Trading the Charts for Tuesday, August 8th

In order to read this entire newsletter which includes full access to my trading portfolio (up ~66% YTD), daily watchlist, daily activity (buys, sells, entry prices, stop losses, performance) and my daily webcasts you’ll need to become a paid subscriber by clicking the button below.

I also run a Stocktwits rooms where I post about my investment portfolio (up ~95% YTD and ~1,000% over the past 3-years) with full access to all holdings, performance, daily activity, market commentary, quarterly earnings analysis, daily webcasts and more.

Here are my deep dive newsletters…

Good morning and Happy Tuesday,

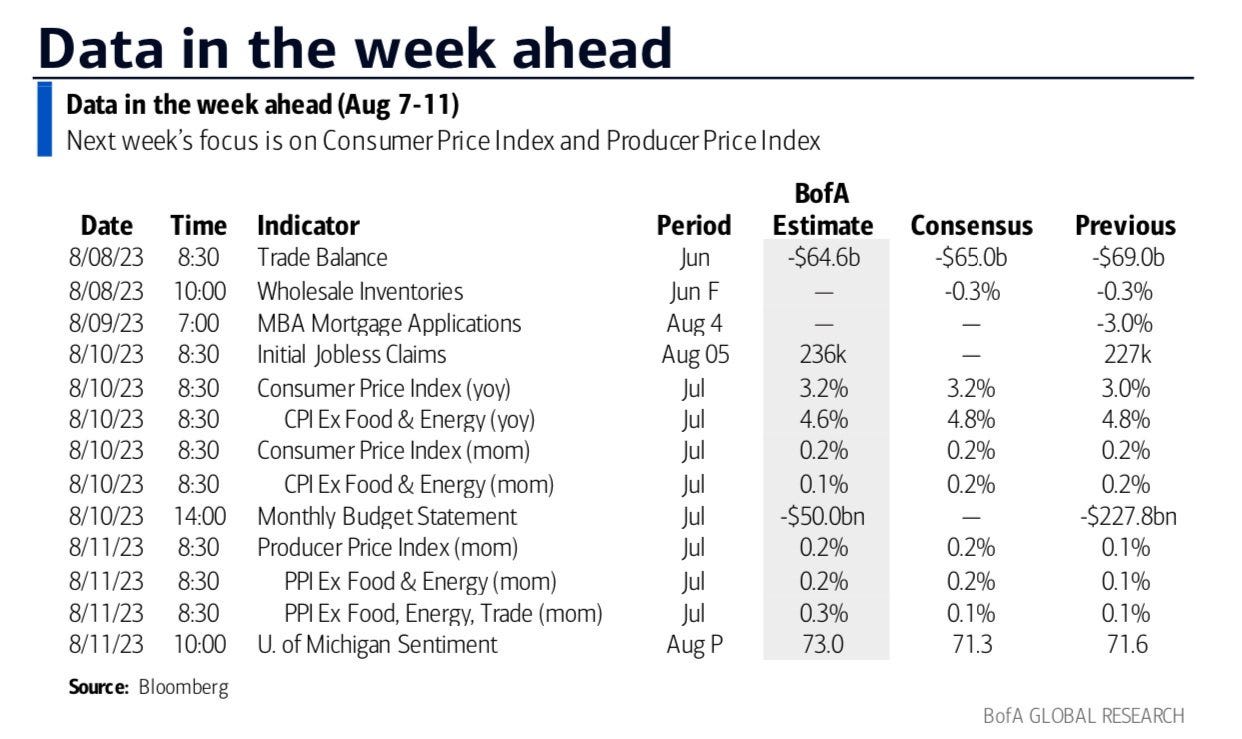

Lots more earnings over the next three days with CPI on Thursday and PPI on Friday.

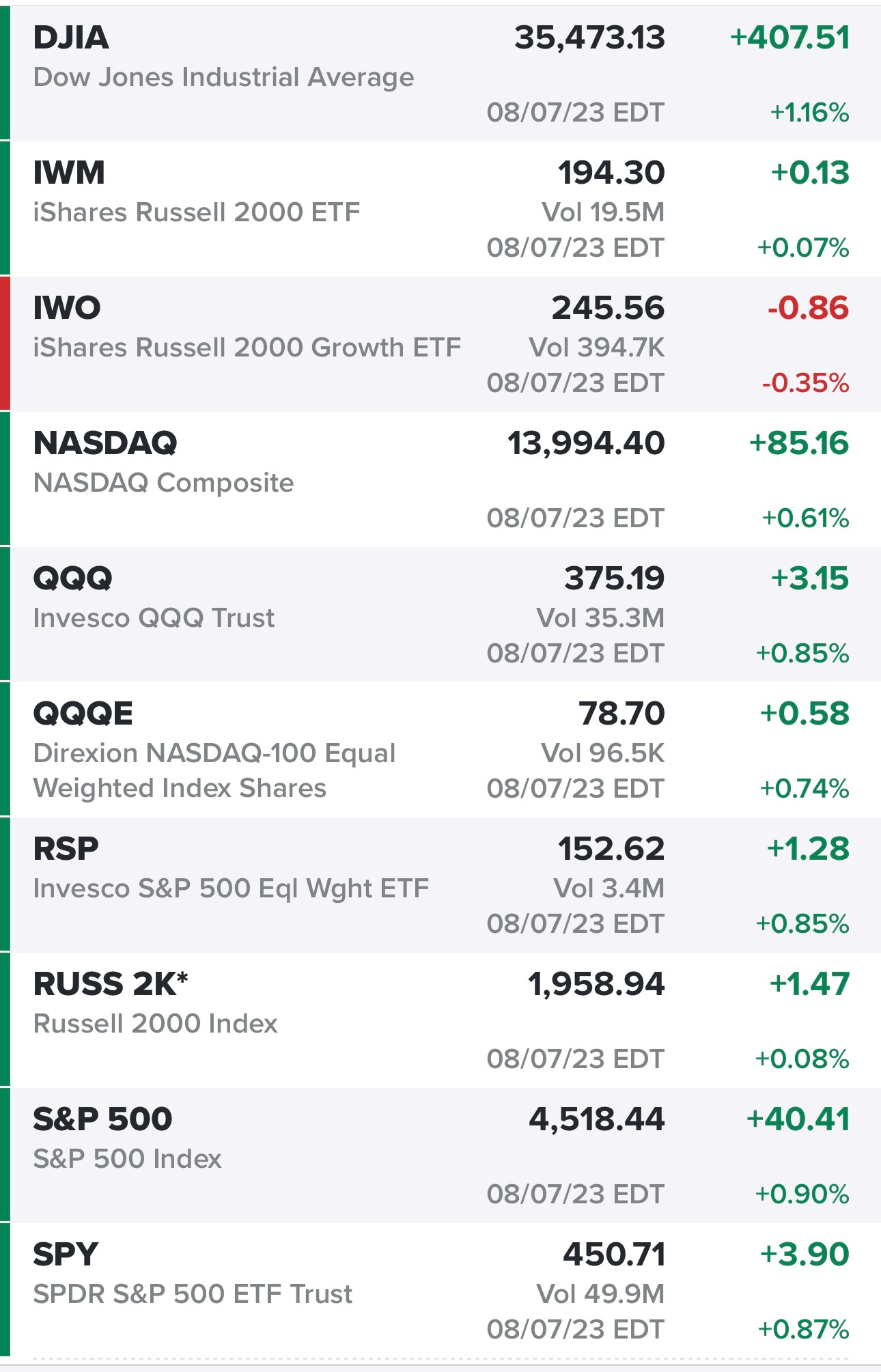

Markets coming off a good day although it felt like most growth stocks and small/mid caps were down big in the morning although some of them did bounce back in the afternoon. Clearly we are see the larger cap companies start to take some momentum back. Q2 earnings season continues to be brutal for any companies that miss on revenues, EPS or guidance with dozens of stocks falling more than 10% after they report.

Here’s how the individual sectors performed yesterday, interesting that energy was the laggard given that it’s been the outperformer for the past few weeks so maybe yesterday it was just taking a pause or money is starting to rotate elsewhere.

Yields down again this morning, kind of crazy that the 10Y is already back under 4% after touching 4.2% late last week

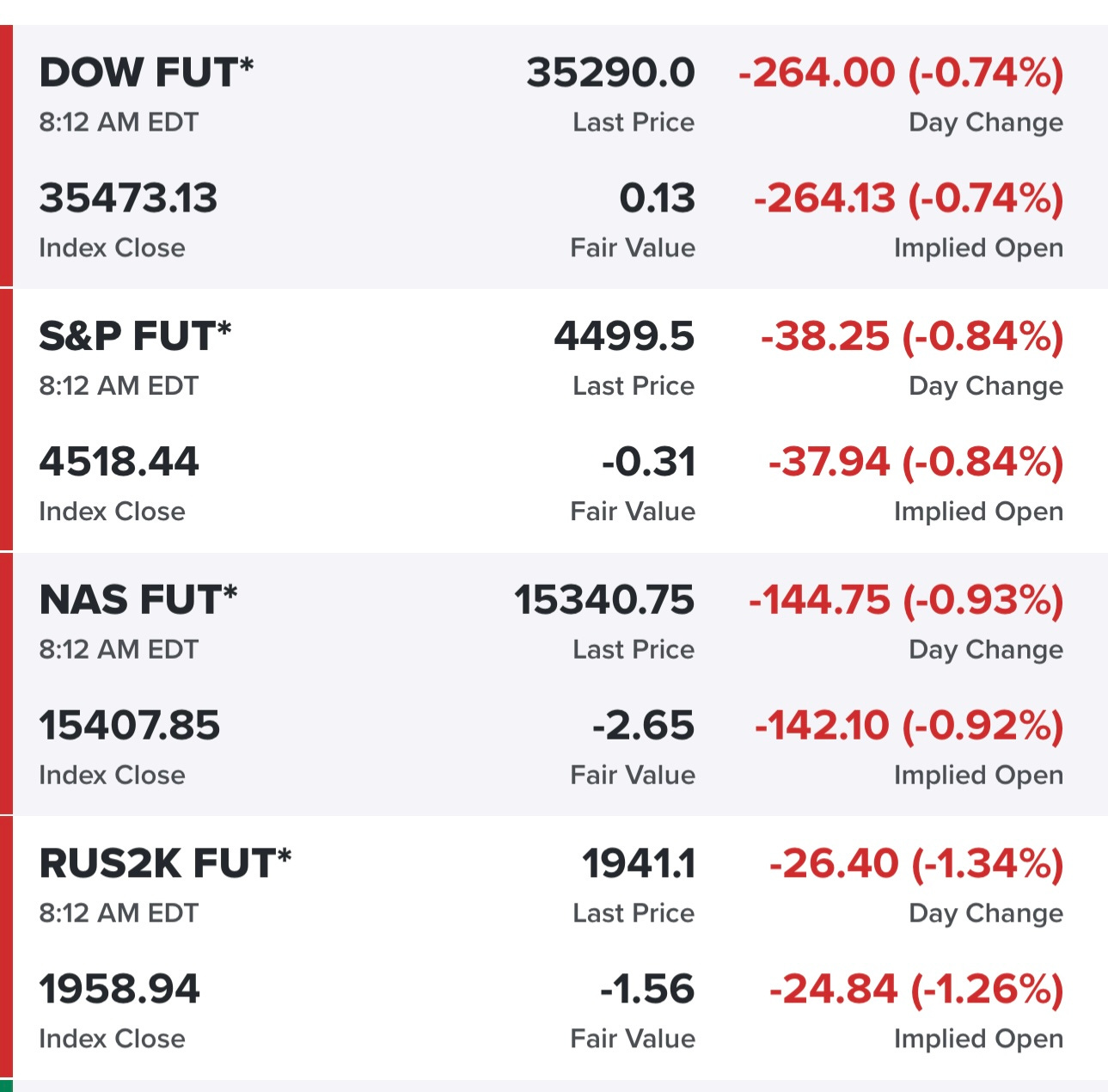

Futures looking very ugly this morning…

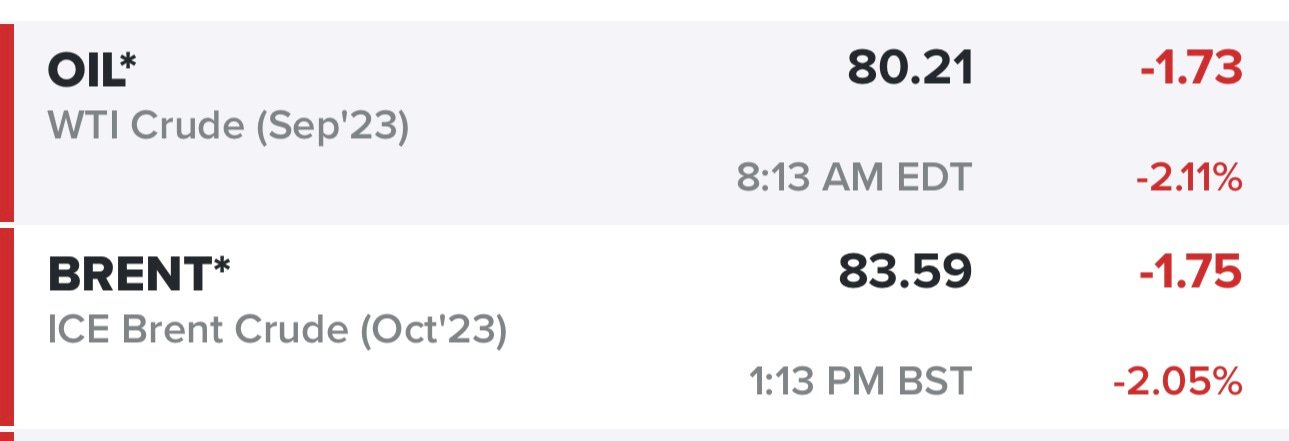

Oil trying to stay above $80

SPY with an inside candle, back above the 21/23d ema and running into resistance at 6d ema and 20d sma

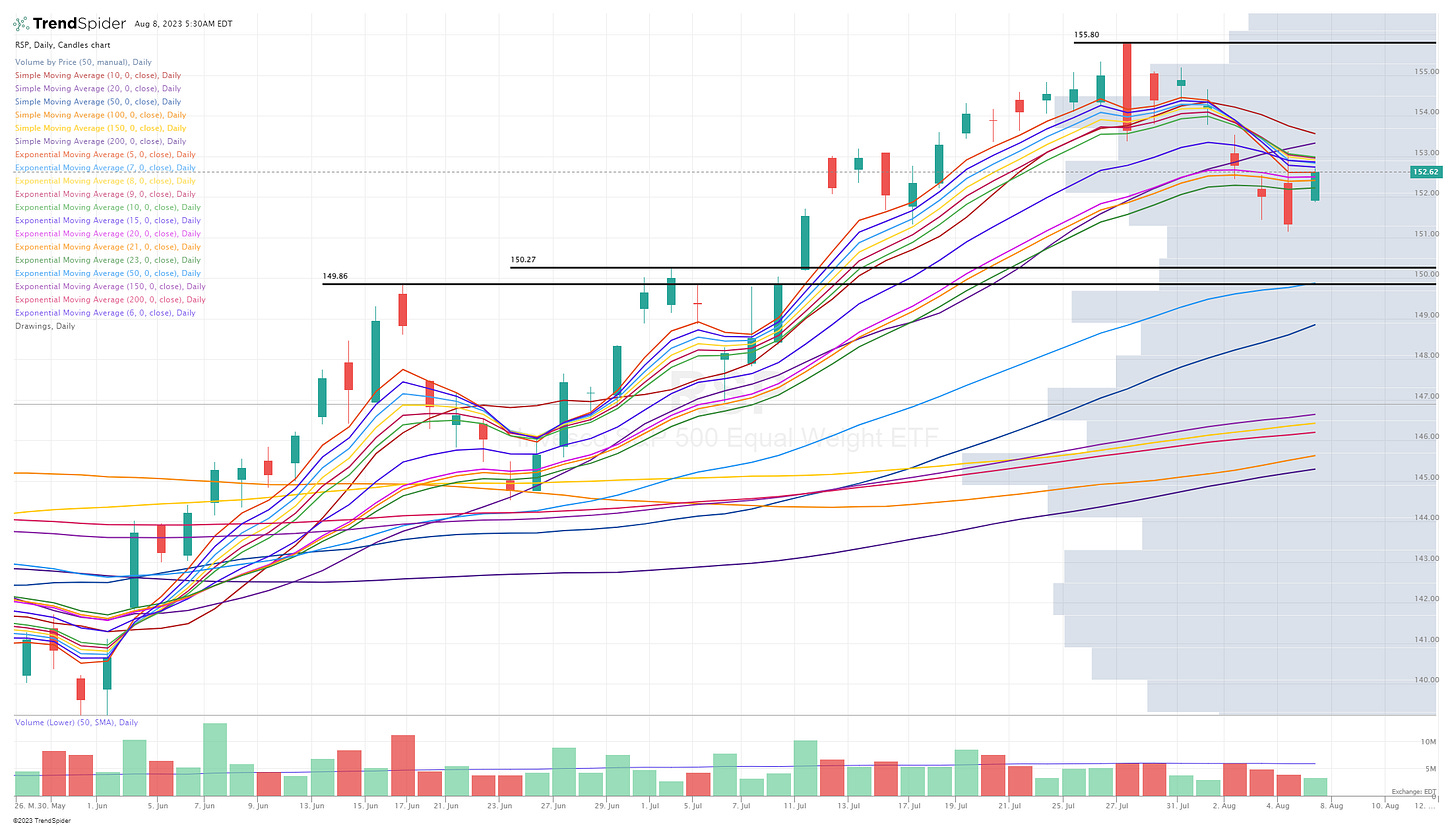

RSPY with an inside day, back above the 21/23d ema, running into resistance at 6d ema

QQQ off that early July pivot at ~372, then pushing through 23d ema and closing just below 21d ema

QQQE with an inside day, closing just above the 23d ema

IWM bouncing off the 23d ema but getting rejected at 20d sma

IWO bouncing off the July pivot but closing in the red unlike all the other indexes which just shows that growth was a big underperformer yesterday.

ARKK did worse than all the indexes yesterday, big morning drop, slicing through the pivot support but ultimately closing back above the 50d ema/sma. I was hoping that we’d see growth bounce back today but pre-markets aren’t looking pretty.

Below the paywall is my current trading portfolio including all positions (open & closed), watchlists, entry prices, stop losses and YTD performance and my daily webcasts.