Trading the Charts for Monday, August 7th

In order to read this entire newsletter which includes full access to my trading portfolio (up ~68% YTD), daily watchlist, daily activity (buys, sells, entry prices, stop losses, performance) and my daily webcasts you’ll need to become a paid subscriber by clicking the button below.

I also run a Stocktwits rooms where I post about my investment portfolio (up ~100% YTD and ~1,000% over the past 3-years) with full access to all holdings, performance, daily activity, market commentary, quarterly earnings analysis, daily webcasts and more.

Here are my deep dive newsletters…

Good morning and Happy Monday,

Last week was the first down week for the markets in 5+ weeks as the market tried to digest alot of earnings reports which overall have been better than expected by it’s valuations/multiples and the interest rate that are creating headwinds. We have a lot more earnings this week including dozens of popular growth stocks like CELH, PLTR, TWLO, SMCI, IONQ, RIVN, TTD, DIS, DDOG, SWAV, HIMS, BABA, PLUG, LCID and many more.

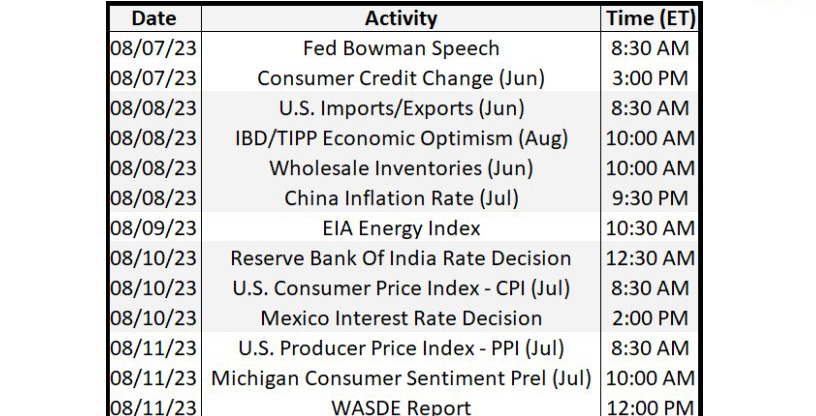

We get a few macro reports this week but nothing major, the one I’ll be watching closest is PPI

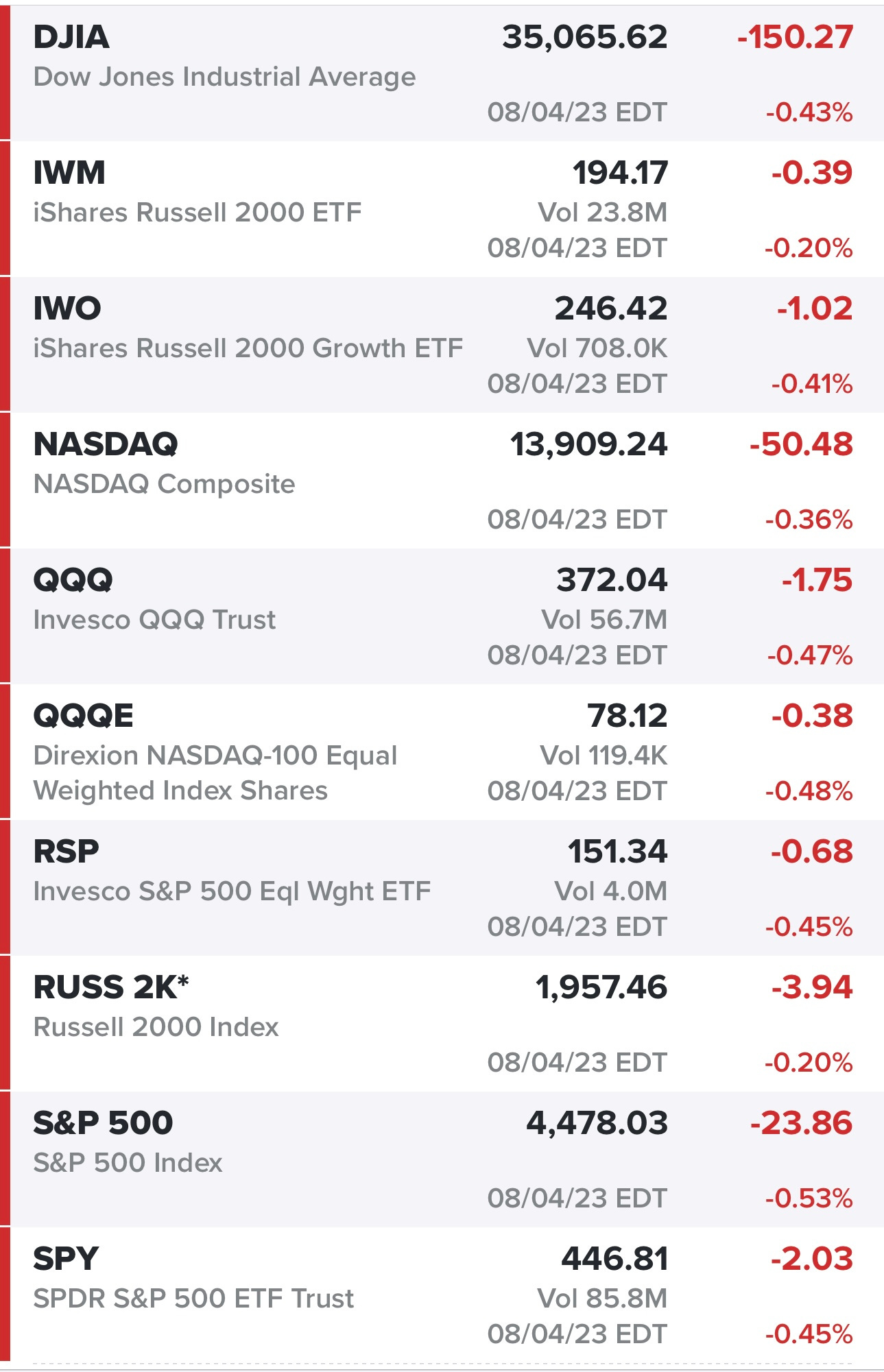

Lots of red on Friday, the indexes did bounce off the lows but faded in the afternoon…

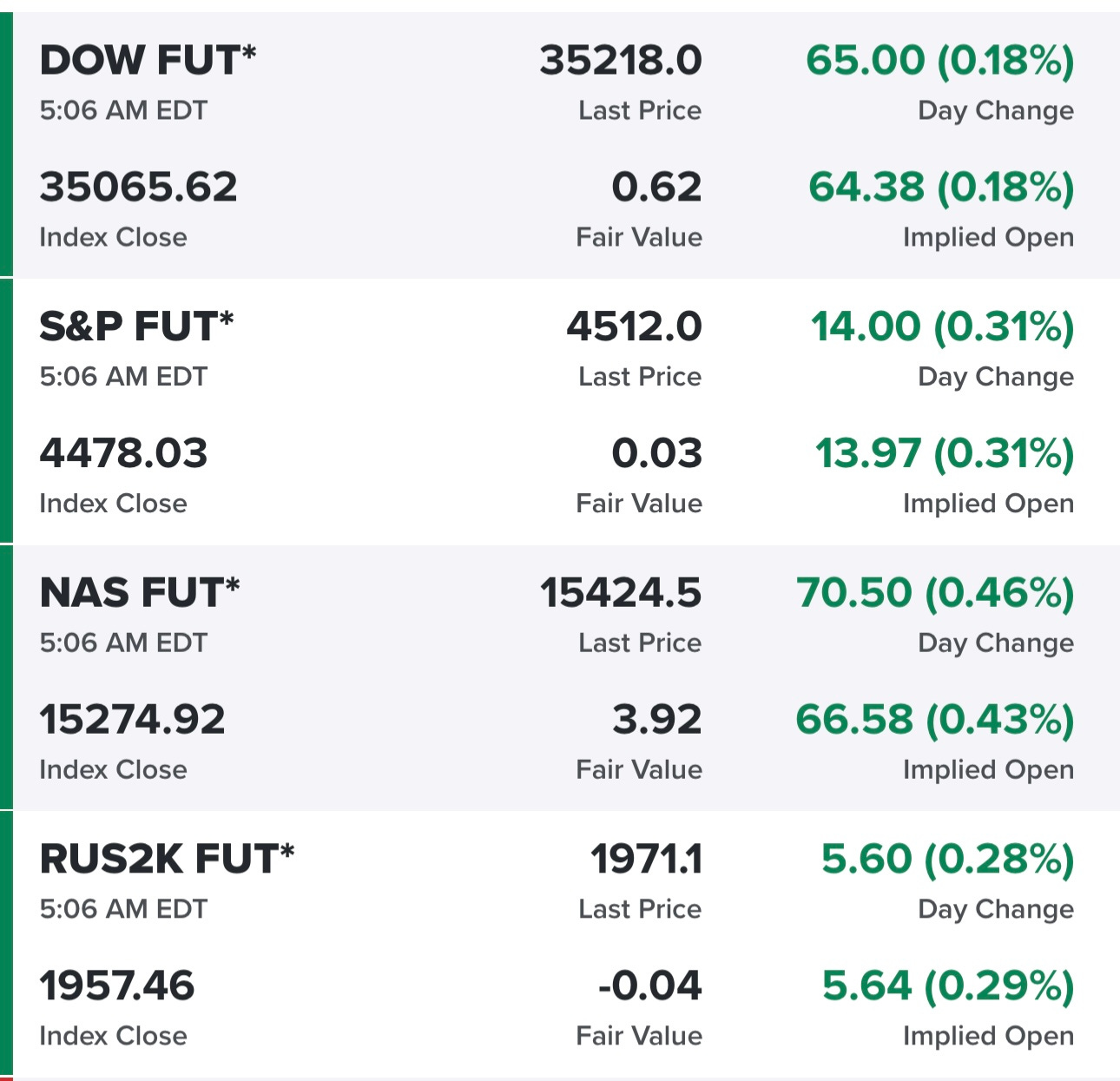

Futures in the green this morning…

Yields up slightly today and the 10Y is still above 4% but off the high from last week when they touched 4.2%

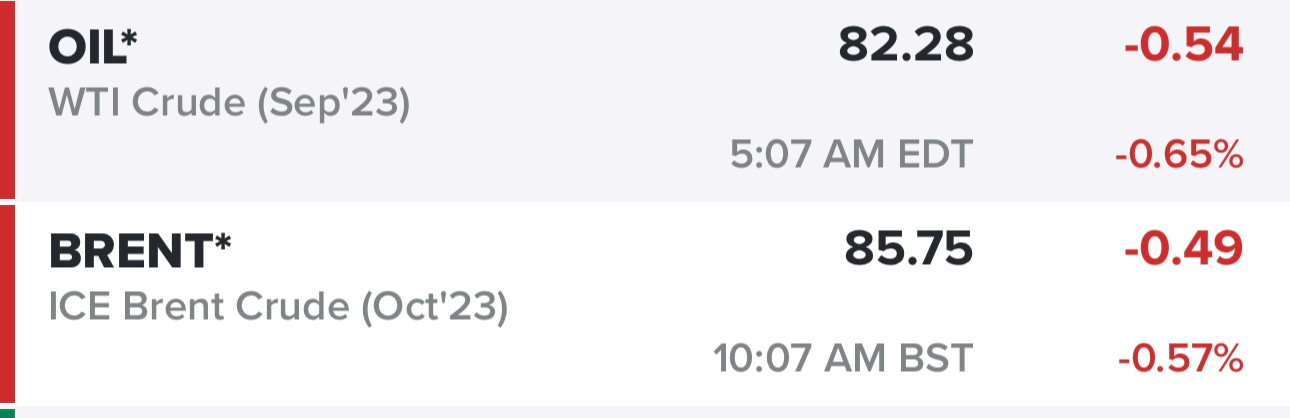

Oil with a small pullback this morning…

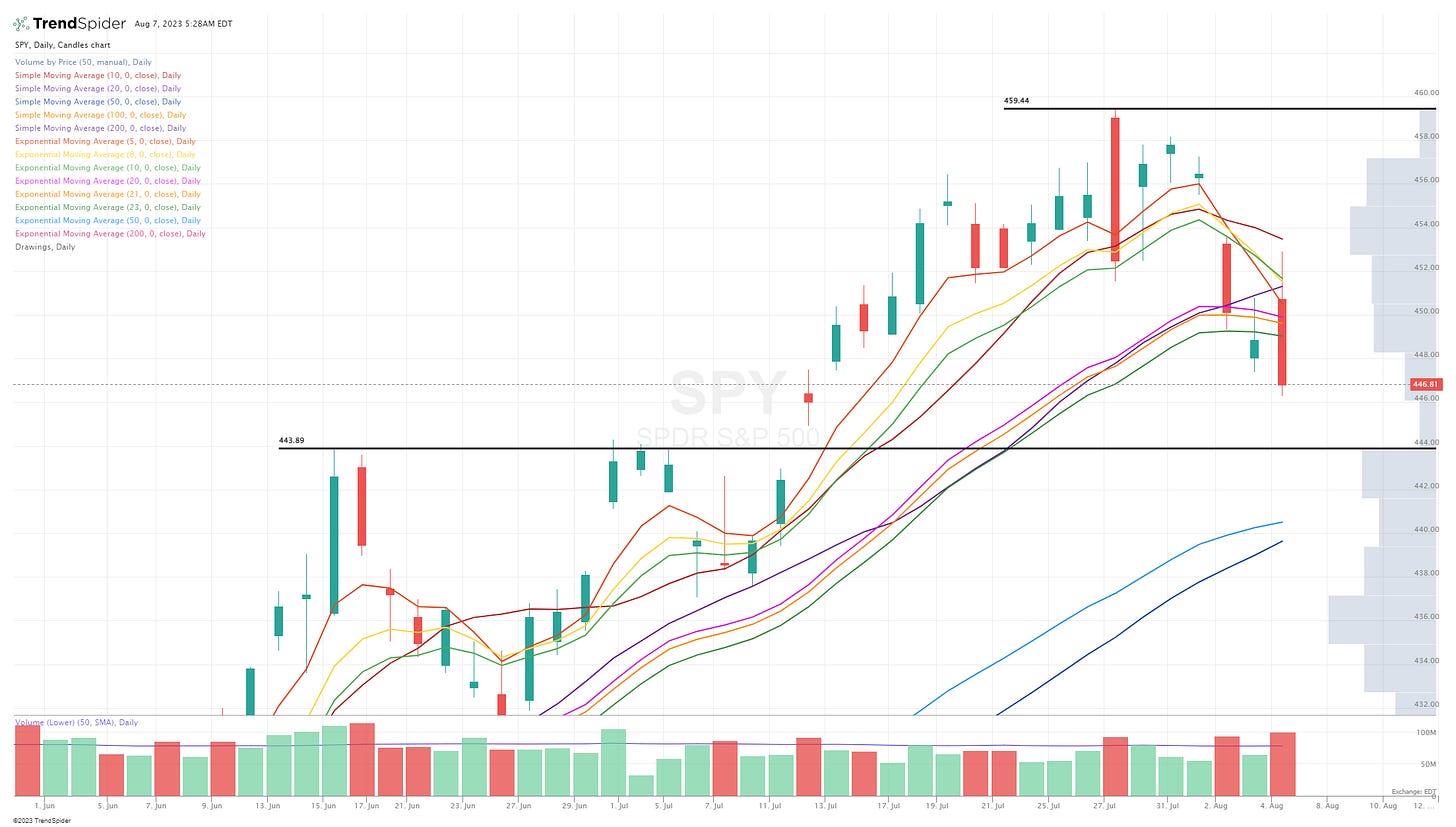

SPY not looking good, next obvious area of support to the downside would be 443.90 with an unfilled gap just below 445.00

RSP also looking ugly, next area of support to the downside would be 150.27

QQQ trying to find support at the 317.96 pivot

QQQE with a perfect bounce off the 77.94 pivot, I regret not buying some calls on Friday when it bounced off that support

IWM finding support at the 20d ema on Friday

IWO slicing through the 21/23d on Friday and taking out Thursday’s low, still have an unfilled gap down to 245.15

ARKK trying to hang onto the 45.44 pivot with the 50d ema/sma just below, lots of support in the 44.80 to 45.40 range

Below the paywall is my current trading portfolio including all positions (open & closed), watchlists, entry prices, stop losses and YTD performance and my daily webcasts.