Trading charts for Tuesday, March 7th

I have another Substack newsletter called Jonah’s Deep Dives where I publish a weekly deep dive writeup (8,000+ words) on different growth stocks: deepdives.luptoncapital.com

I run the largest Stocktwits room where I post about my investment portfolio and trading portfolio including access to my daily buys/sells, market commentary, investment models, daily webcasts and much more: stocktwits.luptoncapital.com

I run Disciplined Growth Investor on Seeking Alpha which is the combination of all my investment services but all on one platform: seekingalpha.luptoncapital.com

Good morning and Happy Tuesday,

Yesterday was a mixed day but we definitely saw a fade in the afternoon as the 10Y yield bounced off the morning lows. Yields are down slightly this morning but this is something we need to continue watching.

Fed funds futures are pricing in 30 bps at the next FOMC meeting which is March 21-22 with the decision on the 22nd followed by the Powell press conference. FOMC would only do 25 bps or 50 bps so the fact the futures are pricing in 30 bps means there’s a 73% chance they do 25 bps and 27% chance they do 50 bps [click here]. Right now I’d say there’s no chance they do 50 bps after doing 25 bps at the last meeting unless the Jobs report this Friday [click here] and CPI report next Tuesday [click here] both come in hot.

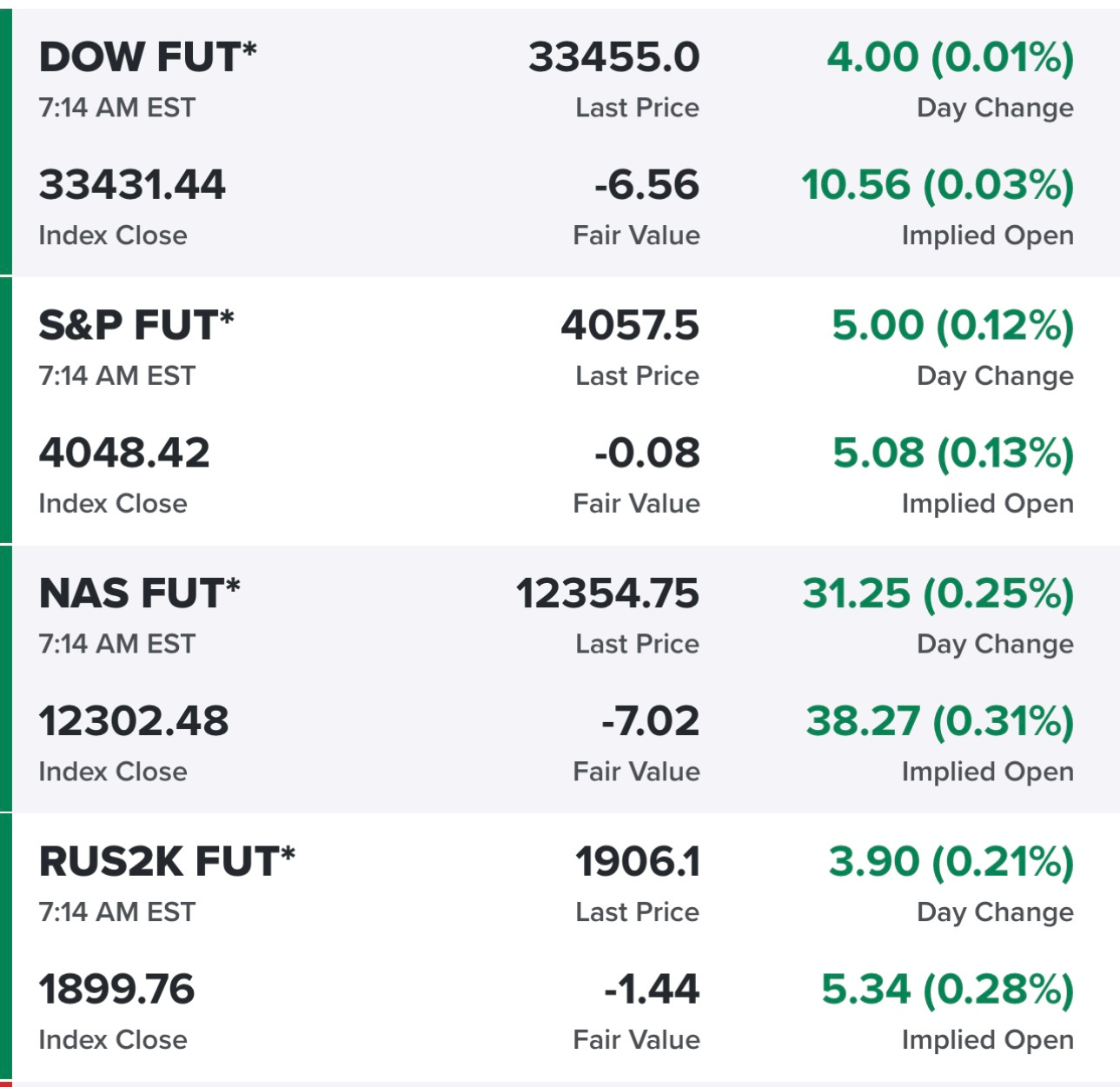

Equity futures are very flat this morning as of 7:30am with a few more earnings reports this week. Looks like SE reported better than expected numbers this morning and the stock was up 11% pre-market.

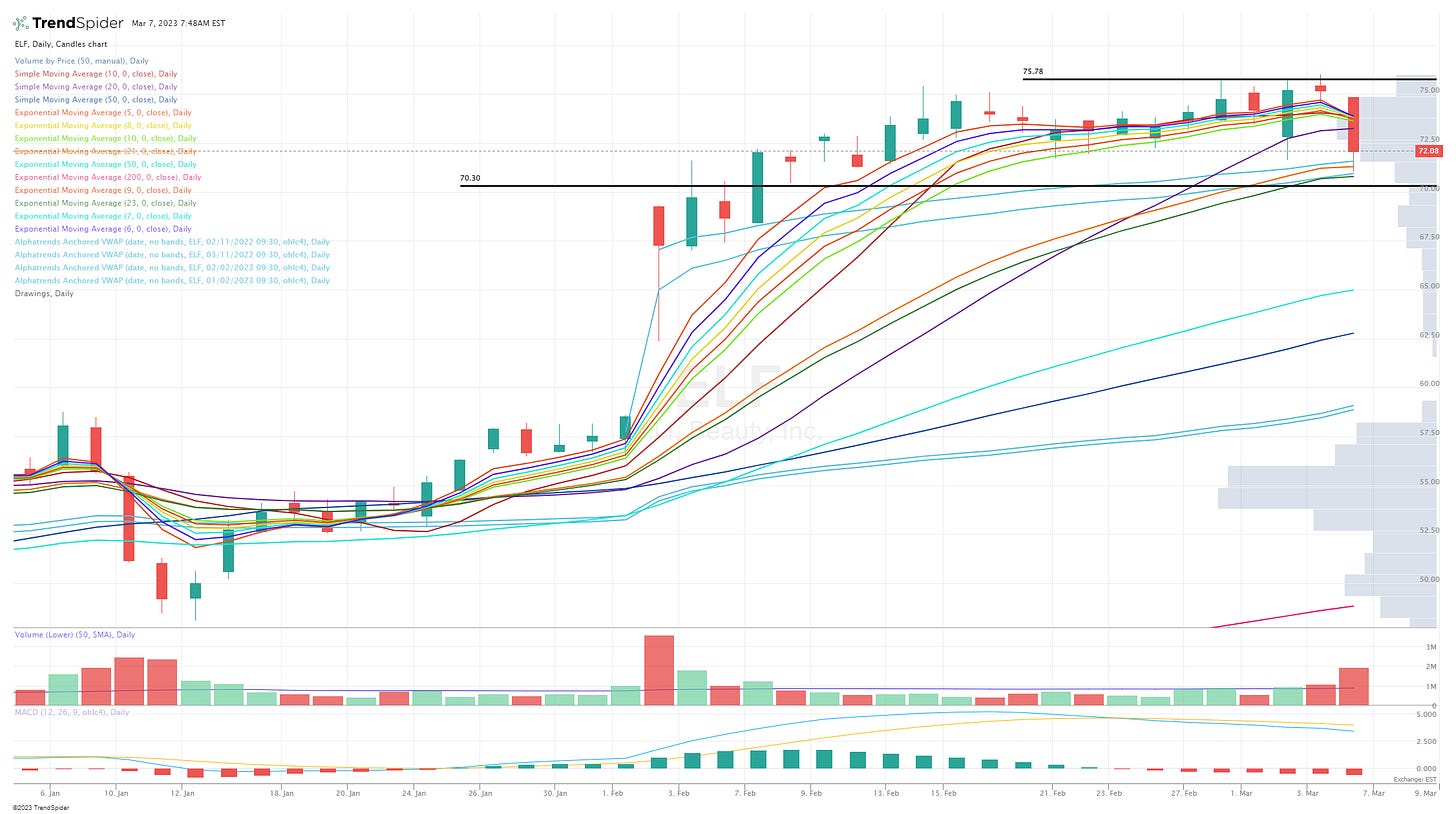

In my own trading portfolio I got stopped out of MNDY yesterday as the market faded and sold ALGN and LSCC to lock in some nice gains (15% and 8% respectively). I started a new position in PCOR as it pulled back to 10d ema, a new position in ELF as it pulled back to the 21d ema and a new position in PERI as it broke out to new highs. As you can see from the chart below (ELF), I love stocks that gap up on earnings then do some consolidating and wait for the moving averages to catch up, starting a position on a bounce off the 21/23d ema is one of my favorite entries because I can throw a stop loss just below the 23d ema so if I’m wrong my loss is small.

This is why I’m still stalking and adding to the list of Q4 gap ups because these are the companies that could get re-rated higher over the next few months before they report Q1 earnings. Here’s my spreadsheet [click here].

With the jobs report coming up on Friday I’m really not looking to force any trades or increase my equity exposure over the next few days. I’d rather not take more than 70% exposure into that report knowing it could whipsaw the markets in either direction. However with that said, I do see lots of attractive setups today and it’s possible I start a few new positions today, probably from one of my two watchlists. Lots of potential pullbacks to the 8/9/10d ema which have me interested but I want to see how the market open shakes out before I decide what I’m going to do.

Below the paywall is my current trading portfolio (19 positions, ~76% invested) and watchlist (12 stocks with charts) including a link to my trading portfolio spreadsheet (with entry prices, position sizes, stop losses, win/loss rates). You also get links to my two daily Zoom sessions at 10:30am EST and 3:30pm EST where I review charts for both my portfolios plus my watchlist stocks and explain where & why I started new trading positions or closed out existing ones.