Trading charts for Wednesday, March 29th

Good morning and Happy Wednesday,

I’m still 100% cash in my trading portfolio as these markets continue to chop around. Over the past 5 days the S&P is down -0.79%, the Dow is down -0.51%, the Nasdaq is down -1.21% and the Russell is down -1.41%

I think sitting on the sidelines the past week was the right decision and I will continue to hold at least 80-85% cash in my trading portfolio but I’m willing to start a few small positions if I see the right setups however until the markets start cooperating we’re just going to see more sideways action ie stop losses getting chewed up and spit out.

Indexes finished in the red yesterday…

Futures looking good as of 8:40am EST…

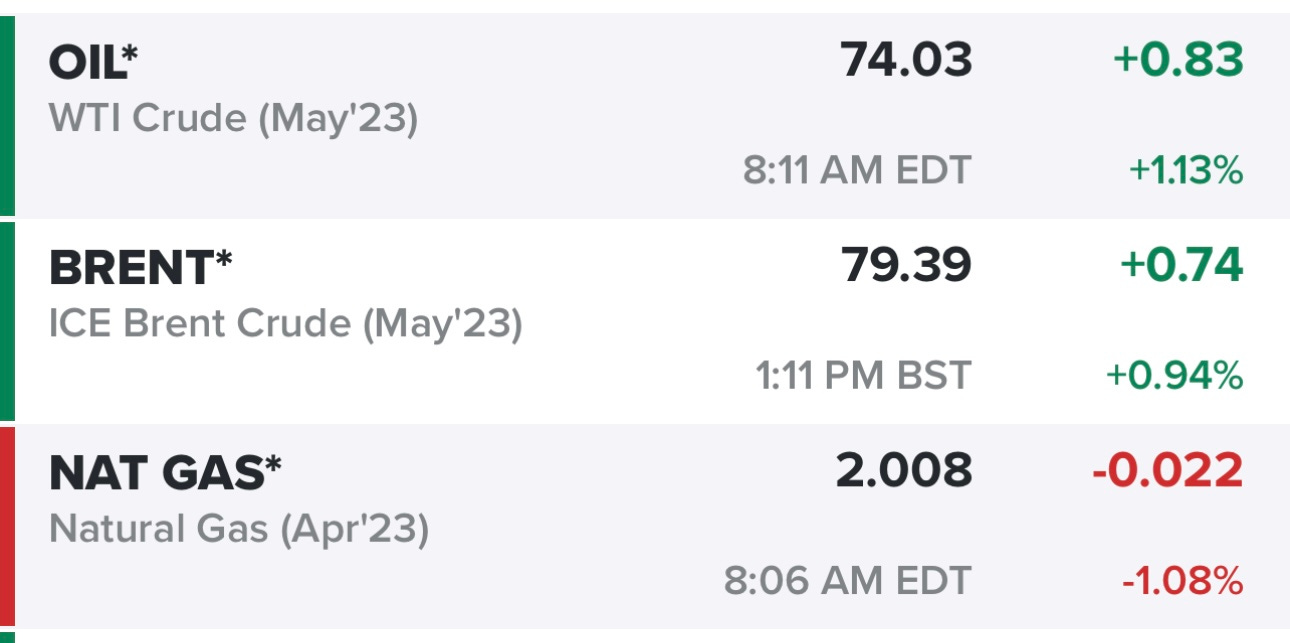

Commodities up again, oil taking a run at $75, I’ve talked to a few traders that think it’s going to $80 and some that think it’s going sub-$60

Yields are relatively flat but 2Y is now firmly above 4% and 10Y is above 3.5% — still inverted…

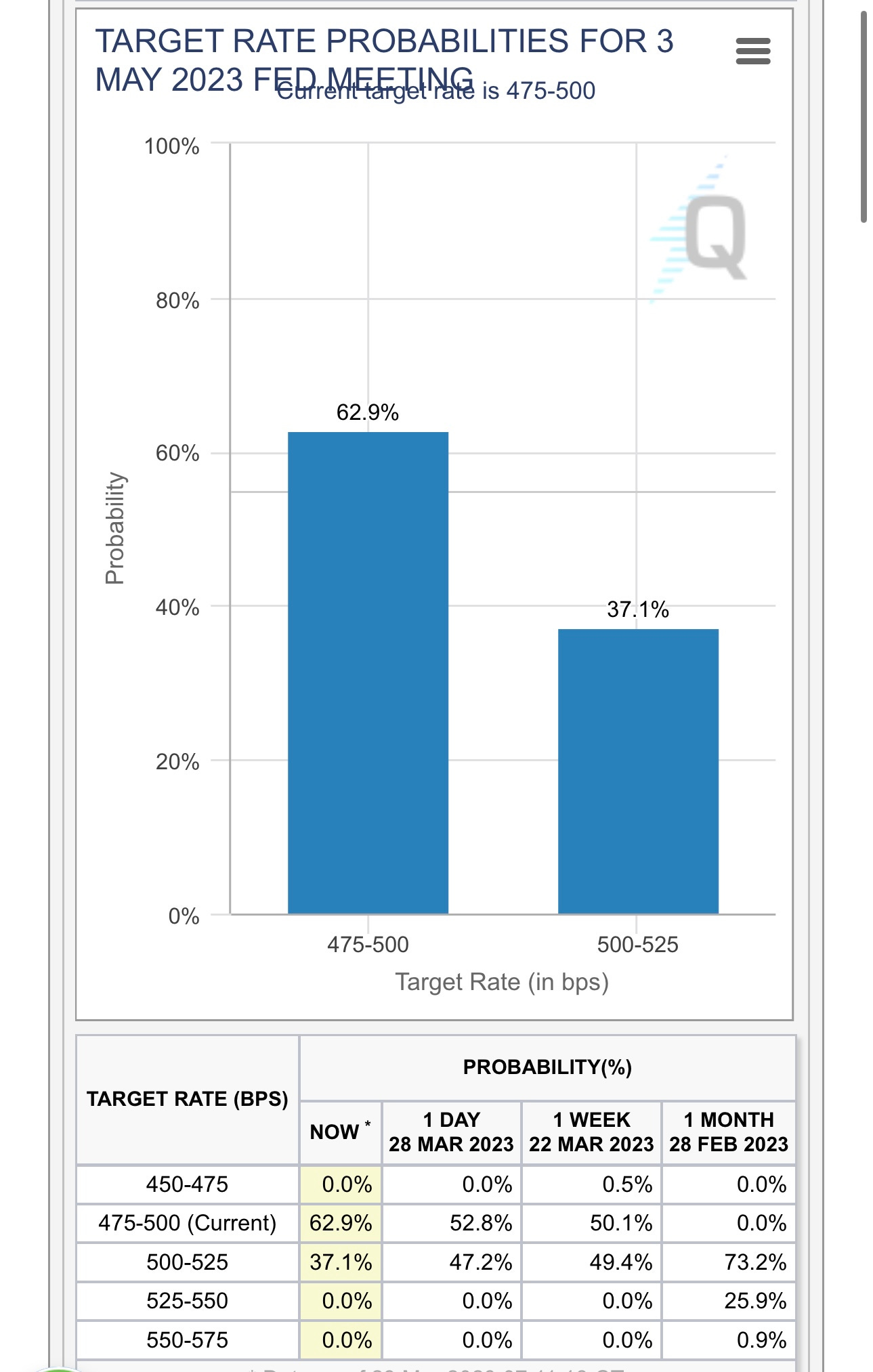

I’m a little surprised that the probability of no rate hike in May has not gone from 37% yesterday to 62% this morning but this number will bounce around alot in the coming weeks as we get more macro data…

One of those data points comes out this Friday, it’s PCE, this is something the FOMC watches very closely, the forecast is 4.7% YoY which is what we got last month…

Just to reiterate, there’s a chance I start a few small positions today but I’m not going to chase anything or feel pressured, I need to be patient in this chopfest market. Cash is still an asset class and risk management should always be priority #1 when it comes to trading. I have no interest in day trading and trying to scalp a few pennies here and there, that’s a waste of my time. I’d rather wait for that “fat pitch” and then get very aggressive.

I am seeing some decent charts/setups but as we’ve seen over the past 5-6 weeks, things can fall apart very quickly so you need to manage risk, position size, entry price, etc.