Trading charts for Thursday, April 13th

In addition to my newsletters and my podcast I also run a stocktwits room where I share content for both my portfolios plus my investment models, market/macro commentary and much more…

Good morning and Happy Thursday,

In case you haven’t heard yet, CPI came in yesterday slightly below estimates at +0.1% MoM and +5.0% YoY versus estimates of +0.2% MoM and 5.1% YoY. The markets initially rallied off the report and we saw lots of green in the morning session however we started fading and than the selling accelerated after the FOMC minutes came out showing the Fed is expecting a light recession later this year.

PPI just came in much lower than estimates at -0.5% MoM which brings the YoY number down to +2.7% — https://www.bls.gov/news.release/ppi.nr0.htm

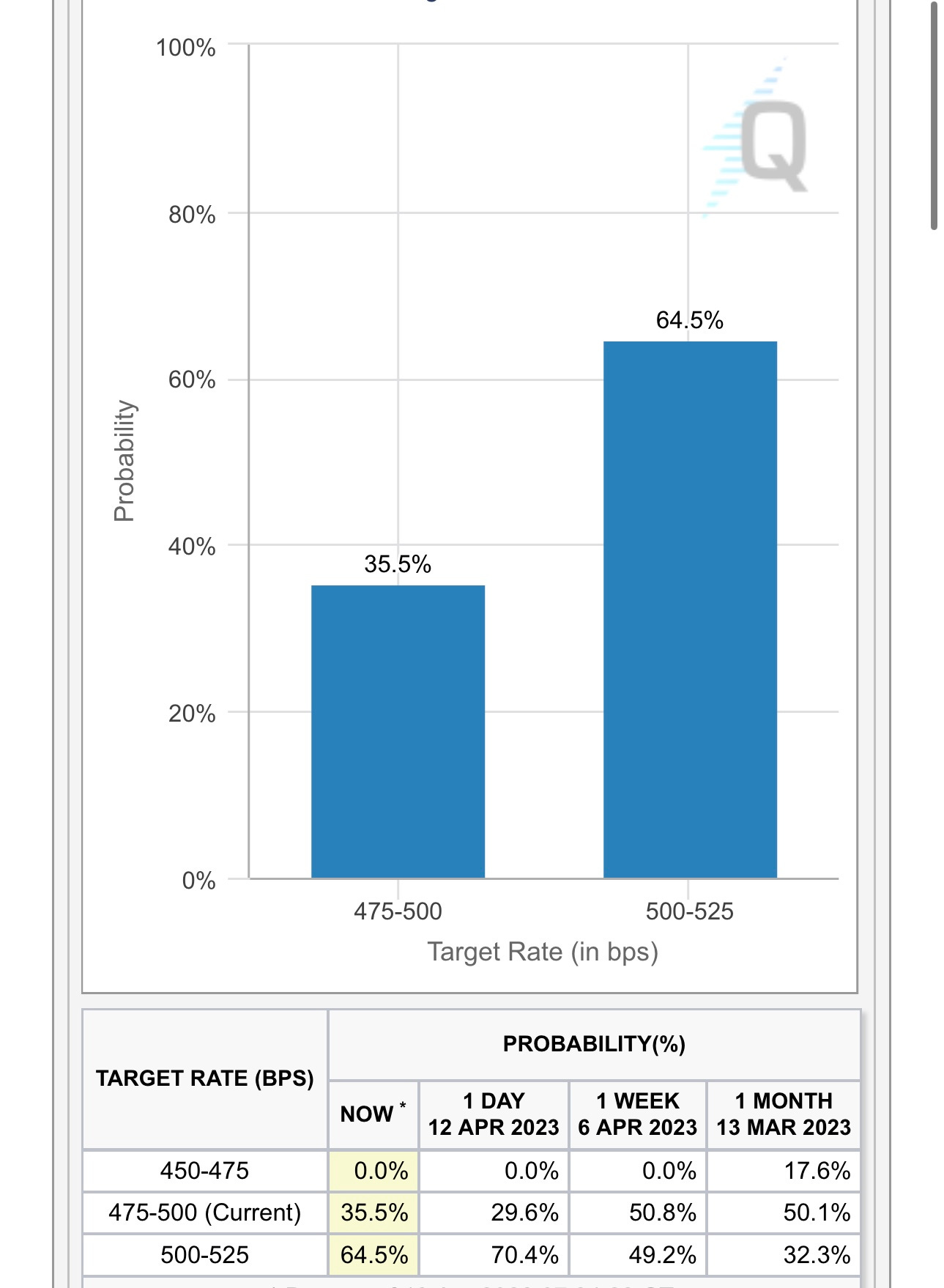

CME fed watch chart still showing at least one more rate hike before a pause and than we could get a pivot in the second half of this year. Let’s see if this number changes throughout the day as the bond markets digest a cooler CPI yesterday and cooler PPI today.

I’m on the record as saying we’ll see headline CPI below 3% YoY by end of summer which means the FOMC might be cutting as soon as September although I’m sure they’ll try to hold rates above 5% for as long as possible. Powell and his posse talk about the lag effects for previous rate hikes plus the credit tightening that will ensure from the banking issues plus they’re still doing QT — add it all up and there’s zero reasons for the FOMC to continue hiking but they seem hell bent on hiking until something else breaks. I used to respect Powell, now I just think he’s a dope and rather than try to navigate a soft landing he’s going to create another mess that needs to get fixed with lower rates… rinse and repeat.

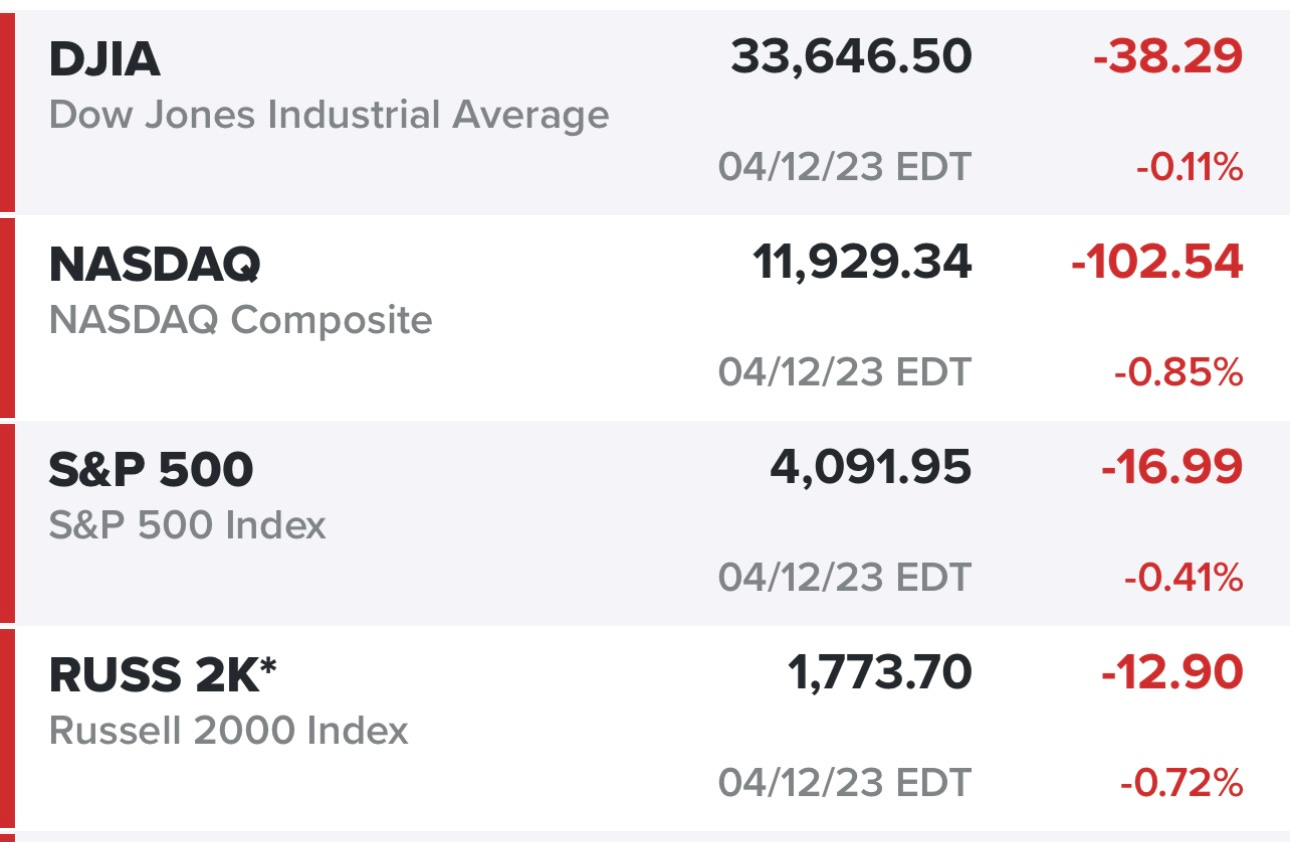

Here’s how the markets finished yesterday… the Nasdaq closed 250+ points lower than the pre-market highs :(

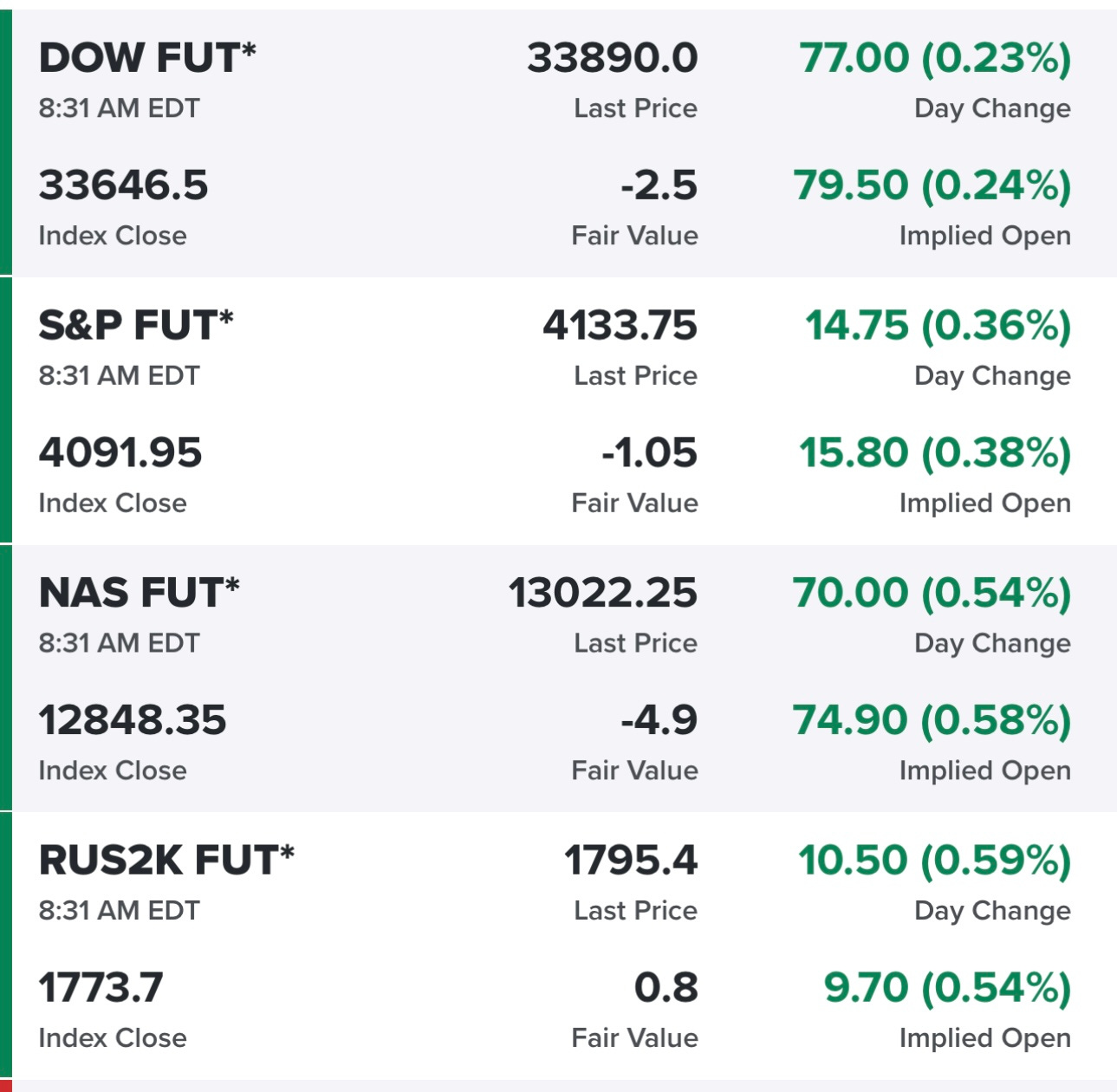

Equity futures up…

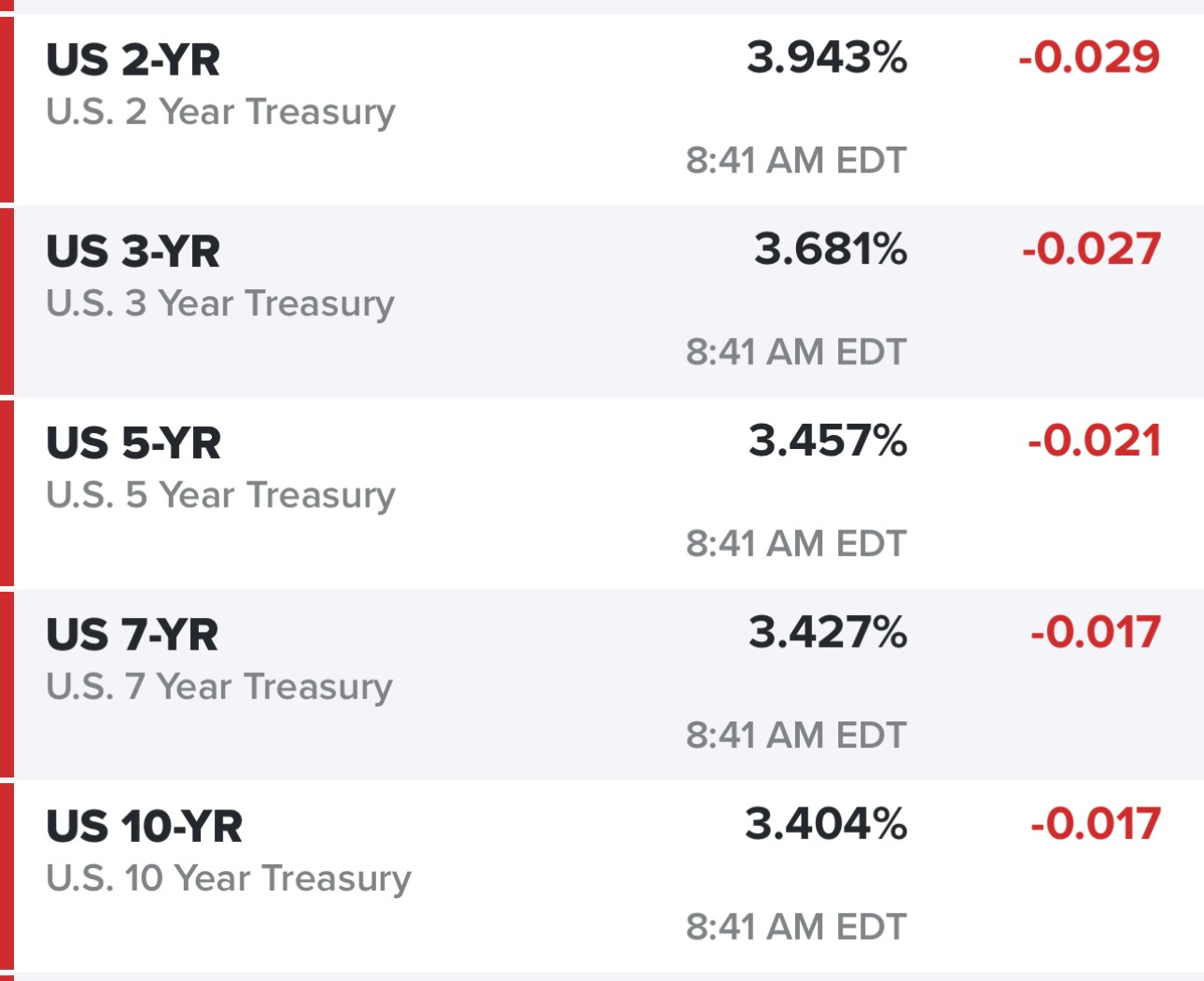

Yields down slightly…

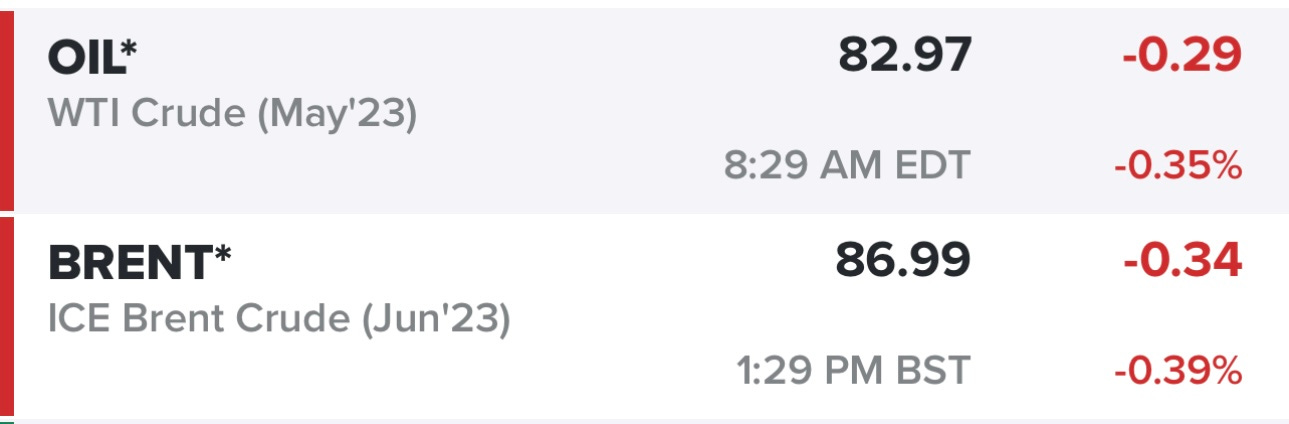

Oil still holding above $80+ which makes me more bullish on energy stocks…

Yesterday morning we saw lots of stocks starting to breakout and push through prior resistance but then the sellers came in and 95% of these stocks reversed, some by 5% or more like SHOP TTD PLTR etc with lots of very ugly closes. As I scanned through 100+ charts last night and this morning there are very few that didn’t have a big red candle from yesterday which certainly doesn’t give me that fuzzy warm feeling like it’s time to get aggressive in my portfolio. This market should have had a better reaction to that CPI report yesterday, the fact it didn’t hold the gains just proves this market is still too choppy to trade and therefore I’d rather be more patient. Lots of stocks I’m watching did pullback to some support areas yesterday afternoon ie 10d ema, 21/23d ema, 50d ema, etc but now we need to see if they hold up today and tomorrow. I’m still tracking the stocks that had the best reactions to Q4 earnings with better than expected 2023 guidance and now waiting for those stocks to pullback to where I can buy them while managing risk and keeping my stop losses under 2% from my entry price.

If you like buying breakouts than you’re not going to find too many setups today. If you like buying potential market leaders on pullbacks than things are looking a little more attractive today. However with that said, buying stocks on a pullback to the 50d sma/ema (my favorite) only works if they hold/bounce and if the broad markets are moving higher. It’s too hard to make money in a down-trending market so that’s when you want to be sitting on cash and waiting for the next uptrend.

Below the paywall is my current portfolio (12 stocks) and current watchlist (18 stocks) plus links to my portfolio and daily webcasts.