Trading charts for Wednesday, March 15th

I have another Substack newsletter called Jonah’s Deep Dives where I publish a weekly deep dive writeup on different growth stocks. Last night I published my 8th deep dive of 2023, the previous 7 were ALB, HIMS, MBLY, ONON, NU, SDGR, and SQ.

I also run the largest private Stocktwits room where I post all day about my investment portfolio and trading portfolio including access to my daily buys/sells, market commentary, investment models, daily webcasts and more.

Good morning,

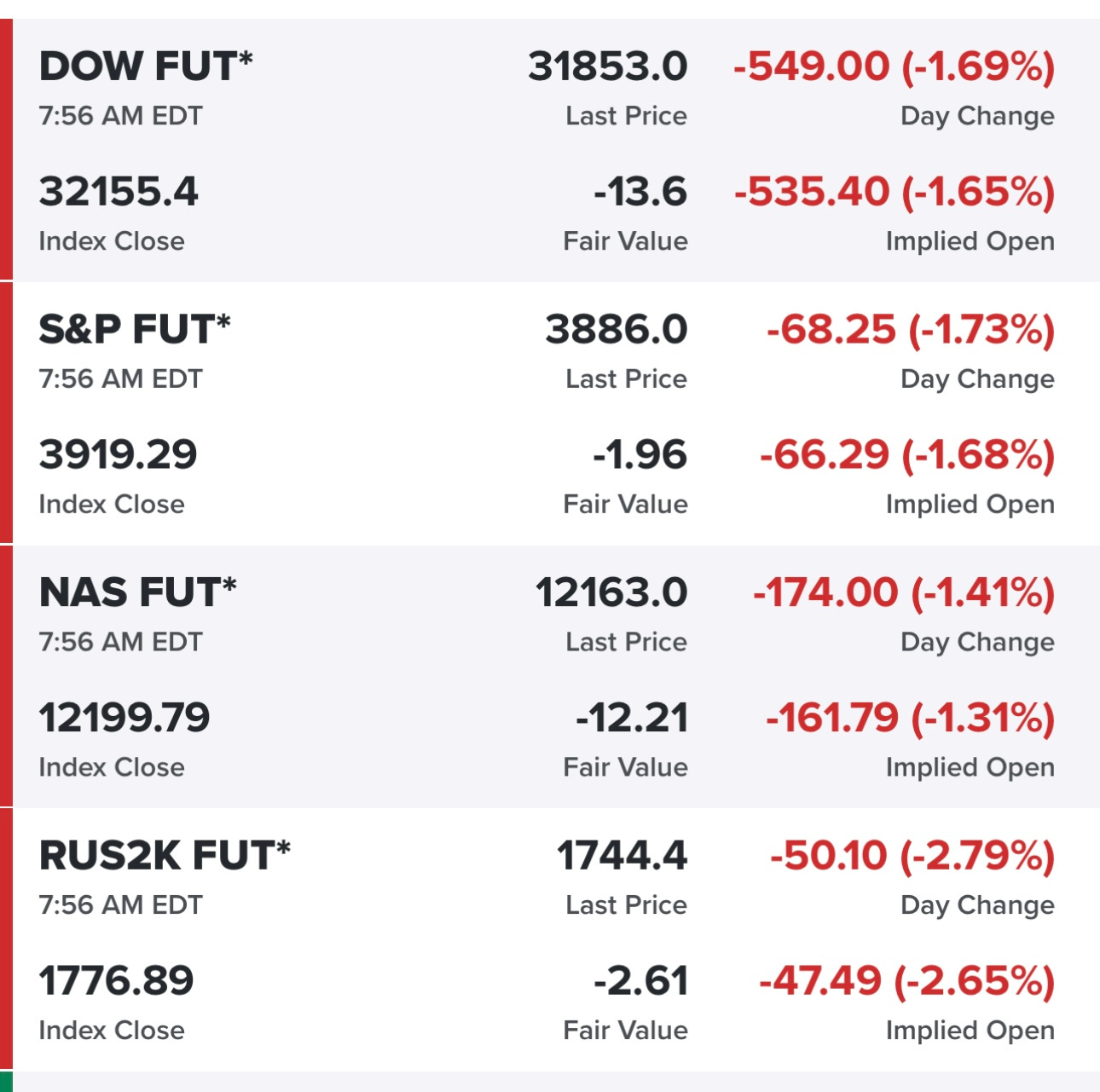

If you are just waking up than I would suggest not looking at CNBC, Bloomberg or your portfolio because the futures are UGLY. When the only green on my screen is the VIX (volatility index) you know it’s going to be a rough day for the markets.

I didn’t get to bed last night until after 1am because I was working on some stock research stuff so by the time I woke up at 7am (usually up at 4:30am) the futures were already in the toilet. Clearly this market is still a mess and wants to go lower…“1 step forward, 2 steps back” — horrible market for trying to swing/position trade. You can still make some money day trading but that’s not what this newsletter is for. I’m trying to find stocks that we can hold for days, weeks, months and make 20-30% at a minimum but we need a healthier market without these nasty gap downs.

It appears that most of the ugliness today is stemming from bank problems in Europe, mostly Credit Suisse so now investors aren’t convinced that this regional bank issue in the US is behind? Treasury yields are down this morning after rising yesterday. We’re back to Monday’s yields the 2Y under 4% again — it was over 5% a week ago.

If we look at the CME’s fed funds monitoring tool, there’s now a 40% chance of no rate hike next week from the FOMC, up from 30% yesterday. If the markets continue selling off today/tomorrow and yields go lower than I suspect we see the probability of no rate hike at 60% or higher by end of week.

Yesterday on CNBC, Josh Brown had one of his best rants about the FOMC, you can watch it here… (he starts talking at 2:33). I agree with everything he said. The FOMC has already done enough, it’s time to pause and let this banking mess play out not to mention inflation is coming down and we’re about to see shelter (OER) roll over into easier comps. I still think we have CPI at 3-4% YoY by end of summer so hiking rates the Fed Funds to 5% or higher is totally unnecessary and just exacerbates the current cracks we’re starting to see in the banking system not to mention we’re going to see lending standards get even tighter which is also dis-inflationary.

Yesterday I interviewed John Boik, author of Lessons From the Greatest Stock Traders, Monster Stocks and How Legendary Traders Made Millions — I asked him how long the best traders would hold cash and do nothing while waiting for a better market and their “fat pitch”, he said they’ll wait as long as necessary, sometimes 2+ years without doing a single trade. I think many of us, me included, need to learn patience. Often times doing nothing is the prudent thing. When you’re running a paid service like I am with this Substack newsletter, I feel pressure to put out charts so it looks like I’m working and adding value for my subscribers but in this market the best thing to do is NOTHING, sit in cash and wait for the dust to clear. We’ll have plenty of time to make money on the other side. We don’t need to chase stocks and hope that something bounces. This is the time to study and do research so once these markets are more favorable we’re ready to crush it.

You can signup for my podcast and alerts on new interviews at…