Trading charts for Monday, March 6th

I have another Substack newsletter called Jonah’s Deep Dives where I publish a weekly deep dive writeup (8,000+ words) on different growth stocks: deepdives.luptoncapital.com

I run the largest Stocktwits room where I post about my investment portfolio and trading portfolio including access to my daily buys/sells, market commentary, investment models, daily webcasts and much more: stocktwits.luptoncapital.com

I run Disciplined Growth Investor on Seeking Alpha which is the combination of all my investment services but all on one platform for simplicity: seekingalpha.luptoncapital.com

Good morning and Happy Monday,

I hope everyone had a good weekend. Sorry there was no newsletter or webcasts on Friday. I needed a day away from the computers and screens.

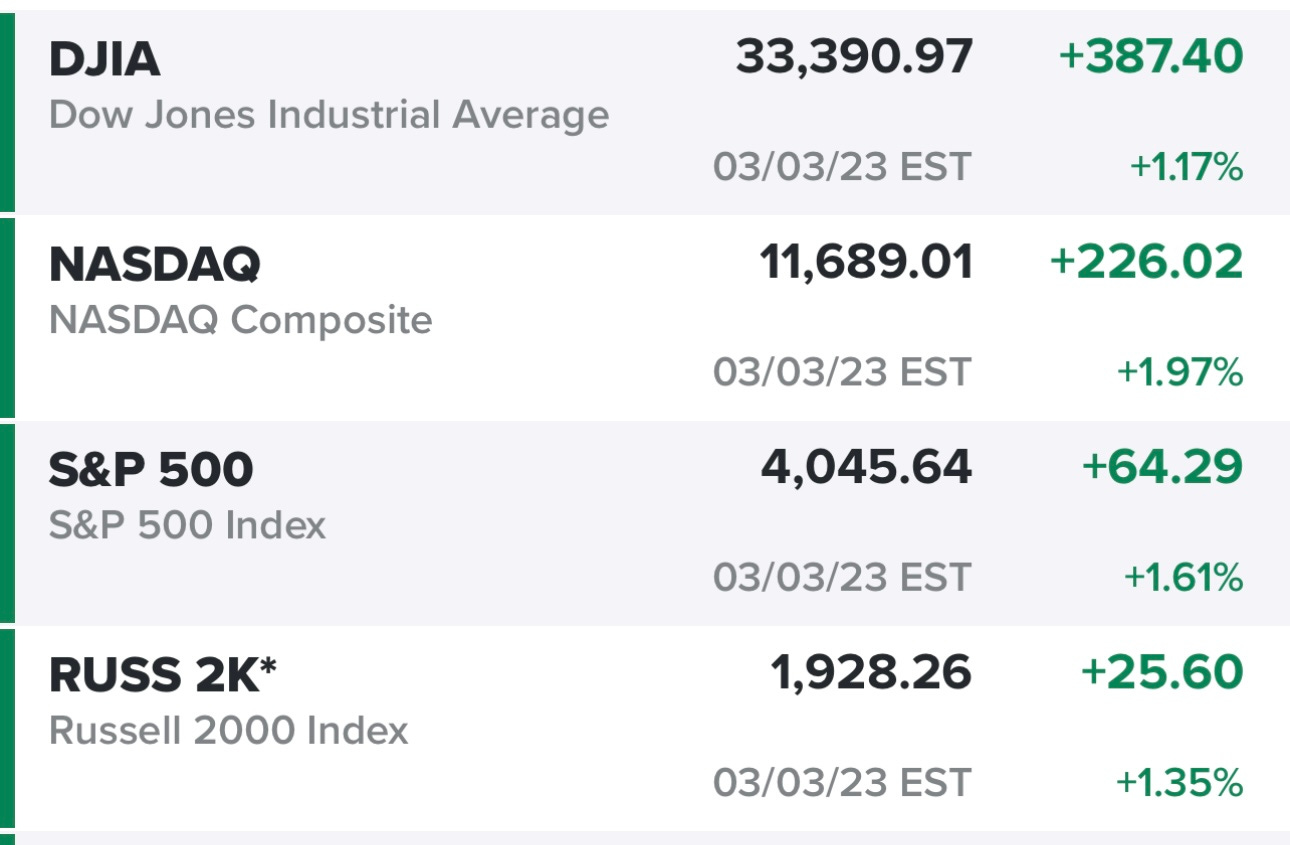

Both SPY and QQQ finished the week strong after testing their 200d sma on Thursday as you’ll see on the charts below. Both look pretty bullish right now so it’s “risk on” in my trading portfolio hence why I’m 80% invested coming into today although raising my stop losses accordingly.

Here is spy bouncing off the 200d sma last Thursday, now needs to get through the 20d sma and VWAP from the early February highs.

Here is QQQ which also bounced off the 200d sma last Thursday then got rejected at 20d sma on Friday but still finished near highs of the day. QQQ also needs to get through the VWAP from recent highs.

We’re definitely through the heart of earnings season but still have a few more noteworthy companies reporting this week ie CRWD SE ULTA DOCU and ORCL.

Next payroll/jobs report is Friday, March 10th [click here].

Next CPI/inflation report is Tuesday, March 14th [click here].

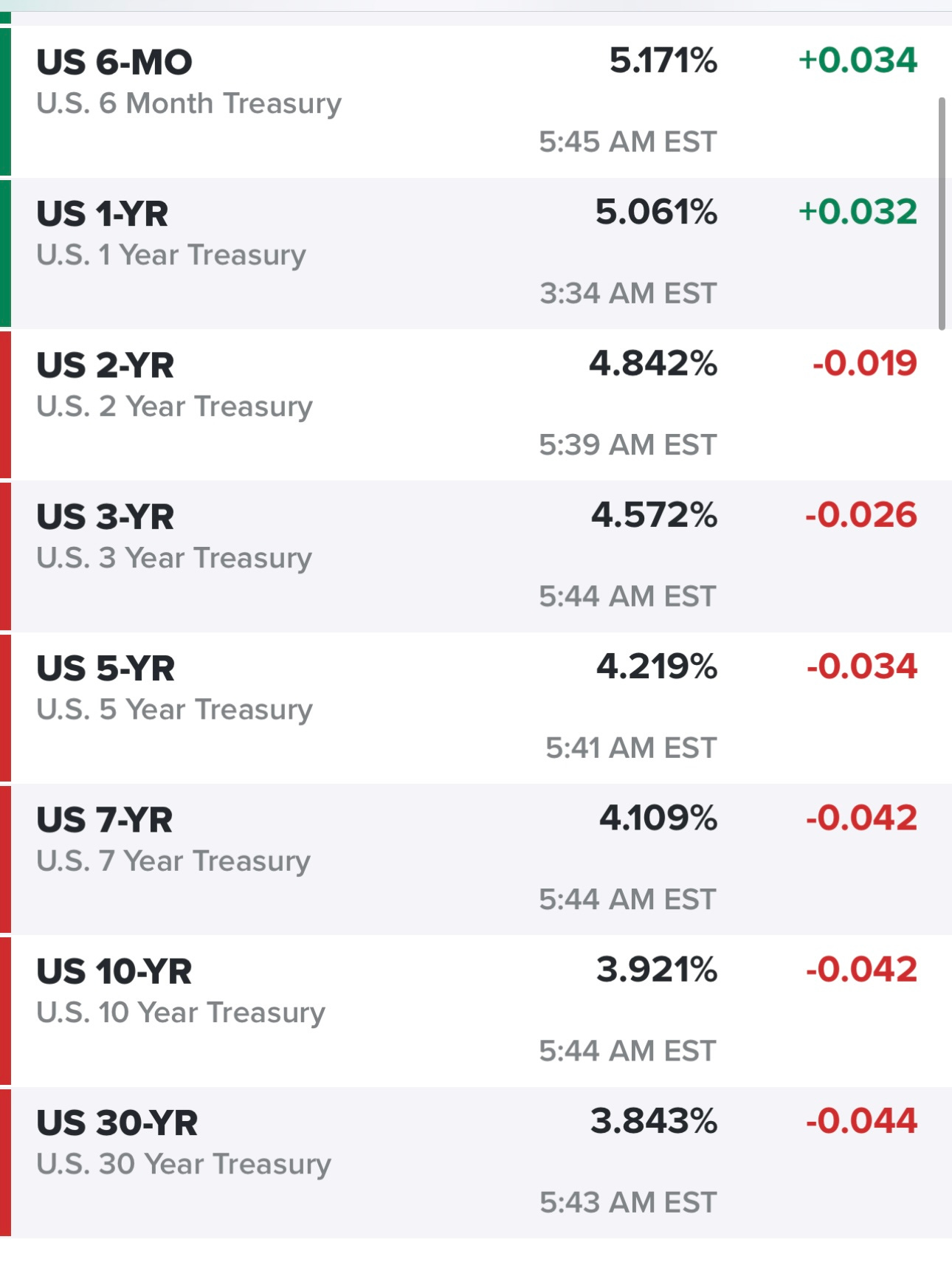

10Y yield has been down the past few sessions after hitting 4.09% last week, down again this morning as of 5:30am EST with the equity futures flat. It’s not a coincidence that equites started rally last Thursday and Friday as yields retreated. This is something we need to keep watching along with the macro because both still have the potential to be headwinds for equities but I still think we could see inflation under 3% YoY by year end, I thought it would happen this summer until the BLS/FOMC changed the CPI composite coming into 2023. They pushed back my timeline for inflation coming down to the FOMC target of 2%.

Below the paywall is my current trading portfolio (20 stocks, ~80% invested) and watchlist (20 stocks with charts) including a link to my trading portfolio spreadsheet (with entry prices, position sizes, stop losses, win/loss rates). You also get links to my two daily Zoom sessions at 10:30am EST and 3:30pm EST where I review charts for both my portfolios plus my watchlist stocks and explain where & why I started new trading positions or closed out existing ones.