Trading the Charts for Monday, May 8th

In addition to my “Trading the Charts” newsletter, below are a few more newsletters that I publish plus my Investing with the Whales podcast, my Stocktwits room and my Seeking Alpha investment service.

I also run a Stocktwits room where I’m very active throughout the day and post about both of my portfolios with 100% transparency and FWIW I’m up 35.5% YTD thanks to huge gains with LNTH UBER ONON TSLA SDGR MELI GLBE SWAV XPOF and several others. You can join by clicking the button below:

Good morning and Happy Monday,

We get the next CPI report this Wednesday but like Jeremy Siegel said this morning, the bar is very high for the FOMC to do another rate hike which means CPI would need to come in very hot plus we get another jobs report and a second CPI report before the next FOMC meeting on June 13-14 so the FOMC will have alot of data to work with before they need to make their next decision. We also have 500 bps of previous rate hikes to work through including the lag effect on at least half of them plus the credit tightening from the bank failures. Throw it all together and it’s very possible the FOMC is done which means these CPI reports might not move the markets like they did last year (to the downside in most cases). With that said I’m not looking to get super aggressive ahead of the CPI report but I’m still willing to add new positions if I see an attractive setup/breakout.

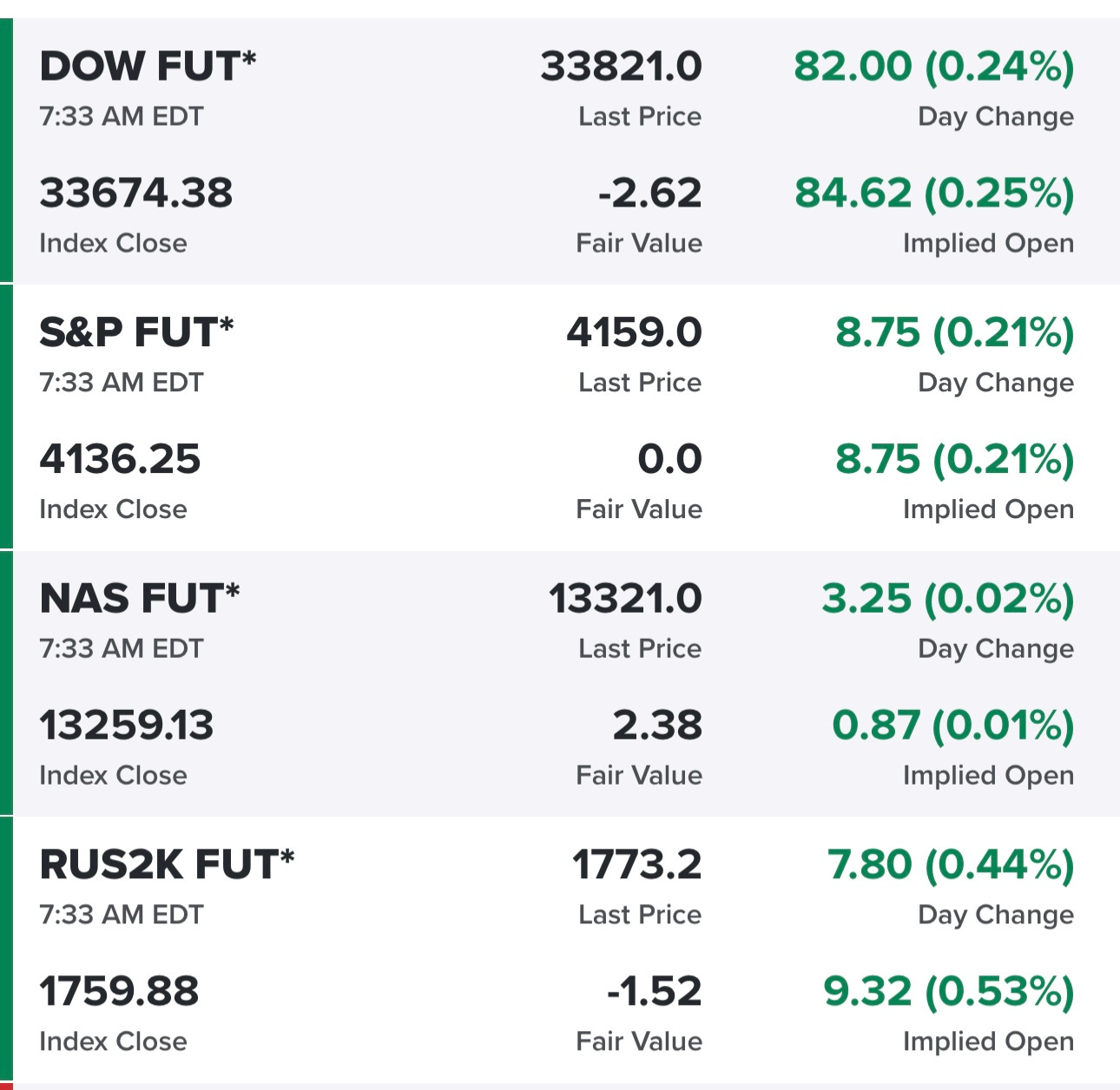

Futures looking decent…

Yields up slightly but the 10Y is still under 3.5% …

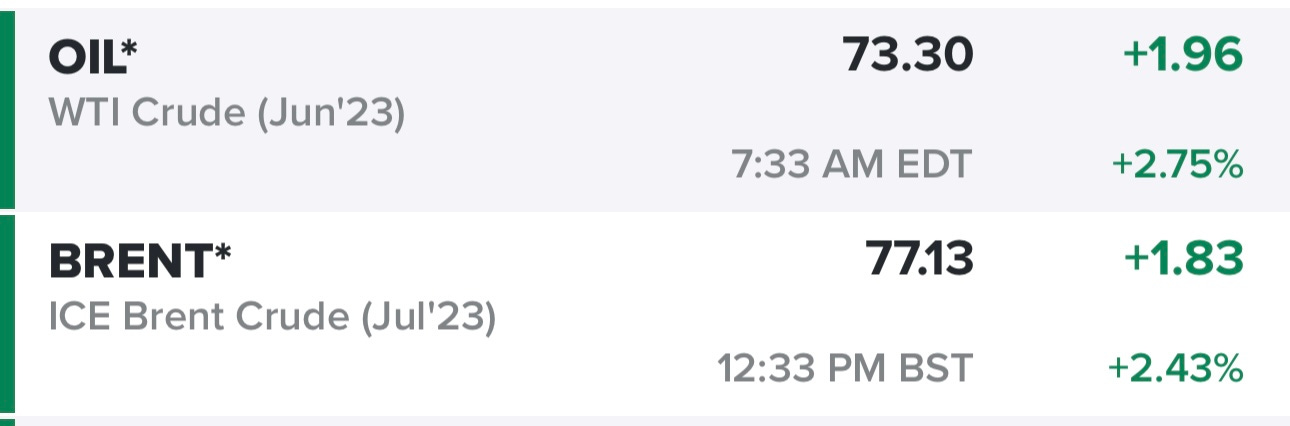

Oil bouncing back from the lows last week, curious to see if energy stocks are up today on this…

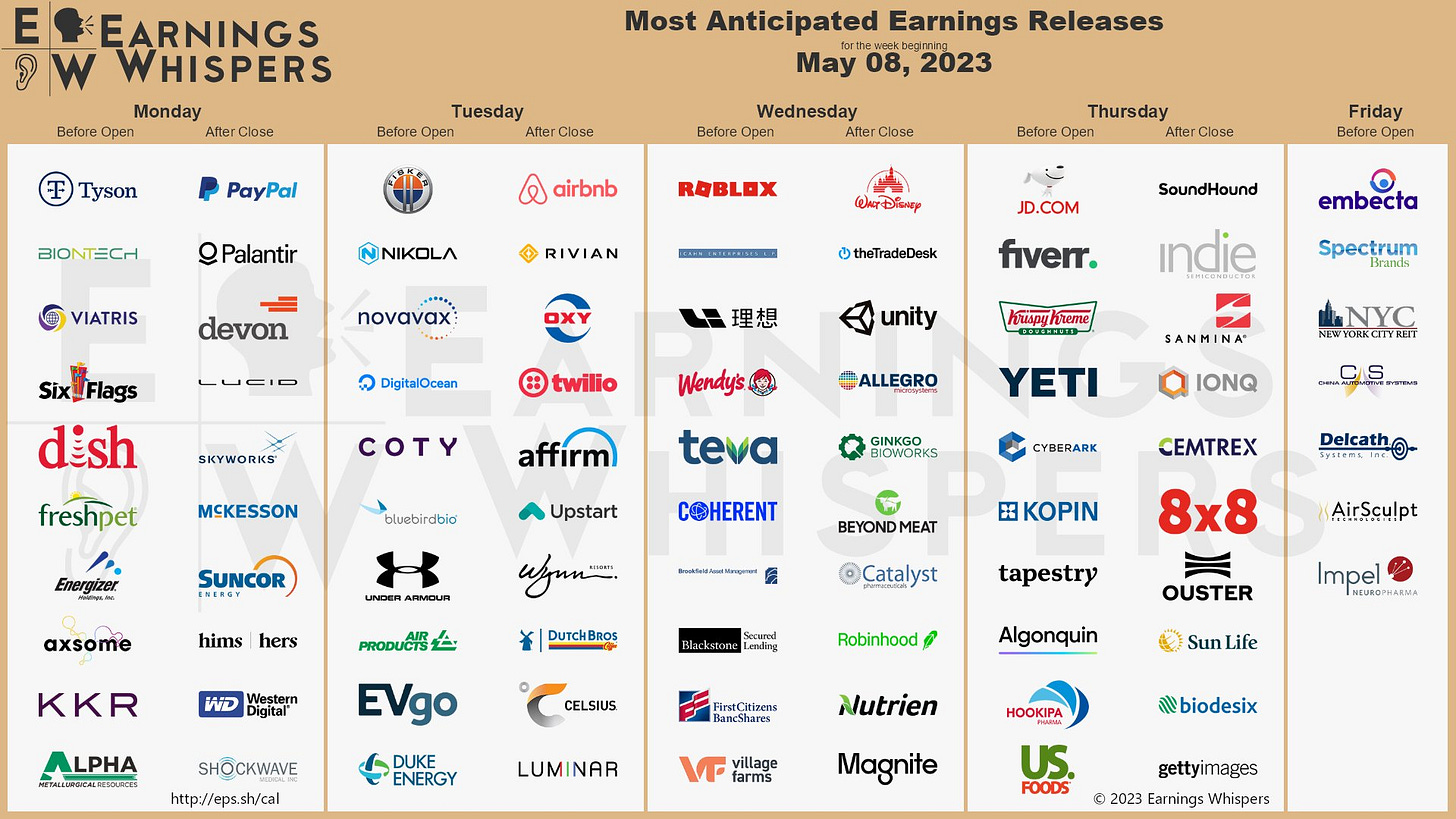

In stock specific news, ZS did a prelim announcement this morning and raised guidance so the stock is up 23% pre-market and taking most of the cybersecurity stocks higher especially CRWD and S which have not reported yet. Lots of analysts upgrades and downgrades this morning after earnings last week but lots more earnings on deck for this week including alot of popular stocks and ones that I regular trade so I’ll be watching them closest ie CELH ABNB PLTR HIMS IONQ SWAV DOCN TWLO

Below the paywall is my current portfolio, current watchlist and links to my daily webcasts.