Trading the Charts for Thursday, March 28th

In order to read this entire newsletter you’ll need to become a paid subscriber by clicking the button below. Paid subscribers get full access to my trading portfolio (up +25.7% in 2024, up +97% in 2023), daily watchlists with charts, daily activity with entry prices & stop losses, all trading stats with performance, and my daily webcasts.

My other Substack newsletter is called Growth Stock Deep Dives where paid subscribers receive 2-3 deep dives per month (8,000+ words each), 2-3 mini deep dives per month (2,000+ words each) and quarterly earnings analysis (on most of my portfolio companies) plus access to my investment portfolio (up +102% YTD in 2024, up +134% in 2023 and up +2,050% since January 2020) with real-time activity and notes/commentary throughout the day on my portfolio spreadsheet.

Earnings reports for the week…

Macro reports for the week…

CPI spreadsheet…

FOMC updates…

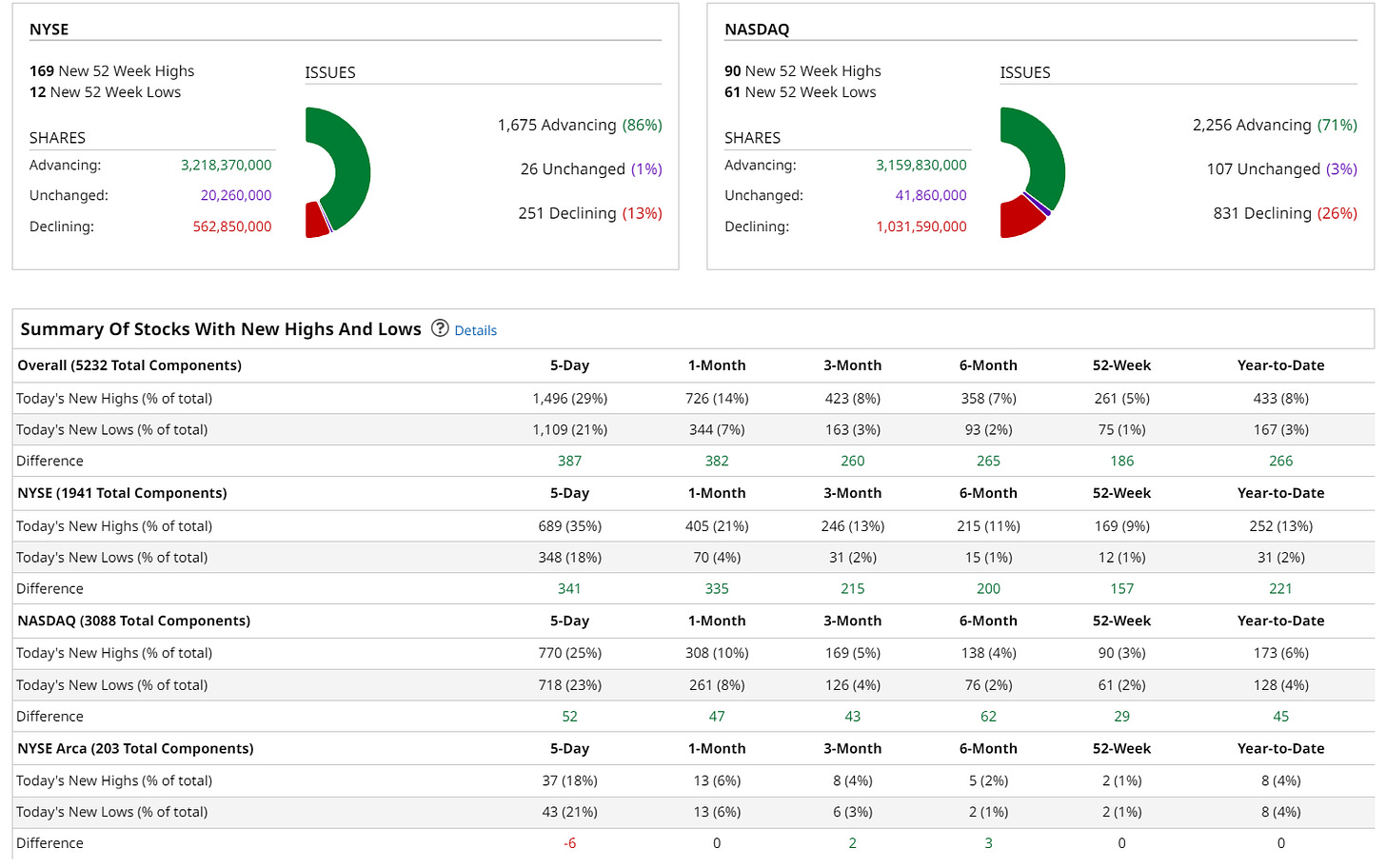

New highs vs new lows…

Market momentum…

$TNX (10Y Treasury)

$VIX

$CL1! (Oil)

SPY (S&P 500, market cap weighted)

RSP (S&P 500, equal cap weighted)

QQQ (Nasdaq 100, market cap weighted)

QQQE (Nasdaq 100, equal cap weighted)

IWM (Russell 2000, small/mid caps)

IWO (Russell 2000 Growth, small/mid caps)

Finviz screen #1: ACGL ACMR ADMA AEM AGIO ALAB ALPN APO APP ASPN ATAT AVGO AX AXNX BBAR BBVA BEAM BK BLBD BMO BPMC BROS BTSG BZ C CAVA CELH CFLT CIFR CIVI CLBT CLDX CLSK COIN CP CPRX CRWD CYBR DASH DB DKNG DUOL DXCM EDR EGO ELF EPRT ESNT EVH EWBC EXR FCF FDMT FIHL FNF FROG FRPT GGAL GLNG GTLS HALO HASI HBM HIMS HTGC HTHT IBKR IBRX INSP INTR IOT ITCI JPM JXN KKR KYMR LLY LPG LW LYV MARA MMYT MNDY MS MSGE MU NBIX NCLH NET NMR NTRA NTRS NTST NU NVDA NVEI NVO NWG NXT ONB ONON OZK PCOR PGNY PGR PMT POST PR PRM PSN PWR QRVO RBA RCL RITM RKT ROIV RUM RYAN RYN SBS SDRL SG SLM SMCI SMFG SN SOUN SPR SRPT STR STT SWAV SYF SYM TARS TCN TCOM TDW TECK TGTX TOST TPG TW TWO VIRT WHD WPM WYNN XNCR XP XYL YOU

Criteria: stock price above $5, market cap above $1 billion, above 50d sma, above 200d sma, average daily volume above 500k, sales growth above 20%

Below the paywall is my:

morning commentary

daily watchlists with charts

link to current trading portfolio with all positions, entry prices and stop losses

YTD trading stats and performance

Commentary:

I don’t love doing lots of trading on the day before a long weekend (markets closed tomorrow) but it will depend on the price action after the open. There’s some decent setups this morning… some are potential breakouts and some are mini pullbacks.

The price action yesterday in some of the recent leaders was pretty ugly, curious to see if that trend continues which means money might be rotating into other sectors and some of the beaten down stocks. Also worth noting that the Russell 2000 was the bigger winner yesterday, closing at a 2 year high, if the 10Y yield continues to move lower then IWM could keep chugging higher.

Current trading portfolio [click here]:

ACVA

AVAV

CELH

CTVA

DKNG

ERJ

ESNT

FOUR

FROG

FRPT

HASI

HIMS

HOOD

IOT

MBLY

MMYT

OII

PCOR

TOST

TTD

Current watchlist [click here]:

AGR

ANET

APAM

APP

APPF

ASPN

ASND

ATAT

AVDX

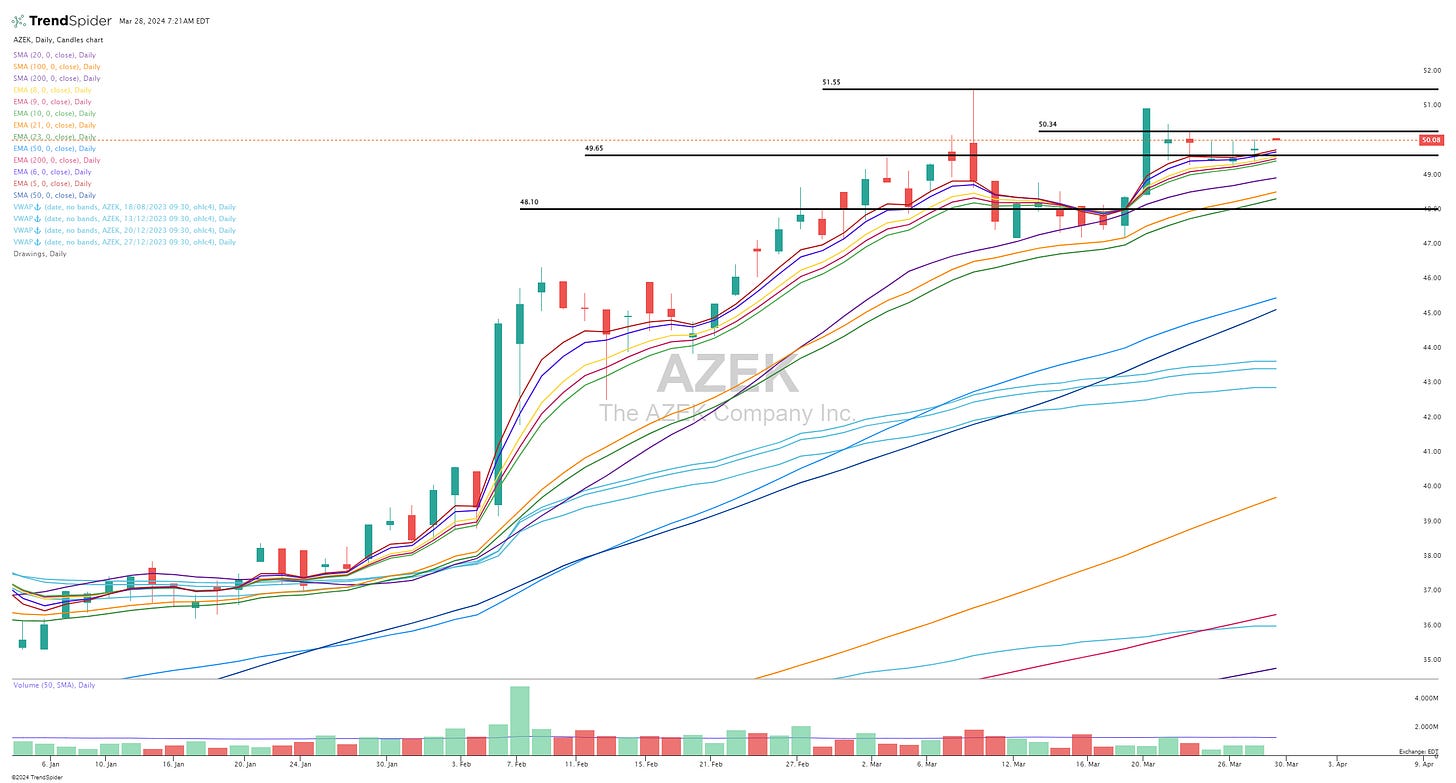

AZEK

BROS

CLSK

COIN

DO

DXCM

EDR

ERX

FTI

GEN

HAL

INSP

ISRG

LVS

MARA

ML

MTCH

OKTA

OPRA

OSCR

POST

RBA

SHAK

SLB

SQ

SRPT

SYK

TXRH

TW

VERX

VKTX

W

AGR — pushes through 36.25

ANET — bounces off 20d sma or 21/23d ema

APAM — pushes through 45.60 or 45.93

APP — pushes through 10d ema

APPF — pushes through 248.69 or bounces off 246.35

ASPN — pushes through 17.45

ASND — pushes through VWAPs

ATAT — pushes through 19.80

AVDX — pushes through 13.15

AZEK — pushes through 50.34

BROS — pushes through 10d ema or bounces off 32.32 or 20d sma

CLSK — pushes through 23.71

COIN — bounces off 5/6d ema

DO — pushes through 200d sma

DXCM — pushes through 141.51 or bounces off 139.33 or 5d ema

EDR — pushes through 25.77 or bounces off 25.49 or 5/6d ema

ERX — pushes through 69.55 or bounces off 5/6d ema

FTI — stays above 25.72

GEN — pushes through VWAP

HAL — pushes through 39.07 or bounces off 5d ema

INSP — opens/stays above 200d sma

ISRG — stays above 399.89 or pushes through 406.09

LVS — pushes through 200d sma

MARA — pushes through VWAPs

ML — bounces off 5d ema

MTCH — pushes through 50d sma or wait to push through 36.36

OKTA — bounces off 21/23d ema

OPRA — bounces off 5/6d ema or 8/9d ema

OSCR — pushes through 50d sma

POST — pushes through 107.13

RBA — pushes through 77.17 or 77.30

SHAK — bounces off 21/23d ema

SLB — pushes through 54.95 or 55.10

SQ — bounces off 5d ema

SRPT — opens/stays above the VWAP from recent high

SYK — pushes through 360.29 or 361.49

TXRH — pushes through 154.66

TW — bounces off 21/23d ema

VERX — pushes through 30.83

VKTX — pushes through 83.79

W — pushes through 69.71

Have a great day,

~Jonah Lupton, CEO/CIO of Lupton Capital

You can follow me on Twitter at @JonahLupton