Trading the Charts for Thursday, May 18th

In addition to my “Trading the Charts” newsletter, below are a few more newsletters that I publish plus my Investing with the Whales podcast, my Stocktwits room, my Seeking Alpha investment service and my new Twitter Spaces coming soon.

I also run a Stocktwits room where I’m very active throughout the day and post about both of my portfolios with 100% transparency. FWIW, I’m up 48.5% YTD thanks to huge gains with CELH, LNTH, UBER, ONON, TSLA, SDGR, MELI, GLBE, SWAV, XPOF, FLNC, NU and several others. You can join by clicking the button below:

Good morning and Happy Thursday,

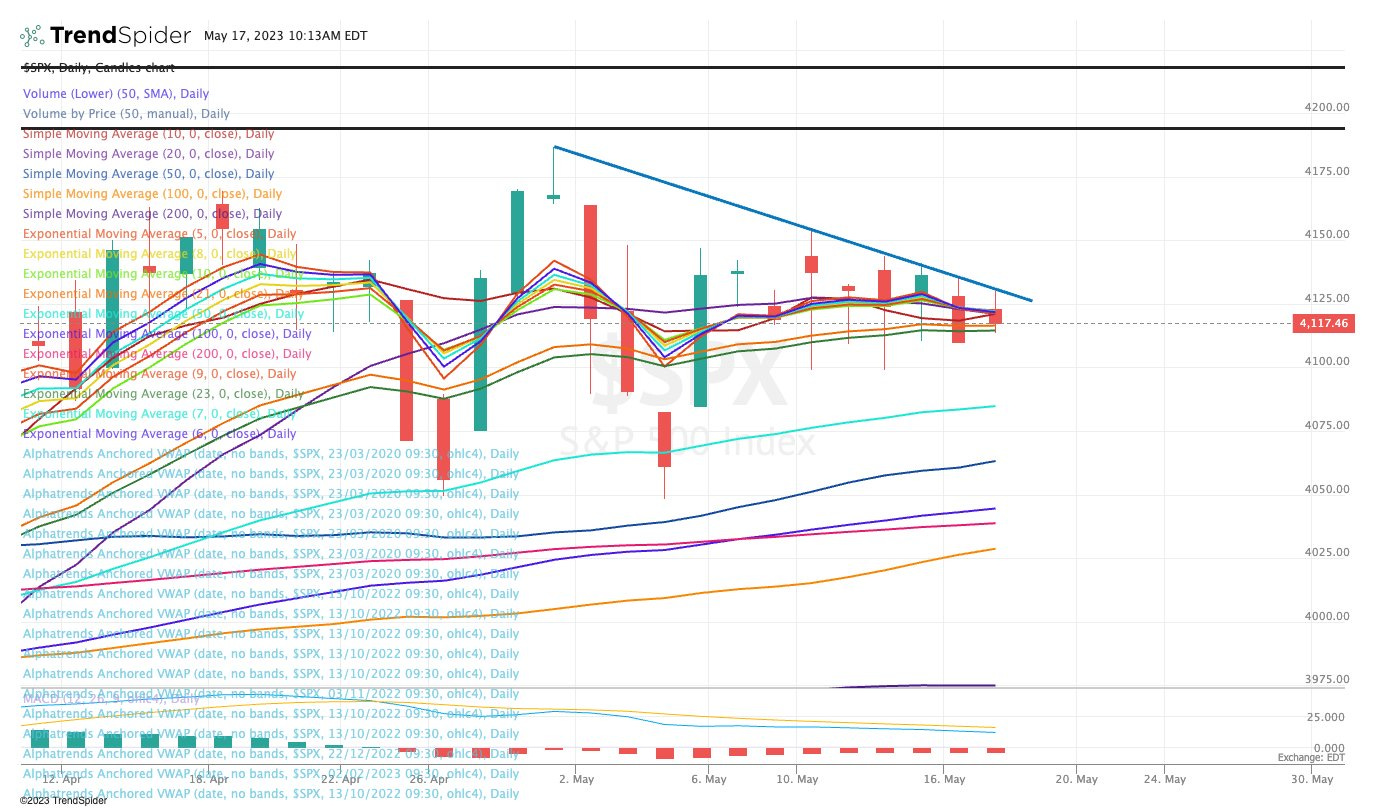

Yesterday morning SPX got rejected at the DTL from May 1st highs…

then it bounced off the 23d ema and ripped higher through the DTL…

Should be an interesting day for small/mid caps with the IWM trying to push through the 50d ema…

Should be an interesting day for growth stocks with the IWO trying to push through the VWAP from February high then the 200d ema…

Even ARKK is one to watch, rejected yesterday at the 200d sma, does it finally push through today?? and then if it does watch the VWAP from the February high because that’s where it got rejected last week.

Yesterday on Twitter I shared the updated YTD stats from my trading portfolio…

406 trades (approx 20 trades per week)

36% win rate

average winner is +6.61%

average loser is -2.05%

This has been a choppy market so I'm pretty happy with these numbers although I'd like to get my win rate up to 45% which is certainly doable in a better market. I also gave back a handful of double digit winners so I need to take profits sooner when the markets start to pullback. I also need to start increasing my average position size because that will amplify my gains assuming I can hold these stats or even improve them.

Below the paywall is my current trading portfolio (with positions, sizes, entry price, stop loss, etc), current watchlist and links to my daily Zoom webcasts.