Trading the Charts for Friday, May 26th

In addition to my “Trading the Charts” newsletter, below are a few more newsletters that I publish plus my Investing with the Whales podcast, my Stocktwits room, my Seeking Alpha investment service and my new Twitter Spaces coming soon.

I also run a Stocktwits room where I’m very active throughout the day and post about both of my portfolios with 100% transparency. FWIW, I’m up ~58.5% YTD thanks to huge gains with CELH, LNTH, UBER, MELI, SDGR, ONON, TSLA, GLBE, SWAV, XPOF, NU, FLNC, and several others. You can join by clicking the button below:

Good morning and Happy Friday,

Some of the inflation data (PCE) was a little warmer than expected this morning but inflation is now under 3% according to Truflation which looks at way more data than CPI so I think Truflation is probably more accurate. For the past 6+ months I’ve been saying that we’d see inflation under 3% by end of summer so maybe we are already there.

Yields flat this morning but sitting at a 2-month high…

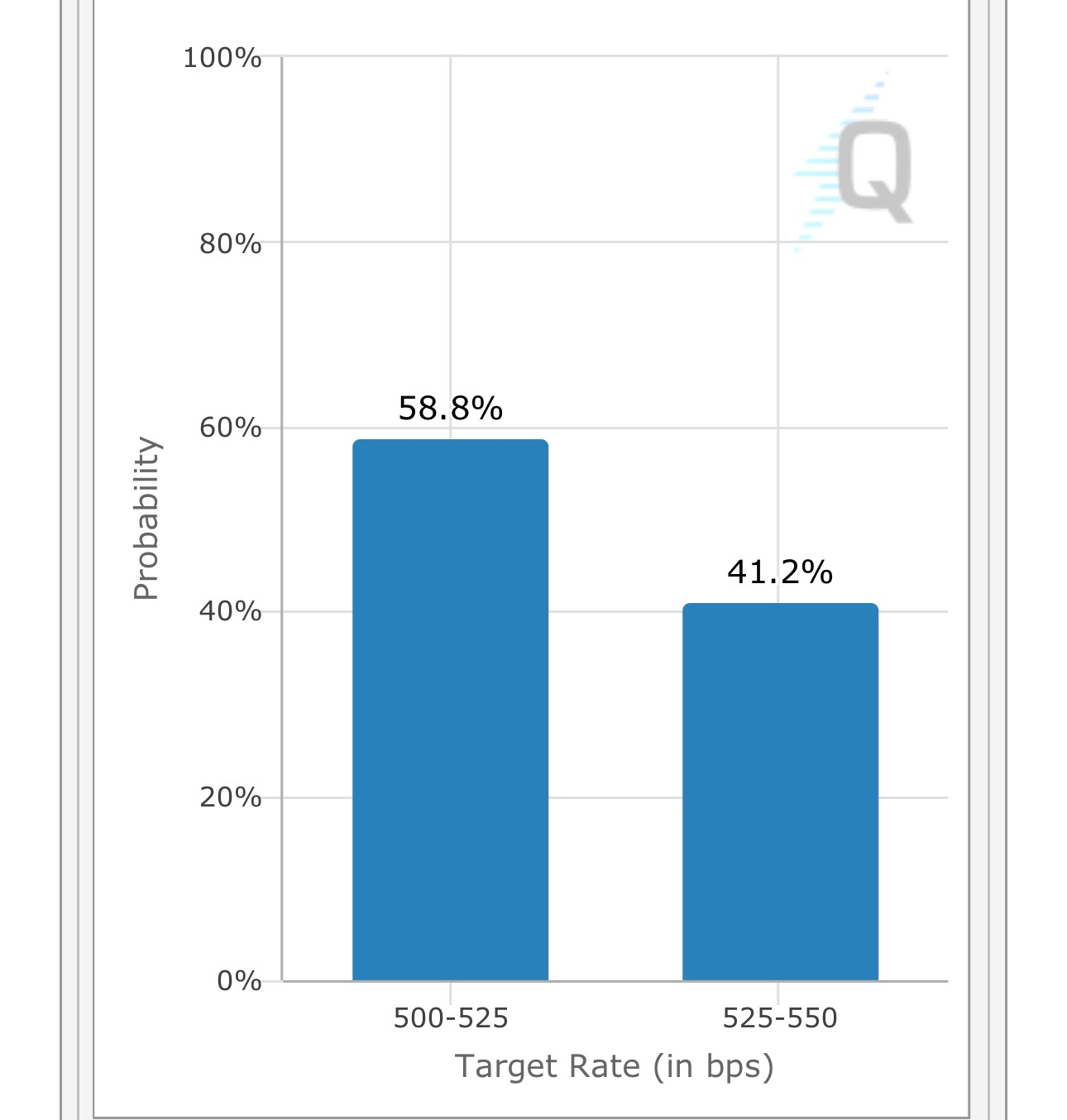

At one point yesterday there was a 50/50 chance we’d get another rate hike at the next FOMC meeting, I have a feeling those chances are going up today after the PCE report but we still get the jobs report next Friday and then CPI the following week…

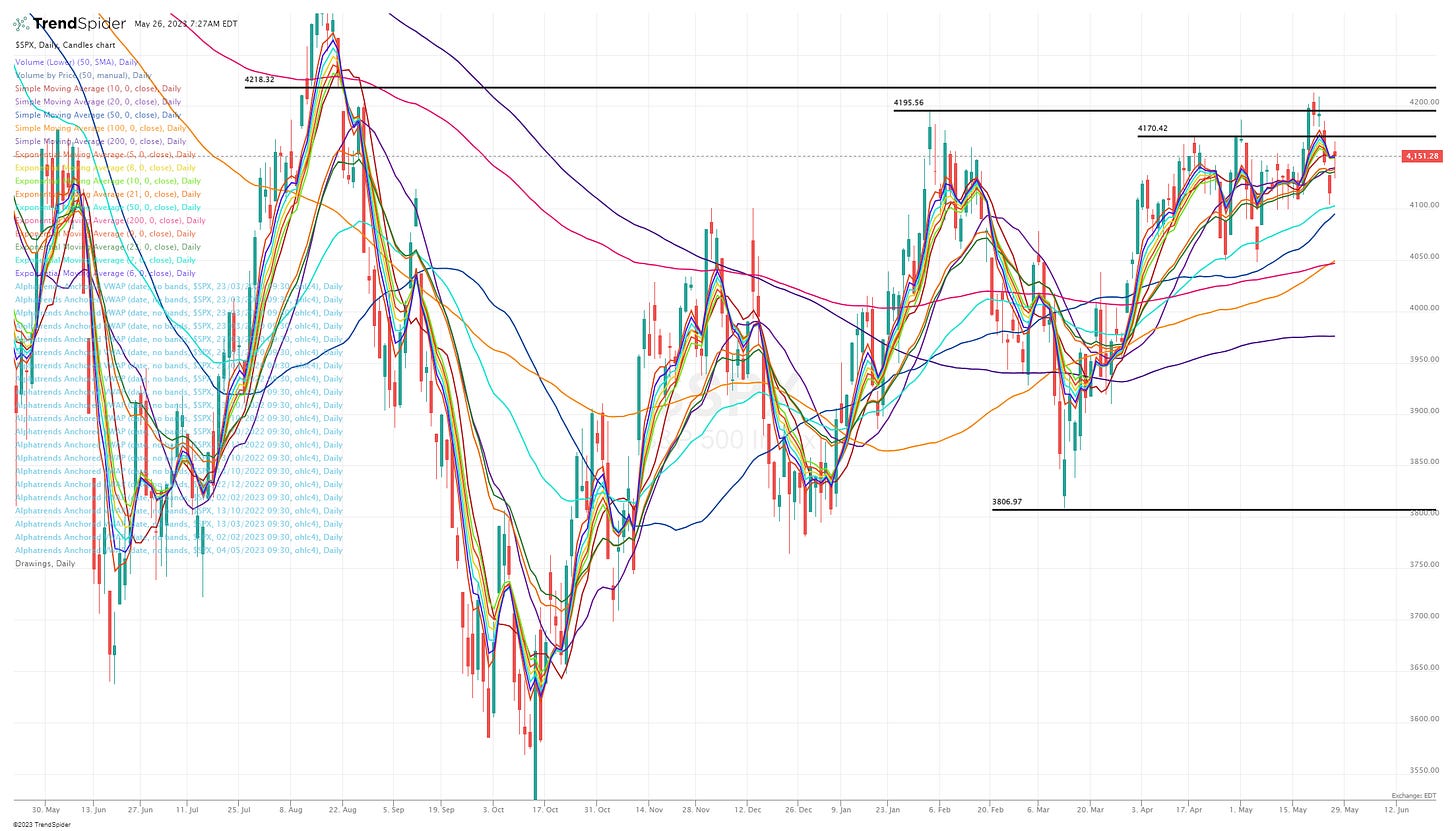

SPX trying to hang onto 4150, I’m still net-bullish on the markets as long as SPX stays above the 50d ema/sma which we tested a couple days ago and then got bailed out by NVDA earnings.

RSP (equal weighted S&P) looks pretty ugly although nice bounce off the lows yesterday, this just shows the average stock is not doing nearly as well as the 10 largest companies in SPX/SPY.

QQQ had another great day, thanks to NVDA, closing at another 52-week high. Just hard to believe these megacap tech stocks can keep rallying without the rest of the market.

QQQE (equal weighted Nasdaq/QQQ) bouncing off the 21/23d ema yesterday and closing above the 10d ema but still underperforming the QQQ. I think you can own tech stocks as long as QQQE stays above the 50d ema/sma.

IWM looking ugly after that rejection at the 200d sma on Tuesday, I’m net-bearish on small/mid caps unless IWM can reclaim the 50d ema and then the 200d sma. I’ll keep my IWM short position (hedge) until both are accomplished.

IWO also looking bad but better than IWM, at least IWO is sitting on the 200d sma after being unable to hold the 200d ema earlier in the week. I’ll short IWO if it can’t hold the 50d sma where it bounced yesterday.

ARKK with another nasty candle yesterday although did find support at the 50d ema and closed right on the 200d sma. I still have an ARKK short position which I’ll keep as long as ARKK is below the VWAP from February highs. I’ll increase that short (hedge) if ARKK loses the 200d sma and then another increase if we close below the 50d ema.

IPO looking very ugly after being rejected at the 200d ema earlier this week (down 6% since), although did bounce at the 200d sma. I’ll probably short IPO if it fails to hold the 200d sma (15-20% as a hedge) and then will cover my short once it reclaims the 200d sma or just gets too oversold and is due for a reversal in which case I’d want to cover to lock in my gains.

Below the paywall is my current trading portfolio (with positions, sizes, entry price, stop loss, etc), current watchlist and links to my daily Zoom webcasts.