Trading the Charts for Monday, July 10th

I also run a Stocktwits room where I’m active throughout the day but post mostly about my investment portfolio which is up ~86% YTD

Here are my other newsletters…

As you probably know I use Trendspider for all my charting and they’re currently running a massive July 4th sale which you can claim by clicking on the button below…

Good morning and Happy Monday,

The big event this week will be CPI on Wednesday morning. I believe the current estimates are 3.4% YoY with some economists looking for a number as low as 3% YoY. Last month (June report) we had CPI come in at 4% YoY for headline and 5.4% YoY for core (less food & energy). Here’s the full report from last month [click here].

Tom Lee was just on CNBC and think the markets could rally 2-3% in the back half of this week after a cooler CPI report.

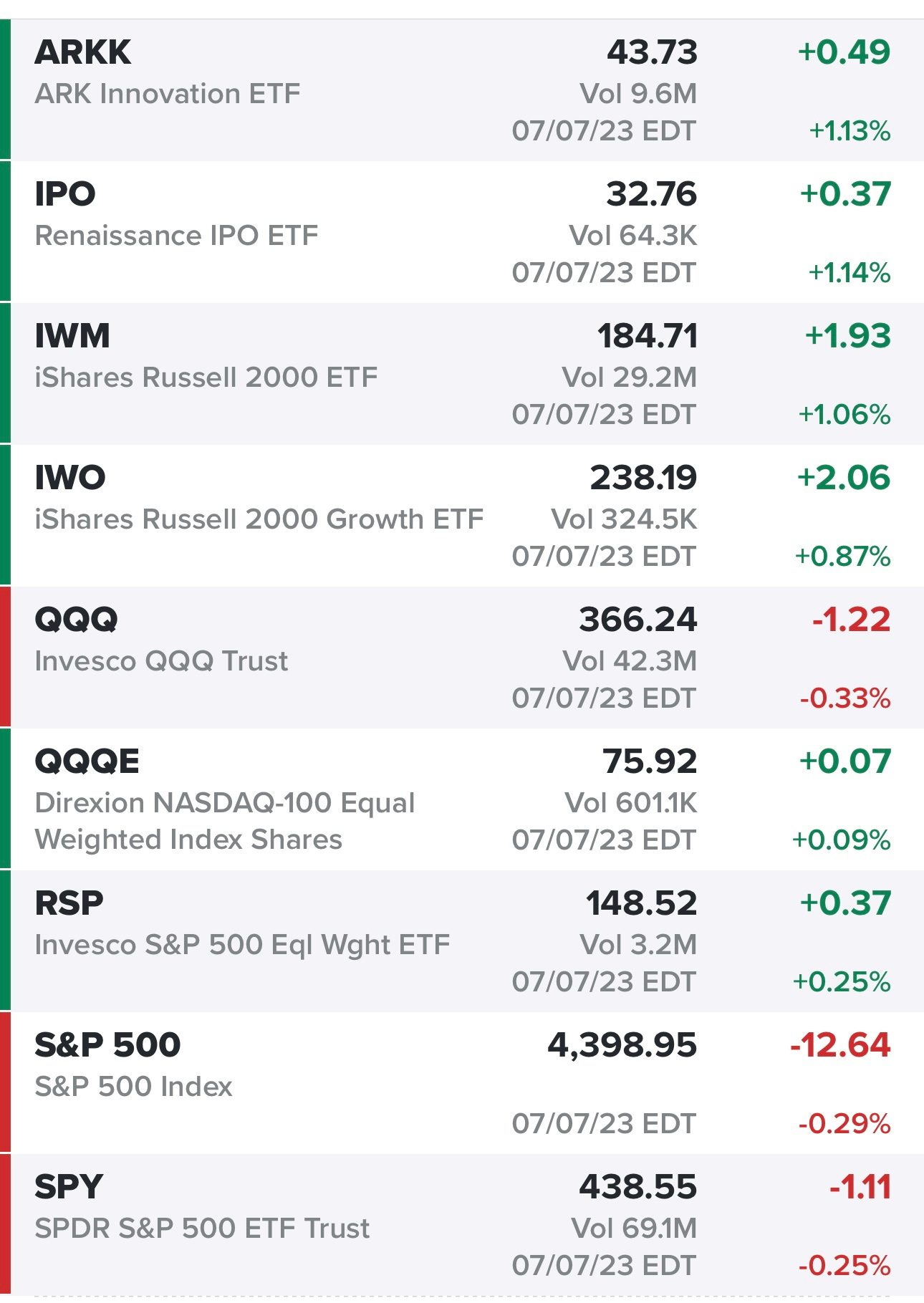

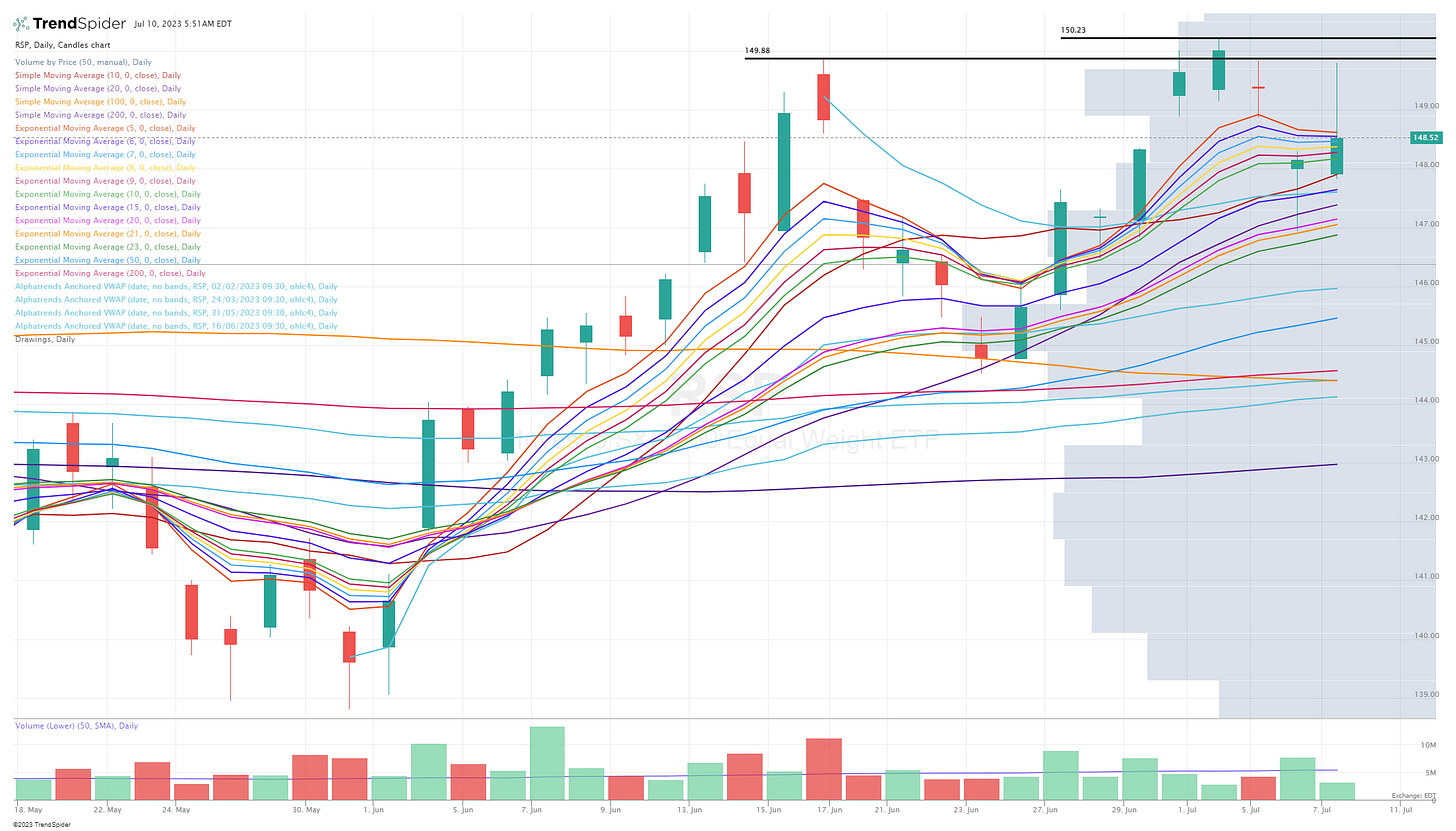

We’re coming off a mixed day for the markets with small/mid caps outperforming large caps the the equal-weighted S&P (RSP) and Nasdaq (QQQE) outperforming the market cap weighted S&P (SPY) and Nasdaq (QQQ).

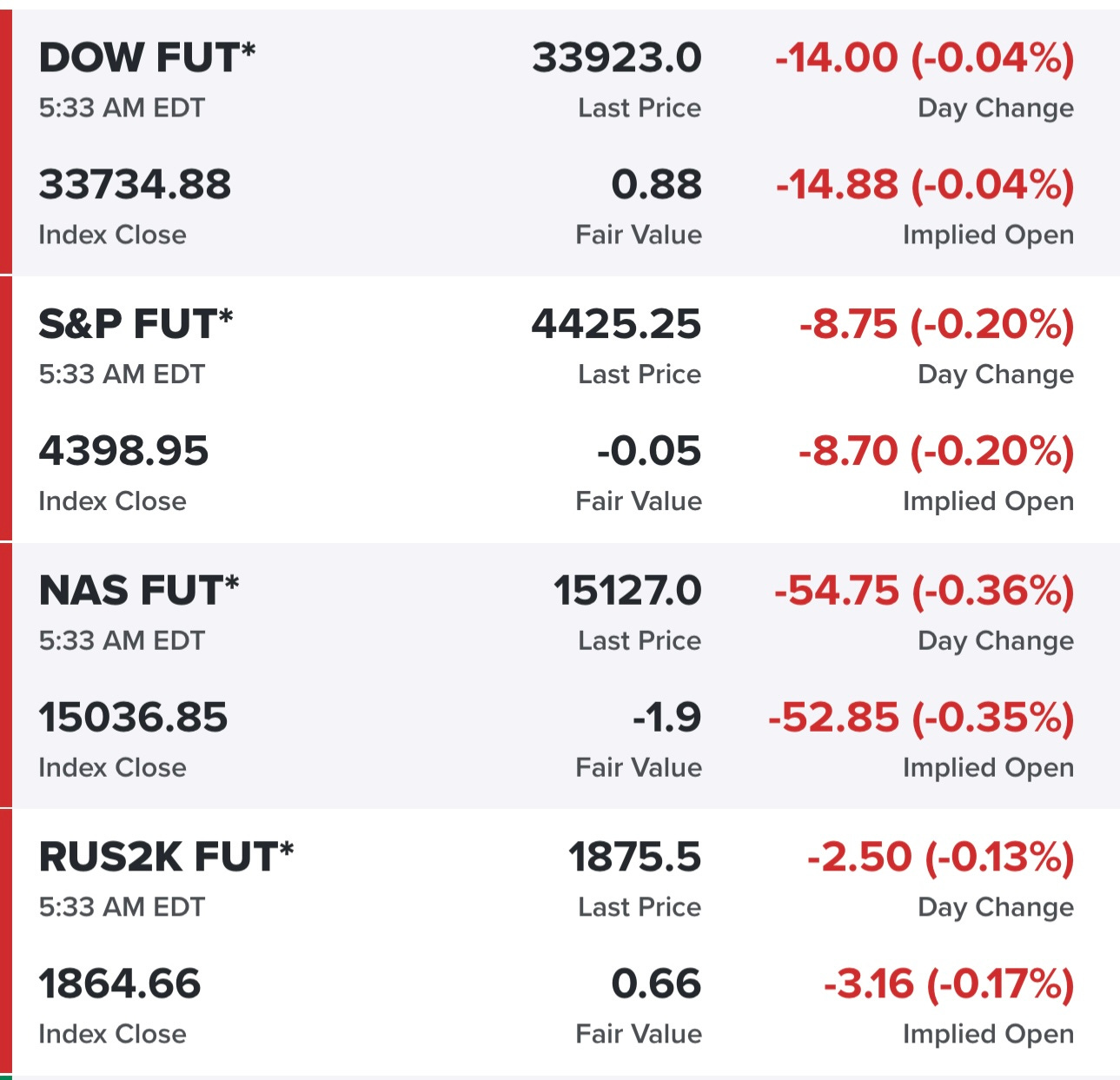

Equity futures mixed this morning…

Yields up again this morning, it will be a volatile week for them, if we get a cooler CPI on Wednesday we could see the 10Y back below 4%

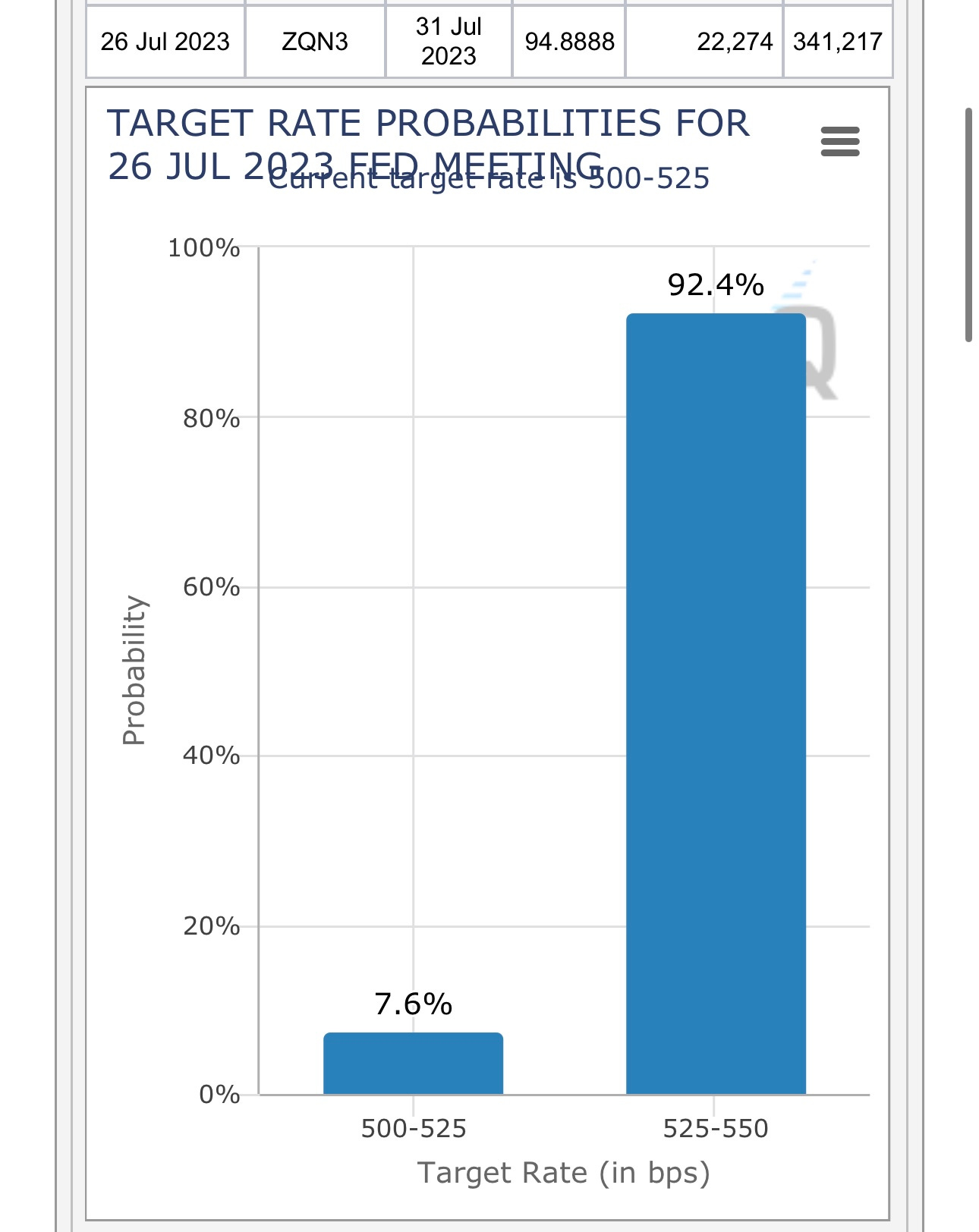

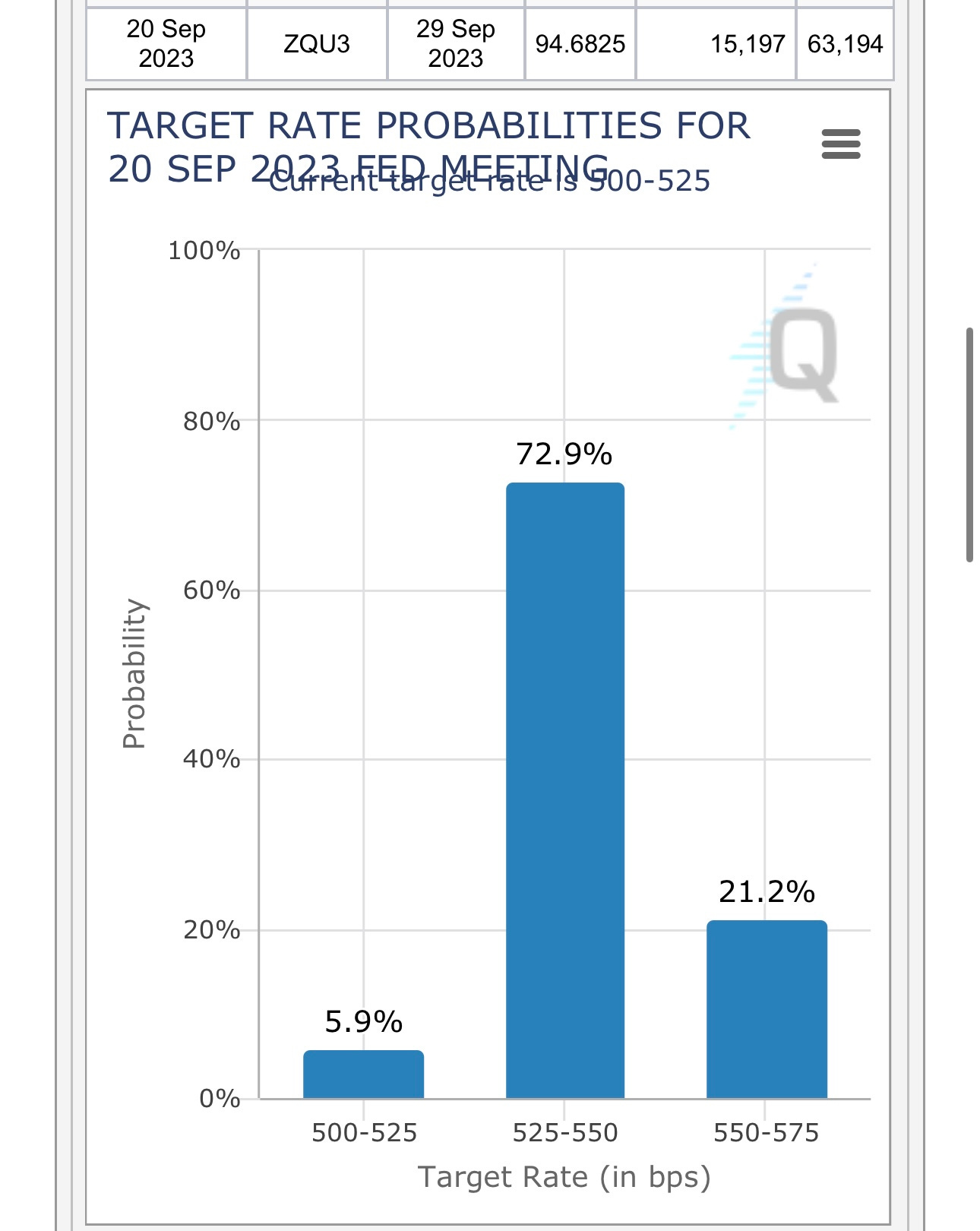

Markets expect a rate hike in 2 weeks at the next FOMC meeting but the probability of another hike at the September meeting is only 21%

SPY closing Friday just above the 10d sma with the 15d ema and 20d sma just below, SPY is trading just below 438 in the pre-market

RSP bouncing off the 10d sma on Friday although fading into the close

QQQ looking similar to SPY, closing near the lows of the day, just above the 10d sma

QQQE finished in the green but closed way off the lows of the day, closing just below the 10d sma and 20d sma.

IWM coming off a good day although it also faded into the close, that was after a big flush last Thursday as you can see from that candle. Still good to see IWM back above the 21/23d ema

IWO also with a decent day but closing in the bottom half of the day’s trading range, not sure why we faded on Friday but it could be profit taking into the week and nervousness with CPI this week.

ARKK candle looking similar to IWO, closed in the green but way off the highs of the day in the bottom half of daily trading range but back above 10/20d sma. ARKK is down slightly pre-market to 43.47 which would put it just below the 10/20d sma. If we get any sort of pullback today the bulls will be hoping for a bounce off the 20/21/23d ema, the 20d ema is approx 1.1% below Friday’s close.

Below the paywall is my current trading portfolio and watchlist with charts, entry points, stop losses, etc. (PS: my investment portfolio is different and only available to my Stocktwits subscribers and my Substack deep dive subscribers)