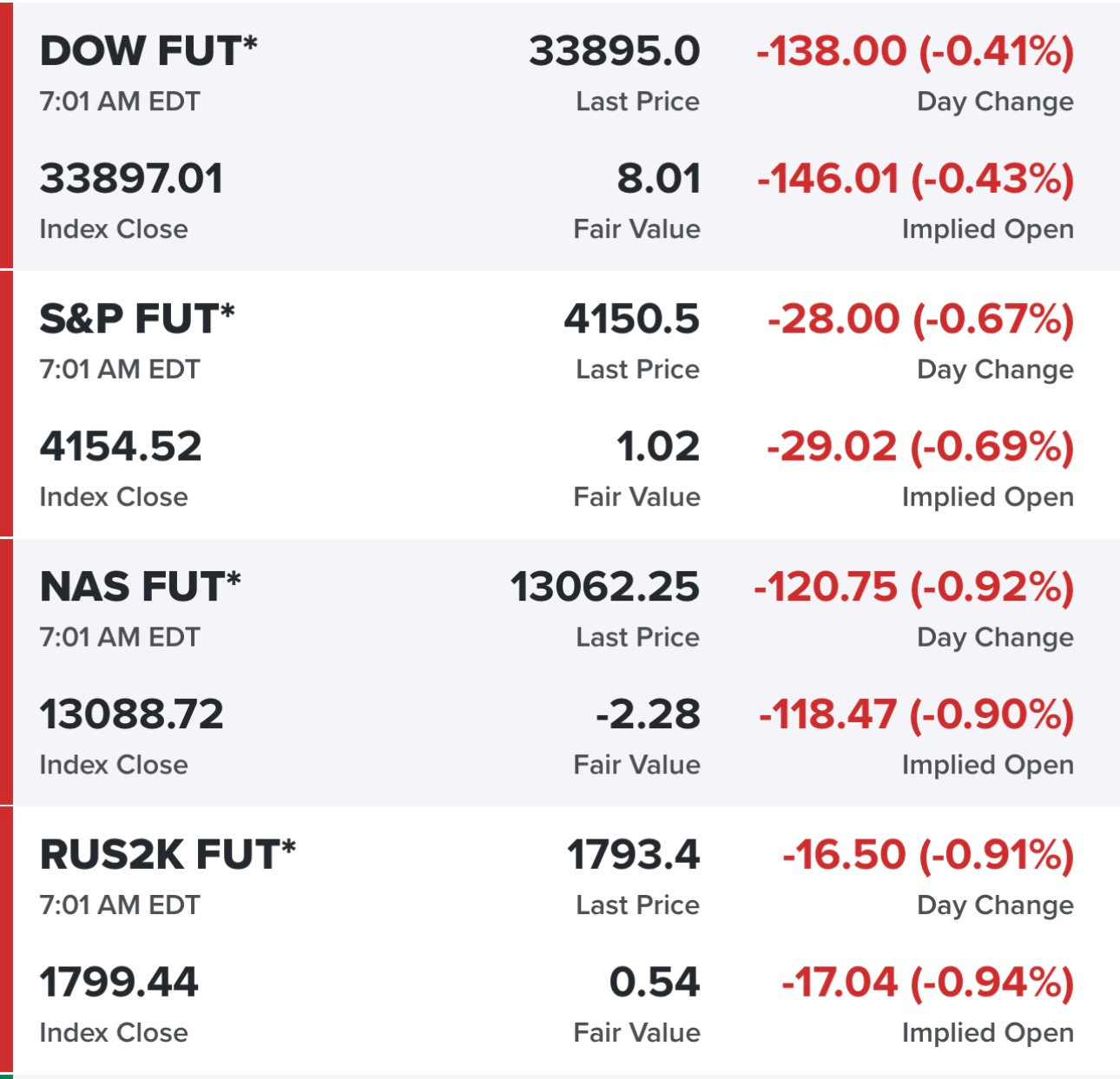

Trading charts for Thursday, April 20

In addition to my “Trading the Charts” newsletter, here are some other newsletters that I publish plus my Investing with the Whales podcast and my Stocktwits room.

I also run a Stocktwits room where I’m very active throughout the day, you can join by clicking on the buttons below:

Good morning and Happy Thursday,

I’m visiting my parents on Cape Cod today so I’m not planning to be very active in my trading portfolio unless we see some big pullbacks and attractive setups/bounces. I have 60% exposure right now which feels appropriate given macro + earnings season. Most of the companies that I’m trading don’t report for another 2+ weeks but you still want to be mindful that you’re not holding into earnings with a small profit cushion unless you have really strong conviction. It’s worth noting this is just my mindset/strategy with my trading portfolio, in my investment portfolio I almost always hold into earnings because these are stocks I’m planning to hold for 12+ months and typically add on pullbacks as long as fundamentals remain strong and valuation remains reasonable.

I’m willing to trade this market but still keeping position sizes smaller, I just don’t see any significant catalysts on the horizon that will take the markets higher (not including selective stocks with their own individual stories) plus valuations are not very attractive (not including individual names). You could not pay me to own SPY or QQQ are current levels but I’m willing to own some select names inside those indexes that still look attractive with considering fundamentals and technicals.

Equity futures are looking rough, partly because of TSLA and partly because investors are probably worried about earnings season. I think it will be a decent earnings season but I’d be shocked if it’s good enough to push the SPX through 4300

Yields up slightly in the past week…

Below the paywall is my current portfolio [15 stocks] and current watchlist [16 stocks].