Trading the Charts for Friday, June 9th

Here are my other newsletters…

I also run a Stocktwits room where I’m very active throughout the day and post about both of my portfolios with 100% transparency.

FWIW, I’m up 70% YTD thanks to huge gains with CELH, LNTH, UBER, MELI, SDGR, ONON, TSLA, GLBE, SWAV, XPOF, NU, FLNC, CFLT, DOCN and several others. You can join by clicking the button below:

Good morning and Happy Friday,

Trading portfolio stats for 2023 which I also posted on Twitter this morning:

total trades (including open positions): 504

win rate: 34%

average winner: +7.74%

average loser: -2.07%

YTD performance: +46.4%

I'm definitely a high volume swing trader. I'd rather have 15-25 positions at 5-10% each rather than 5-6 positions at 10-30% each. There's a million ways to trade stocks, the key is finding what works best for you and then sticking to it. Don't get FOMO and ignore 99% of the noise on Twitter and CNBC. Focus on price, volume, trends and risk management.

I probably do not need any new positions with CPI and FOMC next week so I’m not planning to do anything today in my trading portfolio other than raise my stop losses and look to take some profits which means selling several positions and trimming others. I’m currently at 145% exposure and I want to be under 100% going into CPI next Tuesday morning which means I have some work to do to reduce my equity exposure. The other option would be adding hedges ie buying puts or shorting the indexes. Since I’m currently 1450% long I’d get 30-50% hedged with SQQQ, SPXU and/or TZA which are the 3x leveraged inverse index ETFs. If we don’t get a pullback in the next couple days and my positions are still working for me than I’m more likely to add hedges rather than force myself into selling winners.

SPX still flirting with 4300, technically we’re now in a bull market because we’re officially 20% off the October lows :)

RSP still looking good, signs that breath is widening out beyond the top 10 megacaps. No reason to be bearish yet.

QQQ with a nice consolidation/pullback into the 10d ema then bouncing. As long as the QQQ’s stay above the 10d ema than you should be long tech/growth.

QQQE also with a nice week of consolidation/pullback into the moving averages and bouncing off the high from last summer. As long as QQQE stays above 73.87 you should remain long growth/tech.

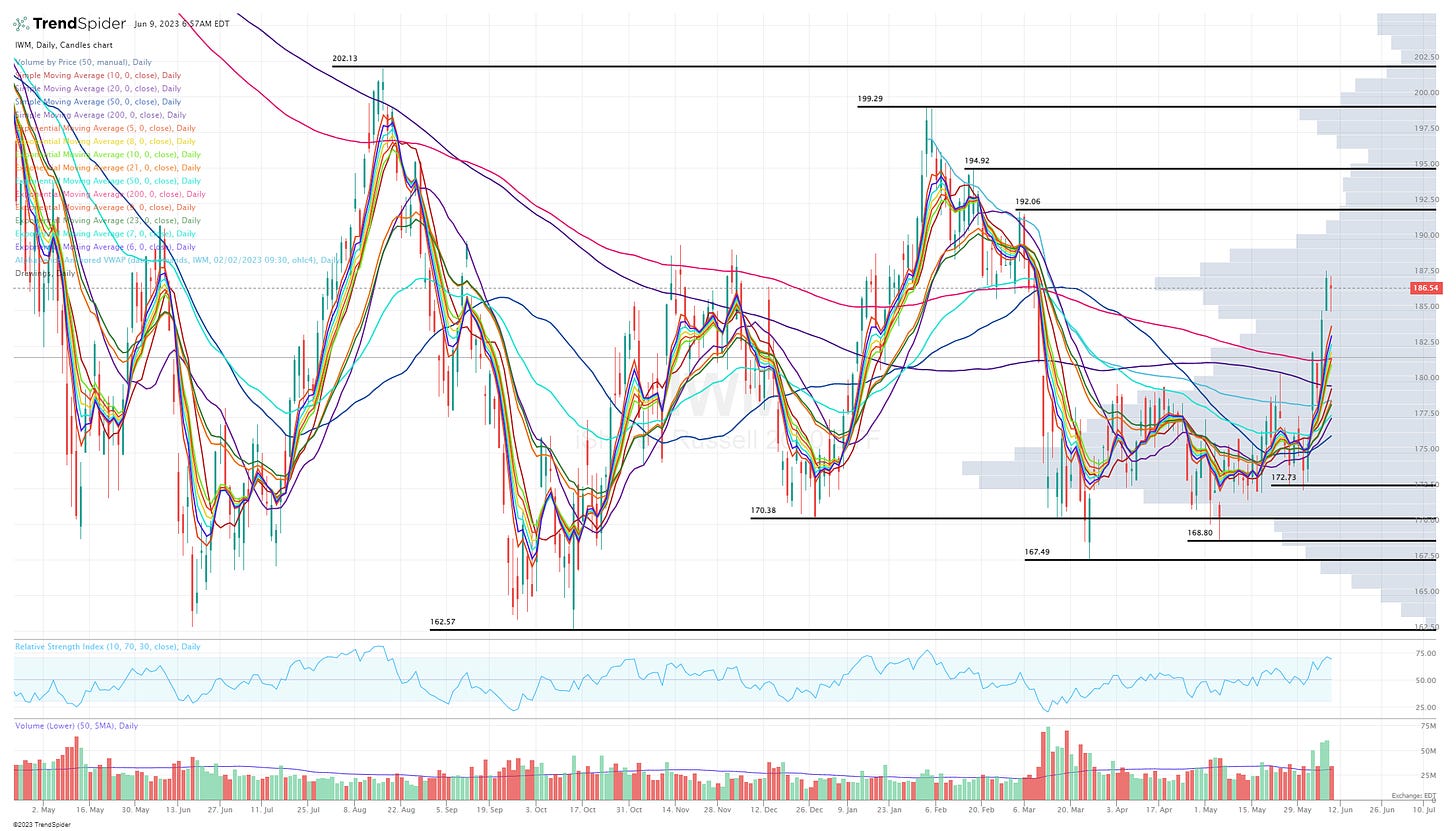

IWM coming off a strange day but nice bounce off the morning lows, let’s see if we can take out Wednesday’s high.

IWO price action the past two days looking similar to IWM, unable to hold the lows from Wednesday but bouncing nicely from the morning selloff.

ARKK with a solid bounce off the 200d ema yesterday, I was prepared to increase my ARKK short if she couldn’t hold the 200d ema. Right now I’m looking to see if ARKK can finish press through 43.77 where she got rejected on Wednesday. I still have my 15% ARKK short but it’s mostly just a hedge in my investment portfolio to help protect my insane YTD gains.

Below the paywall is my current trading portfolio and watchlist with charts, entry points, stop losses, etc. (PS: my investment portfolio is different and only available to my Stocktwits subscribers and my Substack deep dive subscribers)

Please note that I have changed the links/URLs for my webcasts as well as my portfolio spreadsheet — I have to do this at the beginning of every month so former subscribers no longer have access to the content that is exclusive for paid subscribers.