Trading the Charts for Monday, May 1st

In addition to my “Trading the Charts” newsletter, here are some other newsletters that I publish plus my Investing with the Whales podcast, my Stocktwits room and my Seeking Alpha investment service which is all of my newsletters/services under one roof.

I also run a Stocktwits room where I’m very active throughout the day, you can join by clicking on the buttons below:

Good morning and Happy Monday,

Hope everyone had a nice weekend. It’s a big week for macro and earnings with the FOMC meeting on Wednesday, Jobs report on Friday and 25% of the S&P reporting Q1 earnings this week. Given all of this plus the fact I’m 48% invested in my trading portfolio and not feeling overly bullish I’m probably not doing much trading the next few days but I’ll be tracking which stocks have the most positive reactions (gap ups) to Q1 earnings.

Here are some of the company’s report this week… SOFI had a strong report this morning and the stock is up 6-7% pre-market, I own SOFI in both my portfolios.

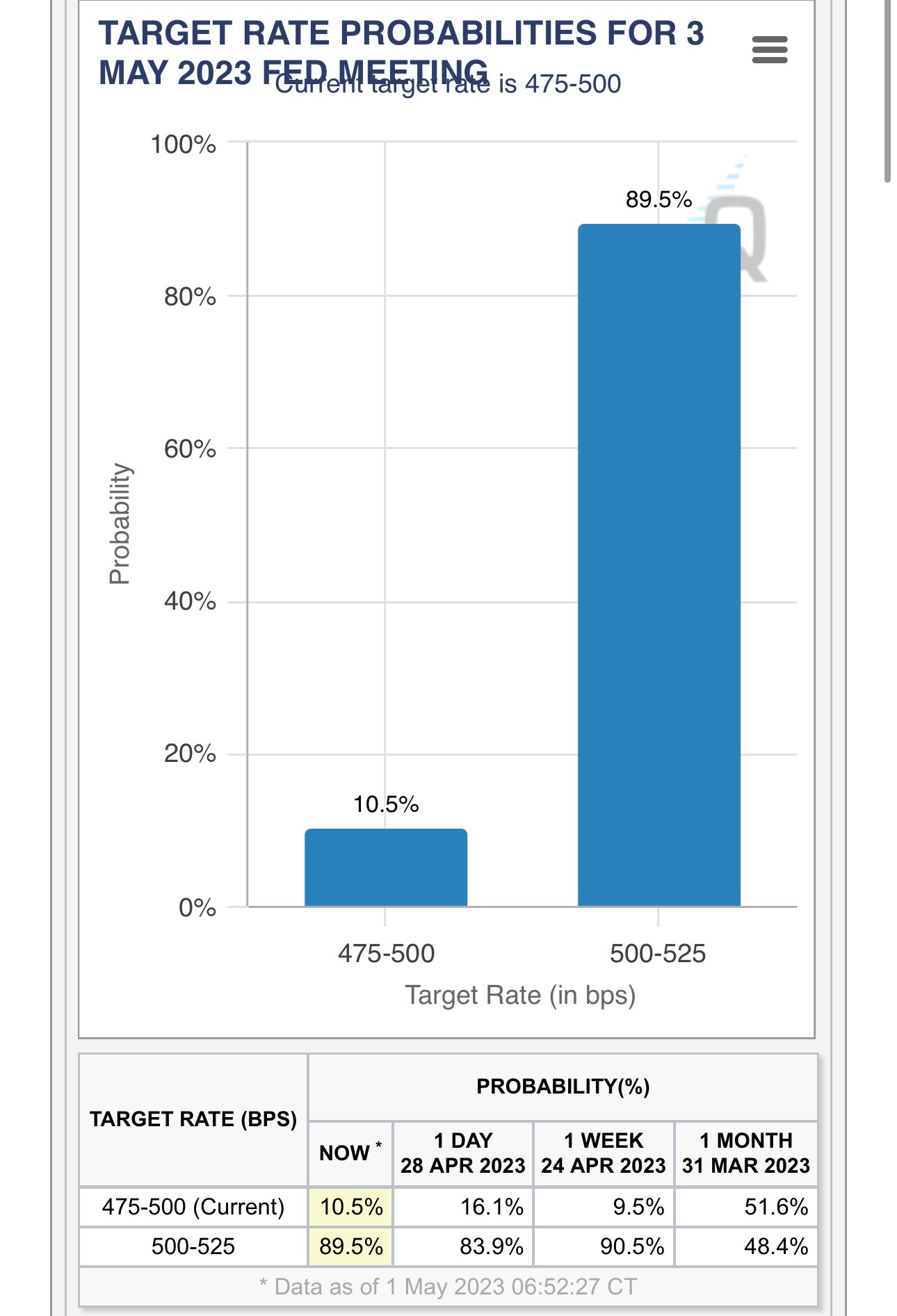

Even though First Republic (FRC) was seized this weekend by the FDIC and sold off to JPM (which means equity & bond holders get wiped out) it’s basically a slam dunk that we get another 25 bps from the FOMC on Wednesday so the most important question is what does Powell say about future rate hikes and will he hint at a pause? The image below shows an 89.5% probably of 25 bps on Wednesday but if we look ahead to the June FOMC meeting, there’s a 67.9% chance of no rate hike with 24.5% chance of another 25 bps. We’ll probably see this numbers move around after the Jobs report on Friday and CPI report next Wednesday morning (May 10th).

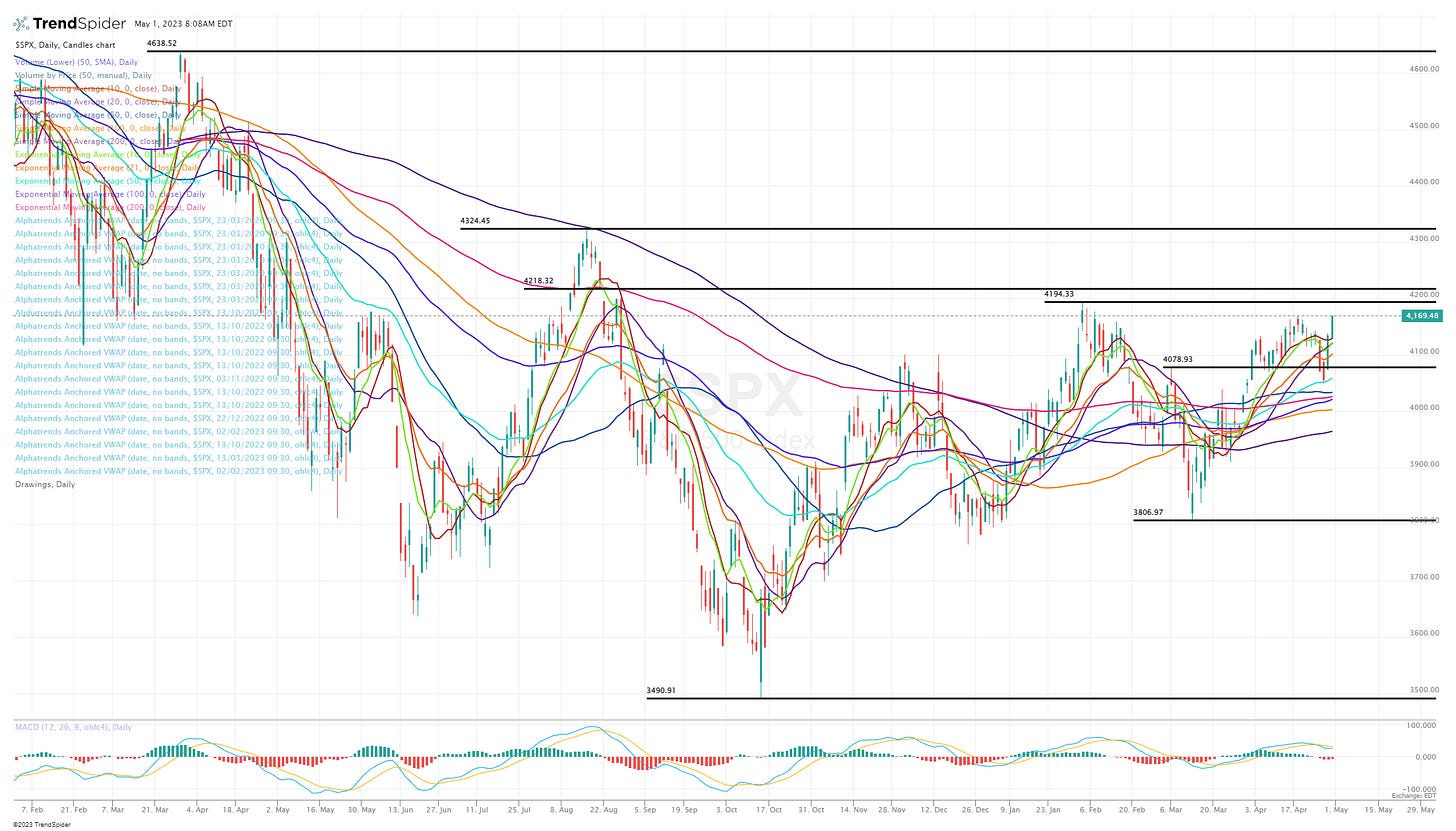

It’s possible SPX could rally up to 4300 with a dovish sounding FOMC/Powell on Wednesday followed by a tame Jobs report on Friday and cooler than expected CPI report next week but I don’t think we have enough juice or catalysts to push though 4300 in the near term. Hedge funds are positioned very bearish and they have good reasons to be with rates at 5%, a recession looming on the horizon and earnings flat YoY however if SPX can do $240-250 in EPS next year (2024) than I think we could see SPX back at the ATH of $4800+ by end of 2024 but it’s going to be pretty choppy from here to there. Personally I would not want to own the indexes now or over the next 18 months, this is the kind of market where you need to own/trade individual names or sector ETFs.