Trading the Charts for Thursday, July 6th

I also run a Stocktwits room where I’m active throughout the day and also post about my investment portfolio which is up ~85% YTD thanks to big gains in CELH, LNTH, UBER, MELI, SDGR, ONON, TSLA, GLBE, SWAV, NU, FLNC, CFLT, DOCN and others.

Here are my other newsletters…

As you probably know I use Trendspider for all my charting and they’re currently running a massive July 4th sale which you can claim by clicking on the button below…

Trading portfolio stats through July 5th (including open positions):

657 trades

34% win rate

+8.5% average winner

-2.0% average loser

+55.4% YTD performance

Good morning and Happy Wednesday,

We’re coming off a red day for stocks, I don’t think the FOMC minutes yesterday afternoon helped because they basically said the FOMC wants to continue hiking rates after pausing in June. The next FOMC meeting is just 3 weeks (July 26-27) away with the next jobs report tomorrow morning and the next CPI report on July 12th…

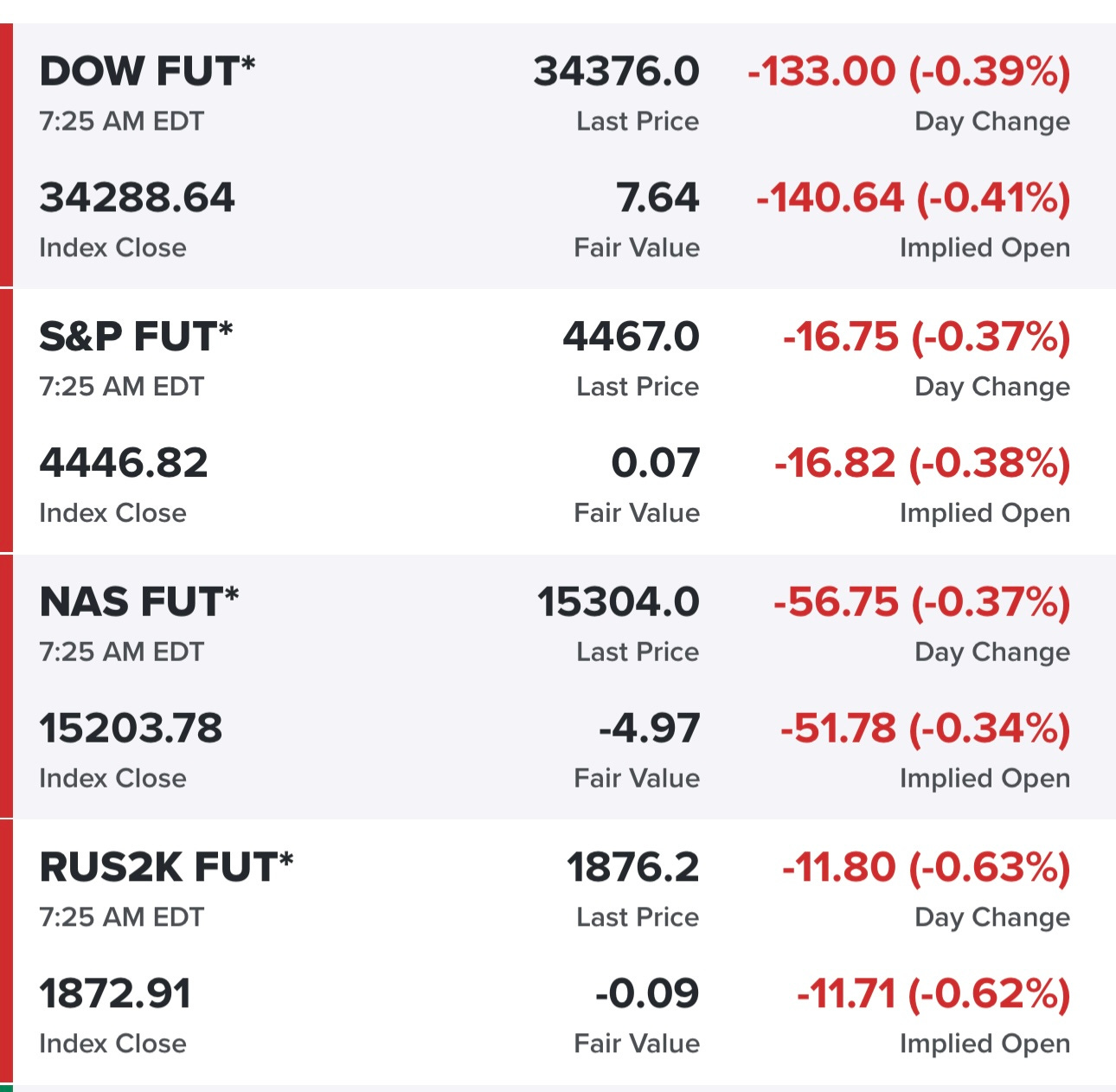

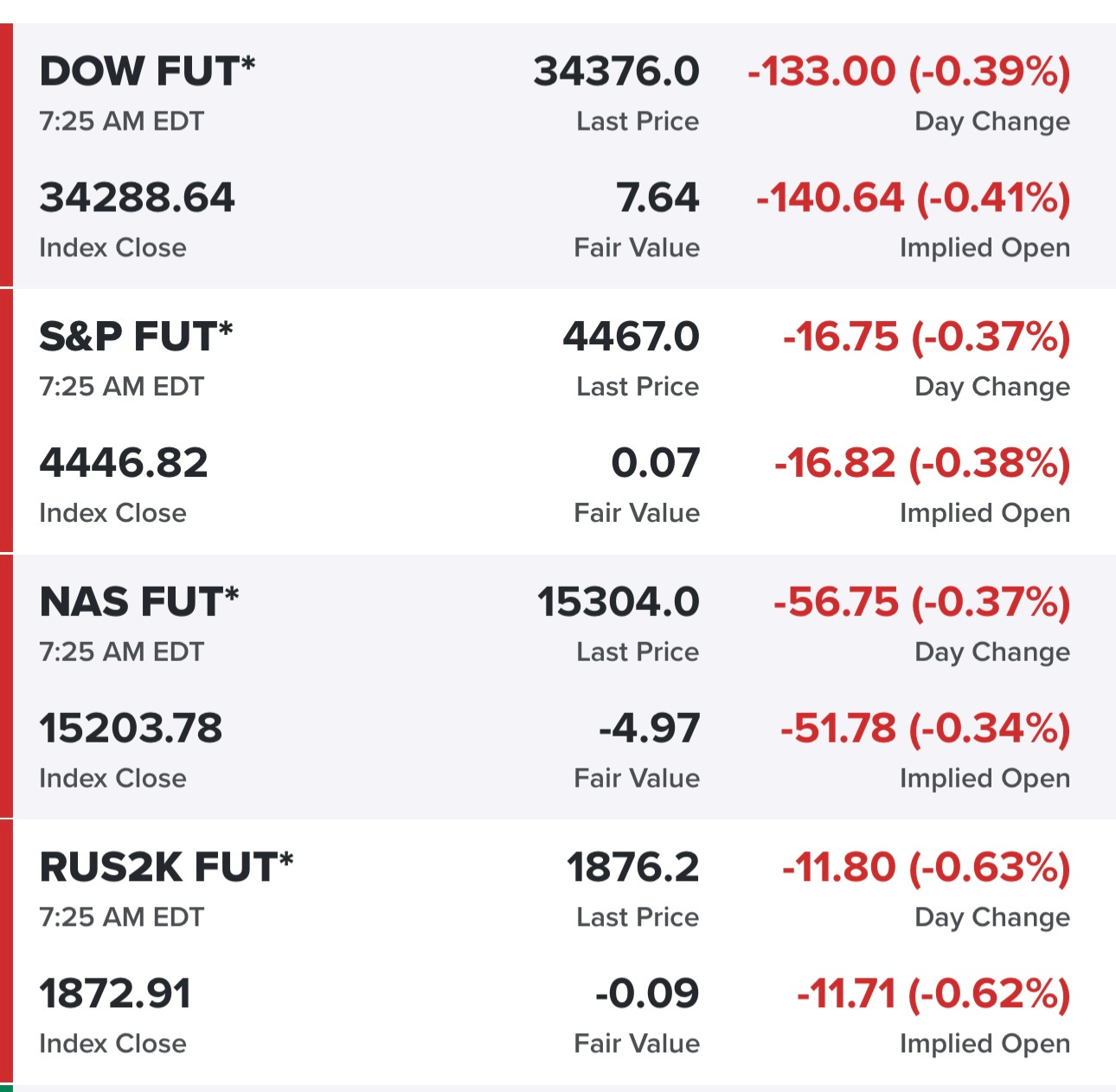

Equity futures not looking very good this morning…

Yields have been grinding higher for the past few months (since the bank failures) and we’re now at the point where the 10Y approaching 4% could be a problem for equities and stall this rally…

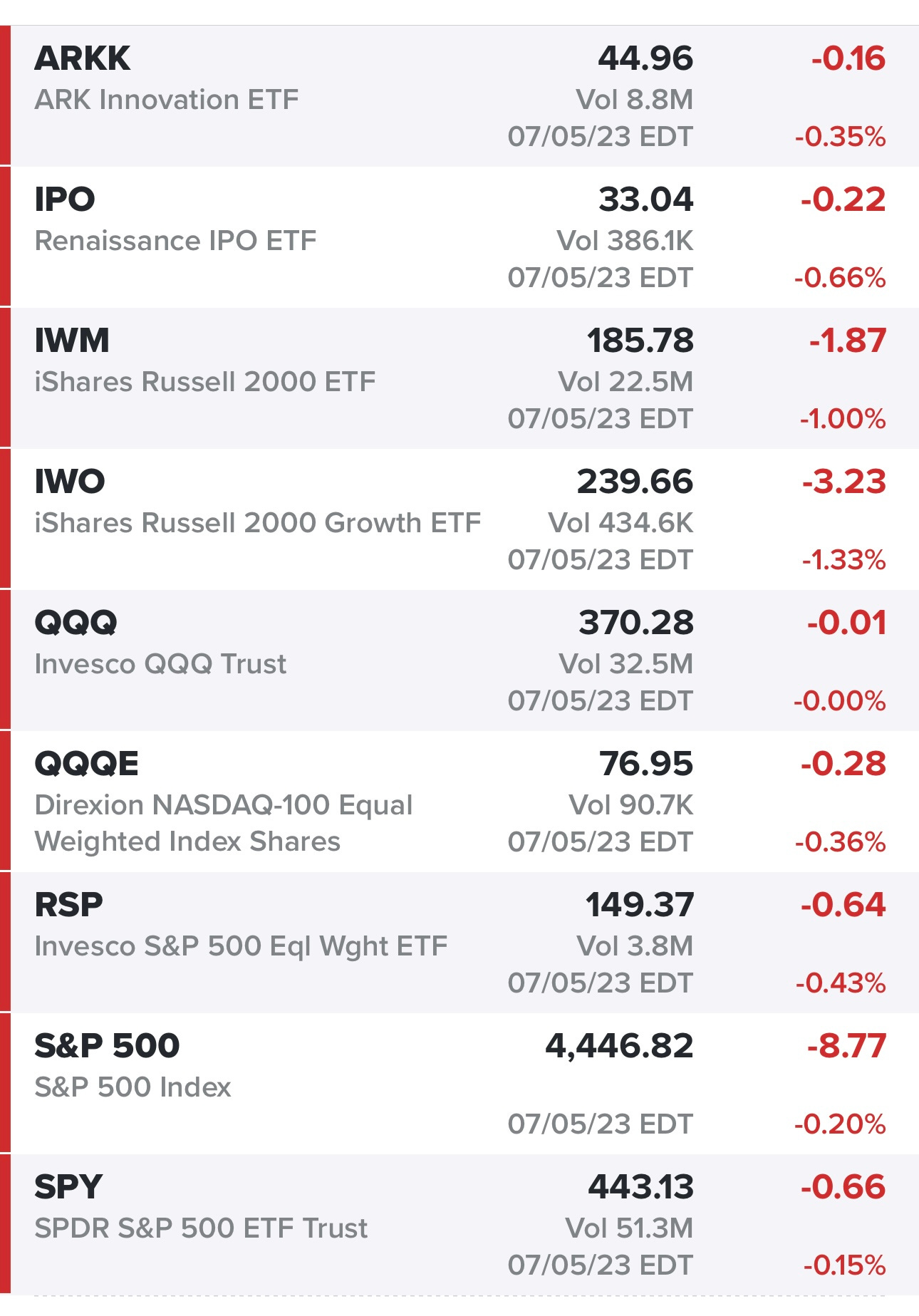

SPY finished in the red yesterday but not by much, didn’t even test the 5d ema.

RSP bouncing off the 5d ema yesterday.

QQQ bouncing just above the 5d ema yesterday.

QQQE bouncing just above the 5d ema yesterday.

IWM bouncing off the 8d ema yesterday

IWO with a tiny bounce off the 10d ema, closing right at the 9d ema.

ARKK with a nice bounce off the 5d ema, based on pre-market prices it looks like ARKK will open up at the 5d ema today.

Below the paywall is my current trading portfolio and watchlist with charts, entry points, stop losses, etc. (PS: my investment portfolio is different and only available to my Stocktwits subscribers and my Substack deep dive subscribers)