Trading charts for Tuesday, March 21st

I also run the largest Stocktwits room where I share both of my portfolios, daily activity, investment models and much more. You can signup with the link below:

Good morning and Happy Tuesday,

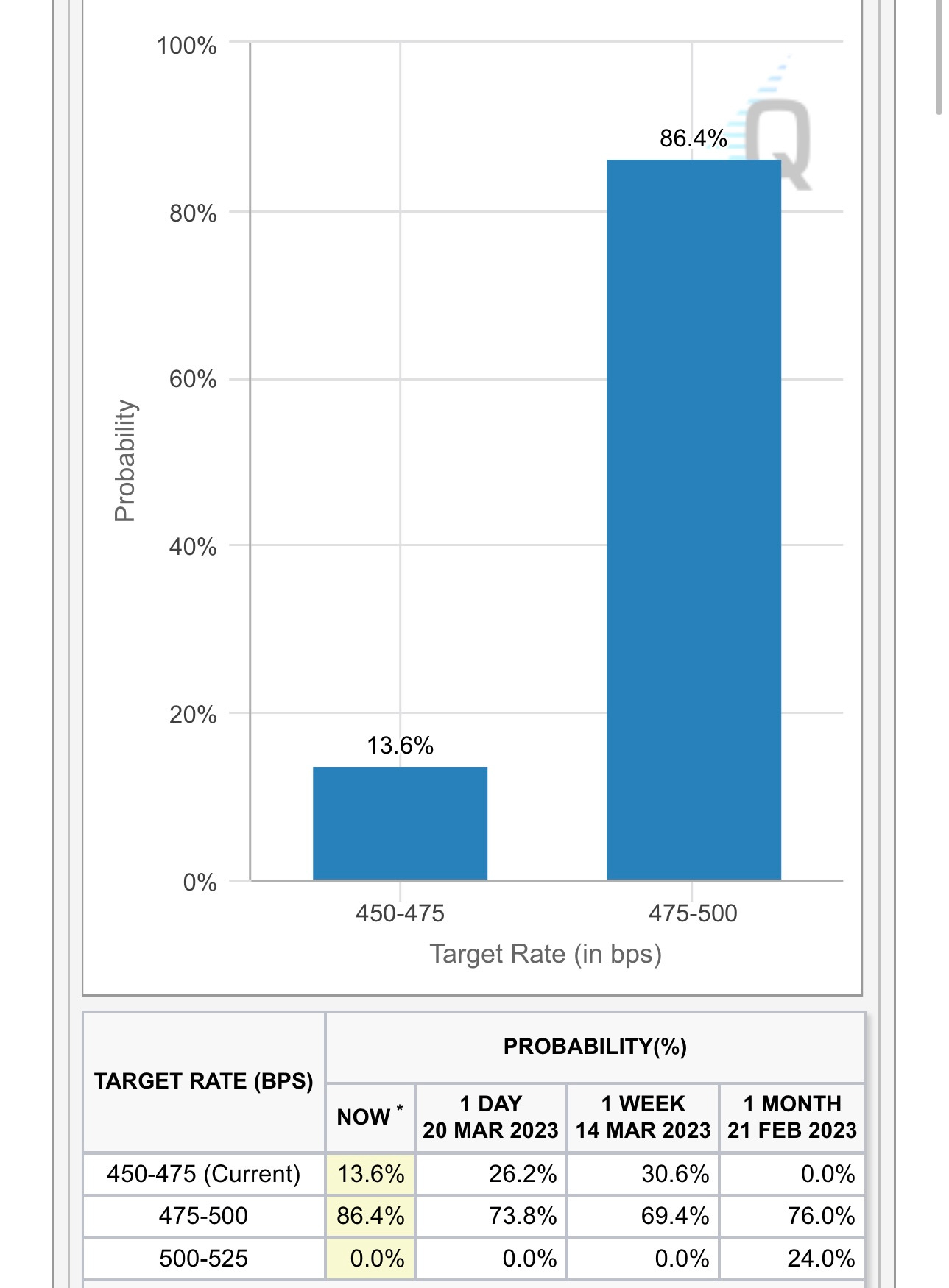

By now everyone should know that tomorrow is FOMC day which means we’ll get the FOMC rate hike decision at 2pm EST followed by Powell’s press conference at 2:30pm — as you can see below the markets are now expecting a 25 bps rate hike but that could always chance over the next ~30 hours.

Personally I think the markets care less about the decision (ie rate hike or no rate hike) and instead care more about the prepared statement and Powell’s comments during the press conference. If they don’t hike the markets might see that as a sign that the FOMC is more worried about the economy and banking system and we could see a sell off.

However the market might also see a pause as the end of the rate hiking cycle and rip higher. If they do hike rates by 25 bps the market might sell off at first unless the statement sounds very dovish and points to this being the late rate hike.

TBH, there are so many ways to dissect what may or may not happen — it’s almost not worth thinking about because we’re just guessing. Because of this uncertainty I have no plans or intentions to start new positions today.

If the FOMC gives us the recipe for easier monetary policy going forward than we could see the markets rip higher for the next couple weeks, there’s no need to play the gambling game in advance.

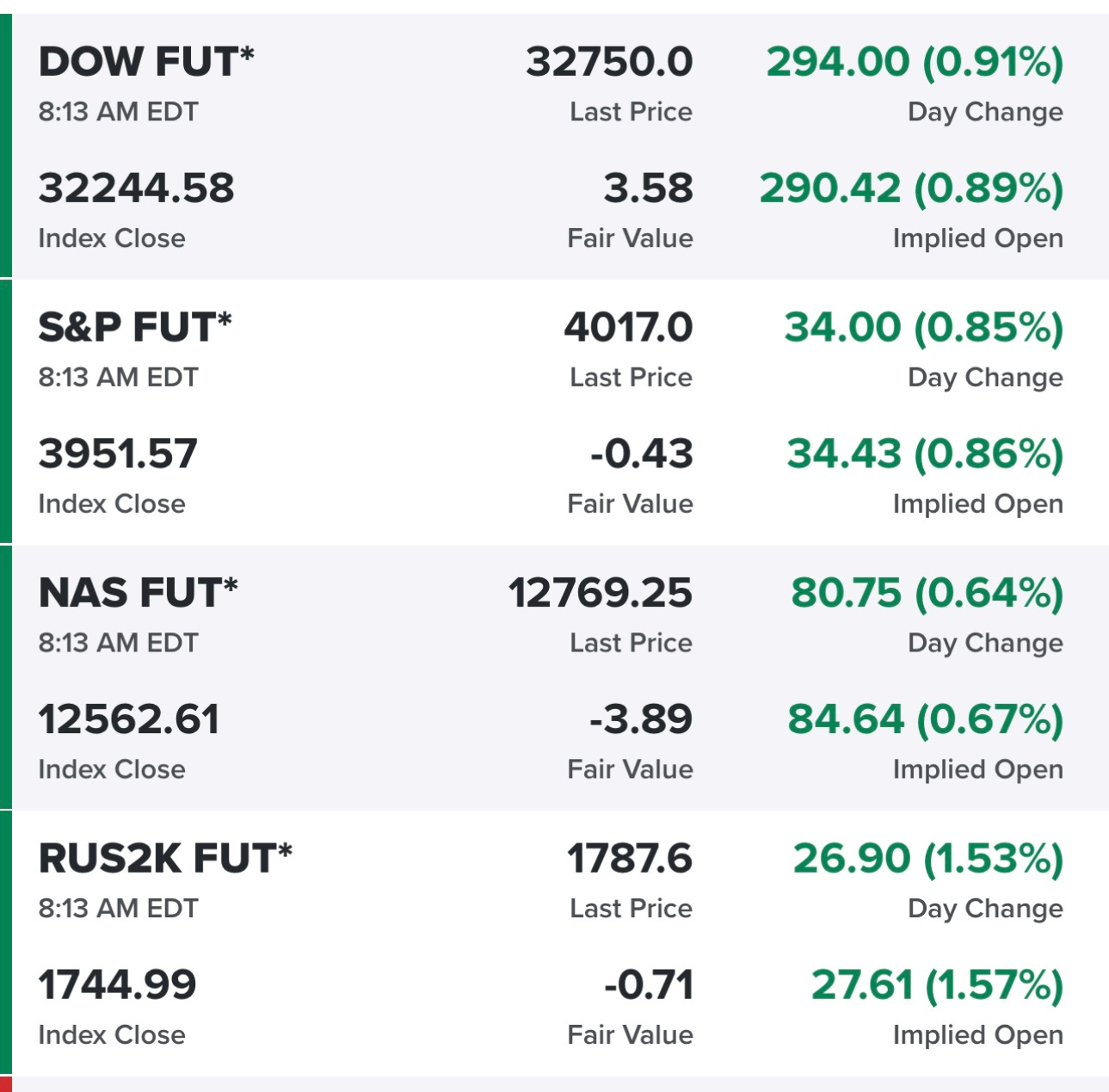

I have 25% exposure going into today and assuming I don’t get stopped out of anything that feels like the appropriate amount of exposure into tomorrow. I might even sell some positions today to lock in some gains and then I have zero stress going into that 2pm decision tomorrow. As you can see below the futures are up nicely this morning, let’s see if it holds throughout the day.

The most interesting thing happening this morning is the 2Y yield up 21 bps, not sure why. Perhaps this is just some selling ahead of the FOMC decision tomorrow or perhaps we’re seeing money flowing out of “risk off” assets and into “risk on” assets ie equities.

Here’s a chart that shows how the major indexes and sectors are performing year-to-date:

Below the paywall are links to my current trading portfolio, my watchlists with charts/setups and my daily Zoom webcasts.