Trading charts for Monday, April 10th

In addition to my newsletters and my podcast I also run a stocktwits room where I share content for both my portfolios plus my investment models, market/macro commentary and much more…

Good morning and Happy Monday,

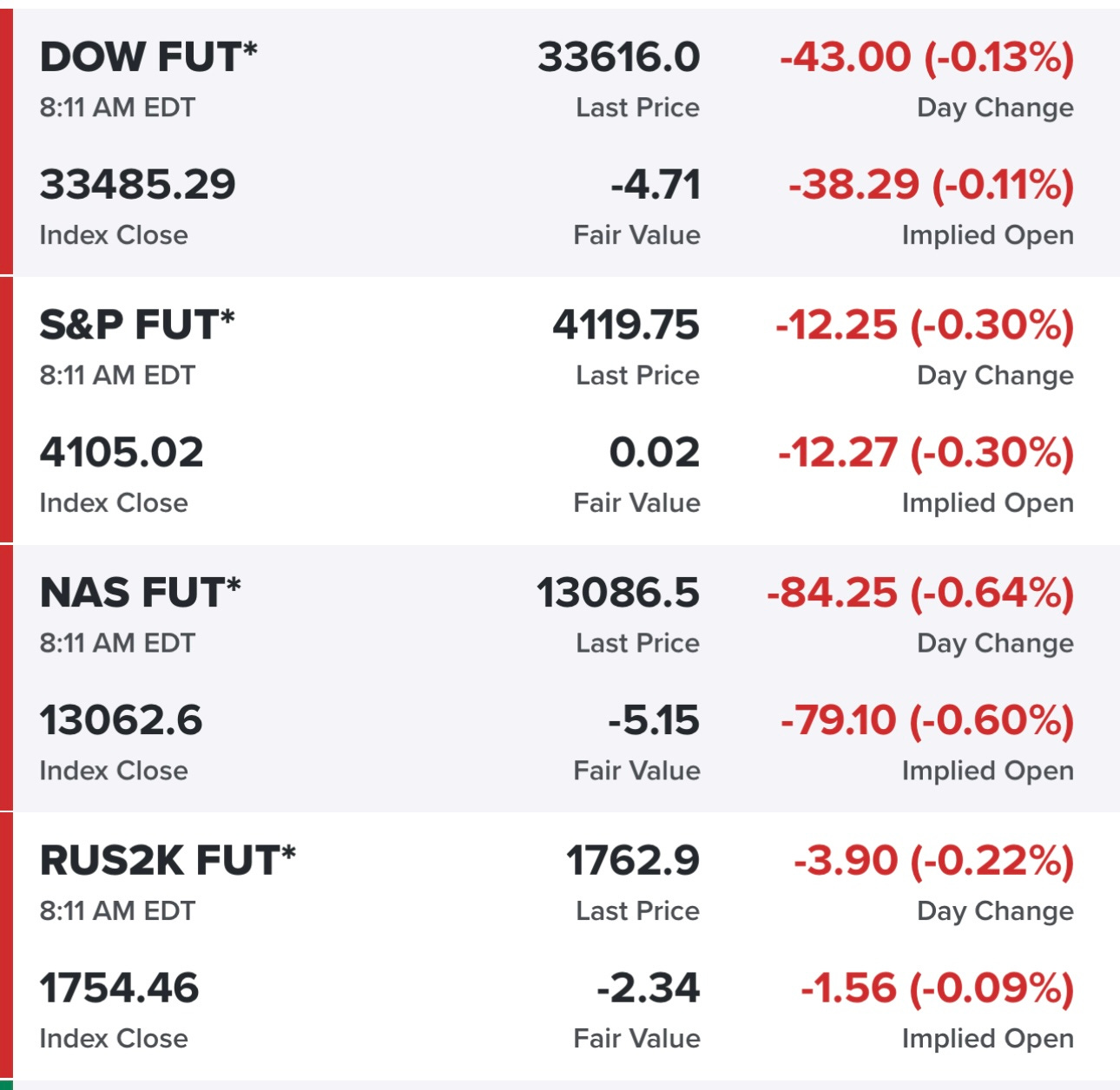

Hope everyone had a nice weekend. In case you missed it, we got the jobs report on Friday morning which were essentially inline with estimates (+236,000 added in March) with the unemployment rate actually dropping to 3.5% and wages up 4.2% YoY. Futures were up slightly a couple hours ago but have been getting worse throughout the morning…

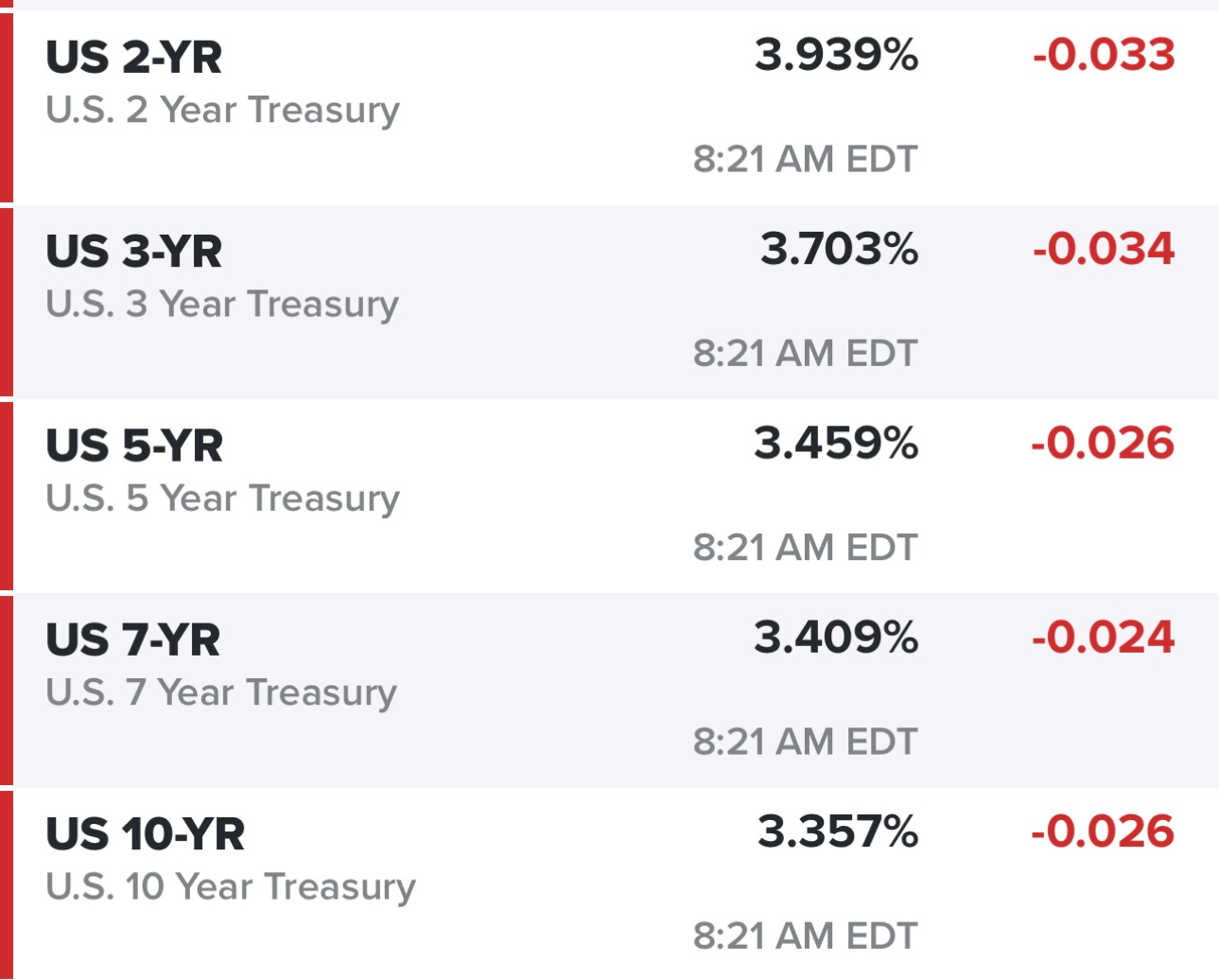

Yields are down slightly this morning but remember we get the next CPI report on Wednesday morning at 8:30am so things can change quickly. Either way the 2/10 yield curve is still inverted by 50+ bps which probably means recession but not sure when. Depends on economic activity, employment and whether the FOMC is willing to take their foot off the gas pedal. We all study the fundamentals and technicals but nothing matters as much as the FOMC and their balance sheet ie net liquidity…

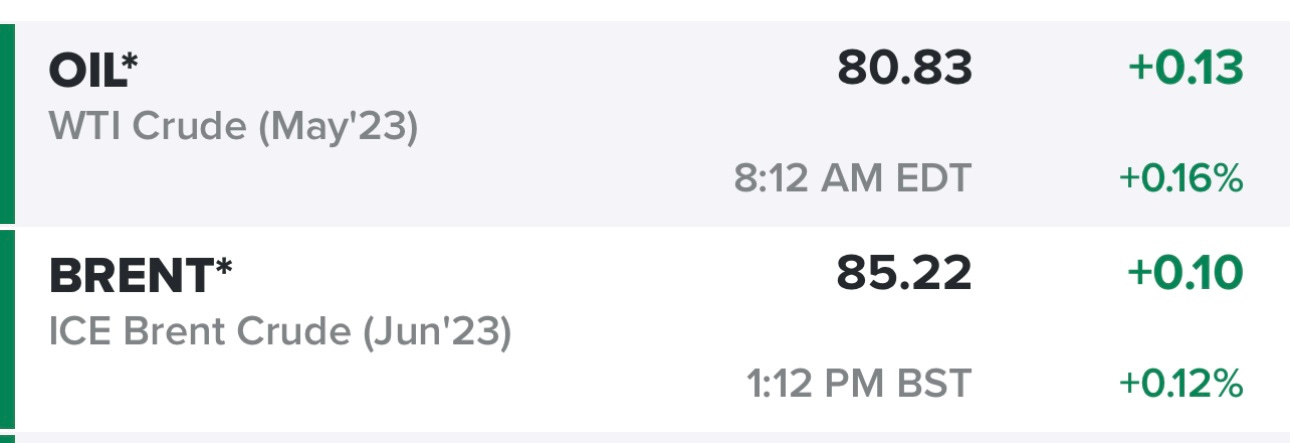

Oil still holding that $80 line… plus we got news over the weekend that XOM might be looking to acquire PXD which could be a $50-60 billion deal (maybe more)…

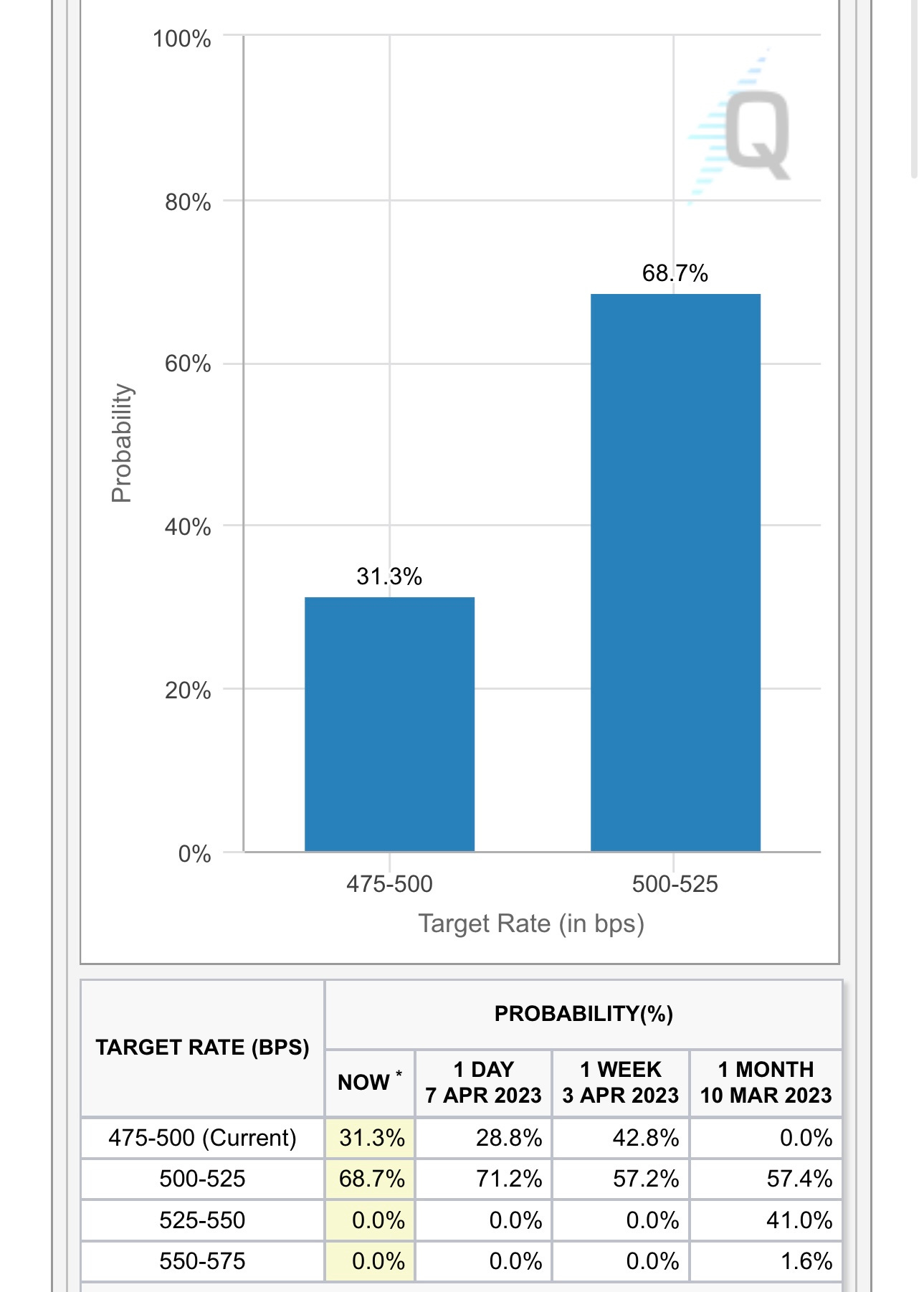

Looks like the markets are starting to accept the fact the FOMC might not be done yet, however with the CPI report on Wednesday we probably see the likelihood of another rate hike drop to below 20% (cool CPI number) or above 80% (hot CPI number). I’ll stand by my opinion that the FOMC has already gone too far and is likely to put us into a worse recession than necessary because they’re monetary policy over the past two years has been nothing short of moronic.

I still don’t trust these markets and I don’t see many catalysts that could take the indexes more than 5% higher from here but I’m willing to have some exposure in my trading portfolio, just need to pick your spots and manage risk appropriately. This is not the time to be aggressive or reckless. Capital preservation should still be priority #1 and nothing wrong with sitting on cash while waiting for your “fat pitch”

Below the paywall is my current portfolio (12 stocks) and current watchlist (21 stocks) plus links to my portfolio and daily webcasts.