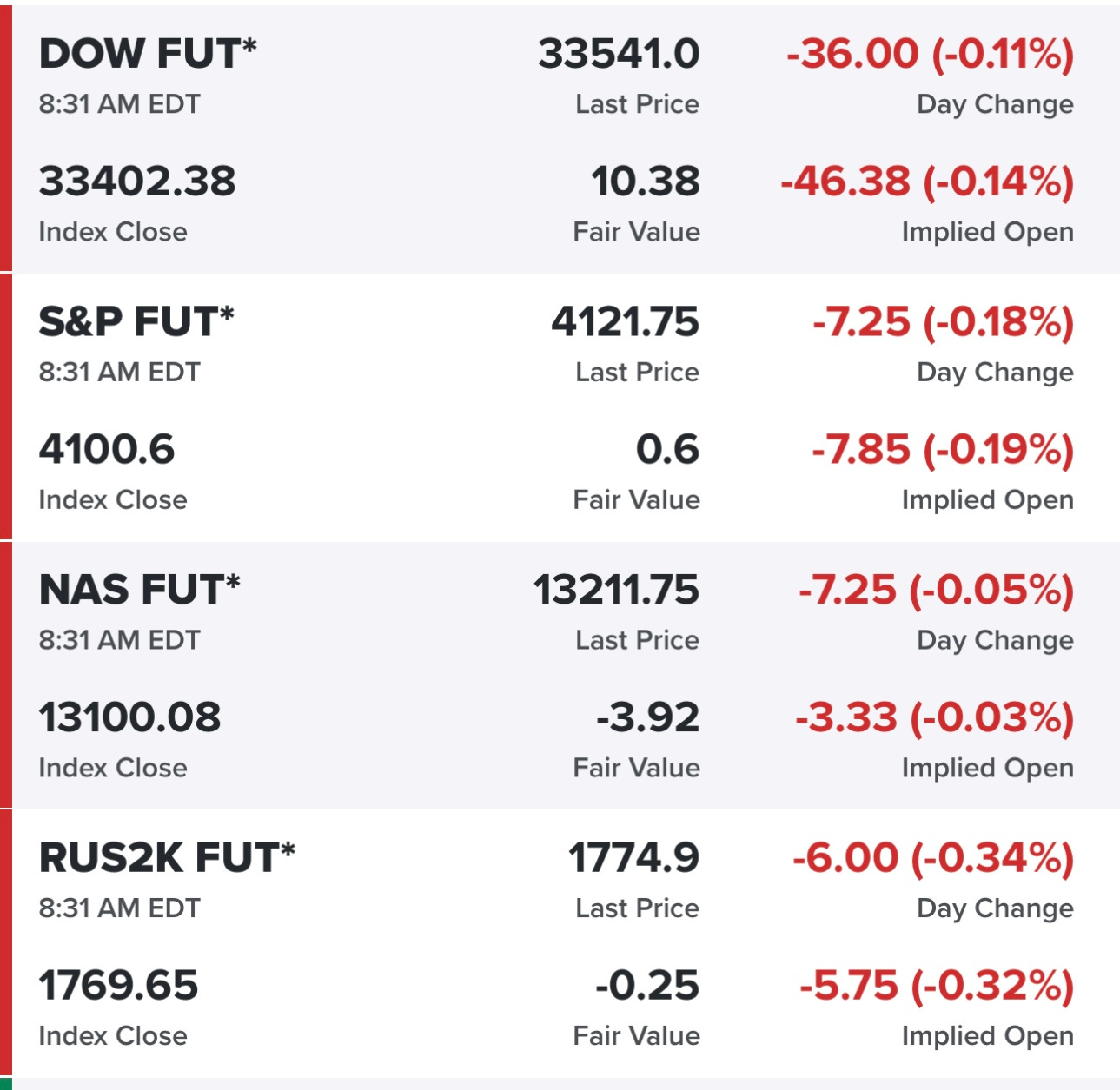

Trading charts for Wednesday, April 5th

I run the largest stocktwits room where I share content all day for both my portfolios, my investment models, market/macro commentary and much more…

Good morning and Happy Wednesday,

Markets are closed this Friday however we get the jobs reports on Friday morning, this seems ridiculous and I can’t remember this happening before but I also can’t remember a time that the markets were so obsessed with macro data as they are now because that obviously drives monetary policy which has never influenced the markets more than it does now. This means that I’m less likely to start new positions today or tomorrow because I’d rather not take more exposure into the jobs report and the 3-day weekend.

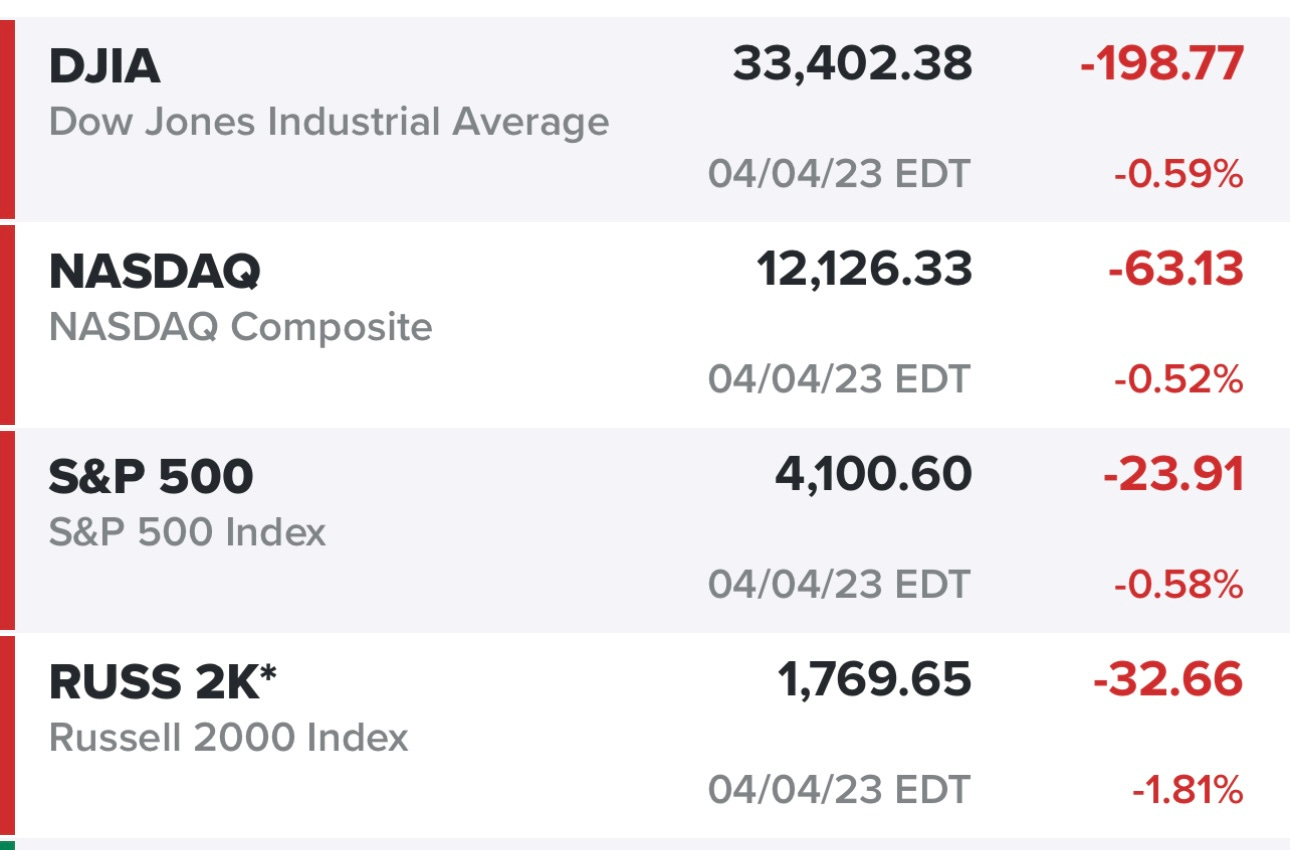

Indexes were in the red yesterday but small/mid caps got the biggest spanking…

I suspect small/mid caps have been the laggards for the past couple months because investors are worried about a bigger economic slowdown over the next 12 months (partly from restrictive monetary policy and partly from tighter lending standards from bank failures) but this is showing up now in the Treasury market with yields continuing to move lower today…

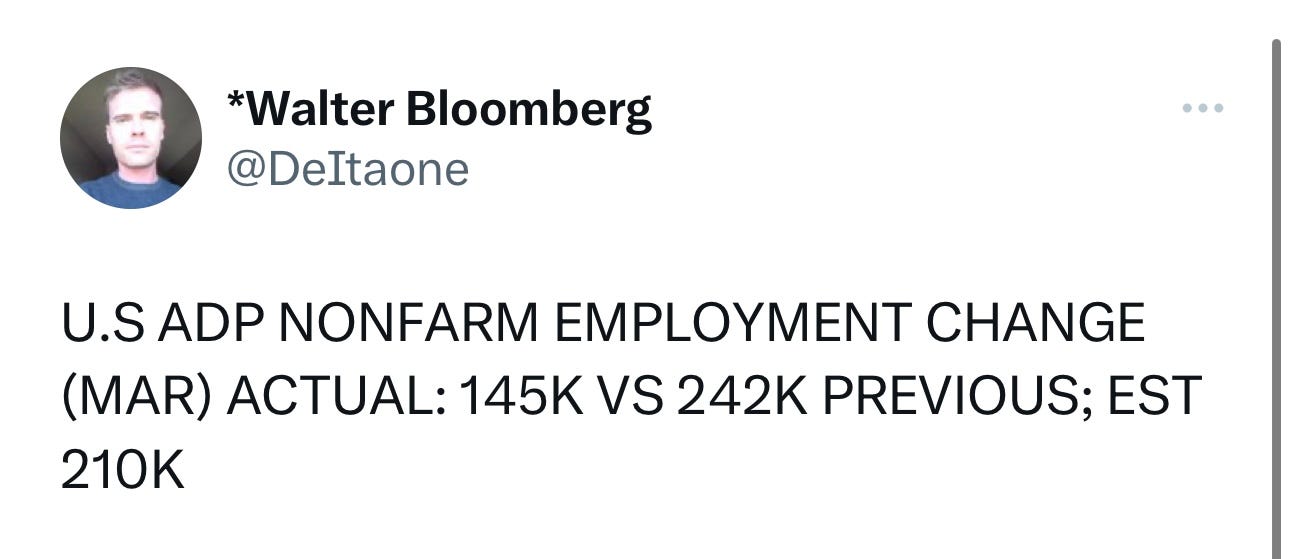

We’re finally starting to see signs that the jobs market is slowing down, this is the ADP report that came out this morning…

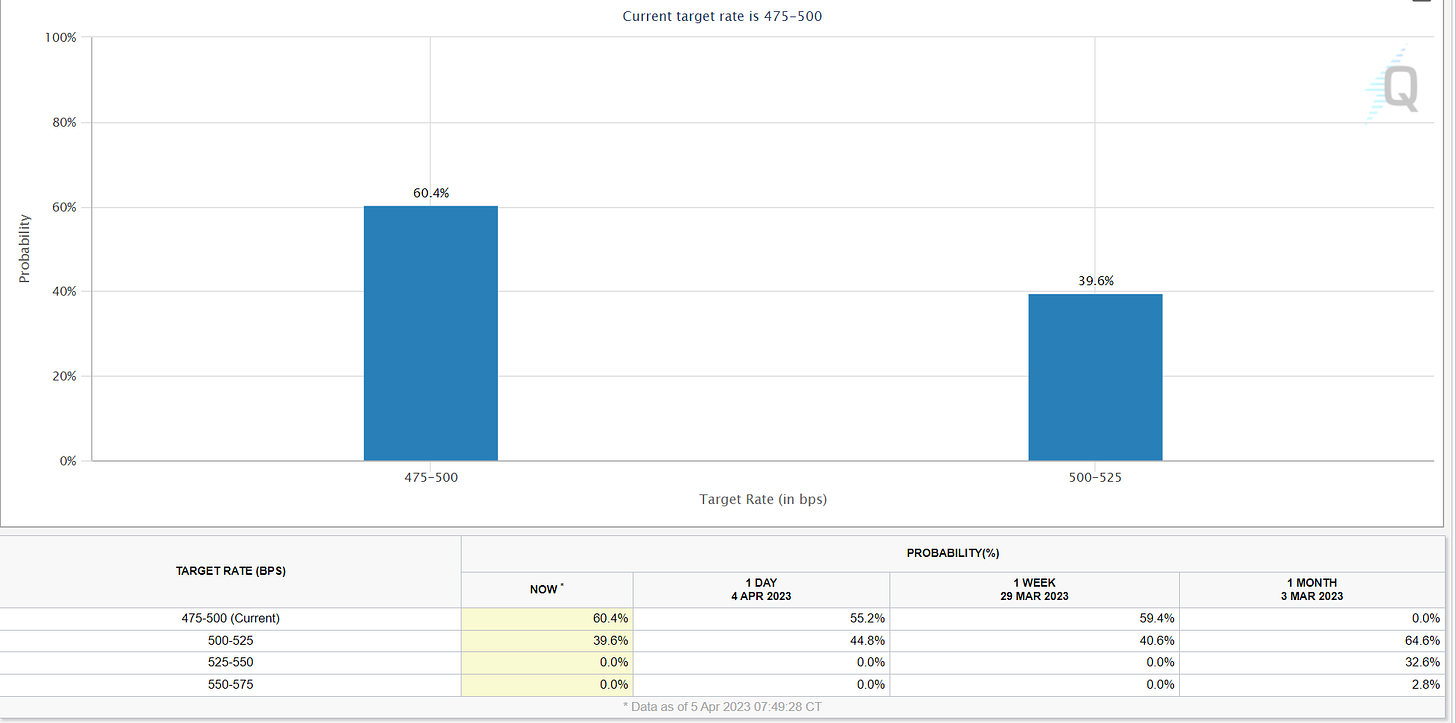

We’re back to 60% probability of no hike at the FOMC meeting in May — this chart below does not include the ADP report from this morning so we could see these numbers move in the next couple hours plus the jobs report on Friday will definitely move it. If the jobs report on Friday comes in cooler and then CPI next week comes in cooler we could see the probability of no rate hike jump to 80-90%

Energy was the big outperformer on Monday but gave back a chunk of those gains yesterday — yesterday was clearly a risk off day with utilities, communications and healthcare showing relative strength.

Last but not least the futures are slightly down this morning but nothing major. I’d be surprised if we saw any meaningful moves higher today or tomorrow ahead of the jobs report on Friday.

I don’t think yields coming down is a flight to safety anymore like it was during the banking crisis, now it’s the market saying that inflation is no longer a big focus and now we’re turning our attention towards slower growth and a possible recession.

Below the paywall is my current portfolio (11 stocks) and my main watchlist for today (15 stocks) plus links to my portfolio and daily webcasts.