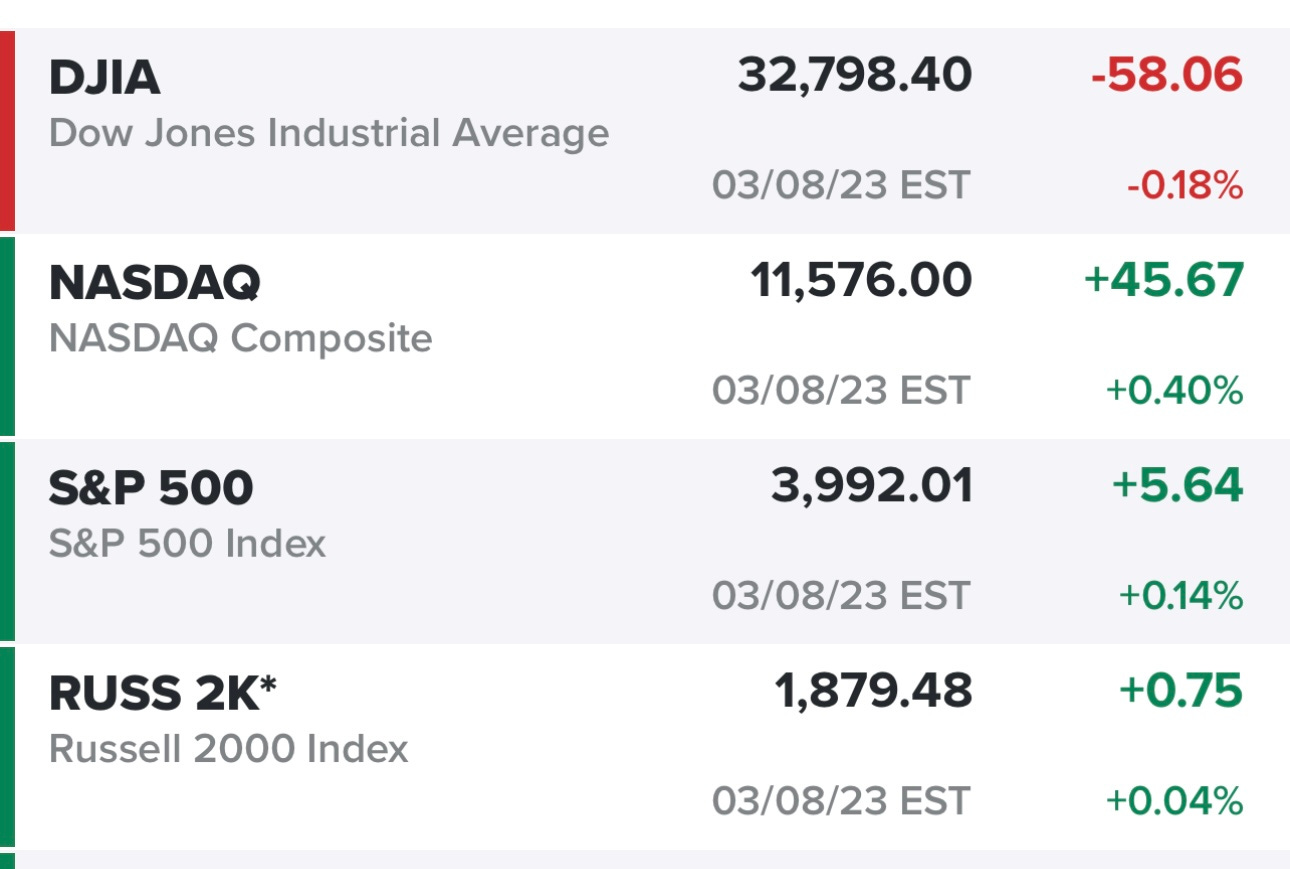

Trading charts for Thursday, March 9th

I have another Substack newsletter called Jonah’s Deep Dives where I publish a weekly deep dive writeup (8,000+ words) on different growth stocks: deepdives.luptoncapital.com

I run the largest Stocktwits room where I post about my investment portfolio and trading portfolio including access to my daily buys/sells, market commentary, investment models, daily webcasts and much more: stocktwits.luptoncapital.com

I run Disciplined Growth Investor on Seeking Alpha which is the combination of all my investment services but all on one platform: seekingalpha.luptoncapital.com

Good morning and Happy Thursday,

The markets looked a little better yesterday despite Powell’s continued hawkish comments in front of Congress. He did say the FOMC has not made any decisions about their next rate hike and that it will depend on the incoming economic/macro data including the jobs report tomorrow and CPI next Tuesday.

The 10Y yield is creeping back to 4%, not surprising with the Fed Funds now expected to reach 5.50% to 6.00% and stay there for a prolonged period of time. However, even though short term rates continue to go higher, it doesn’t mean that longer term rates need to go any higher because the higher the FOMC takes short term rates, the probably for a recession goes up which then increases the chances of slower growth over the next few years which leads to lower inflation and rate cuts. I’ll be looking to get back into TMF pretty soon which is the 3x leveraged TLT, if you wanted a little less beta/volatility then I’d suggest just going with TLT but only if you think the 10Y/20Y yield is topping out.

I saw this post on Twitter last night and it should make you nervous. Not only is money supply contracting but rates are going higher because of inflation all while the economy is likely slowing which leads to lower earnings. This is not an ideal backdrop for risk assets like equities. With all of this to worry about along with the already stretched valuations in the SPX, it’s hard to imagine we see any sort of meaningful rally in SPX unless jobs report and CPI both come in cooler but that just means the FOMC is going a little slower to their terminal rate and doesn’t really get us out of the woods. Personally I think we’re going to be in this sideways/choppy market for the rest of this year and maybe into next year. That’s means it’s not only a stock pickers market but you need to compliment your investing strategy with some trading and options, perhaps even selling some calls and cash covered puts to generate income for your portfolio which is the best way to make money in a sideways market.

I’ll be adding options to my trading strategy/portfolio in the coming days and weeks. If I’m going to be spending 5+ hours per day looking at charts and watching stocks bounce off support levels, VWAPs and moving averages than I might as well play some options on this bounces ie ETSY bouncing off the 200d sma yesterday…

and just like I’ll be looking to buy calls on these meaningful bounces, I’ll be looking to buy puts when stocks get rejected at meaningful resistance levels ie TSLA at the 200d ema a few weeks ago…

FWIW, there’s now a 75.7% chance that the FOMC hikes by 50 bps at their next week, it will be interesting to see what this number looks like after the jobs report tomorrow and CPI next week. It’s either going to 90-100% or 10-20% depending on the data and whether it’s hot or cold.

It’s unlikely that I start any new positions today ahead of the jobs report tomorrow but I’ll keep reviewing the charts just in case I see something too good to pass up.

Below the paywall is my current trading portfolio (17 positions, ~56% invested) and watchlist (13 stocks with charts) including a link to my trading portfolio spreadsheet (with entry prices, position sizes, stop losses, win/loss rates). You also get links to my two daily Zoom sessions at 10:30am EST and 3:30pm EST where I review charts for both my portfolios plus my watchlist stocks and explain where & why I started new trading positions or closed out existing ones.