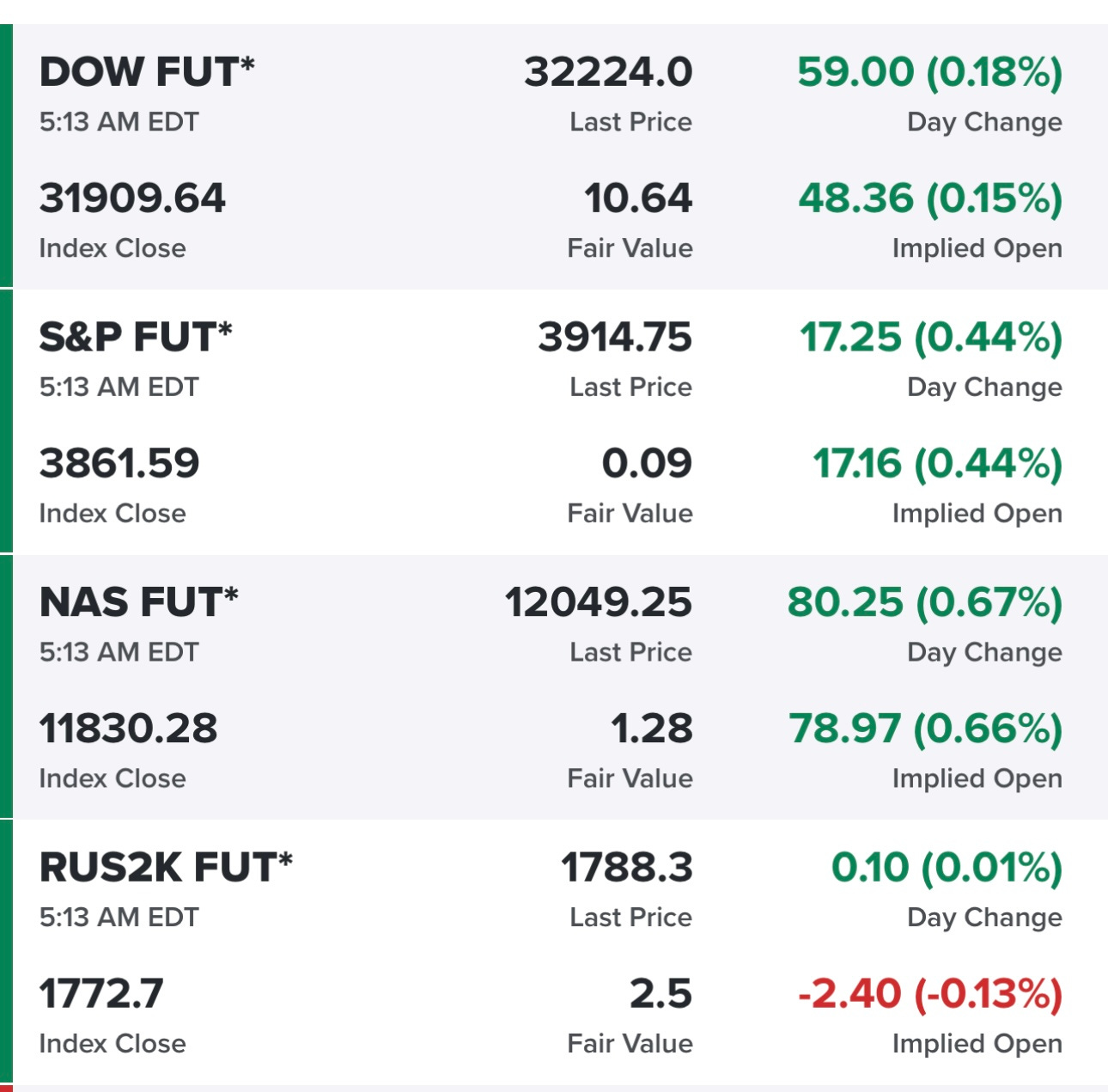

Trading charts for Monday, March 13th

Good morning and happy Monday,

It’s currently 4am EST and I wasn’t able to stay asleep so I’m just going to start putting together my morning newsletter. If you’ve been following this SIVB (Silicon Valley Bank) drama the past few days on twitter or in the finance/investment blogs than you probably had a good idea of what’s going on but I’ll try to break it down in a paragraph in case you have no idea what I’m talking about.

SIVB was seized by the FDIC on Friday and then backstopped by the US government on Sunday. This all started a few years ago when the startup and venture capital industry was at it’s peak and many of those founders and businesses turned to Silicon Valley Bank. Because of this (plus all the new money pushing into the banking system during the pandemic), SIVB watched their deposits explode from $60B in 2018 to $190B in 2021. Since they weren’t able to lend all this money out (that’s typically how banks make their money — on the spread) they decided to invest those deposits into income generating assets like treasuries and mortgages. This would allow them to increase their NII (net interest income) to make shareholders happy. This is all somewhat normal however once the FOMC started hiking rates those treasuries and mortgages started to lose their value. Since they were purchased when rates were historically low, as the FOMC hiked rates those lower rate securities have to adjust accordingly. Let’s say you buy a 5-year treasury with a 2% coupon/yield. Now it’s 18 months later and the FOMC has hiked rates so much that now you can buy a 5-year treasury with a 4% coupon. That means the treasury you bought 18 months ago is now worth significantly less because the YTM needs to be comparable to current yields so maybe it’s trading at $94 versus the $100 you bought it at (or perhaps you paid a premium for this treasury so you cost basis is above $100). Now do this across a massive treasury & mortgage portfolio and this is why SIVB had to recognize $1.8 billion of losses last week when they sold some assets. They needed to sell them because deposits were dwindling and they needed the liquidity. They tried to do a capital raise at the same time but it fell apart because as they announced it, too many customers started pulling their deposits in fears that SIVB might not be solvent at some point. Then the capital raise fell apart which did in fact mean that SIVB was no longer solvent because the rest of their $100B investment portfolio was also sitting on unrealized losses which would not have mattered (because they could have held until maturity) but the “bank run” on deposits accelerated this process and forced them into recognizing these losses. I partly blame the FOMC for their horrendous monetary policy the past years. I partly blame the SIVB investment and risk management teams for not hedging their rate/duration risk. I partly blame the OCC, FDIC and other regulators for being asleep at the wheel and allowing SIVB to get over-leveraged on longer-duration rate-sensitive assets.

The collapse of SIVB could have been avoided if SIVB had operated more prudently the past few years and if the “run on the bank” last week hadn’t been sparked by a handful of VCs and large twitter accounts. It’s very unfortunate that it happened but also breathtaking at the speed in which this happened. I was working in the investment industry during the Great Financial Crisis and even Bear Stearns, Lehman and Washing Mutual didn’t fail as fast as Silicon Valley Bank.

On a similar note, Signature Bank also went into FDIC receivership over the weekend which means they’ve also failed and stock/bond holders are going to $0. However similar to SIVB, the FDIC and US government are providing a backstop to make sure that depositors get all their money back.

On top of all of this, now we get CPI tomorrow morning, PPI on Wednesday morning and the next FOMC meeting on March 22nd.

With regards to CPI, the estimates are for 6% YoY versus 6.4% YoY for January data and then 0.4% to 0.5% for the MoM number. Here’s a link to all this data [click here]

Going into last Wednesday there was a 75% chance the FOMC would hike by 50 bps at their next week and a 25% chance they’d do 25 bps. Now fast forward to this morning and now there’s a 0% chance they do 50 bps, an 82% chance they do 25 bps and 18% chance there is no hike at all. Quite the drastic chance from just 5 days ago. If you follow the history of the FOMC, they tend to leave rates too low for too long and then raise them too fast and leave them too high for too long, and often times they only stop hiking when something breaks and over the past week we’ve seen 3 banks fail, one of which was a top 20 bank in the country (SIVB). Here’s the data for the Fed Funds monitoring forecast tool [click here].

Last night when we got the announcement that the FDIC, Treasury, etc would backstop SIVB and SBNY for depositors we saw the futures rip higher (Dow futures were up 250 points). Then when Goldman Sachs said they didn’t think the FOMC would hike rates next week we saw the futures rip even higher (Dow futures were up 400+ points) but now it’s 5:20am and those futures are fading hard.

Just in case this wasn’t enough to take in, we also have yields crashing this morning with the 2Y at 4.3% and the 10Y under 3.6% — this means the 2Y yield is down 75+ bps in the last few days which is a very big move. The 2/10Y curve is still inverted but now it’s only 70 bps and not 100+ bps like last week.

Given all of this chaos with bank failures, CPI reports, yields crashing and the uncertainty about the FOMC next week I’m not planning to do any trading today which means it would be pointless for me to spend the next 90 minutes looking at charts and trying to find the best 10-20 charts. This is not a healthy market, it might work for some day trading but that’s not what I want to do. I want to hold positions for days & weeks, not minutes or hours. Trading with FOMO is something we all need to avoid and right now it feels like doing nothing is the best decision.

I’ll still be on Zoom today at 10:30am so we can look at some charts together but I won’t be starting any new positions ahead of CPI tomorrow.

Have a great day!!

~Jonah