Trading the Charts for Monday, May 22nd

In addition to my “Trading the Charts” newsletter, below are a few more newsletters that I publish plus my Investing with the Whales podcast, my Stocktwits room, my Seeking Alpha investment service and my new Twitter Spaces coming soon.

I also run a Stocktwits room where I’m very active throughout the day and post about both of my portfolios with 100% transparency. FWIW, I’m up 54% YTD thanks to huge gains with CELH, LNTH, UBER, ONON, TSLA, SDGR, MELI, GLBE, SWAV, XPOF, FLNC, NU and several others. You can join by clicking the button below:

Good morning and Happy Monday,

We’re not done with earnings season yet, there are some pretty big companies reporting this week. I’ll be watching GLBE, NVDA, SNOW, ELF, WDAY, ULTA, ADSK, COST and DECK.

SPX (S&P 500) is coming off a good week (up +1.65%) thanks to big moves on Wednesday and Thursday before a small pullback on Friday. We got through 4170 which was important but ultimately failed to close above 4200. Next target would be 4218 which is the unfilled gap from last August.

RSP (equal weight S&P) is lagging bad as you can tell, up +0.95% last week and pushed through the 200d sma but got rejected at the 100d ema and the VWAP from early February. I think you can be short RSP as a hedge as long as we’re below that VWAP and then you increase that hedge if we can’t hold the 200d sma.

QQQ (Nasdaq) continues to look phenomenal, up +3.53% last week and closing at a new 52 week high after taking out the highs from last summer. If we pullback today I’d love a bounce off that 333-334 high from last August (333 was closing high, 334 was intraday high)

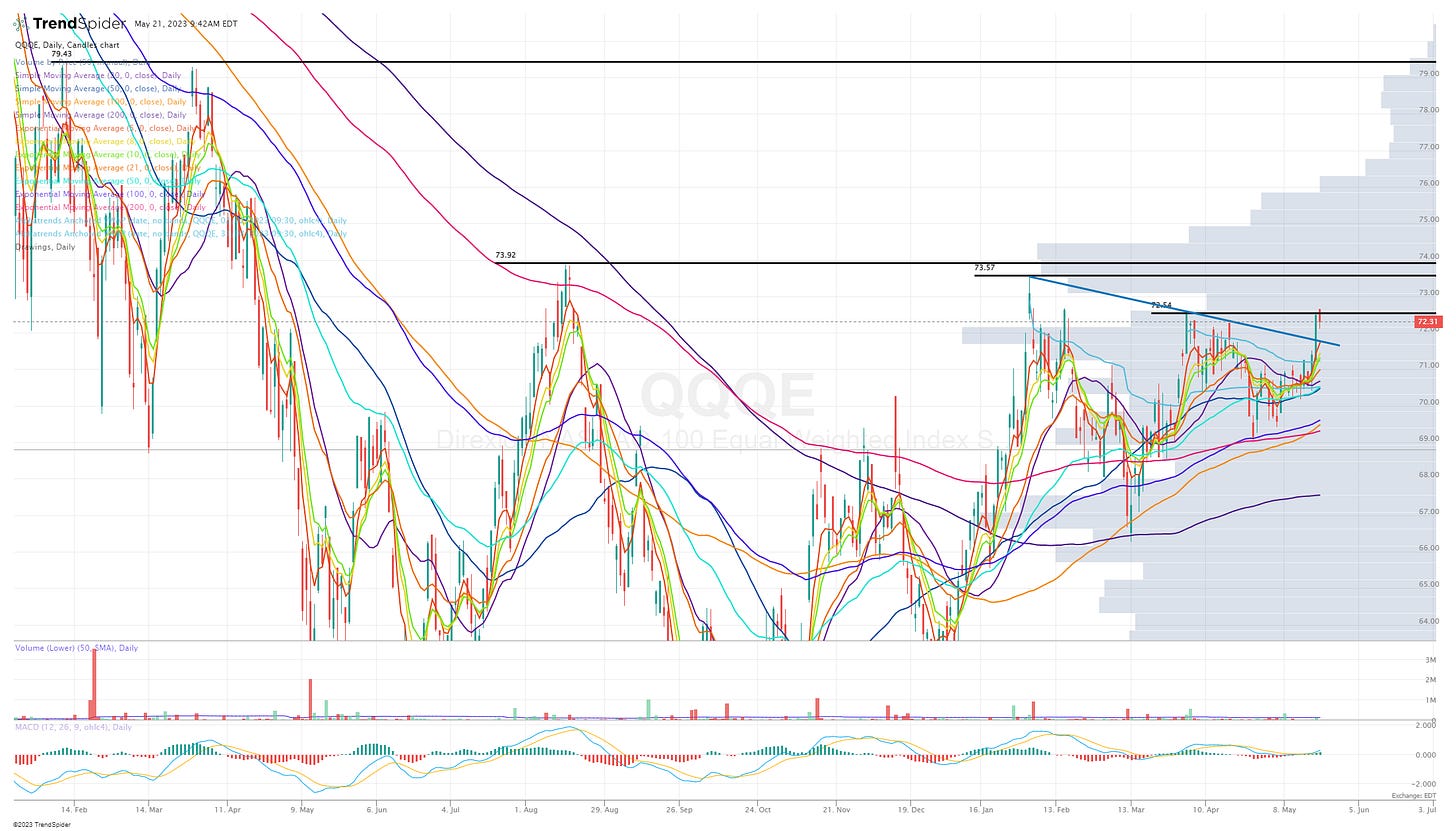

QQQE (equal weighted Nasdaq) is coming off a great week (up +2.51%) but lagged QQQ because the megacap tech stocks continue to outperform. QQQE was unable to close above 72.55 which was the closing high on March 31st.

IWM (Russell 2000) was up +1.96% last week but it’s so far behind QQQ this year. On Friday it got rejected at the VWAP from last August highs.

FWIW, I’m short IWM in my investment portfolio (hedge) as long as it’s below that VWAP

IWO was up +1.90% last week despite a nasty reversal on Friday after failing to stay above the 200d ema. I might add back my IWO short today in my investment portfolio (hedge) if it closes below the 200d ema.

ARKK also coming off a strong week (up +2.71%), pushing through the 200d sma on Thursday but then getting rejected at the VWAP from February highs which is failed to push through on Friday and then pulled back to the 200d sma.

FWIW, I’m short ARKK in my investment portfolio (hedge) and will keep that short position as long as ARKK is below the VWAP from February highs.

Yields down slightly this morning, I’m long TMF in my investment portfolio because I think long Treasury yields are close to topping out again so if they start moving lower TMF will do well as bond prices go higher.

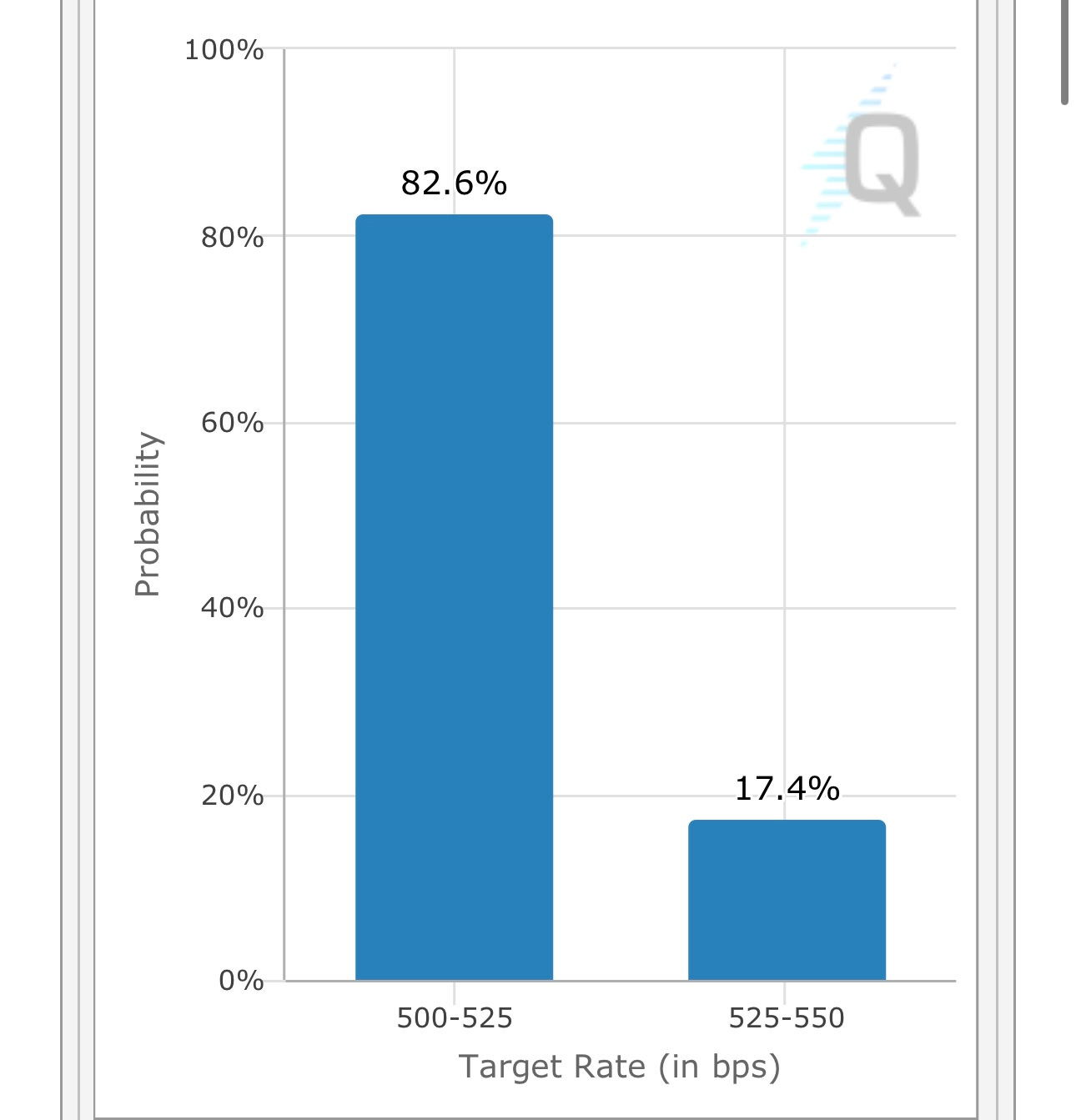

Probability of no rate hike at the next FOMC meeting is back up to 82.6% after getting as long as 70% last week.

Below the paywall is my current trading portfolio (with positions, sizes, entry price, stop loss, etc), current watchlist and links to my daily Zoom webcasts.