Trading the Charts for Tuesday, June 20th

I also run a Stocktwits room where I’m active throughout the day but mainly post about my investment portfolio which is currently up ~77% YTD thanks to huge gains with CELH, LNTH, UBER, MELI, SDGR, ONON, TSLA, GLBE, SWAV, XPOF, NU, FLNC, CFLT, DOCN and several others. You can join by clicking the button below:

Here are my other newsletters…

Good morning and Happy Tuesday,

I hope everyone had a nice weekend. We’re coming off a busy week of macro with CPI, PPI and FOMC so this week will look much slower. We’re also coming off a great week for the markets with SPX up +2.58% and the Nasdaq up +3.25% but the Russell was the big laggard up only +0.12% last week however it was the best performer in the prior 1-2 weeks. Year to date the Russell is now up +6.64% which is way behind SPX at +14.85% and Nasdaq at +30.79% — hopefully we continue to see some broadening out of leadership beyond just megacap tech. Anyone that has been overweight energy, financials and consumer staples this year is definitely underperforming.

I saw this chart on Twitter over the weekend and thought it was interesting…

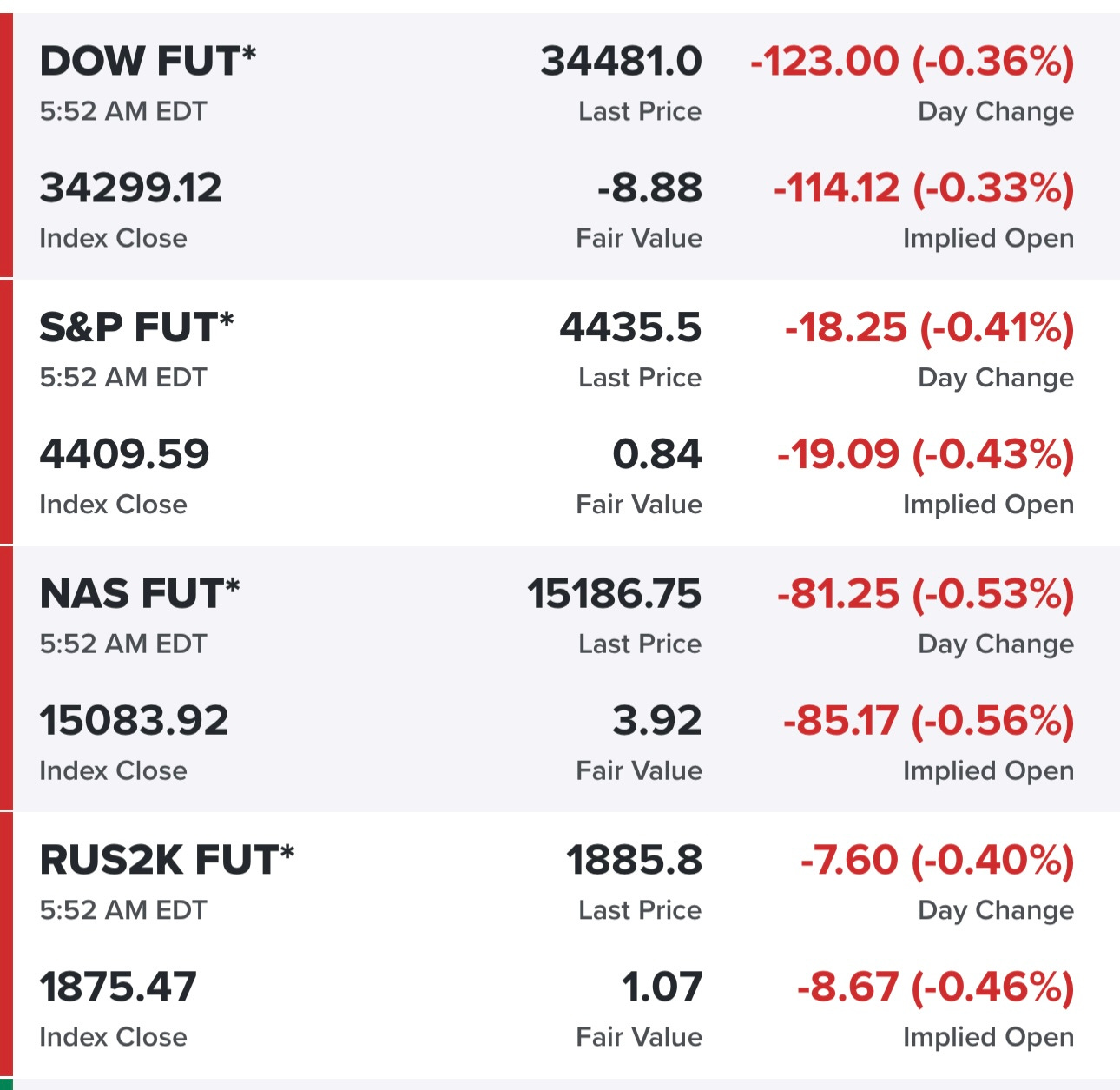

Equity futures not looking great, I would not be surprised if this was a distribution week for the markets…

Yields flat but the 10Y is still hanging around 3.8% which seems to be a ceiling…

I’m tempted to start a position in TMF because I don’t think the 10Y goes much higher from here. TMF bounced off the VWAP from recent lows, I’d use the 20d sma as my stop loss…

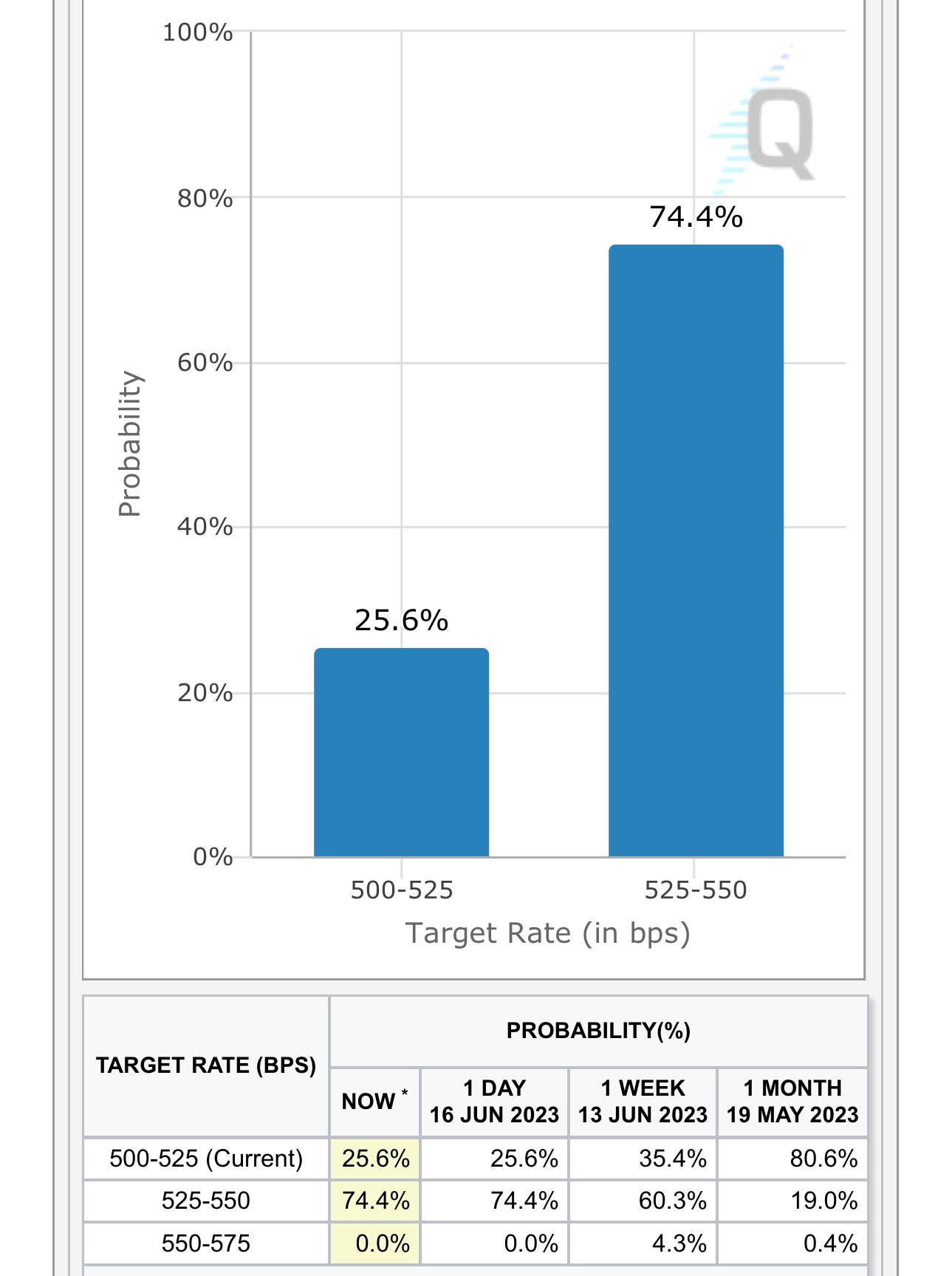

There’s still a 74% chance of a rate hike at the July FOMC meeting but I still think it’s unlikely if headline CPI comes in (on July 12th) under 3.3% YoY (it will be somewhere between 3.0% YoY and 3.5% YoY)…

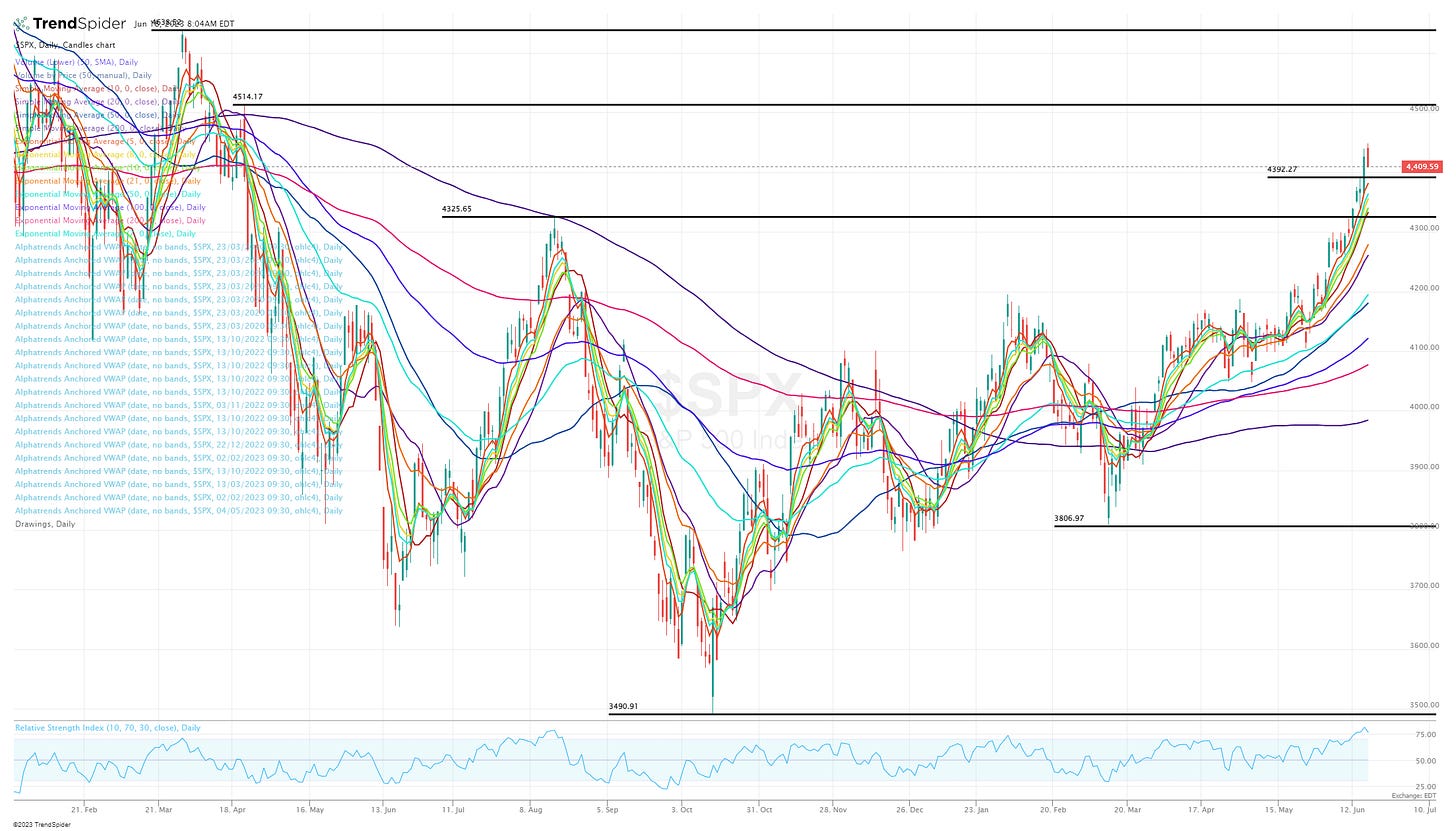

SPX (down -0.37% on Friday) has defied gravity over the past month, surging to take out 4400 which very few strategists thought was possible just 6 months into the year. Coming into 2023 the majority of strategists and big investors thought we were going to revisit those October lows so many of them have been bearish with high levels of cash and now they have to decide to start chasing or hope for a pullback which makes me think the dips could get bought because those big fund managers are sitting on alot of cash with some serious underperformance compared to their benchmarks.

RSP (down -0.08% on Friday) still looking decent, could easily start pulling back to the 5d ema, have an inside day or try taking out 150.24 which is the next resistance

QQQ (down -0.63% on Friday) unable to take out the highs from last March

QQQE (down -0.68% on Friday) made a new YTD on Friday but then reversed and closed just above that gap it filled a few days earlier, curious to see if that 76.80 level holds up.

IWM (down -0.80% on Friday) coming off a flat week, doing some consolidating and bouncing off the 9d ema on Friday. I’d definitely get short IWM if it fails to hold the 10d ema

IWO (down -0.70% on Friday) also doing some consolidating last week, bouncing off the 10d sma on Thursday and Friday.

ARKK (down -0.52% on Friday) rallied 6.5% after crossing the 200d ema so not surprising that it took a breather on Friday, let’s see if it can hold the 5/6d ema today, it did bounce off the 7/8d ema several times over the past couple weeks so I’ll be watching those today.

Below the paywall is my current trading portfolio and watchlist with charts, entry points, stop losses, etc. (PS: my investment portfolio is different and only available to my Stocktwits subscribers and my Substack deep dive subscribers)

Please note that I have changed the links/URLs for my webcasts as well as my portfolio spreadsheet — I have to do this at the beginning of every month so former subscribers no longer have access to the content that is exclusive for paid subscribers.