Trading the Charts for Monday, May 15th

In addition to my “Trading the Charts” newsletter, below are a few more newsletters that I publish plus my Investing with the Whales podcast, my Stocktwits room, my Seeking Alpha investment service and my new Twitter Spaces coming soon.

I also run a Stocktwits room where I’m very active throughout the day and post about both of my portfolios with 100% transparency. FWIW, I’m up 45.5% YTD thanks to huge gains with CELH, LNTH, UBER, ONON, TSLA, SDGR, MELI, GLBE, SWAV, XPOF, FLNC, NU and several others. You can join by clicking the button below:

Good morning and Happy Monday,

The markets are still focused on the debt ceiling which I think is just an excuse from the bears because I’ve been investing for 20 years so I’ve been through a dozen or more of these debt ceiling situations and it always gets resolved without the US defaulting and it will again. It’s ridiculous these morons in Washington can’t get this resolved sooner but they like waiting until the last minute so they have more leverage in negotiations because they’re all sleazy and these are the times when it shines brightest.

Equity futures looking decent…

Yields up slightly with 2Y still hovering around 4% and 10Y below 3.5% but yields have been up the past few days…

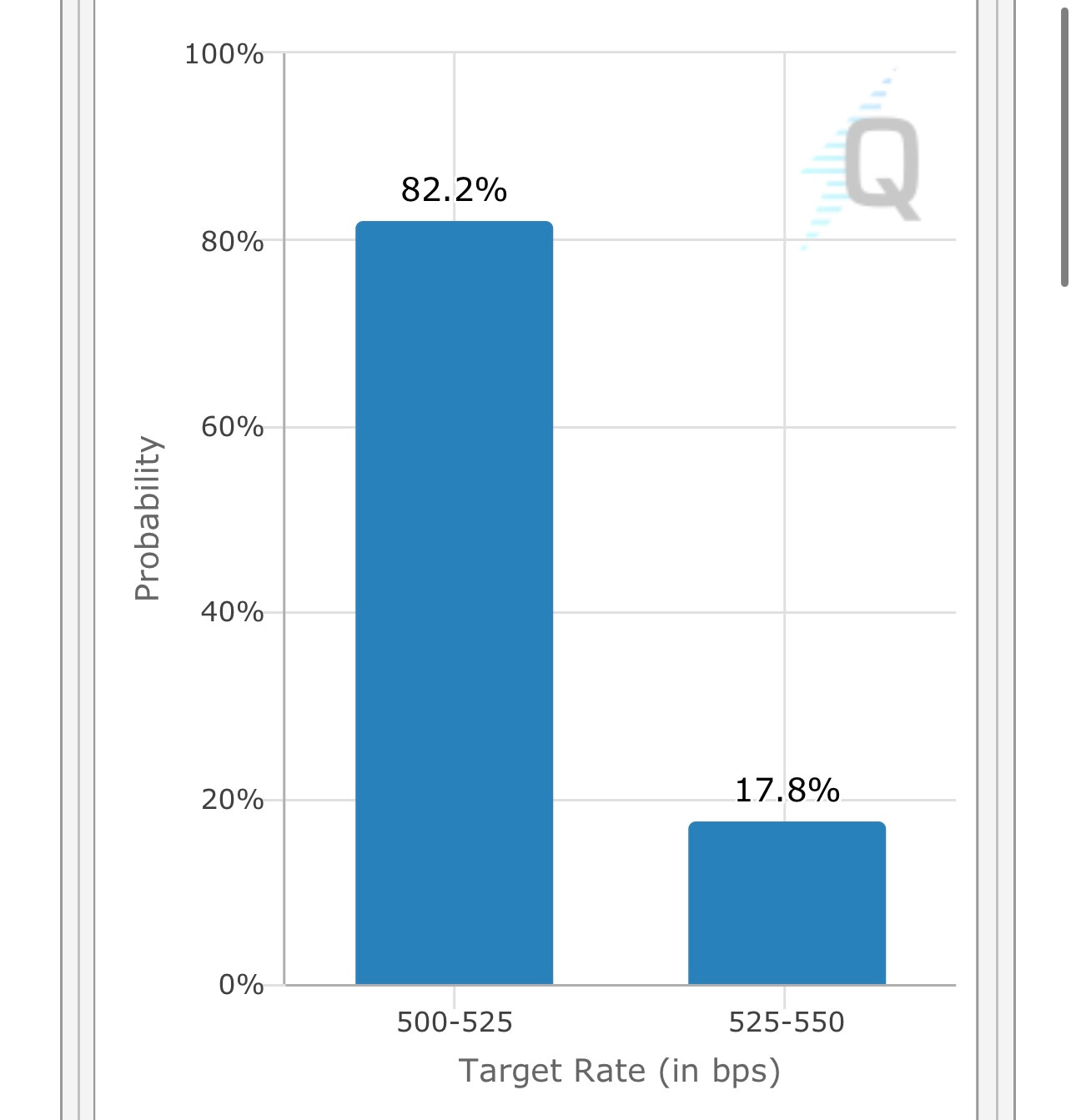

Still an 82.2% chance of no rate hike at the June FOMC meeting but remember we get another jobs report and CPI report before the next FOMC meeting so lots of data left to analyze…

We’ve gotten through the heart of earnings season but still have a few left including most of the major retailers. This week the ones I’ll be watching closest are MNDY (reported this morning), NU (later today), ONON (tomorrow morning) and then SE, DOCS, DLO, GRAB, CSIQ, BOOT.

Before the FOMC blackout window starts we’re blessed with a slue of these clowns speaking this week, several of them are speaking multiple times. Anyone that reads my newsletters knows my feelings about the FOMC, I think they’re a clown show and this week they’ll prove it again. The fact they were still hiking rates as multiple top 30 banks were failing is a testament to their obliviousness not to mention inflation is coming down quickly and I still believe we’re going to see headline CPI under 3% YoY by end of summer with the Fed Funds at 5% which won’t make sense for very long.

Below the paywall is my current portfolio, current watchlist and links to daily Zoom webcasts.