1 billion, above 50d sma, above 200d sma, average daily volume above 500k, sales growth above 15%, earnings growth above 0%

Below the paywall is the links to my current trading portfolio spreadsheet with all holdings, position sizes, entry prices, stop losses, etc plus my spreadsheet includes all daily activity (real time), daily notes/commentary (real time) and my daily watchlist with charts.