Trading the Charts for Monday, July 17th

I also run a Stocktwits room where I’m active throughout the day but post mostly about my investment portfolio which is up ~99.5% YTD, I’m currently offering a free trial if you’d like to check it out.

Here are my other newsletters…

Good morning and Happy Monday,

We’re coming off a good week for the markets although we did the week in the red.

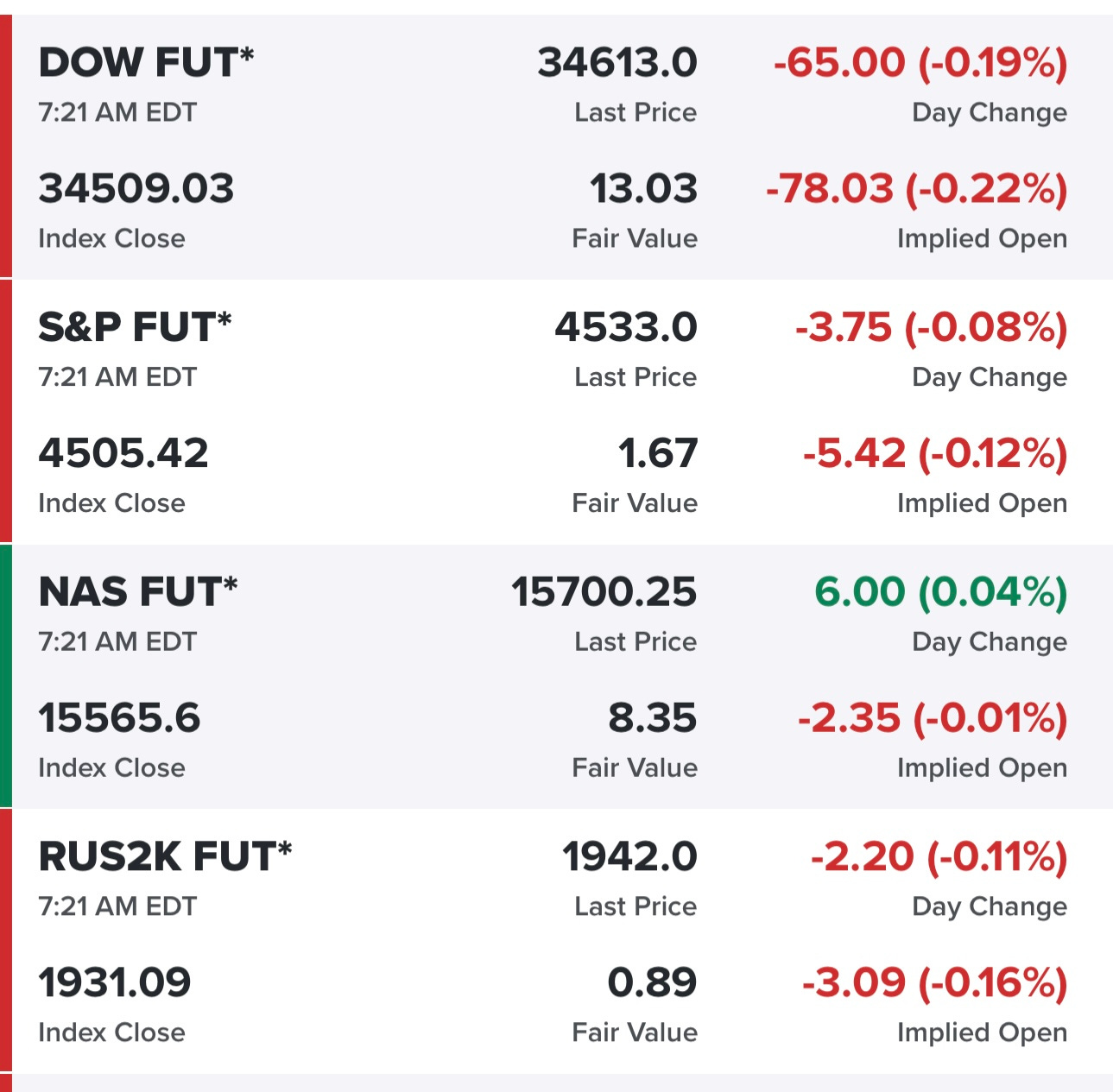

Equity futures are slightly down this morning…

Yields down slightly this morning, 10Y still down approx 30 bps from a couple weeks ago…

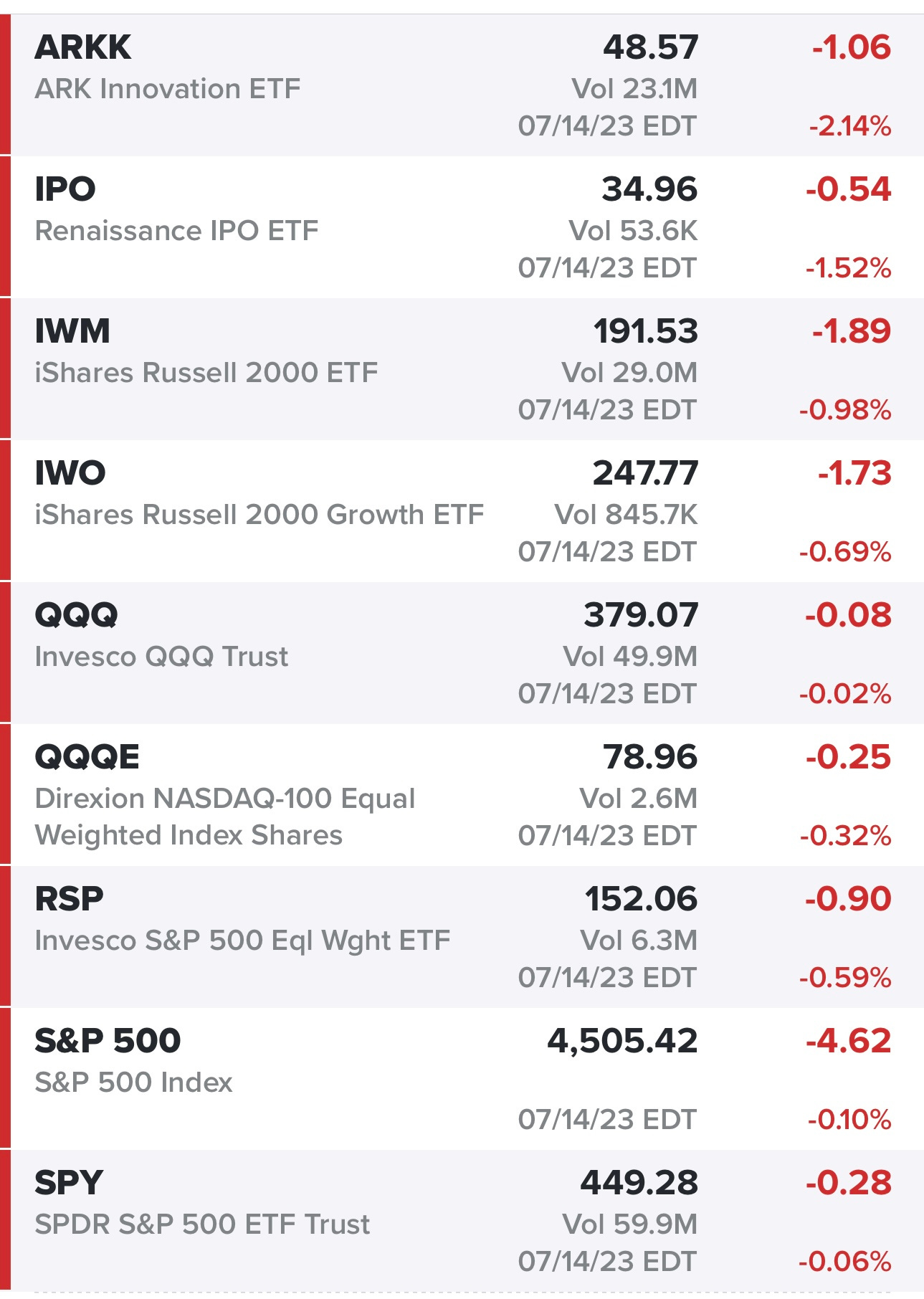

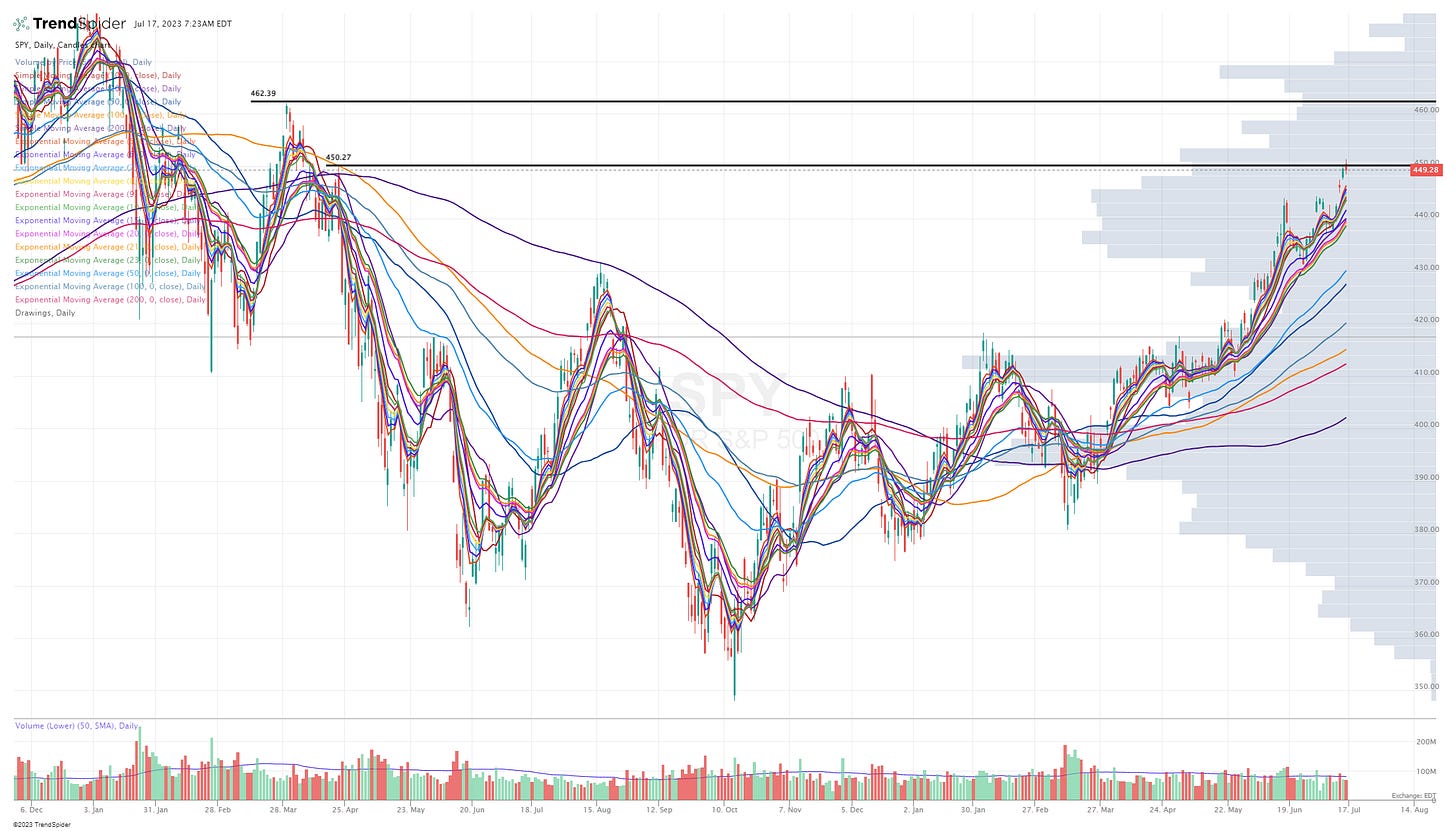

SPY running into resistance at the highs from last April, very possible we get a short term pullback to 5/6d ema as we get into earnings season.

RSP pulling back and finding support at 5d ema

QQQ actually took out the previous day highs but could not hold it, that’s a shooting star candle that often times shows the market is short-term overextended so I’d be cautious here with TSLA and NFLX both reporting this week. Some of the mega cap tech stocks are up 50-100% in the past 6 months which means expectations might be too high.

QQQE running into resistance from the highs last April.

IWM got over-extended so we saw a pullback Friday to the 5d ema.

IWO looks similar to IWM, unable to take out Thursday’s high then pulling back to the 5 d ema although it looks like IWO might have bounced off the February highs.

ARKK did take out Thursday’s high but then a big reversal, closing 3.7% off the morning highs, I would not be surprised if ARKK tested the 5/6d ema today. Lots of individual names in ARKK that are overdue for a 10% correction.

Below the paywall is my current trading portfolio and watchlist with charts, entry points, stop losses, etc.

PS: my investment portfolio is different and only available to my Stocktwits subscribers and my Substack deep dive subscribers