Trading charts for Monday, March 27th

I also run the largest Stocktwits room where I share both of my portfolios, daily activity, investment models and much more. You can signup with the link below:

Good morning and Happy Monday,

In you forgot, the indexes squeaked out some small gains on Friday but they did spend half the day in the red…

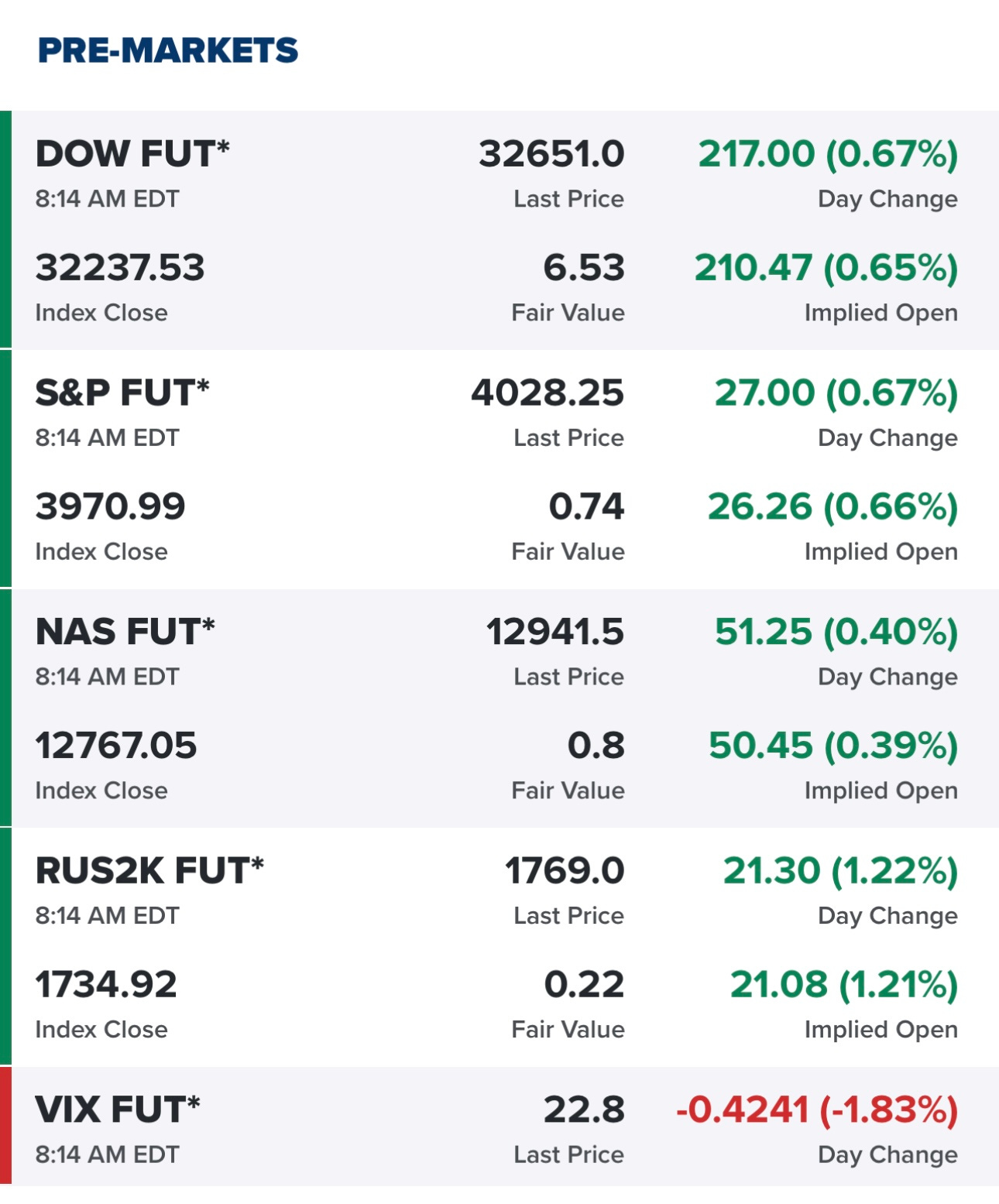

Pre-markets are looking pretty good this morning…

In case you missed it, First Citizens Bank has agreed to buy Silicon Valley Bank’s loan portfolio and deposits but not their investment securities which is where the unrealized losses are sitting. This announcement is helping the regional banks this morning with the KRE (regional bank ETF) up +3.7% pre market.

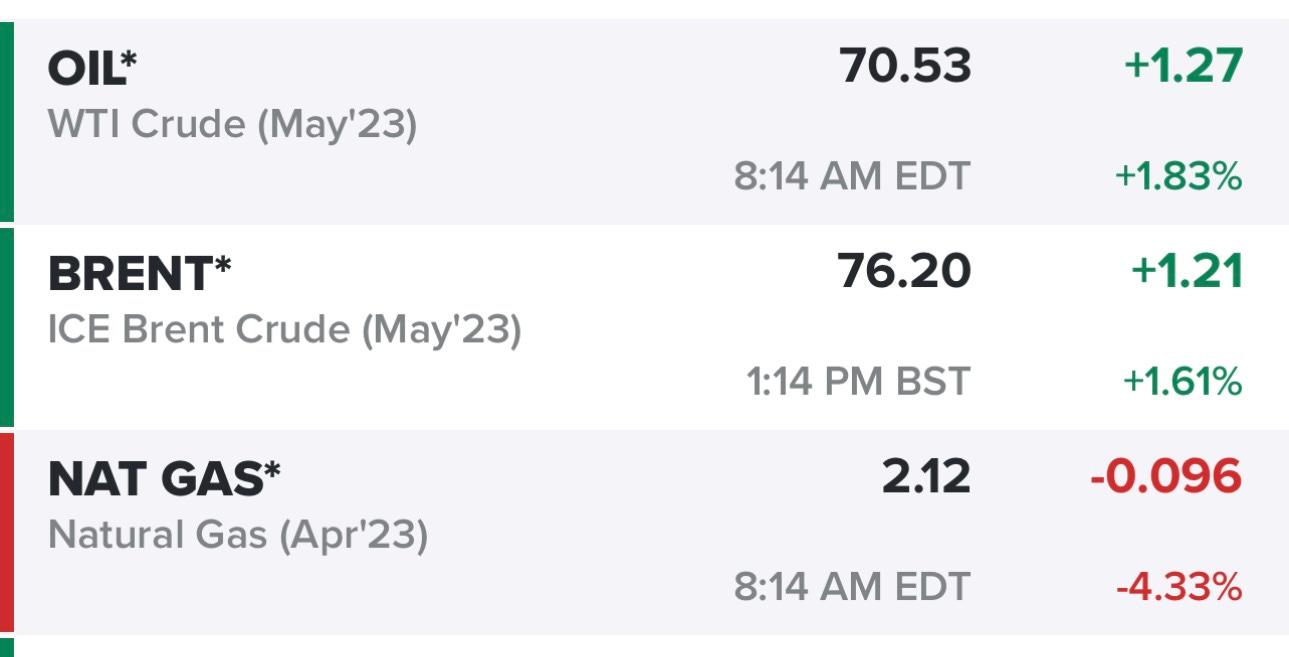

Oil is back above $70…

Yields are higher this morning which could mean several things including “risk on” or investors selling Treasuries today because they are worried about higher rates which hurts prices

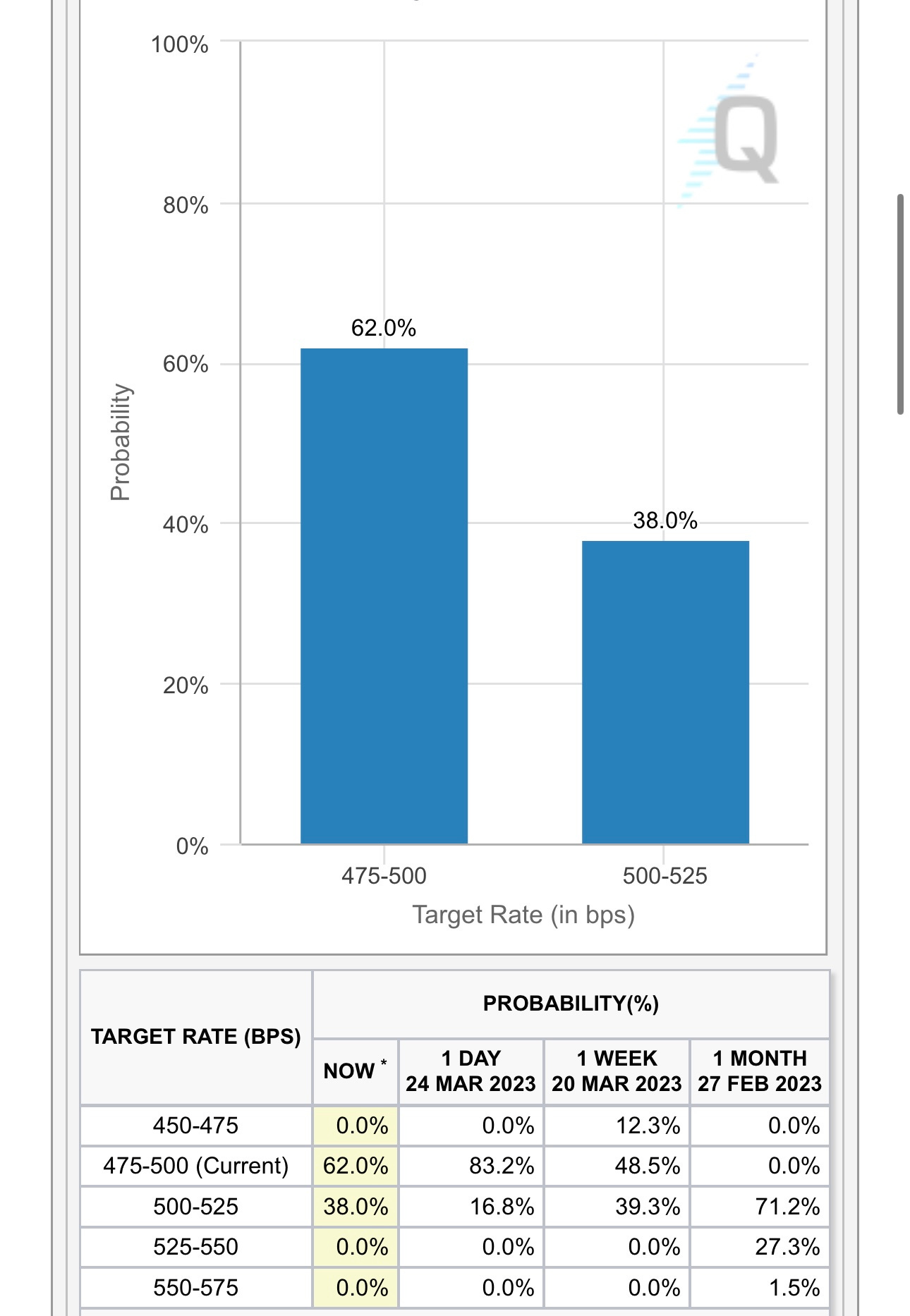

The probability of getting another 25 bps at the next FOMC meeting in May has increased from 17% on Friday to 38% today. If we continue to see stabilization in the banking sector and a decent economy/markets then this likelihood will continue to rise however it’s very possible the FOMC has already gone too far. The clowns at the FOMC are dictating monetary policy based on backwards looking data and not taking into account the lag effects of 475 bps of rate hikes plus the credit tightening that will most definitely ensue from the current bank failures and falling consumer sentiment.