Trading charts for Wednesday, March 22nd

I also run the largest Stocktwits room where I share both of my portfolios, daily activity, investment models and much more. You can signup with the link below:

Good morning and Happy FOMC Day,

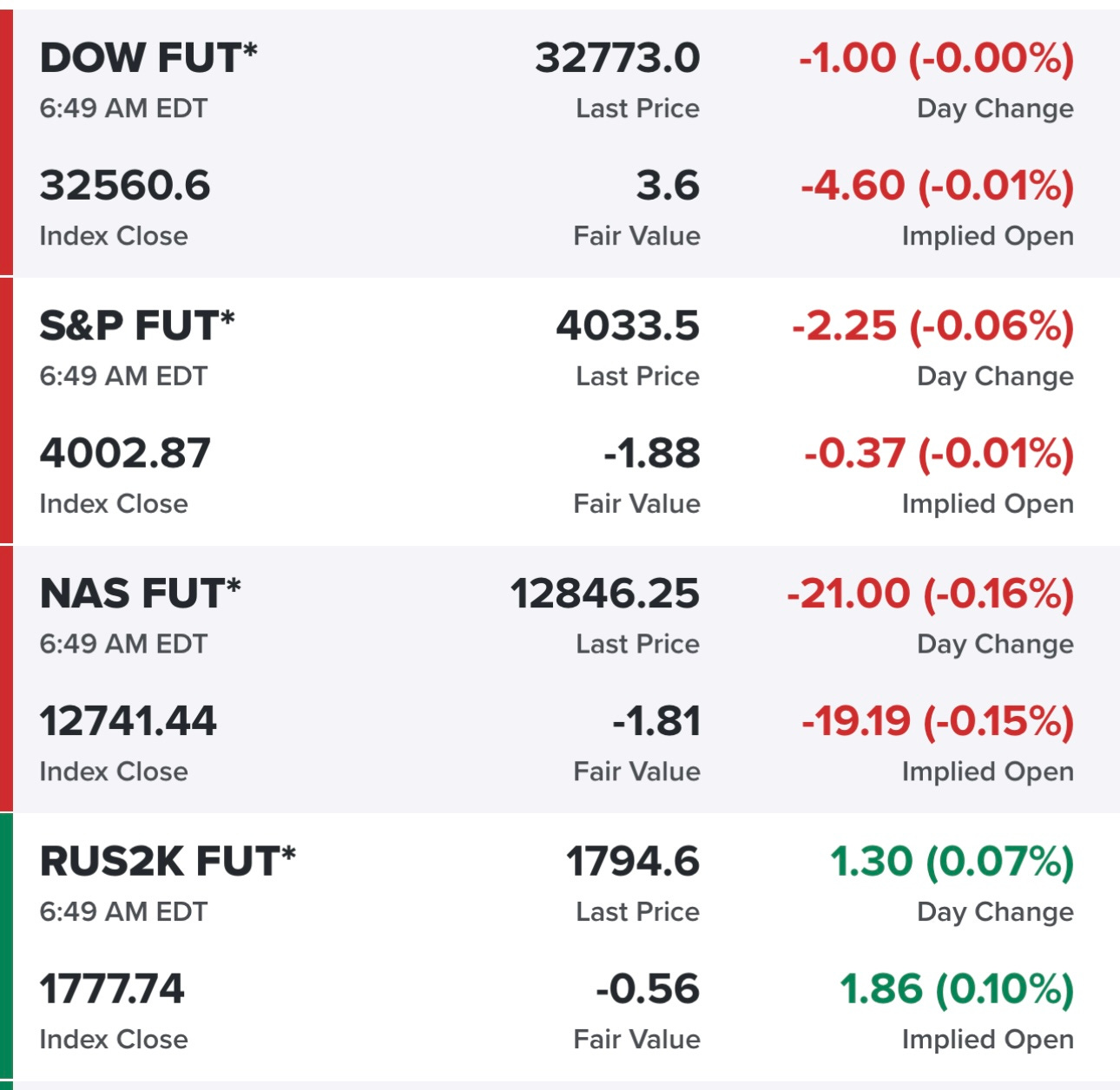

Markets are looking very flat and calm pre-market as we await the FOMC decision at 2pm EST today.

We’re also seeing the bond market very flat today which is the opposite of what we’ve been seeing the past two weeks as yields have been whipping around. Just a couple weeks ago we had the 2Y at 5% and 10Y at 4% then we saw a massive flight to safety after the SIVB and SBNY failures which pushed rates lower and then over the past couple days we’ve seen some selling of Treasuries — perhaps because investors are locking in some profits ahead of the FOMC meeting today or they’re worried about yields rallying from here so they’d want to take down their duration risk even further.

Yesterday we saw a big rally in the equity markets with the indexes up an average of 1.4% — I had one of my best days in the market yesterday (in my investment portfolio) in a while with several of my largest positions up 7-12% on the day. That was quite unexpected going into the FOMC meeting, perhaps some FOMO (fear of missing out) as some believe the FOMC will pause and/or hike but sound dovish — both of which could spark a rally however a pause might also signal that things are worse than we think and I also think it would be hard for the FOMC to hike and sound dovish.

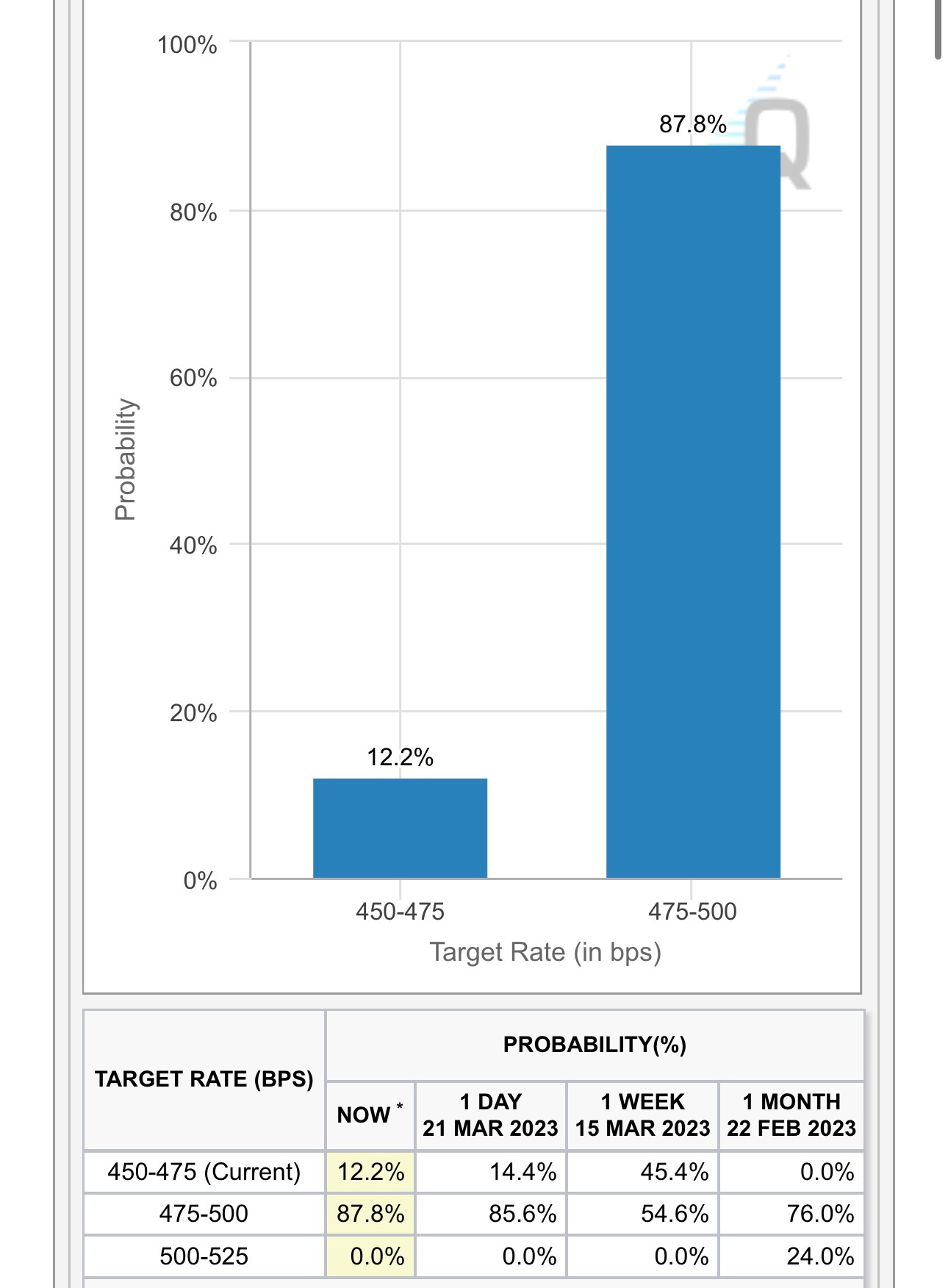

I’m a little worried they’ll hike 25 bps and continue the hawkish tone which just reinforces how out of touch they are with reality. FWIW, the CME Fed watch tool shows that we’re likely to get a hike but I do think there’s still alot of uncertainty and nobody really knows what the FOMC will do.

I continue to believe when we look back in a few years we’ll agree this was the most incompetent FOMC in recent memory. I have zero faith in their ability to make accurate forecasts nor do I have any faith their ability to navigate a soft landing for the economy. That doesn’t mean I’m willing to just sit in 100% cash and wait for things to play out but it does mean this is not the time to get aggressive and crank up your equity exposure. I did take some hedges off my investment portfolio yesterday because SPX was back above the 200d sma (for 2nd straight day) but if we’re unable to hold the 200d sma on SPX I’ll put those hedges back on.

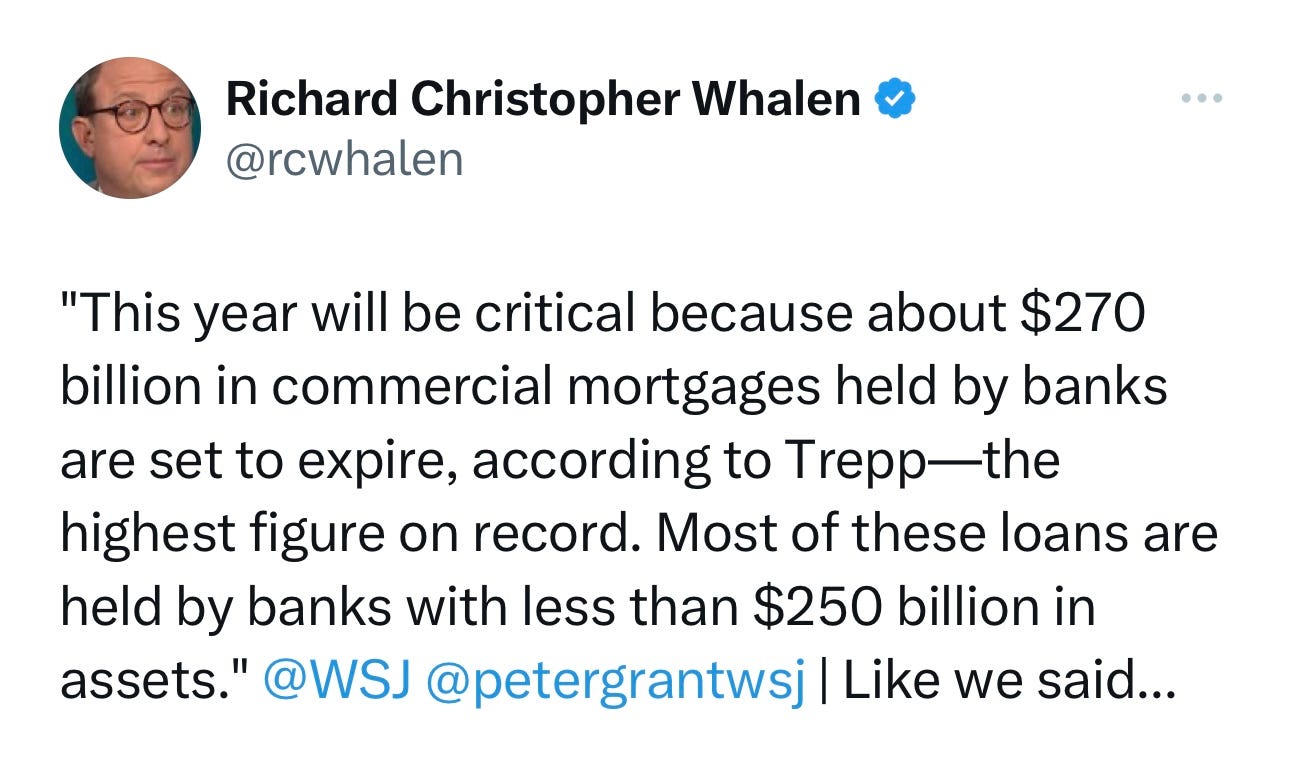

I’m also worried about the commercial real estate market which could be the next landmine for the banking industry, if the FOMC continues with their rate hikes this potential problem will just get worse — the FOMC has already given us 450 bps of rate hikes over the past 12 months and there’s a 6-12 month lag effect that the FOMC is not taking into consideration plus stresses in the banking system will tighten lending standards which will slow growth over the next 6-12 months. I still believe we’re going to see CPI under 3% YoY by end of summer and before the September FOMC meeting which means the FOMC will be cutting rates by then.

I have no intention of starting any new positions today before the FOMC decision, also unlikely I start any new positions after the FOMC decision because we’ve seen plenty of instances over the past year when we ripped after the FOMC decision then started fading during the press conference and ended up in the red or we rallied after the FOMC decision and then had a nasty gap down the next day when all the news was properly digested.

With respect to risk management, in this kind of choppy market it often more prudent to sit on the sidelines and wait for the volatility to subside before starting new positions — with that said the price action yesterday was encouraging and we saw some breakouts through previous resistance levels but we also saw plenty of rejections and some afternoon fades especially in small/mid caps.

For instance we saw a huge move in LNTH through that $79.50 resistance level…

but we saw a stocks like ALGN CROX and XPOF all get rejected at the VWAP from recent highs…