Trading the Charts for Thursday, June 8th

Here are my other newsletters…

I also run a Stocktwits room where I’m very active throughout the day and post about both of my portfolios with 100% transparency.

FWIW, I’m up 68% YTD thanks to huge gains with CELH, LNTH, UBER, MELI, SDGR, ONON, TSLA, GLBE, SWAV, XPOF, NU, FLNC, CFLT, DOCN and several others. You can join by clicking the button below:

Good morning and Happy Thursday,

Equity futures are flat, yields up slightly but notable the 10Y is back above 3.8%, still a 68% chance of no rate hike at the FOMC meeting next week but most importantly we get our next CPI report next Tuesday (just one day before FOMC meeting)

I sold my TMF ahead of the jobs report last Friday to lock in a 10% gain, I’d consider getting back in if we retest/hold that 7.26 level but this is not something I’m buying ahead of CPI/FOMC just in case we get an unpleasant surprise from either and rates rip higher (that would be bad for TMF)

SPX still flirting with 4300 but unable to push through, might happen this week or perhaps next week with a cool CPI report (very possible) or FOMC pause

RSP outperforming SPX/SPY, nice follow through day after taking out 200d ema on Tuesday. This is definitely a bullish setup.

QQQ continues to consolidate, nothing wrong with that, yesterday bounced off the 10d ema/sma, if fails to hold that level I’d probably get short

QQQE only pulling back to the 7d ema but finding support at the highs from last summer.

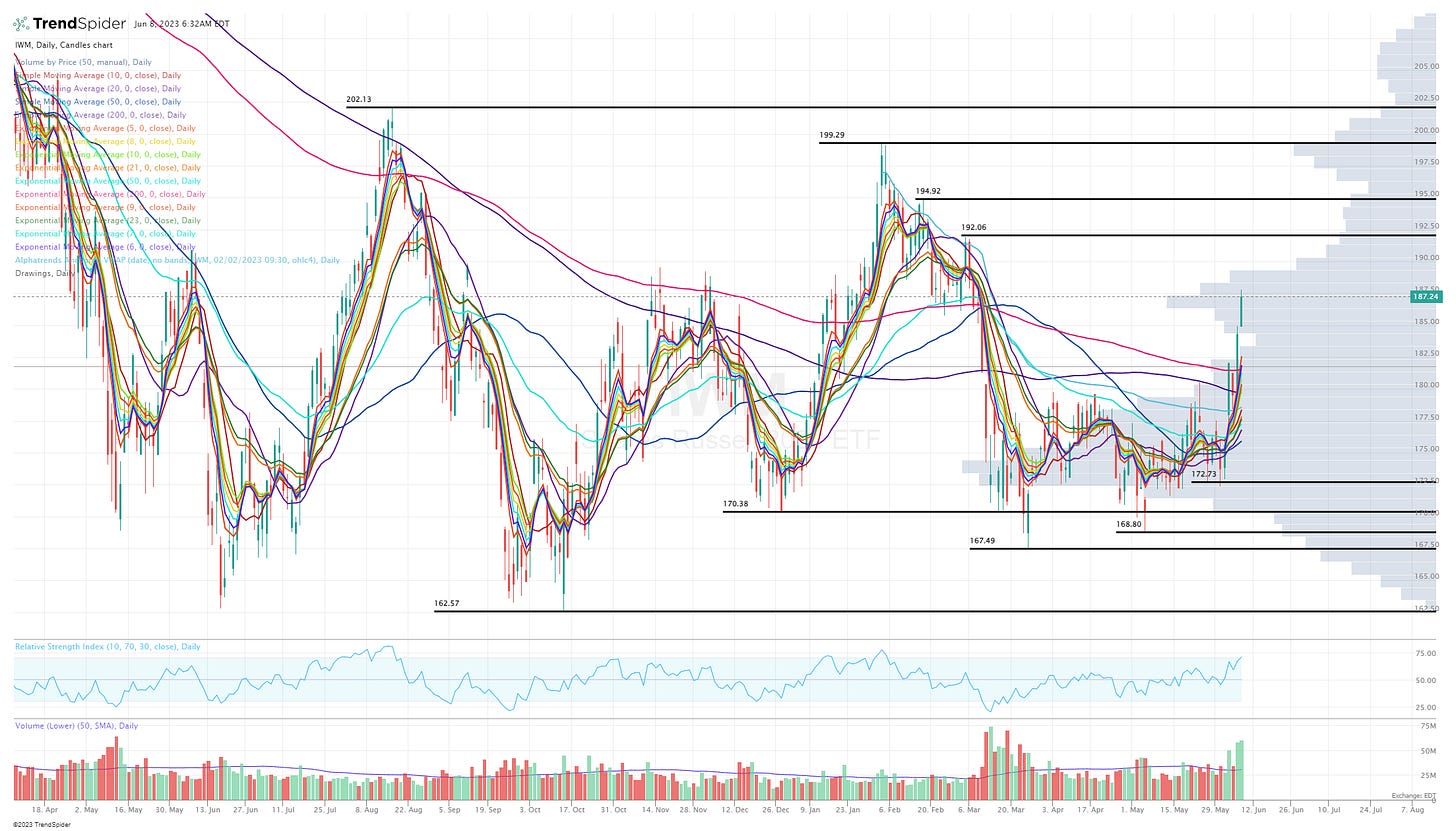

IWM with another big day, massive outperformance the past few days compared to SPX/SPY and QQQ. This means small/mid caps are starting to see some buying interest as the market tries to broaden out beyond large cap tech. I have a small IWM short position which hurt yesterday but it’s just a hedge to protect my YTD gains.

IWO also looking great, another big day yesterday, now only 4% from the highs last summer.

ARKK with a big reversal yesterday, rejected at 43.77 and then closing right on the 200d ema, I still have my ARKK short position which I’ll decrease above 43.77 but increase below the 200d ema

Below the paywall is my current trading portfolio and watchlist with charts, entry points, stop losses, etc. (PS: my investment portfolio is different and only available to my Stocktwits subscribers and my Substack deep dive subscribers)

Please note that I have changed the links/URLs for my webcasts as well as my portfolio spreadsheet — I have to do this at the beginning of every month so former subscribers no longer have access to the content that is exclusive for paid subscribers.