Trading charts for Tuesday, April 11th

In addition to my newsletters and my podcast I also run a stocktwits room where I share content for both my portfolios plus my investment models, market/macro commentary and much more…

Good morning and Happy Monday,

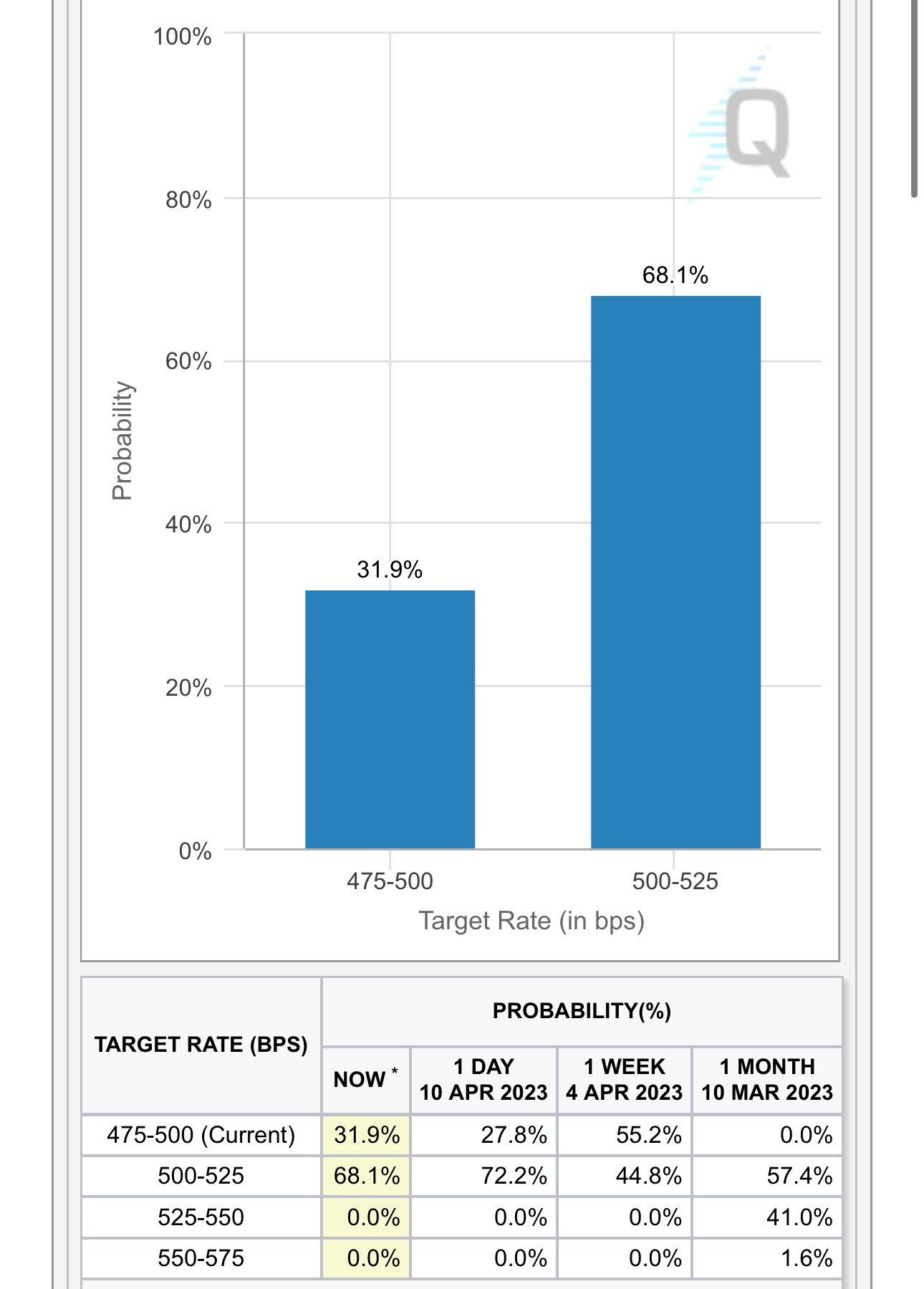

Just a reminder that we get the next CPI report tomorrow morning at 8:30am EST with the estimates currently at +0.2% MoM and +5.1% YoY which would be down from +0.4% MoM and +6.0% YoY. I still believe we’re going to see headline CPI under 3% YoY by end of summer which means the FOMC will probably be cutting at the September meeting however oil/gas prices will need to stay where they are.

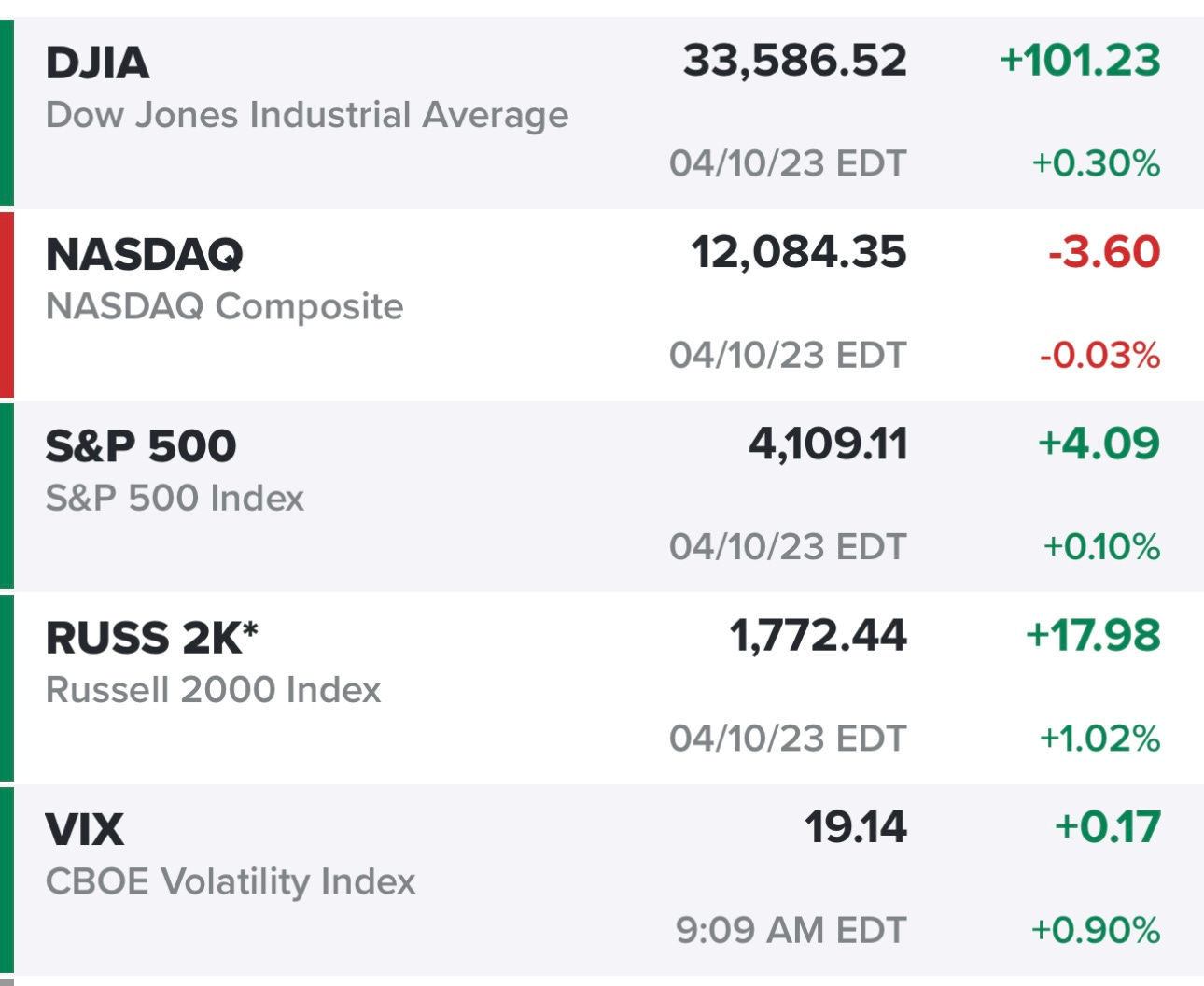

Indexes were mostly flat yesterday, nice bounce off the morning lows but worth noting that small/mid caps were the outperformers. As I discussed on my webcasts yesterday, the Russell has been a dramatic laggard since the February highs in all the indexes so this might be nothing more than a catchup trade. IWM is still 11.7% lower than those early February highs whereas SPY is only down 2% from those early February highs.

Here’s how the individual S&P sectors did yesterday…

Futures looking flat today, we might be in for a boring day ahead of CPI tomorrow…

Yields also flat ahead of CPI tomorrow…

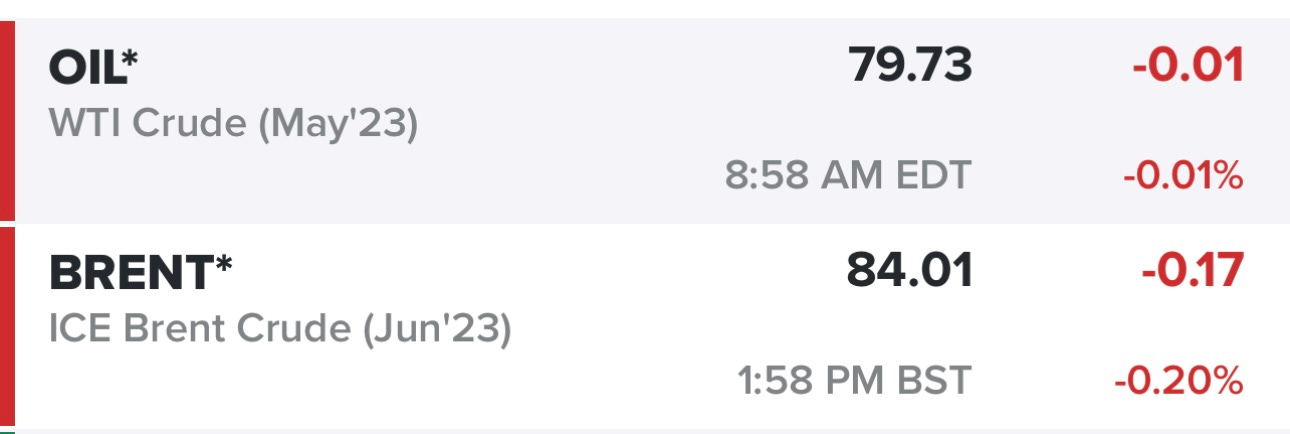

Oil breaking below $80 but still up more than 20% from the recent lows, just as a reminder oil was above $100 last April 11th so being down 20% YoY is still going to help the CPI numbers that we get over the next couple months.

Here’s the probability of “no rate hike” vs “25 bps rate hike” at the next FOMC meeting, will be interesting to see how these numbers change after the CPI report tomorrow.

Below the paywall is my current portfolio (14 stocks) and current watchlist (17 stocks) plus links to my portfolio and daily webcasts.