Trading the Charts for Monday, February 12th

In order to read this entire newsletter you’ll need to become a paid subscriber by clicking the button below. Paid subscribers get full access to my trading portfolio (up +10.1% in 2024, up +97.3% in 2023), daily watchlists with charts, daily activity with entry prices & stop losses, all trading stats with performance, and my daily webcasts.

Here’s my other Substack newsletter called Growth Stock Deep Dives where I provide weekly deep dives (8,000+ words) and weekly mini deep dives (2,000+ words), plus you get access to my investment portfolio (up +55% in 2024, up +134% in 2023, up +1,552% since January 2020), my daily activity, my daily webcasts, and my investment models.

Earnings reports for the week…

Macro reports for the week…

CPI spreadsheet…

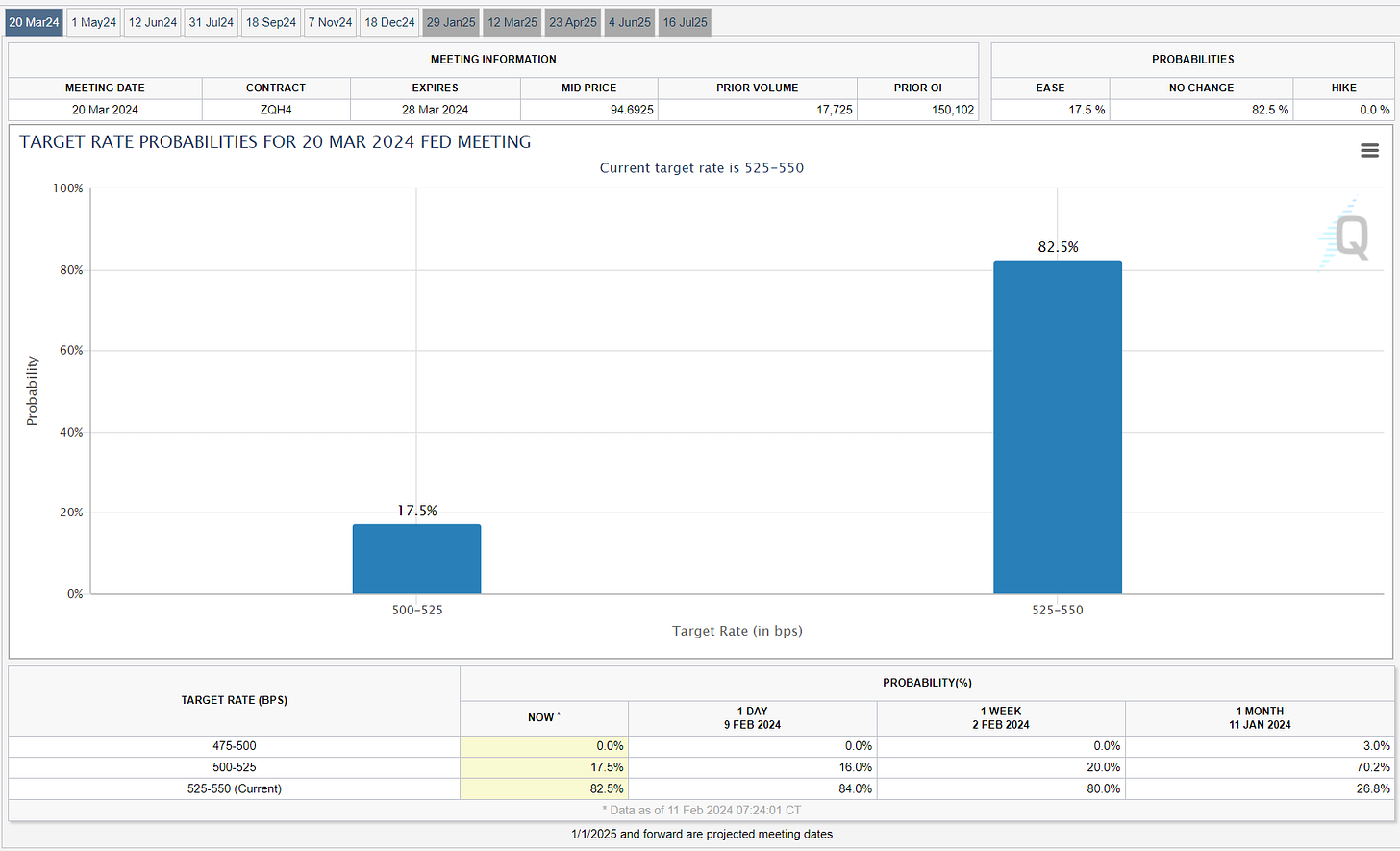

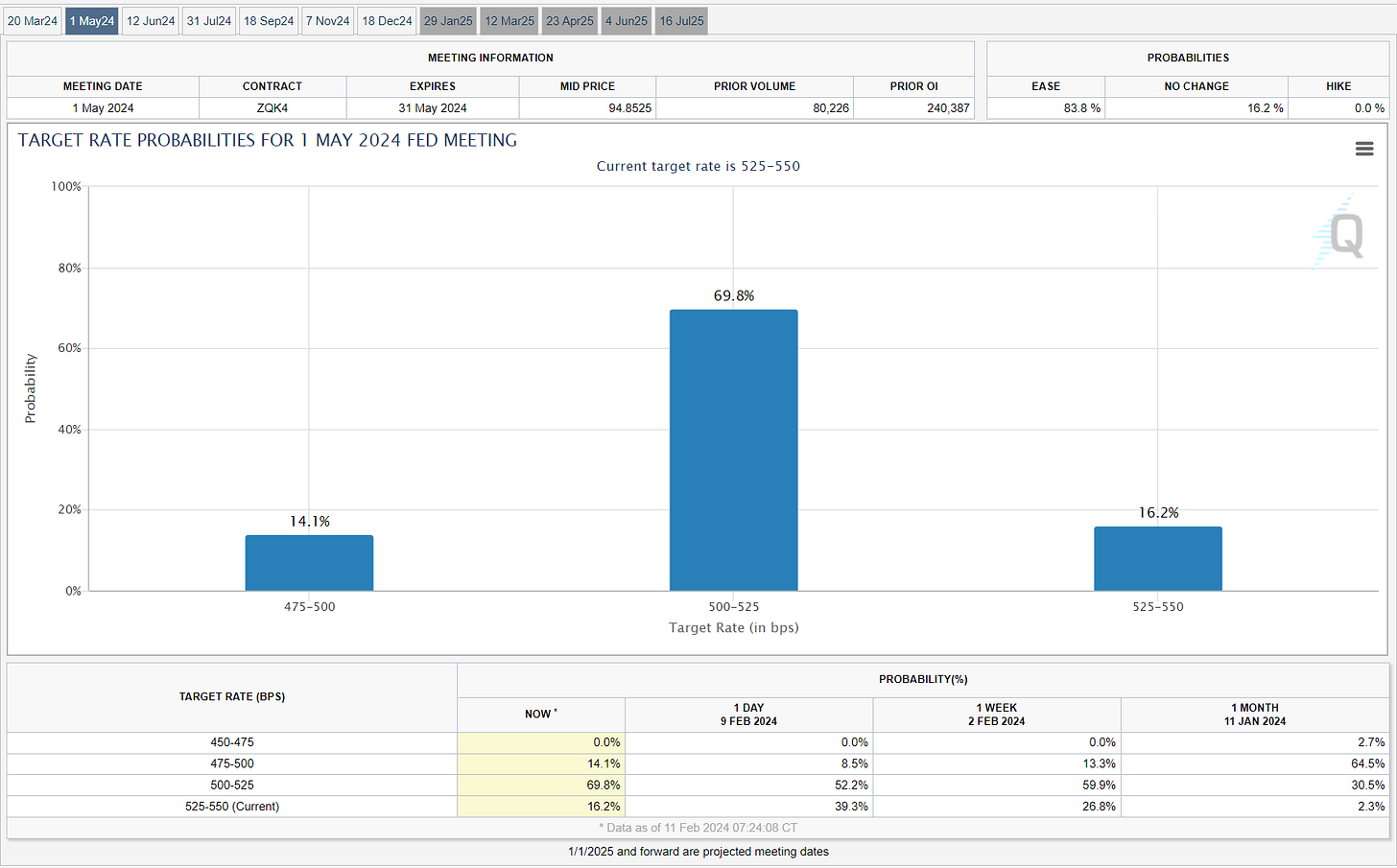

FOMC updates…

Indexes from yesterday…

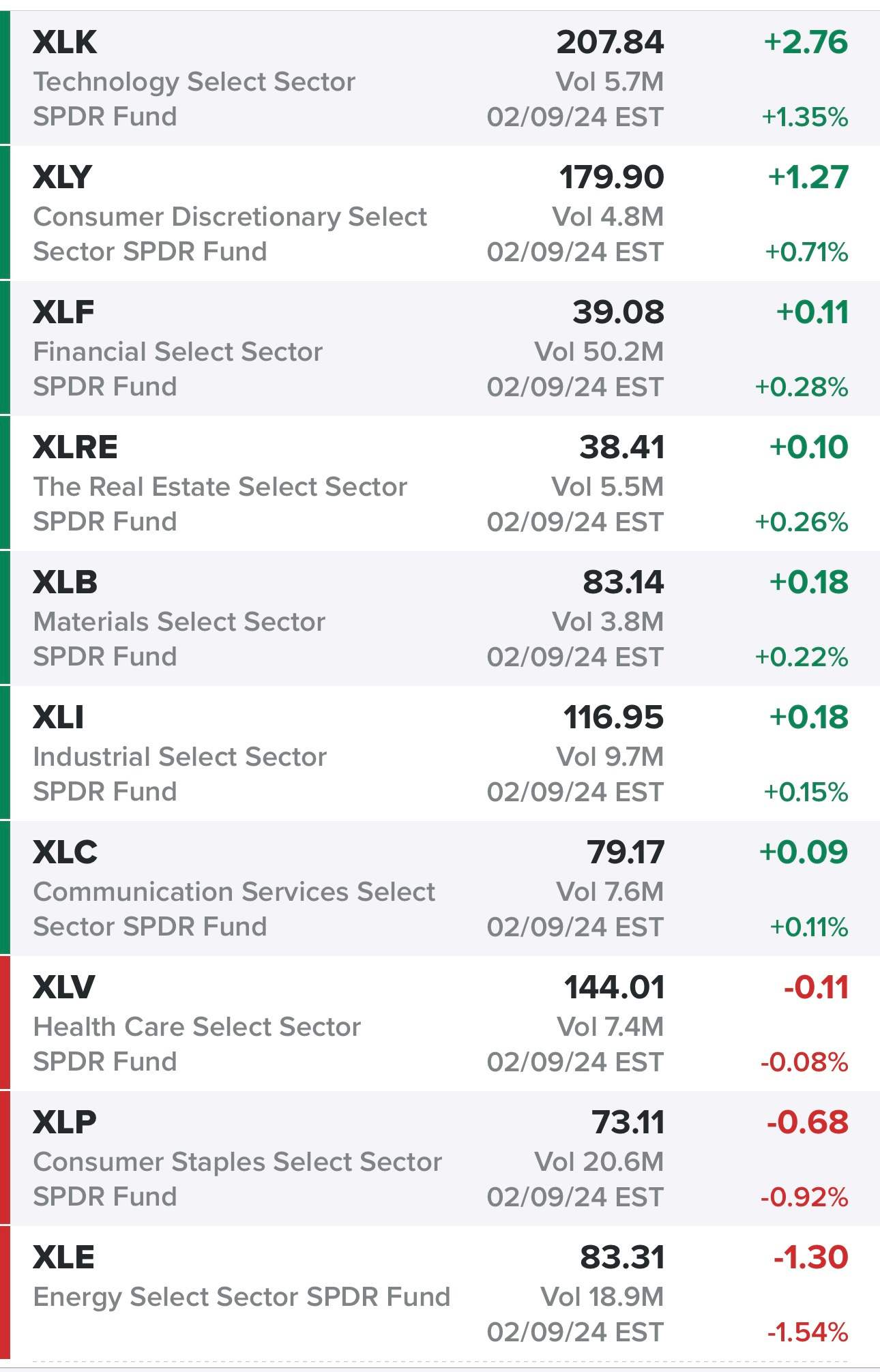

Sectors from yesterday…

New highs vs new lows…

Market momentum…

$TNX (10Y Treasury)

$VIX

$CL1! (Oil)

$SPX (S&P 500)

SPY (S&P 500, market cap weighted)

RSP (S&P 500, equal cap weighted)

QQQ (Nasdaq 100, market cap weighted)

QQQE (Nasdaq 100, equal cap weighted)

IWF (Russell 1000 Growth)

IWM (Russell 2000, small/mid caps)

IWO (Russell 2000 Growth, small/mid caps)

IWN (Russell 2000 Value, small/mid caps)

ARKK (Ark Innovation ETF)

IPO (Renaissance IPO ETF)

FFTY (IBD Innovator ETF)

Finviz screen #1: AFRM ALKS ANET ANF APAM APLS APO APP ARDX ASND ATEC AXNX AXSM BAC BIRK BK BNS BRK BRZE C CELH CFLT CLSK CNO COF COOP CP CRWD CYBR DASH DDOG DFS DKNG DV EDU ELF EMR EVH FLS FOLD FOUR FRO FROG FRPT FTAI GGAL GLBE GS GTLB HIMS HOOD IBN IMGN IMO INTA INTR IOT ITCI JPM KKR LAZ LLY LVS LYV MDB META MMYT MNDY NBIX NET NMR NOW NTRA NU NVDA NVO NXT OKTA ONON OSCR OTEX PANW PATH PCOR PGNY POST PR PSN PWR QRVO RBA RBLX ROIV RUM RY RYAAY RYN RYTM S SHAK SHOP SLM SMAR SMCI SMFG SNOW SNPS SOVO SPOT SPR SPT SRPT STNE SWAV SYF TAL TCOM TDW TMDX TREX TW TWST WAB WYNN XYL ZETA ZS

Criteria: stock price above $5, market cap above $2 billion, above 50d sma, above 200d sma, average daily volume above 500k, sales growth above 20%, earnings growth above 0%