Trading charts for Monday, April 3rd

I run the largest stocktwits room where I share content all day for both my portfolios, my investment models, market/macro commentary and much more…

Good morning and Happy Monday,

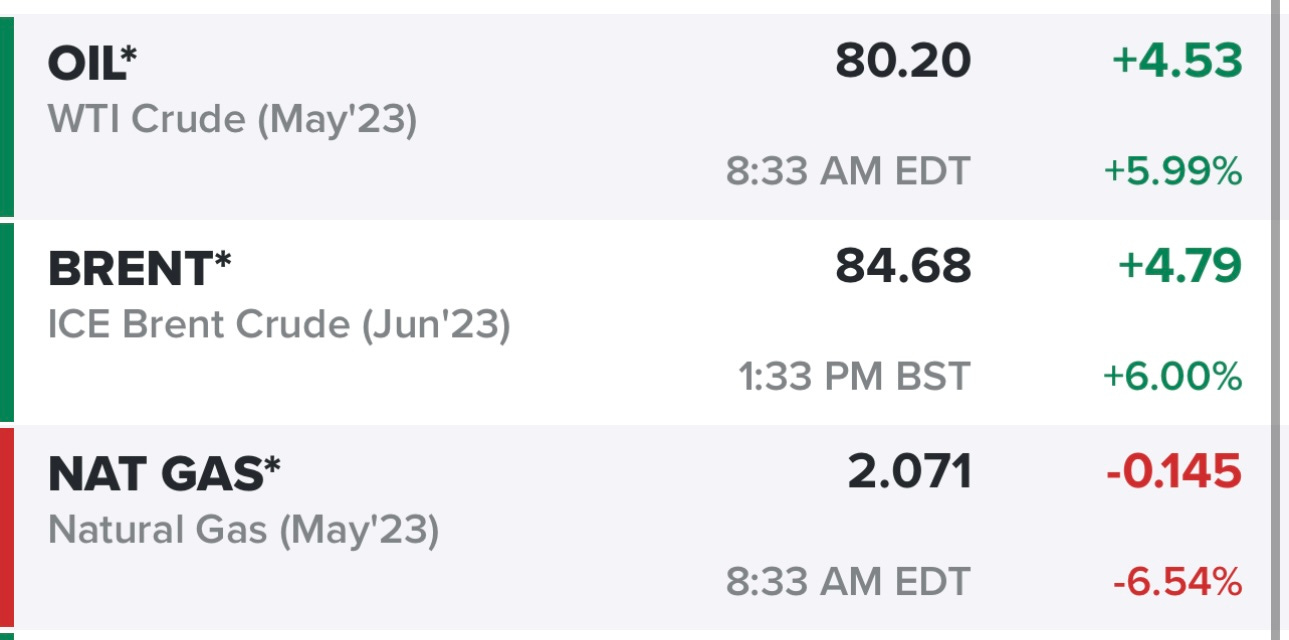

The big news today is that OPEC is cutting production by approx ~1.3 million barrels per day which is sending oil prices higher this morning and thus the energy stocks should have a very good day.

Most energy stocks are are coming off a bad Q1 in terms of performance so they might be setting up for a good Q2. When we get to the end of Q2 in ~12 weeks I’m curious to see how the following trade would have worked out… long energy, short tech

Bonds are muted this morning, looks like the 10Y yield has settled into that 3.5% area…

Equity futures are mixed, it’s a little weird to see the Dow futures up 100+ points and Nasdaq futures down 100+ points but the Dow has CVX (energy stock) and Nasdaq is coming off a very strong week/month/quarter. Personally I think we could see the Nasdaq pullback a little bit, perhaps the S&P outperforms in Q2.

We get the next payroll/jobs report this Friday (April 7th) and the CPI report next Wednesday (April 12th). Both of these could influence the FOMC and whether they hike at their next meeting in May.

There were so many amazing setups/charts last week, I regret not being a little more aggressive in my trading portfolio but now it looks like many of those stocks could be short term overextended and therefore pullback into their 5/6/7d moving averages where we can buy them again or add to existing positions.

As I went through the charts this morning I was looking for stocks that might be on the verge of breaking out as well as reclaiming important resistance spots like the 50d, 200d or the VWAP from recent highs. I’m seeing a handful of stocks that fit this criteria.

Here’s a stock screener I ran this weekend, looking for profitable companies with strong fundamentals…

Below the paywall is my current trading portfolio (14 stocks) and current watchlist (20 stocks).