Trading the Charts for Friday, August 18th

In order to read this entire newsletter you’ll need to become a paid subscriber by clicking the button below. Paid subscribers get full access to my trading portfolio (up ~61% YTD), daily watchlists, daily activity (buys, sells, entry prices, stop losses, performance), daily webcasts/recordings and my options portfolio.

I also run a Stocktwits rooms where I post about my investment portfolio (up ~90% YTD)with full access to all holdings, performance, daily activity, market commentary, quarterly earnings analysis, daily webcasts and more.

Here are my deep dive newsletters…

Good morning and Happy Friday,

It’s been a tough month so far, feels like many stocks are in oversold territory with lots of RSI’s under 30 but they can stay that way for a while. We’re beginning to see some of the strongest names in the market start to roll over ie ELF which isn’t a great sign or it means we’re getting close to the bottom in this pullback. SPY and QQQ are only down an average of ~7% from the highs but plenty of stocks have pulled back 20-30% over the past 4-6 weeks and now IWM has given back most of it’s 2023 gains and ARKK is down 21.5% from the July high. Without a doubt the stocks that were up the most coming into the “dog days of summer” are the ones that have seen the most violent corrections with many of those names down 30-50% from their July/August highs.

As earnings season comes to an end the focus turns to macro, FOMC, yields, China, valuations and now we start to look ahead to 2024 estimates. PANW reports after the close today which is kind of strange for a large tech company, hopefully they surprise to the upside which could give the Nasdaq a lift next week.

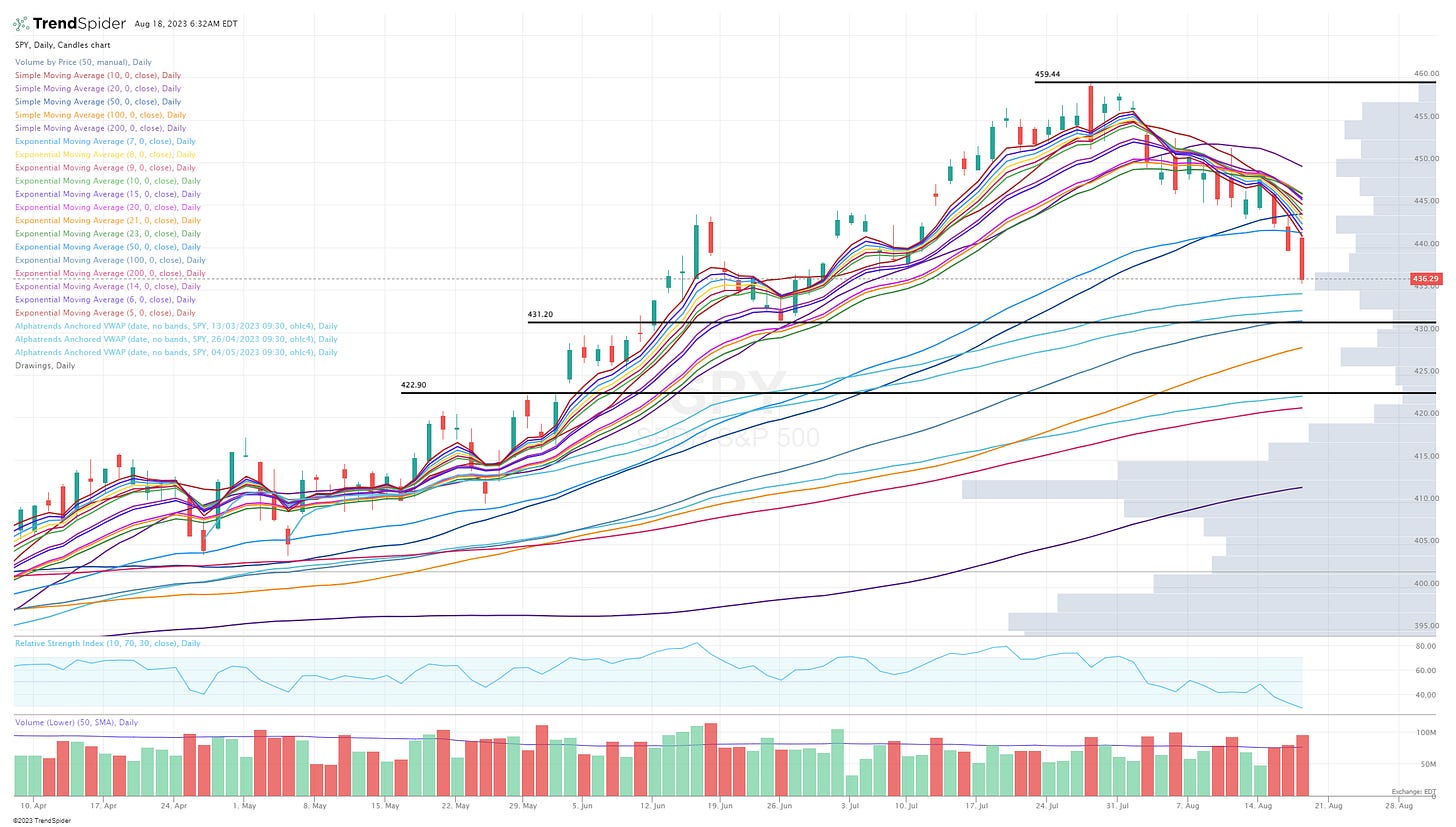

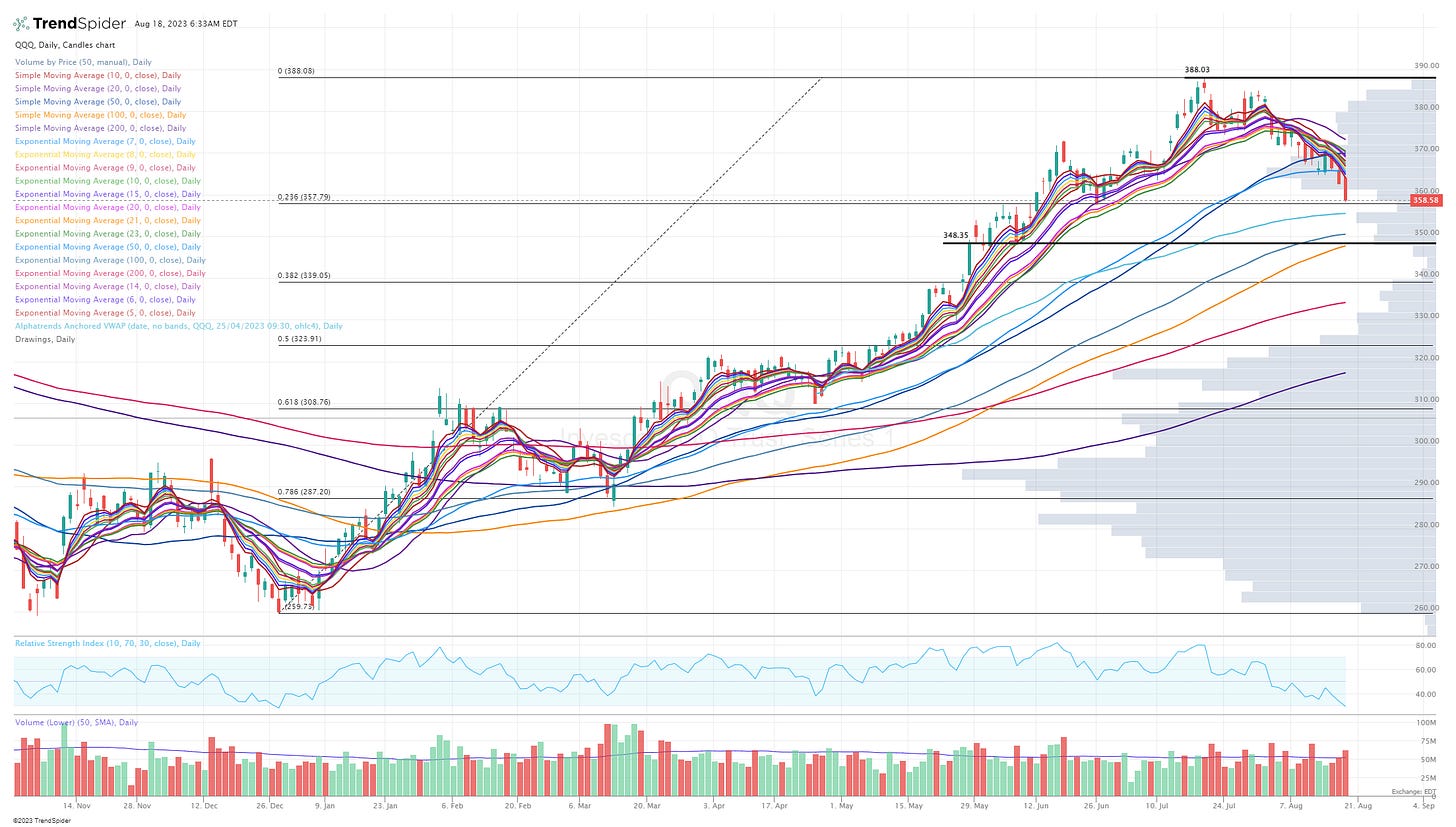

If you look at SPY and QQQ on the weekly charts you’ll see that both of them are trying to hang onto their 15w ema; I think today’s close is important but we also have to keep in mind it’s August and volumes are light especially on a Friday so maybe none of this recent price action matters until we get through Labor Day when the big boys/girls are back at their desks.

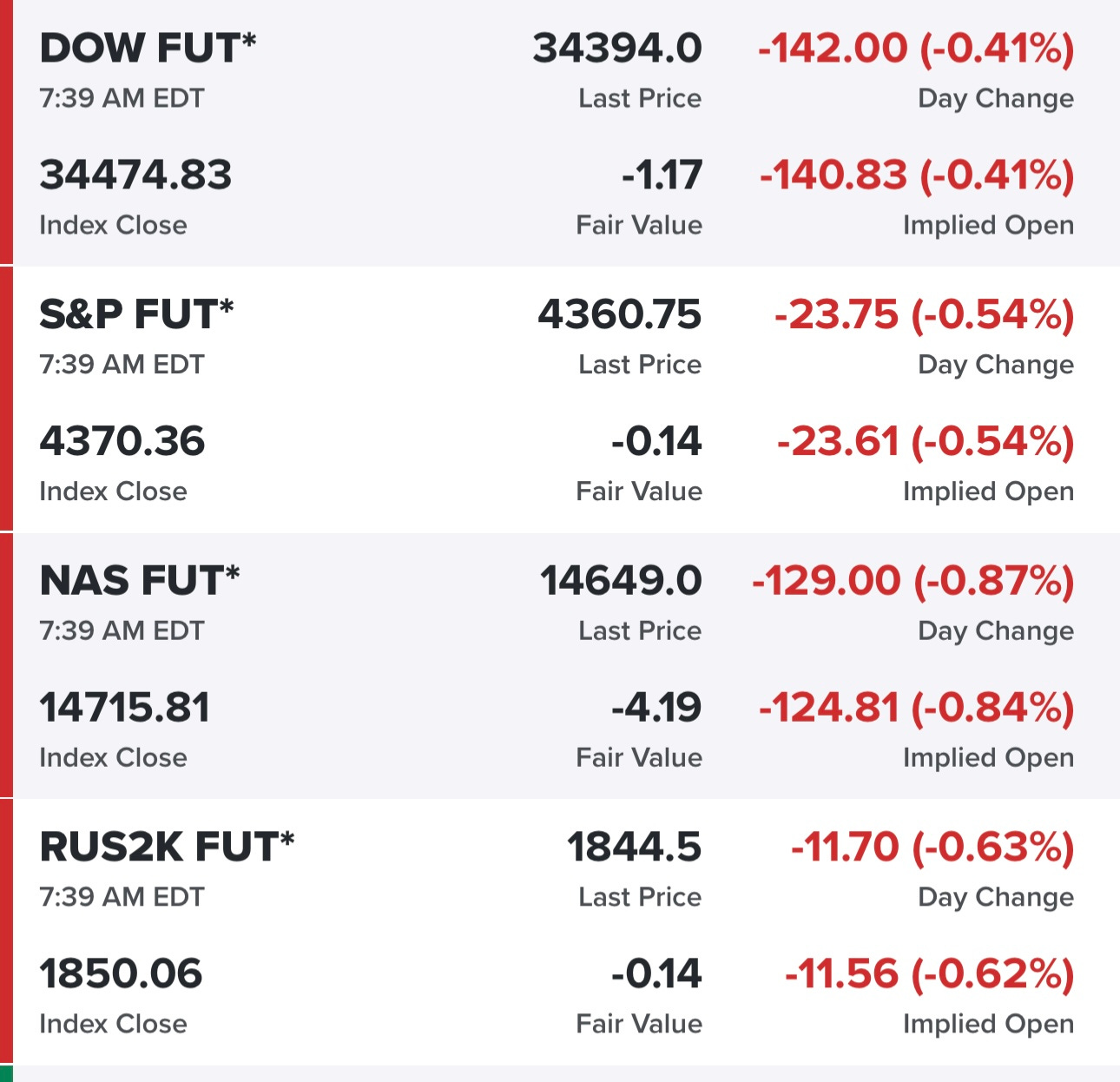

Futures in the red again this morning, we’re overdue for a bounce soon…

Yields pulling back this morning so it’s possible this could lead to a bounce in stocks after the open but 4.2% is still a headwind for growth, tech, small/mid caps…

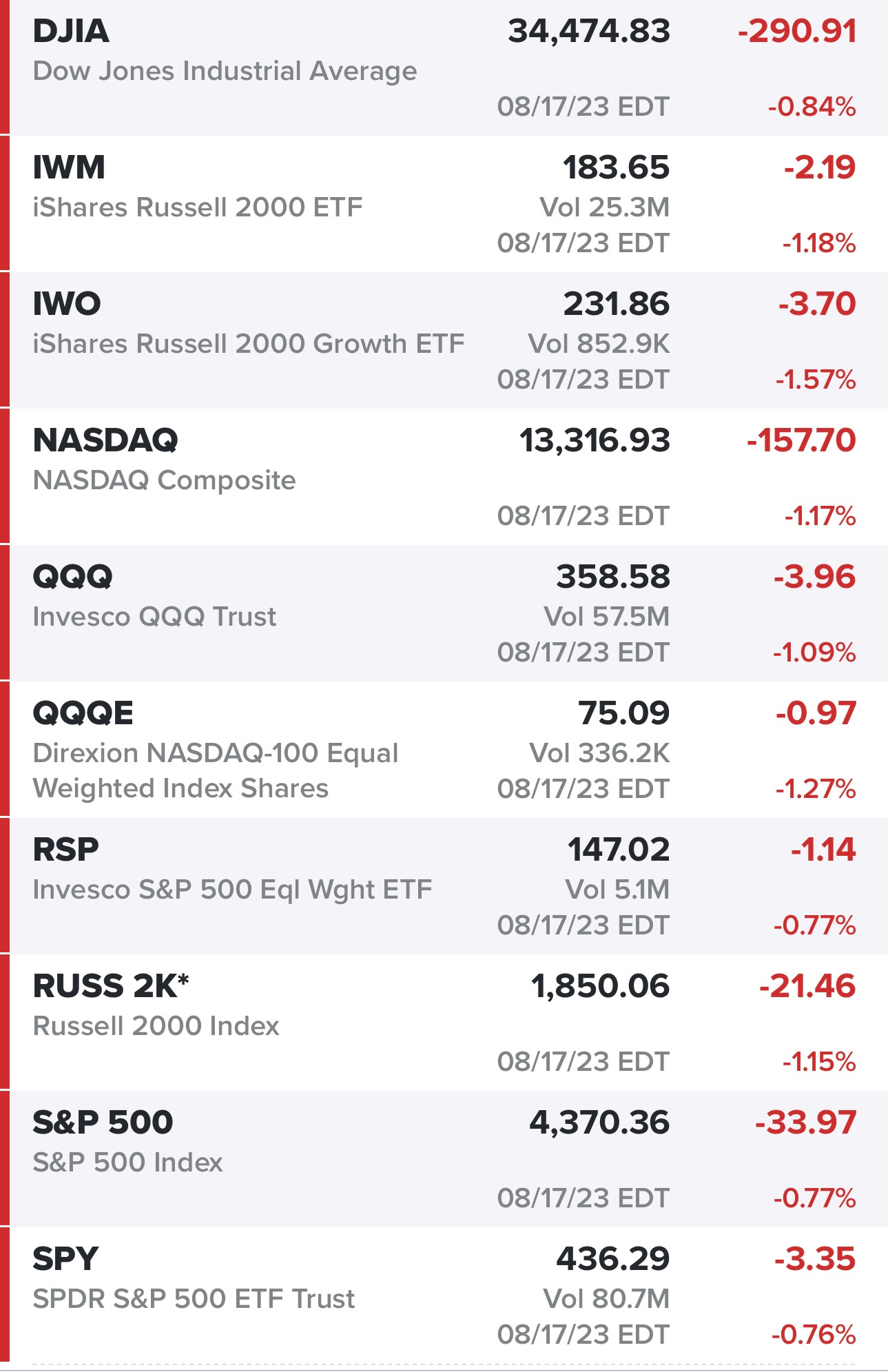

Indexes coming off another down day, Dow was up 100+ points in the morning but did another reversal with small/mid caps having the worst day…

Energy was the only sector in the green yesterday…

SPY is sitting on the 15w ema but hard to see where it finds support on the daily chart, we’re approaching the VWAPs from April lows with possible support at 431.20

QQQ sitting right on the .236 fibs line from the December lows to recent high, if we don’t bounce there then the VWAP from April low might provide support otherwise we could be destined for the 100d ema/sma at ~350.00

IWM in free fall mode, slicing through the 200d ema yesterday, looks destined to test the 200d sma at ~182.50 with the 100d sma and VWAP from March lows just below.

ARKK looking similar to IWM, now down -21.6% from the July high and trying to bounce off the .50 fibs retracement from December low to July high, if we don’t bounce there (and looks like we won’t) then the VWAP from December low or 200d sma could provide support.

Below the paywall is my current trading portfolio including all positions (open & closed), watchlists, entry prices, stop losses and YTD performance and my daily webcasts.