Trading the Charts for Thursday, May 25th

In addition to my “Trading the Charts” newsletter, below are a few more newsletters that I publish plus my Investing with the Whales podcast, my Stocktwits room, my Seeking Alpha investment service and my new Twitter Spaces coming soon.

I also run a Stocktwits room where I’m very active throughout the day and post about both of my portfolios with 100% transparency. FWIW, I’m up ~60% YTD thanks to huge gains with CELH, LNTH, UBER, MELI, SDGR, ONON, TSLA, GLBE, SWAV, XPOF, NU, FLNC, and several others. You can join by clicking the button below:

Good morning and Happy Thursday,

Not done with earnings yet, I’ll be watching DECK, WDAY, ADSK, COST and ULTA after the close.

This is from 6:22am, I think the futures have changed in the past two hours but I don’t care. Tech is up huge pre-market driven by NVDA earnings last night, curious to see how the other sectors do today and whether the debt ceiling debacle is creating a risk-off scenario for the markets.

SPX bouncing off the 50d ema yesterday (close enough), I’m thinking that megacap tech will put it in the green today but we’ll find out after the open. We’re only 2% away from 4200, I doubt it happens today but could happen soon especially if Congress does their job and avoids a government shutdown.

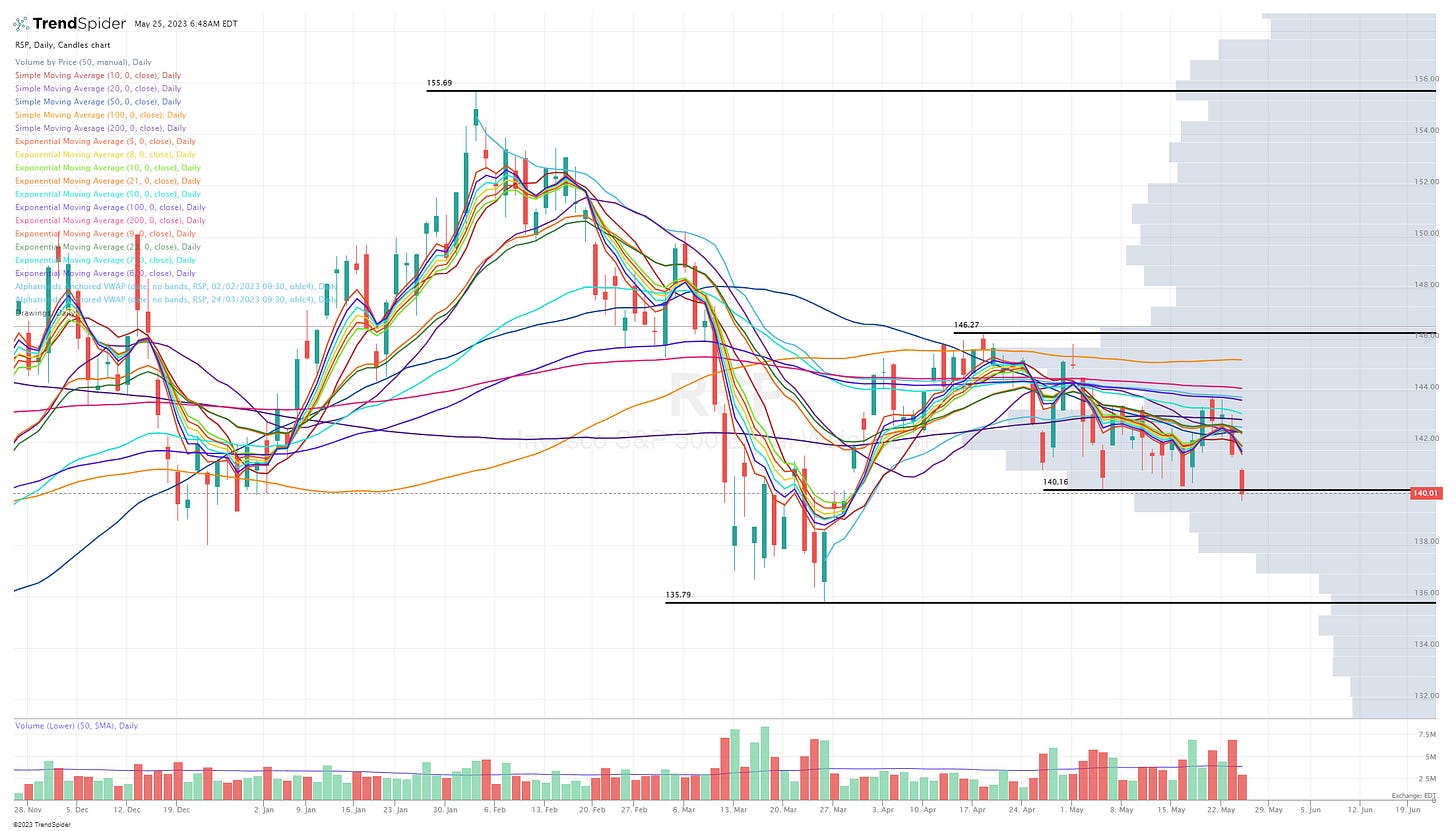

RSP still looking much worse than SPX/SPY and that gap might get even wider tomorrow since megacap tech including NVDA are going to drive the biggest gains today.

QQQ is up 2% pre-market which takes it right back to those recent highs, let’s see if we can close at a new 52 week high today, I think it probably happens.

QQQE will probably underperform QQQ today but should still do well because there’s alot of small AI-related companies in QQQE like PLTR.

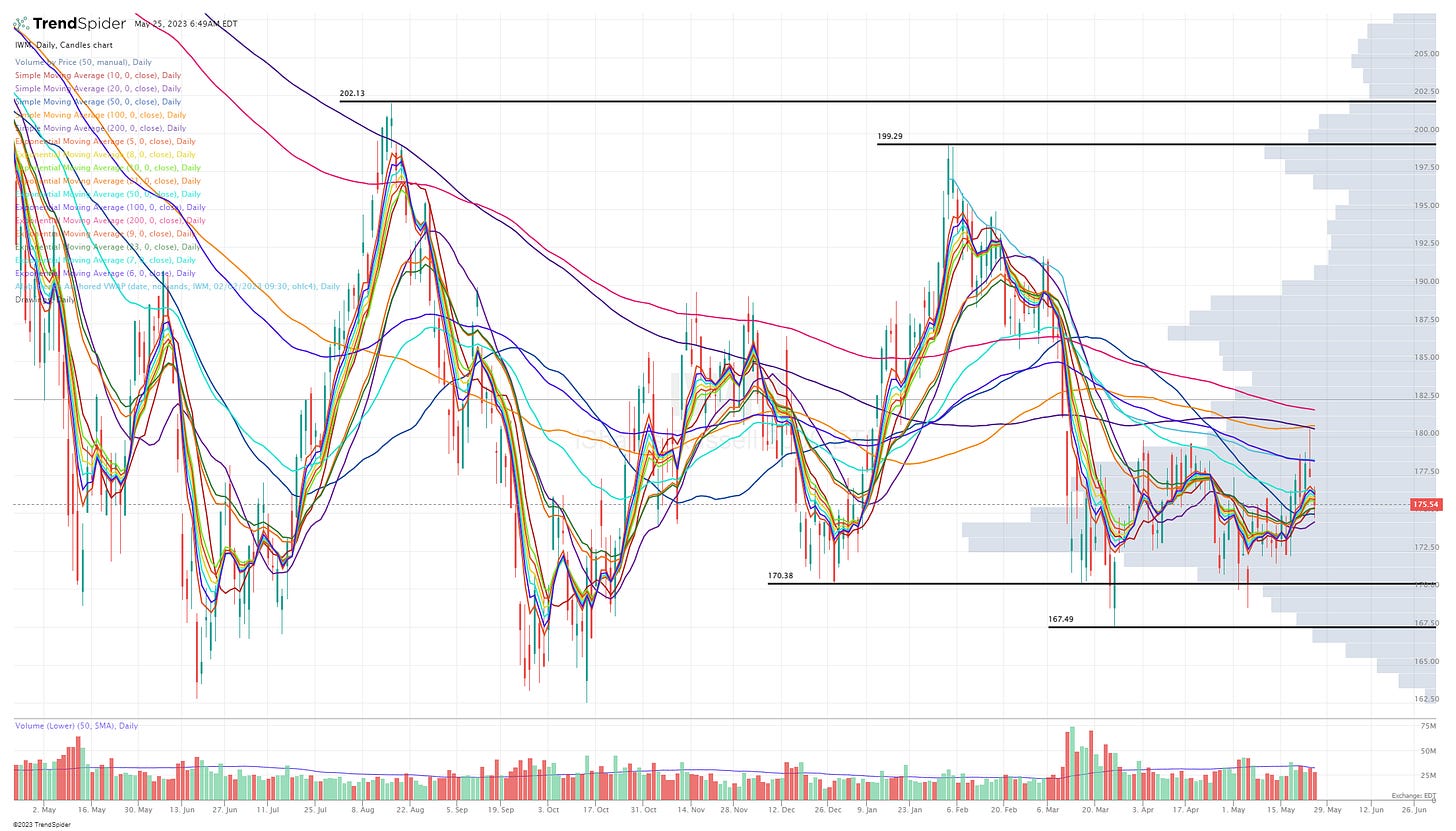

Tech is going to run the show today, let’s see how the small/mid caps do, I expect significant underperformance but will they finish in the green? I’m still short IWM in my investment portfolio as a hedge as long as it’s below the 200d sma although I did cover half my short yesterday when we bounced off the 50d sma

IWO really needs to push through 231.00 today or at the least get back above the 200d ema which it lost yesterday, let’s see if the fallout from NVDA earnings can rise the tide for all growth companies. If I was short IWO (which I’m not), I’d be covering above the 200d ema

I was 30% short ARKK coming into yesterday (as a hedge against my 130% long portfolio plus IWM short) but I covered half my ARKK short yesterday morning when it bounced off the 10d ema. I’d go back to 30% short if ARKK gets rejected at ~41.00 or the highs from a couple days. I’m anxious to see what happens when ARKK finally gets back to the 200d ema.

IPO will underperform today because SNOW is a big weighting which is down 13% pre-market on disappointing earnings. In hindsight I wish I had shorted IPO when it got rejected at 200d ema and had my hedges spread evenly between ARKK IWM and IPO. IPO is only down -0.3% pre-market, could be worth a trade if it bounces off the 21/23d ema

Yields up again this morning, I’m still long TMF because I think we’re close to a top in yields.

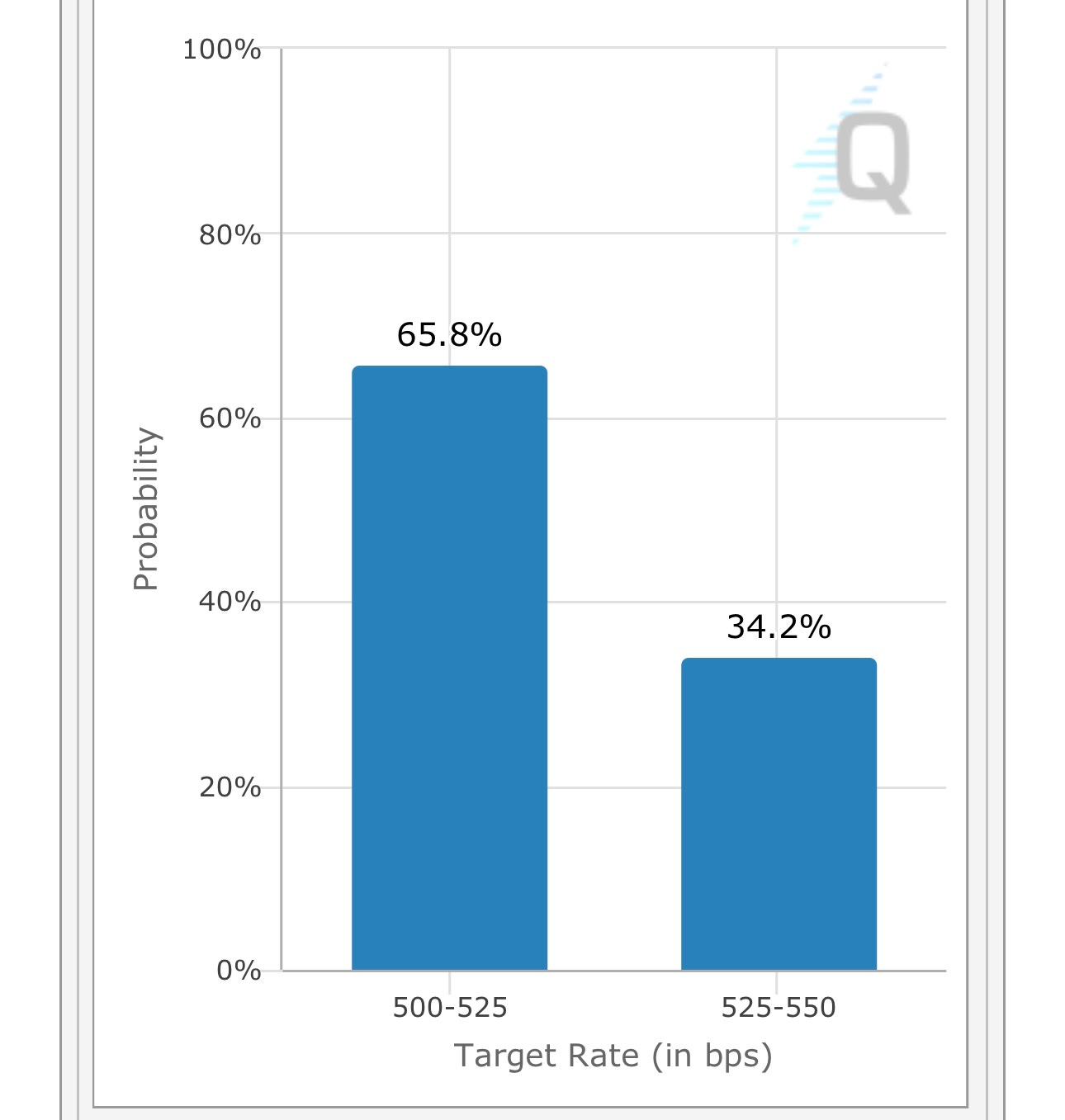

The probably of no rate hike at the June 14th FOMC meeting is down to 65.8% which is the lowest it has been, curious to see where this number goes over the next couple weeks as we do or don’t resolve debt ceiling then get into June macro reports like CPI and jobs/payroll.

Below the paywall is my current trading portfolio (with positions, sizes, entry price, stop loss, etc), current watchlist and links to my daily Zoom webcasts.