Trading the Charts for Friday, April 28th

In addition to my “Trading the Charts” newsletter, here are some other newsletters that I publish plus my Investing with the Whales podcast, my Stocktwits room and my Seeking Alpha investment service which is all of my newsletters/services under one roof.

I also run a Stocktwits room where I’m very active throughout the day, you can join by clicking on the buttons below:

Good morning and Happy Friday,

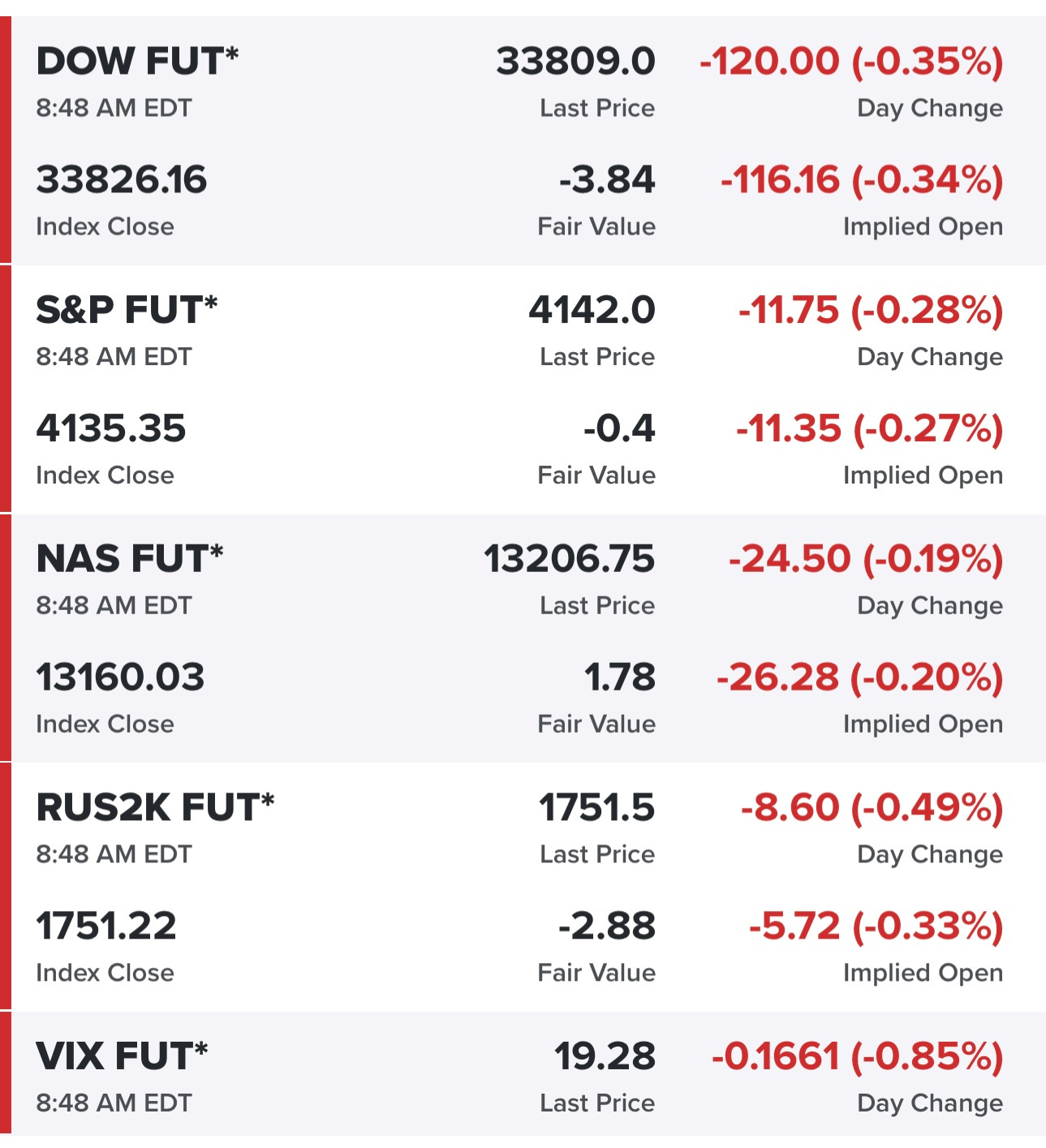

Yesterday was a very strong day in the markets with the indexes up 2% on average (S&P up 1.96%, Dow up 1.57%, Nasdaq up 2.43%, Russell up 1.2%) so we’re continuing to see small/mid caps lagging the large caps with IWM down -2.06% over the past 5 days versus SPY up 0.53% over the past 5 days but then if you look at RSP (equal weighted S&P) its down -0.92% over the past 5 days which continues to show that mega cap tech is holding up the market cap weighted indexes while the majority of stocks under the surfaces are pulling back. We’re seeing some breakouts the past week on earnings but we’re also seeing lots of big drops and pullbacks to key support levels. I’m less interested in buying the breakouts (because I think many of those stocks are already overextended) and more interested in buying the pullbacks/bounces however with that said I’m not looking to get my exposure above 50% going into the weekend with FOMC next Wednesday, the jobs report next Friday and a slew of earnings reports coming up. We’re seeing alot of cloud/software stocks down this morning because of comments from the AMZN CFO last night where he said that cloud is slowing down.

Futures not looking great…

2Y yield still hovering around 4%, 10Y yield still under 3.5%…

Don’t be afraid to hoard cash and be patient, it’s hard to put up big numbers when the indexes are pulling back or going sideways so wait for your favorite setups and then get aggressive. Personally I’m looking for stocks that I can make 15-20% on which means I might need to hold them for a few weeks or longer (assuming I don’t get stopped out) so I’m waiting for pullbacks to support levels where i can start a position with a tight stop in case it doesn’t hold. I’ve been getting stopped out of these setups the past week (not in all cases) but even when I’m getting stopped out I’m generally keeping my losses below 2% — risk management needs to be your #1 priority in this market. You can’t make money without taking some risk but it needs to smart/calculated risks.

Below the paywall is my current portfolio (11 stocks) and primary watchlist (15 stocks)…