Trading charts newsletter for Wednesday, March 8th

I have another Substack newsletter called Jonah’s Deep Dives where I publish a weekly deep dive writeup (8,000+ words) on different growth stocks: deepdives.luptoncapital.com

I run the largest Stocktwits room where I post about my investment portfolio and trading portfolio including access to my daily buys/sells, market commentary, investment models, daily webcasts and much more: stocktwits.luptoncapital.com

I run Disciplined Growth Investor on Seeking Alpha which is the combination of all my investment services but all on one platform: seekingalpha.luptoncapital.com

Good morning and Happy Wednesday,

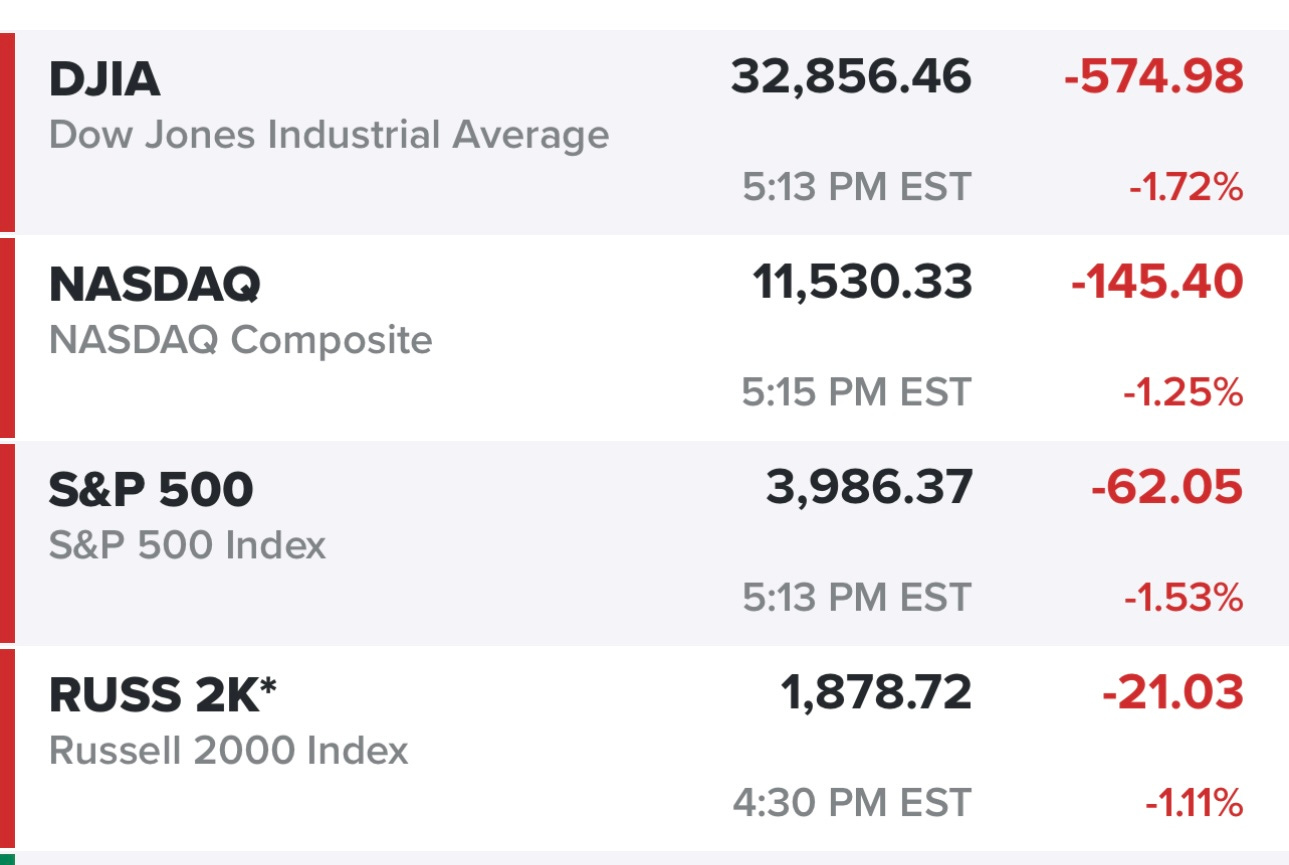

The equity markets were looking decent yesterday morning but that all changed after the FOMC Chairman (Powell) started speaking at 10am. The selling picked up throughout the day and the indexes all closed near their lows of the session.

Everything began fading as soon as he said that inflation was still a problem and the FOMC would need to go higher for longer with their Fed Funds rate in order to slow down the economy and the labor markets. That caused treasuries to sell off thus pushing yields higher. In my newsletter yesterday morning I mentioned that the Fed Funds futures were pricing in a 73% chance of 25 bps and 27% chance of 50 bps at the next FOMC meeting — as of this morning those probabilities have flip flopped and now they’re pricing in a 71.2% chance of 50 bps and 28.8% chance of 25 bps. On top of that there’s now a 60% chance of another 25 bps at the May meeting (b/c no April meeting) and then another 25 bps at the June meeting. These specific hikes at the March, April and June meetings would take the Fed Funds to the range of 5.50% to 5.75% but then it gets interesting because the odds for the July meeting right now is no hike (45.5% chance) vs another 25 bps (32% chance) and then 6% chance of 50 bps (which would take Fed Funds to 6%). After we get the Jobs report on Friday morning and CPI next week it will be interesting to see what happens with these probabilities. There are more economists coming out and saying that the terminal rate might need to be closer to 6% versus a few months ago when we thought a terminal rate at 5% might do the trick. If we get hot jobs & inflation data in the next couple weeks and then it looks like the FOMC will do 50 bps at their next meeting, it might be hard for SPY and QQQ to hold onto their 200d moving averages at which point it’s probably time to raise cash and/or add some hedges.

We also need to keep an eye on yields, not only is the 10Y creeping back to 4% but the inversion between the 2Y and 10Y is approaching historic highs.

With the Jobs report just 2 days away it’s becoming less likely that I start any new trading positions today or tomorrow unless something just looks too good to pass up. Yesterday I did start a few positions (ie FOUR LNTH DECK FTNT) as they pulled back to some support areas (ie 7/8/9/10d ema) but I also got stopped out of a few positions with some gains (ie WING AYX ATKR).

FWIW, FOUR and LNTH have been massive homeruns this year, both of which have been top 5 positions in my investment portfolio since last summer.

In my trading portfolio I’m still focused on the stocks that gapped up after Q4 earnings, gave better than expected guidance, rallied higher for a few days and now pulling back to their moving averages on lighter volume. I like buying these stocks at the 8/9d with stop loss below the 10d.

Below the paywall is my current trading portfolio (18 positions, ~68% invested) and watchlist (13 stocks with charts) including a link to my trading portfolio spreadsheet (with entry prices, position sizes, stop losses, win/loss rates). You also get links to my two daily Zoom sessions at 10:30am EST and 3:30pm EST where I review charts for both my portfolios plus my watchlist stocks and explain where & why I started new trading positions or closed out existing ones.