Trading charts for Thursday, March 30th

I run the largest stocktwits room where I share content all day for both my portfolios…

Good morning and Happy Thursday,

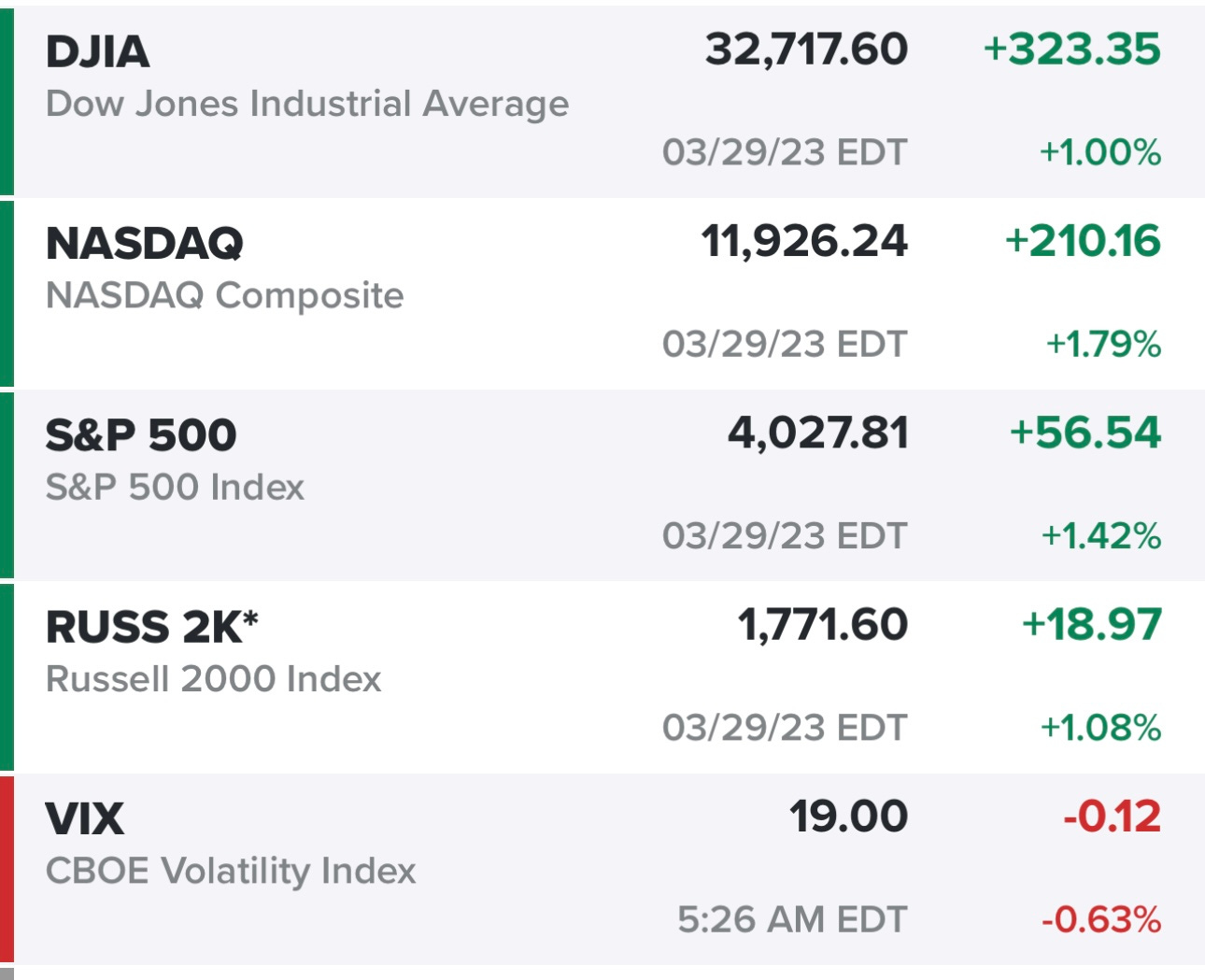

Very nice day for the markets yesterday with tech/growth leading the way…

Bullish looking chart for SPY, bounced off the VWAP from recent highs in the morning then reclaimed the 50d sma…

QQQ is almost back to those February highs, now up 17.5% YTD which means if you were short/underweight tech in Q1 than you’re probably not too happy right now given that most other sectors are flat or down this year…

IWM looks the worst of the major indexes, at the recent lows earlier this week the index had pulled back more than 15% from the January/February highs…

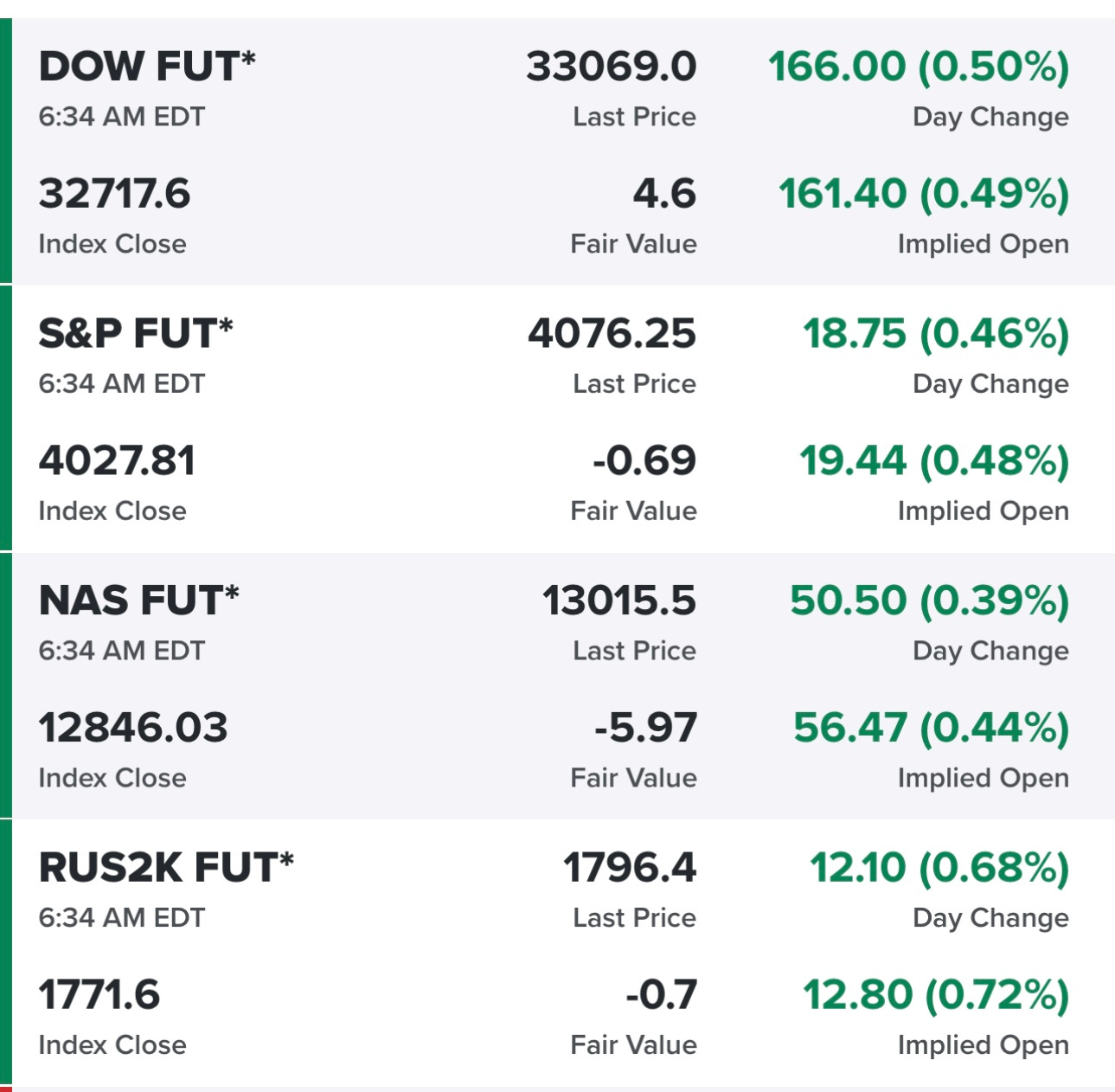

I’ve been up since 5am and the futures have been improving all morning, this is where they were at 6:34am EST…

Another flat morning for yields which is fine with me, the volatility the past couple weeks was quite historic so some stability is much appreciated…

Yesterday the VIX closed right at 19.00 which means it’s down ~40% from the recent highs in the wake of SIVB and SBNY getting seized by the FCIC, going back the past year whenever the VIX has gotten below 19.00 it’s been a good time to start buying as a hedge which is something I might look to do today ahead of PCE tomorrow morning.

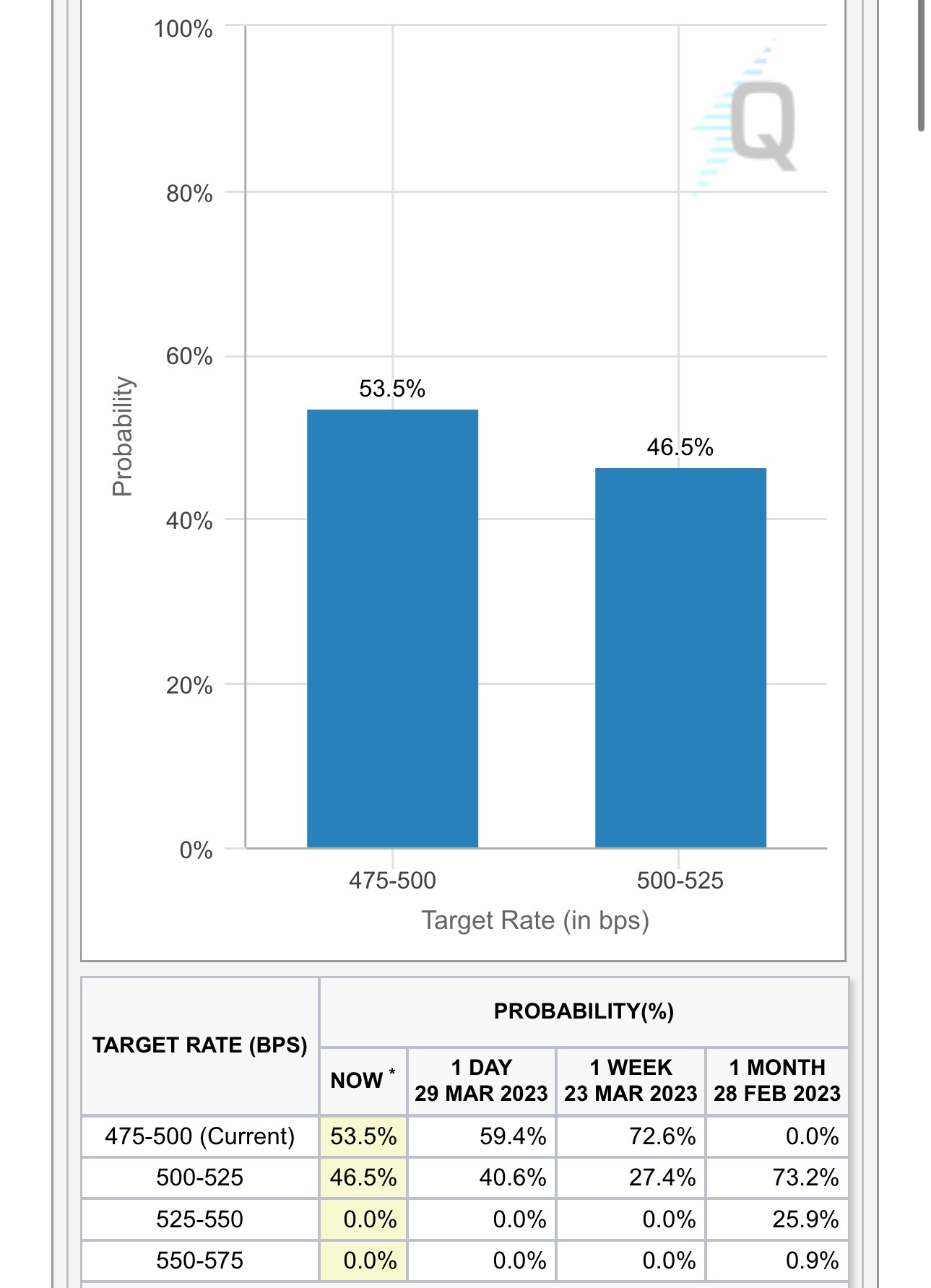

We’re approaching 50/50 odds of no hike vs 25 bps at the next FOMC meeting…

Below the paywall is my current portfolio (4 stocks) and current watchlist (19 stocks), I’m still focusing on the companies with the strongest fundamentals that posted strong Q4 earnings with better than expected guidance which resulted in a big post-earnings gap up and now those stocks have pulled back 10-20% and starting to curl up again on the charts, preferably without too much overhead resistance to get through. I really love the stocks that are now pushing back through the VWAP from those recent highs but I’m also trying to find some stocks that have sold off too much the past 4-6 weeks and could provide a little extra beta if the broad markets are moving higher. There are lots of stocks that look great on the charts but they just don’t have enough beta to make it worth our time and effort. I’m looking for stocks that can move 15-20% in 4-6 weeks if you catch them right.