Trading the Charts for Tuesday, May 23rd

In addition to my “Trading the Charts” newsletter, below are a few more newsletters that I publish plus my Investing with the Whales podcast, my Stocktwits room, my Seeking Alpha investment service and my new Twitter Spaces coming soon.

I also run a Stocktwits room where I’m very active throughout the day and post about both of my portfolios with 100% transparency. FWIW, I’m up 54% YTD thanks to huge gains with CELH, LNTH, UBER, ONON, TSLA, SDGR, MELI, GLBE, SWAV, XPOF, FLNC, NU and several others. You can join by clicking the button below:

Good morning and Happy Tuesday,

Still a big earnings week including lots of retail and cloud companies…

SPX could not close above 4200 but that’s really just a psychological number and means nothing on the charts, the important numbers are 4195 and then 4218. Of course the bulls want to see a close above 4200 but the bears are probably scared if that happens it keeps the momentum going higher. I’m not sure what the bears are doing right now, I assume they are hoping for a government default but in terms of positioning their portfolios I’m not sure if they are covering some of their shorts, adding longs, increasing hedges or all of the above. This market continues to defy gravity despite flat YoY earnings growth (for SPX companies), 5% fed funds rate, 5% inflation, and consensus that a recession is coming in the next 6-12 months. The pain trade is still higher.

RSP with a fade off the highs yesterday, closing just above the 200d sma. If RSP loses the 200d sma I might short it in my investment portfolio (as a hedge).

QQQ with a new 52 week closing high yesterday, the megacap tech stocks just keep grinding higher. Combined market caps for AAPL and MSFT are back above $5 trillion.

QQQE looking alright, yesterday was the highest close going back to February.

IWM is struggling to push through the VWAP from summer 2022 highs and the January highs, also still below the 200d sma.

I’m still short IWM in my investment portfolio (as a hedge), I’m up 60% YTD in that portfolio and need to protect my gains so I have a 20% short position in IWM which I’d reduce to 10% if we push through these VWAPs and the other 10% if/when IWM closes above 200d sma.

IWO with a strong push yesterday through the 200d ema.

If IWO fails to hold the 200d ema I’ll start a short position to hedge my investment portfolio.

ARKK had a monster day yesterday, finally pushing through the VWAP from February highs and some important resistance levels, the 200d ema is now within striking distance (~4% away).

I had a ~40% short position in ARKK coming into yesterday (as a hedge) so I covered 1/3 when it pushed through the VWAP and another 1/3 when it pushed through 39.42 and broke through the DTL which means I still have 1/3 which I’ll cover if ARKK can close above 40.51 today or this week. I don’t need to be hedged if growth is doing well but if ARKK starts to lose these support levels or rallies up to the 200d ema and gets rejected then I’ll put my short back on to hedge my investment portfolio.

Yields up again this morning, I’m surprised to see the 10Y back to 3.78% — I suspect this is from fears about a possible default with no debt ceiling agreement in place yet. It mean investors are selling their Treasuries which is pushing up yields.

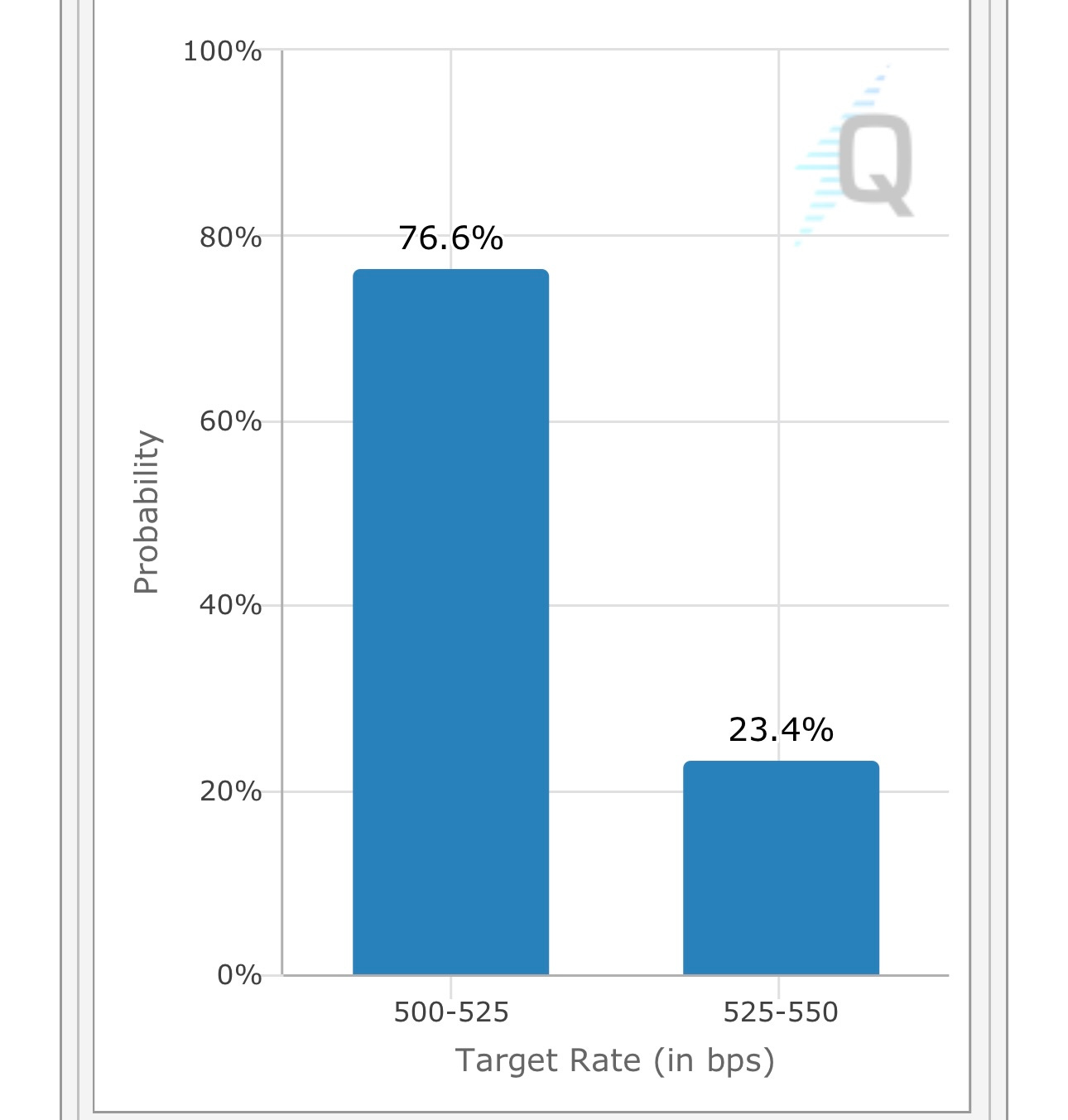

We’re still hovering around 75% chance of no rate hike at next FOMC meeting on June 14th…

Below the paywall is my current trading portfolio (with positions, sizes, entry price, stop loss, etc), current watchlist and links to my daily Zoom webcasts.