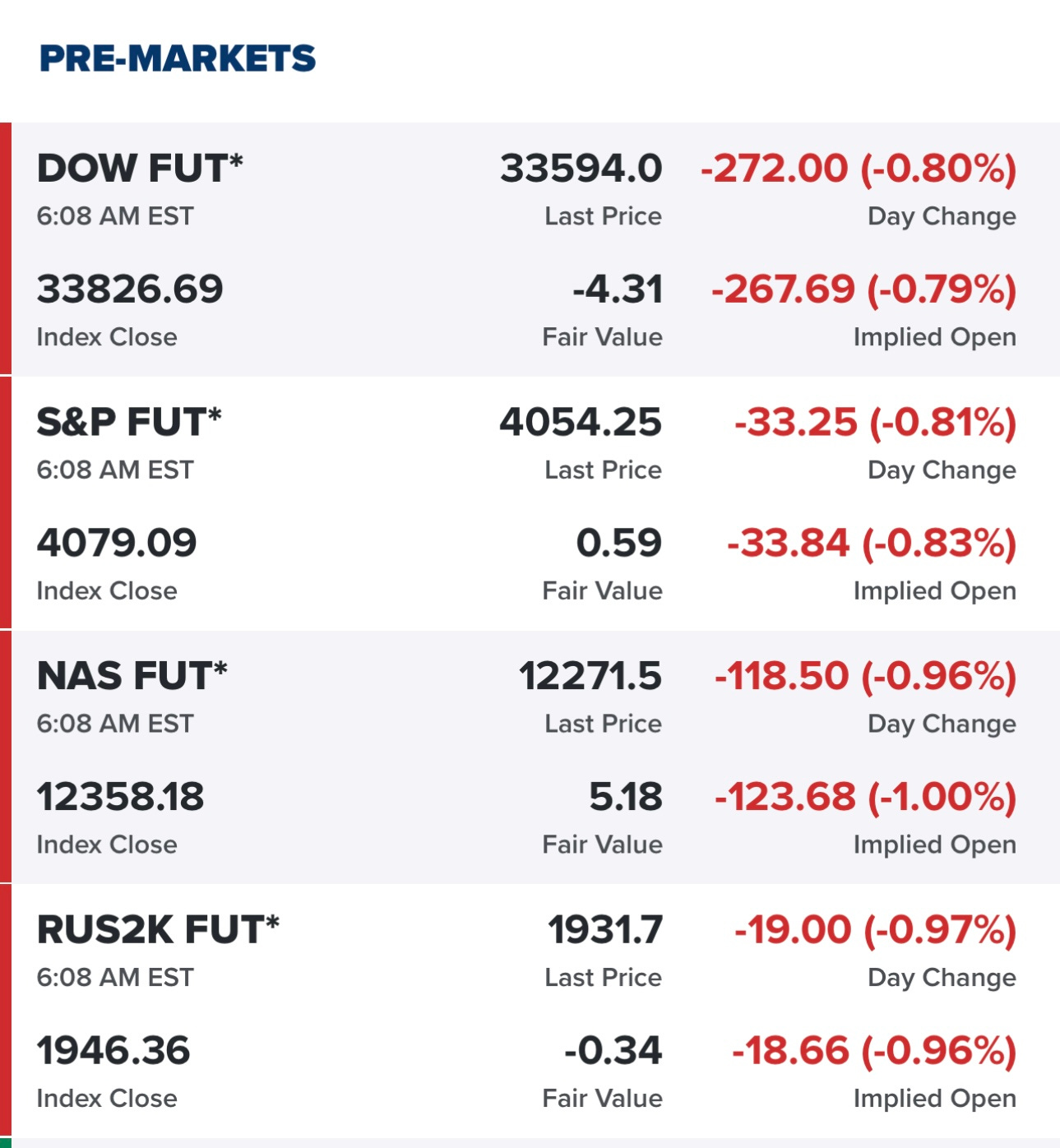

Trading charts for Tuesday, February 21st

Good morning and Happy Tuesday,

I hope everyone had a nice long weekend. We have another busy week of earnings, macro data and Fed speeches from Williams, Bostic, Jefferson and Mester.

Today we get existing home sales.

Tomorrow we get the FOMC minutes

Thursday we get Q4 GDP estimates (#2) and jobless claims.

Friday we get personal income/spending, PCE (personal consumption expenditures) and new home sales.

None of these are as important as CPI and PPI from last week which did come in hotter than expected so it’s possible we continue to see the market pullback because this likely means the FOMC will stay aggressive for longer which increases the odds they overtighten rates because even though they said they talk about a lag effect they’re certainly not willing to take that into consideration in the short term.

As of 5:30am EST the futures weren’t looking great but they got much worse around 6:15am after HD reported disappointing numbers.

Below the paywall is my current trading portfolio (3 stocks, 15% invested) and watchlist (22 stocks with charts) including a link to my trading portfolio spreadsheet (with entry prices, position sizes, stop losses & YTD performance). You also get links to my two daily Zoom sessions at 10:30am EST and 3:30pm EST where I review charts for both my portfolios plus my watchlist stocks and explain where & why I started new trading positions or closed out existing ones.